Lots of Nvidia $NVDA news this week as the world’s best AI chipmaker takes a $5.5B charge due to export restrictions to China. The company has also begun production of their best chips on US soil and intends to get to half a trillion dollars of domestically-produced product in the next few years. Fed Chairman, Jerome Powell, crashes the markets with some terse words about tariffs and stagflation. A day later, President Trump says he wants Powell gone and that the Fed Chair has been consistently wrong. DKI agrees with both, and also thinks all parties involved are wrong. Confusing? Don’t worry: We explain in detail. Consumer use of credit declines. Some say it’s because the banks aren’t lending. DKI disagrees with that as well. Perhaps we should have labeled this the “DKI is cranky issue”. DKI Intern, Cashen Crowe, chimes in with our educational “Thing”. He explains stock splits for beginners. Do they create value? Cashen explains.

This week, we’ll address the following topics:

- Nvidia takes a $5.5B charge due to new limitations on exporting to China. What options does China have now?

- Nvidia has started producing their best chips in the US. Does that change your view of tariffs?

- Powell talks stagflation and crashes the market. Want to know why we don’t care?

- Consumer use of credit falls. Does this mean the banks have stopped lending?

- President Trump and Chairman Powell butt heads in public. DKI thinks everyone is wrong.

- In our educational thing, we explain stock splits. Do they matter?

Ready for a double portion of Nvidia news? Let’s dive in:

1) Nvidia’s Curbed Exports to China:

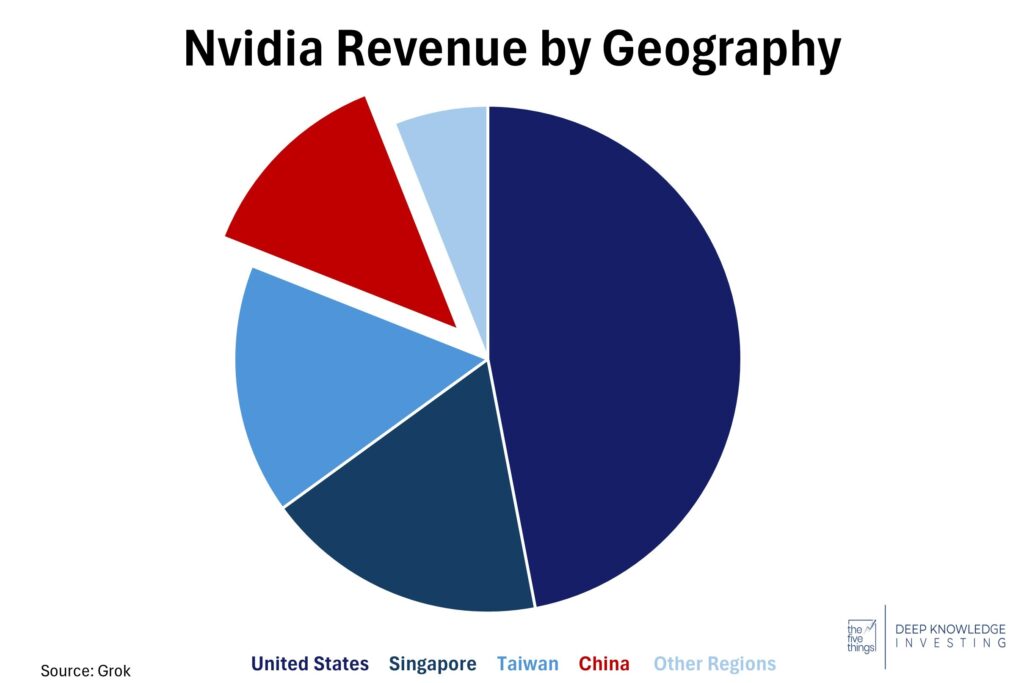

The US government has informed Nvidia $NVDA it is restricted from exporting their high-end H20 chips to China. That’s the chip that was designed by Nvidia to technically comply with government regulations, but delivered similar performance to their flagship H100. Nvidia intends to take a $5.5 billion charge as a result. With an already tense (explosive?) trade landscape between the US and China, Nvidia is now caught in the middle of the escalated dispute. China and Hong Kong make up about 13% of Nvidia’s revenue meaning this will be an issue going forward. Though they can (and probably will) attempt to work around the issue, Nvidia will be facing geopolitical issues as long as they produce the best AI chips.

China represents a meaningful percentage of Nvidia sales.

DKI Takeaway: In terms of US tech supremacy, this is a win. Access to high-performance AI hardware has become a huge advantage in much of the tech race, and China’s limited access to them gives the US the upper hand. China continuing to experience limited access will force them to continue to develop better domestic production, which could create more competition in the future. We’ve also seen reports that some Asian countries are buying more $NVDA GPUs than they have power capacity. The implication is that shell or proxy companies in other countries are sourcing Nvidia product then shipping it back to China.

2) Nvidia Brings Chipmaking Home to America:

Adding to the recent excitement in the week’s $NVDA news, the world’s best AI chipmaker disclosed that they have already started producing Blackwell AI chips in Arizona in partnership with TSMC. Over one million square feet of manufacturing space in Arizona and Texas will allow them to produce their best AI chips and supercomputers in the US. Some of this is due to tariff-related motivation, and other companies may follow as well and start producing in the US. Partnering with Taiwan Semiconductor, Foxconn, Wistron, Amkor, and SPIL will result in more high-end US production and increase resilience to future geopolitical disruptions.

While the $NVDA clean rooms will look different than this, we’re excited about more US-based manufacturing.

DKI Takeaway: As mentioned in Thing #1, cutting off China’s access to high-powered chips could create more competition in the long run, but with more US production, that competition is more easily met. Many have complained about President Trump’s tariffs, but we should also celebrate the wins. The plan is to produce half a trillion dollars in the US within the next four years, and that’s a big win. Credit to the CHIPS Act as well for helping bring more production home.

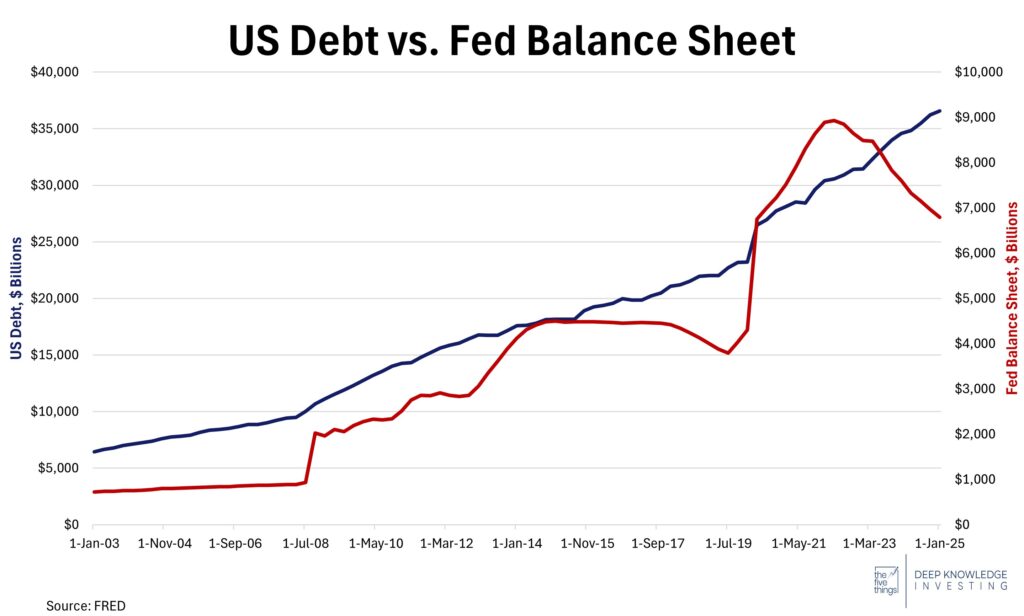

3) The Fed is trapped and Irrelevant:

On Wednesday, Federal Reserve Chairman, Jerome Powell, addressed the Economic Club of Chicago. His remarks crashed markets. Powell talked about the new tariffs reducing economic growth and increasing inflation. That’s the recipe for stagflation, and would put the Fed in a bind. Typically, the Fed responds to higher inflation by raising the fed funds rate. They respond to low economic growth with the stimulus of lower rates. Stagflation means that no matter what the Fed does, they’ll likely make one problem worse. Powell also crushed hopes for a Powell put by indicating he wasn’t going to bail out a falling stock market with a hoped-for rate cut. (The Powell put is a reference to the Greenspan put. Former Chairman Alan Greenspan would cut rates when the market fell in an effort to ensure there was little downside to investing in stocks. When the Fed does this, we end up with asset bubbles.)

With $37B in debt & almost $7T on the Fed balance sheet, the Fed has limited options.

DKI Takeaway: Meh. Markets didn’t like Powell’s comments. At DKI, we’re unconcerned for three reasons. First, our portfolio is heavily hedged and we don’t need a rising stock market to make money. “Fingers crossed the market rises” is not a good plan. Second, we’re not convinced tariffs will lead to long-term inflation. Check out this great article by Anthony Pompliano here. Third, Congressional overspending has led to fiscal dominance. If the Fed cuts, the bond market will price in higher future inflation and the rates on longer-term Treasuries will rise. That’s what happened last September. There’s not much the Fed can do at this point to gain control of the situation. Is your portfolio prepared for more inflation?

4) Consumers Tap the Brakes- Credit Falls:

Far from the $15.2 billion expected increase in consumer credit, February’s numbers fell by $0.81 billion. This credit contraction is indicating continued signs of caution as more households are beginning to tighten their belts. This comes in conjunction with deteriorating consumer sentiment levels.

The decline indicates recent consumer resilience has begun to slow. In recent years, spending has outpaced inflation, as consumers depleted Covid savings and increased credit usage. If income growth doesn’t continue, consumers have to cut back. That’s the recent trend only interrupted by the pre-tariff buying we saw in this week’s retail sales numbers.

A $.8B reduction isn’t big as a percentage, but expectations were for a gain.

DKI Takeaway: Though the decline in consumer credit is a signal worth paying attention to, a single-month dip doesn’t make a trend. If credit growth were to continue to remain weak, retail sales will begin to show signs of deterioration, and the Fed would again have more issues added to its plate. We did see speculation that the reduction was due to banks refusing to lend, but we don’t find that to be credible. As reported in a recent version of the 5 Things, Americans’ savings were up as are stock purchases from retail investors. When people are saving and investing more, that’s not something that corelates with bank credit contraction. We again applaud any Americans who are buying less in exchange for saving and investing more.

5) President Trump Wants Chairman Powell Out Now. Why Everyone is Wrong:

President Trump criticized Fed Chairman, Jerome Powell, for being “too late and wrong” and wrote that “Powell’s termination cannot come fast enough”. There were also allegations that the Chairman has been making policy based on politics, something the Fed isn’t supposed to do. President Trump is right. Powell left rates far too low for far too long which contributed to inflation, and asset price bubbles. If you hate income inequality, the Fed’s loose money policies were huge contributors to that. Powell was too late in raising rates when inflation picked up in 2021, laconically calling it “transitory”. He was wrong about that. When he reduced the fed funds rate last September, DKI pointed out that it appeared like the Fed was trying to assist the Democrats ahead of the November election. Now, with inflation lower than it was in September and unemployment higher, he’s not cutting. The Fed continues to look like a political actor.

Choose your fighter.

DKI Takeaway: Don’t worry Democrats. This section is for you. While President Trump is right that the Fed has made massive policy errors and does appear to be trying to help Democrats, the President now wants the Fed to cut rates. That’s a bad idea. Powell was wrong to cut in September, and Trump is wrong to insist on rate cuts now. The CPI was down last month, but inflation is still not under control. Concerns that potential tariffs will raise the price index are legitimate even if DKI thinks they don’t necessarily lead to long-term inflation. Of greater concern is unless Congress reduces spending, there’s little the Fed can do to help the White House. When they reduced the fed funds rate in September, the yield on the 10-year Treasury rose as the bond market priced in higher future inflation. That would be a disaster for the Trump Administration and a huge blow to Treasury Secretary Bessent. Powell should ignore the President. The DKI verdict: in this matter, everyone is wrong.

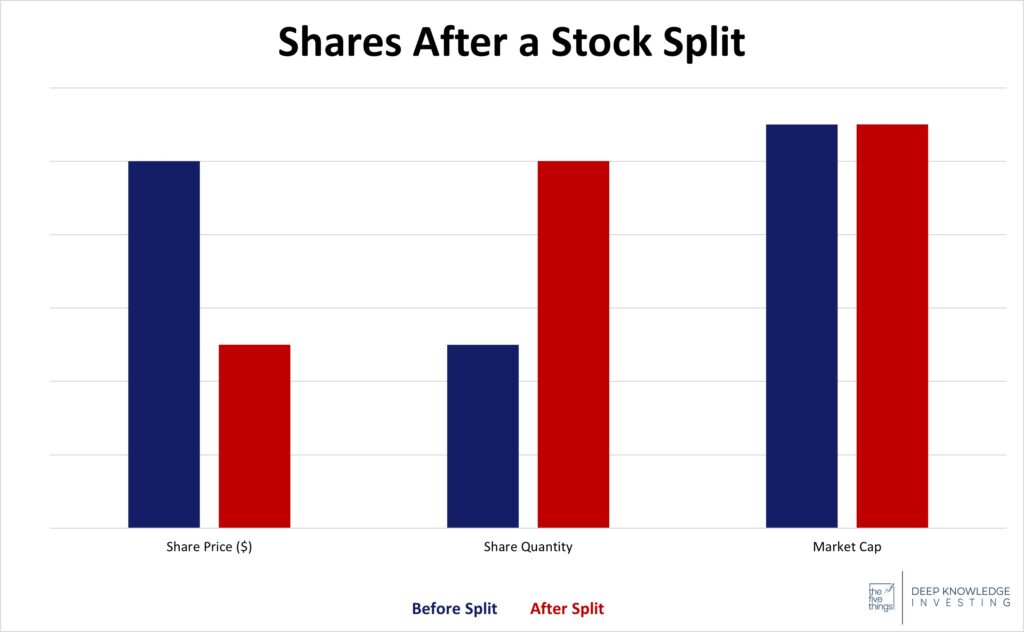

6) Educational Topic: Understanding Stock Splits:

A stock split is a corporate action where the number of outstanding shares is changed without affecting the total market value. Being able to differentiate different kinds of stock splits is important to understanding what it means for both the investor and company when a split takes place.

A stock split, occurs when a company increases the number of shares outstanding. In a 2 for 1 stock split, after the split, you’ll own twice as many shares as you did the day before. This is typically done to make the stock to be more affordable for people who might not be in a position to buy a whole share of stock for their portfolio. However, stock splits can have an administrative cost and cause misleading perceptions among investors that can negatively impact trading habits.

A reverse split does the exact opposite and the number of shares is reduced. Many stocks undergo reverse splits to maintain exchange listing requirements. Exchanges typically have lower limits and institutional investors may not buy penny stocks. A reverse split can resolve that issue by increasing the price of individual shares without affecting the market capitalization of the company. Reverse splits, do have a negative perception because it’s something typically done by companies with falling stock prices.

Share count doubles, stock price cut in half, market cap it unchanged. No matter how many times you slice a pizza, you still have the same amount of pizza.

DKI Takeaway: Stock splits have a lot of misconceptions.

-

“A higher or lower share price means the stock is worth more or less.” Not correct. If that were true, companies could increase the value of their business by doing reverse splits and reducing their shares outstanding. Real value comes from the tough work of increasing sales and margins.

-

“A stock split is bullish, and a reverse split is bearish.” Generally, not true. The splitting itself will not affect the company, only how investors feel afterwards. It is true that companies with rising stock prices will do a stock split signaling to the market confidence that past growth will continue.

-

“My ownership is smaller or larger after a split.” Definitely not true. Stock splits do not change the ownership structure of the company. Your share of ownership in the company is proportional to what it was before the split.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.