One month after the market worried about an increase in the CPI, it celebrated a slightly lower reading. That seems great until you look at the chart and see that there’s been no real progress on inflation in months. In order to get inflation down, the government could cut wasteful spending. DKI likes that option a lot. Blackrock acquires the Panama Canal ports. After claiming they didn’t control the ports, China immediately began whining that the sale was a “betrayal” of the Chinese people. DKI wonders how selling an asset they claim they don’t control is a betrayal. We express our displeasure at their “wrong thought” on this topic. Gold breaks $3k and achieves an all-time high. All fiat is weakening and multiple governments are taking delivery of huge amounts of bullion. Intel $INTC announces a new CEO. The market approves. And in our educational “Thing”, we help investors understand the language of foreign currency pairs.

This week, we’ll address the following topics:

- CPI is lower than expected. I think the market misinterprets this.

- Blackrock acquires Panama Canal ports. China begins whining immediately.

- Gold breaks $3,000 for the first time. Said another way, the dollar is declining.

- New Intel $INTC CEO causes a stock rally. That’s better than failing i7 and i9 processors!

- Educational thing: Understanding currencies.

Nice job this week by Joshua Reaves and Cashen Crowe. I’m pleased to see them continuing to improve and doing consistently high-quality work.

Ready for a week of permanent disinflation (it’s real this time!)? Let’s dive in:

1) February CPI is Below Expectations:

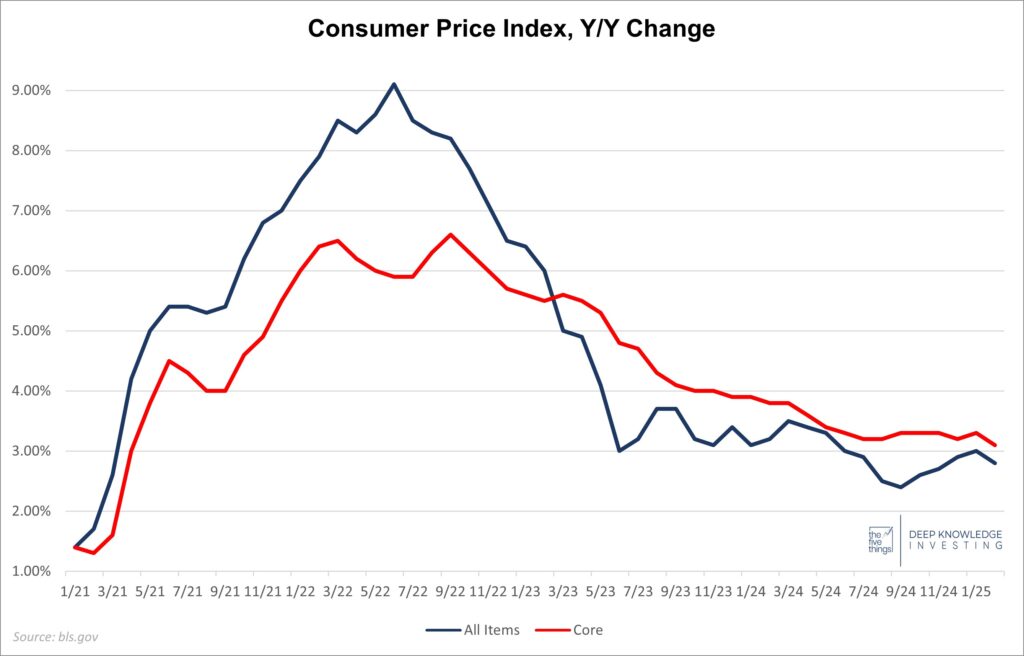

The February Consumer Price Index (CPI) showed an overall increase of 2.8% for the year and 0.2% for the month (annualizes to 2.4%). That’s below last month’s 3.0% and 0.1% below expectations. The Core CPI, which excludes food and energy, was up 3.1% vs last year and 0.2% from last month. Those were both 0.1% below expectations and 0.2% below the prior month. Wall Street celebrated the end of inflation, but is that reasonable?

Down this month, but still above where we were just a few months ago.

DKI Takeaway: I think there’s a lot of optimism about a CPI that was 0.2% below last month and 0.1% below expectations. The market was worried just four weeks ago by a higher-than-expected 3.0% CPI with a 0.5% monthly increase (which annualizes to 6.2%). It’s hard to come up with one inflation number for an economy as large as the United States, and definitely not something you can do to 0.1% accuracy. At this point, the market has been reacting to very small changes in general statistics.

The thing to be potentially concerned about right now is cuts to government spending will throw the country into a temporary recession. Washington has been creating the GDP numbers out of thin air with wasteful spending that adds no economic value, but does add to GDP. This is what DKI has referred to as a Potemkin economy. It looks good, but isn’t real. With prices continuing to rise, stagflation for a couple of quarters is a possibility. We could end up with lower inflation if reduced wasteful government stimulus reduces demand. Higher unemployment in government, the fastest growing sector for employment, is going to start showing up in the employment reports soon. If you think the economy depends on counting theft as production, then you’d be against these coming cuts.

2) Blackrock Acquires Panama Canal Ports:

A consortium of investors including Blackrock recently struck a deal with Hong Kong conglomerate CK Hutchison, leading to the 90% acquisition of CK’s stake in ports around the globe. The $23 billion deal included two ports on either side of the Panama Canal, addressing President Trump’s concerns about China’s “Belt and Road Initiative”.

The Chinese ownership of ports has recently raised concern over misconduct, where some believe China can leverage internal sources to gather data on US products and potentially block future US access. With ownership of Balboa and Cristobal ports, the US also has access to the high demand Panama Canal Railway, capable of transporting containers at a cheaper price than the adjacent canal.

China is buying infrastructure in Africa and Central/S. America, yet this triggers them.

DKI Takeaway: Though the acquisition doesn’t change the ownership of the Panama Canal, it is still a crucial element in reducing the geopolitical risk involved with increasing Chinese influence in critical infrastructure. Despite recent surges in canal transit fees, US port ownership increases leverage to battle against rising costs. Beyond this, the deal is also step towards stronger US-Panama ties. China had previously claimed it did not have control of the ports, yet immediately characterized the deal as “spineless groveling” and a ”betrayal” of the Chinese people. DKI wonders how the sale of assets that China claims it didn’t control represents a betrayal of the Chinese people.

3) Gold Breaks $3,000 for the First Time:

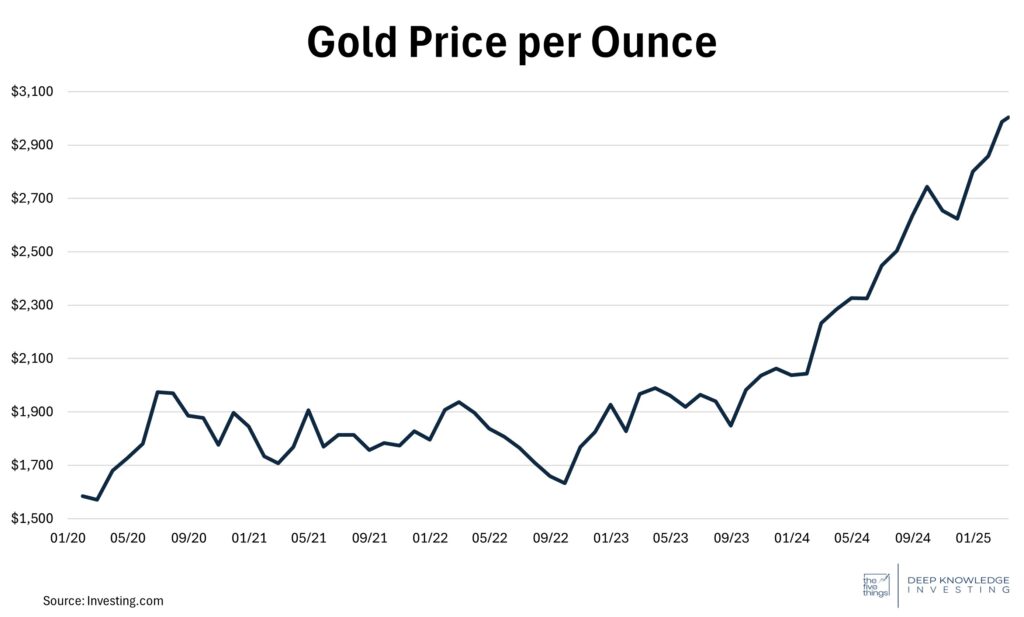

DKI started buying gold in 2000, and since then, it’s had an incredible run. An asset that has tended to be sleepy has become an important indicator of the health of global fiat currencies. Gold almost hit $2,000 in 2011, then declined and didn’t reach its prior high until late in 2019. Contrast that with the price of gold in dollars almost doubling between 2022 and today. Economists keep claiming tariffs would strengthen the dollar which should lead to a lower gold price. So, what’s happening here?

DKI owns both Bitcoin and Gold. Volatility aside, they’ve been huge profit producers.

DKI Takeaway: As we’ve discussed in recent versions of the 5 Things, former Treasury Secretary Yellen left current Secretary Bessent in a terrible situation. He has to refinance $7 trillion in the next 12 months. The Trump Administration has been taking action to reduce the yield on the 10-year Treasury which is weakening the dollar against other currencies. A weaker dollar means higher dollar prices for gold. In addition, more countries like China and India want less exposure to the dollar and have been buying and taking delivery of huge quantities of physical gold. We think this trend will continue. What do you think?

4) Intel Hires an Experienced CEO, Stock Rallies:

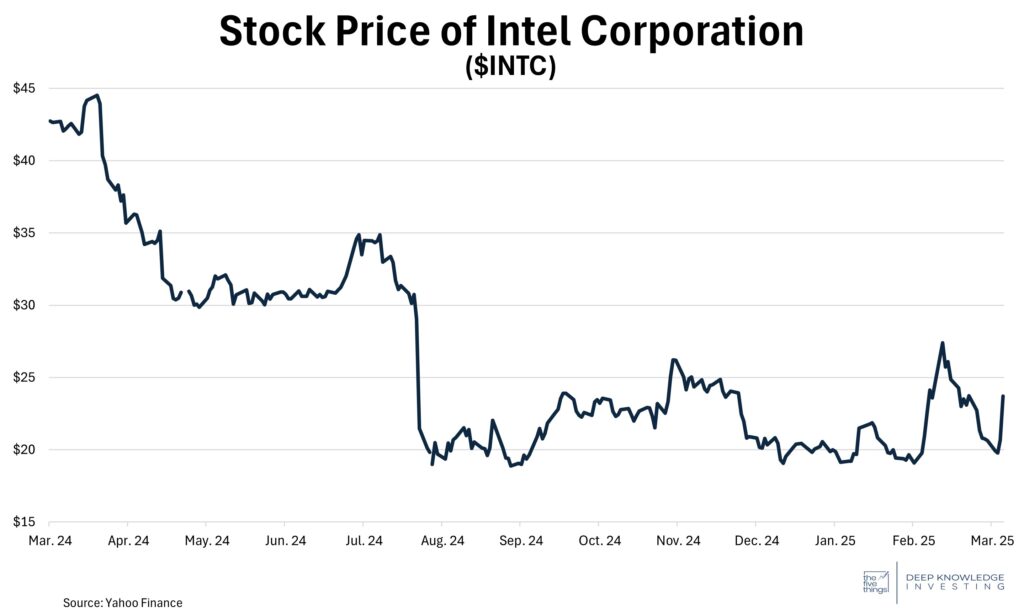

Intel Corporation $INTC appointed Lip-Bu Tan as its new CEO. Lip is a seasoned semiconductor industry executive who served as the CEO of Cadence Design Systems for 12 years and sat on the board of Walden international, a VC firm. This decision sparked a stock rally with $INTC rising from $20.67 to $23.70. With his extensive experience many think he has what it takes to steer the company in the right direction. He led Cadence Design Systems to a 3,200% stock increase.

Intel has struggled recently, reporting a loss of $16.6 Billion in 2024 forcing the company to reduce its workforce by 15,000 people. This led to the loss of over 50% of the stock’s value in 2024 alone.

A bad year for Intel stockholders and customers. Lots of optimism for the new CEO.

DKI Takeaway: The optimism surrounding the appointment of Lip- Bu Tan is palpable, but the road ahead is rough. The semiconductor industry remains fiercely competitive with several well-capitalized competitors. A potential partnership with TSMC could also change their fate into a competitive chip manufacturer. It appears that Intel has addressed its design failures with the new Core Ultra line, but its manufacturing capacity lags the best in the industry. We’d love to see that change.

5) How to read currencies: Spot v. Pegged v. Floating:

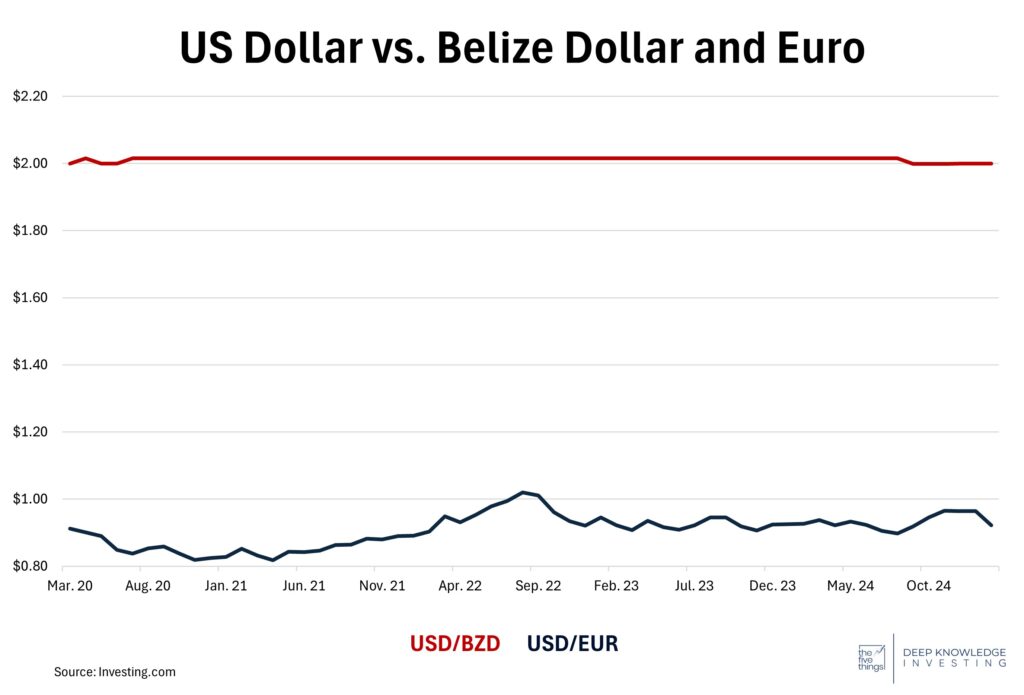

Reading currency prices and pairs can be confusing, with different terms and numbers being thrown around. Understanding what each number or pair represents allows for more informed financial decisions.

Spot Price: The spot price is the real-time market price of a currency—what you pay to exchange for another currency at that moment. Think of it as “The Right Now Price.”

Pegged Currency: Some currencies depend on the value of another like the U.S. Dollar, meaning their price remains stable rather than fluctuating due to economic factors. This reduces volatility, increasing price stability.

Floating Currency: These currencies fluctuate based on market conditions, adjusting naturally to factors like interest rates, inflation, and capital flow impacting their value.

These currencies are listed in pairs like the USD/JPY= 150.00. The first currency (USD) is the base currency and the second (JPY) is the quote currency. This means 1 U.S. Dollar is equal to 150 Japanese Yen. If this number increases, the base currency is strengthening. If it decreases the base is weakening.

The Belize dollar is fixed with small fluctuations due to practical use. The Euro floats.

DKI Takeaway: A fixed exchange ratio offers stability for economies reliant on trade, while floating currencies allow markets to respond naturally to economic shifts. Just remember that in order to maintain a practical fixed exchange rate, the country trying to keep the peg needs to be careful not to issue too much currency and will have difficulty controlling interest rates. Even in the sovereign currency market, there’s no free lunch!

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.