Quick announcement: I’ll be in Bangkok for the next few weeks. While I’m here, I’m open to a small number of in-person conversations. If you’re based locally, or know someone here you think it would be worthwhile for me to meet, feel free to reach out privately at IR@DeepKnowledgeInvesting.com.

President Trump upsets markets and causes NATO allies to panic into sending 30 troops into Greenland to “defend” the island. So, why did DKI tell subscribers not to sell positions when the market started to fall? The US makes a deal on semiconductors with Taiwan. Want to sell into the US market without tariffs? Then produce here as well. Intel wins a government defense contract. Earnings are great but guidance weak. The stock is up since DKI recommended it. Japanese long-term bond yields gap up setting records for volatility. We explained the coming unwind of the carry trade back in 2022. We all measure our portfolios in nominal terms. But what would it look like if we did this in real terms? Check out this week’s educational topic to see.

This week, we’ll address the following topics:

- President Trump threatens to take over Greenland and to tariff NATO objectors. The issue is now heading towards peaceful resolution. Want to know what DKI did with the portfolio?

- The US makes a deal with Taiwan on semiconductor manufacturing and tariffs. The end result is more US-based production. DKI approves.

- Intel wins a major defense industry contract. The stock has risen 40% since DKI bought it two months ago.

- Japanese 30-year yields skyrocket threatening a further unwind of the carry trade. DKI predicted this in 2022.

- We all tend to measure our portfolio in nominal terms. For an understanding of why thinking in real terms is better, check out this week’s educational topic.

DKI Interns, Cashen Crowe and Samaksh Jain, continue to do the heavy lifting for each week’s Five Things. Credit and a big round of applause for them.

Ready for another week of people not doing what they can’t do? Let’s dive in:

1) President Trump & Greenland:

President Trump upset European leaders and roiled markets this week when he insisted the US needed to own Greenland. He refused to rule out using the military to accomplish this and then threatened tariffs against European countries that protested. Early last year, I wrote that the US would never use force to acquire Greenland. Earlier this week, I wrote a subscribers’ only blog post indicating that I still believed the military wouldn’t be used and that the President would have been better off offering Greenlanders a warm friendly bribe. I also said that I wasn’t selling any portfolio positions as a result of the verbal conflict. A day later, there was talk of an offer of three-quarters of a trillion dollars which would wipe out Denmark’s national debt and give each Greenlander $100k in cash. By the end of the week, the outline of a deal (absent US cash) was publicly disclosed.

![]()

If you think this was TACO, you’re not paying attention.

DKI Takeaway: I didn’t sell any portfolio positions because it was obvious neither side was serious. President Trump doesn’t have a mandate to invade Greenland. If he tried to do so, he’d be impeached and removed from office. At that point, President Vance would be asked if he’d like to recall the troops or enjoy the shortest presidential term on record. NATO hilariously sent 30 troops to “defend” the island. That’s 30 soldiers – not 30 divisions. The US didn’t make a serious threat and Europe didn’t make a serious attempt at defense. As usual, the TACO (Trump Always Chickens Out) crowd was crowing, but I think they’re missing the point. The President regularly makes insane initial offers/threats and then retreats to what he actually wants (to the relief of the other side). It now appears that the US will get additional military bases on Greenland, plus mineral rights, plus a guarantee that China and Russia will be blocked from any presence there. In exchange, the US gave up no money, made no concessions, and President Trump earned the harsh words of people who already despised him. Some of you will love this deal and some of you will hate it, but this wasn’t chickening out, and as DKI predicted, no shots were fired. Just so I’m on record, I would have been against deploying the military against Denmark and/or Greenland and am glad to see the issue heading towards peaceful resolution.

2) The US and Taiwan Strike Strategic Trade Deal, Capping Semiconductor Tariffs:

The United States and Taiwan recently finalized a long-negotiated trade and investment agreement that recalibrates tariff policy and aligns semiconductor supply chains with national economic and security goals. Under the pact, U.S. tariffs on Taiwanese goods will be reduced from roughly 20% to a flat 15%, matching the rates applied to Japan, South Korea, and the European Union, and preventing tariffs from being stacked on existing Most-Favored-Nation duty levels. Taiwanese semiconductor producers that commit to expanded U.S. manufacturing will receive preferential treatment under Section 232, with substantial duty exemptions during build-out and beyond.

In exchange, Taiwanese firms, such as TSMC, have pledged at least $250 billion in direct investment in U.S. semiconductor manufacturing, AI, energy, and related industries, supported by an additional $250 billion in credit guarantees. The agreement also allows companies to import 2.5x their newly installed U.S. capacity duty-free during construction.

![]()

The US has a big trade surplus, but still needs more high-end domestic manufacturing.

DKI Takeaway: The real economic impact hinges on execution: capital is deployed to actual fabs, talent is secured, and supply-chain synergies materialize. The preferential tariff treatment tied to American build-out effectively turns tariff policy into a conditional subsidy, favoring physical presence over passive exports. This framework could become a template for future trade deals in strategic sectors. Still, it may also heighten competition among allied suppliers (South Korea and Japan, which are already seeking comparable terms). Ultimately, while tariffs are lowered on paper, the substance is in the trade-for-investment bargain, one that stands to shift not just cross-border duties, but also where critical chips are made and who controls them. In this case, the US is using the threat of tariffs to shore up domestic investment and supply lines while increasing high-quality jobs for American workers.

3) Intel Wins Major U.S. SHIELD Contract Under Massive $151 B Defense Program:

Intel announced on January 20 that it has been selected as a chip supplier and key participant in the US Missile Defense Agency’s Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) program, an indefinite-delivery/indefinite-quantity (IDIQ) contract with a $151 billion ceiling designed to support next-generation homeland defense systems. The SHIELD vehicle, part of the broader Pentagon “Golden Dome” missile defense strategy, allows the Department of Defense to rapidly source capabilities ranging from microelectronics to AI-enabled threat detection, with flexible task orders competed across a broad industrial base. Following the announcement, Intel’s stock jumped in trading, indicating investor confidence in the long-term revenue potential of strategic government engagements.

Intel stock is up 40% since DKI recommended it two months ago.

DKI Takeaway: After years of losing market share in advanced logic and facing intense foundry competition from TSMC and Samsung, Intel is now being positioned as a national security anchor, essentially a “national champion” in chip manufacturing. The SHIELD contract doesn’t guarantee near-term revenue on its own, but it opens the door to a steady pipeline of defense-related orders, insulating Intel from cyclic commercial demand swings tied to PCs and cloud servers. DKI views this as a hedge against continued volatility in commercial AI chip markets because defense budgets are less elastic than enterprise capex and can provide a revenue floor during downturns. If Intel can convert its SHIELD involvement into repeatable defense work and allied industrial partnerships, this could be a foundational step in reshaping the American semiconductor supply chain and reviving Intel’s long-term growth trajectory.

Intel’s 4Q earnings were stronger than expected while guidance disappointed. The reason for the weaker-than-hoped guidance is difficulty getting supply of enough components to satisfy demand. While selling product is the key determinant of success, I view “we don’t have enough materials to satisfy demand” to be a far superior problem than “there’s no demand for our product”.

4) Japan’s Bond Reality Check:

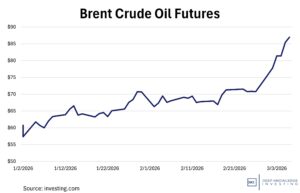

On January 20th, Japanese government bond markets experienced a historic repricing, with the yield on the 30-year bond rising more than 30 basis points in a single session. This was the largest daily jump in decades for long-dated bonds and marked a separation from Japan’s historically stable, low-yield environment. A snap election announcement and fiscal promises (essentially tax cuts and higher spending) signaled materially higher future JGB issuance, and investors immediately repriced Japan’s long-term fiscal risk. The move was also amplified by weak auction demand and thin liquidity. The BOJ is attempting to balance its inflation goals and financial stability, but sharp yield increases add another layer of complexity for the bank.

This is an incredible move and one DKI predicted in 2022.

DKI Takeaway: I’ve been talking and writing about Japan’s bond market since 2022. The Bank of Japan is trapped. Low rates and purchases of government bonds has led to a weak yen and inflation. Raising rates means a larger budget deficit that can only be met with more yen printing which leads to inflation. The risk to US equities is an unwind of the “carry trade”. That involves selling low yield yen-denominated bonds and buying higher-yielding US Treasuries, or for the more adventurous, US tech stocks. As yen-linked yields rise, there is a greater incentive to stop rolling that trade forward. This could lead to large sales of US bonds and equities. If you want to know how we’re hedging that risk, you’re welcome to join us.

5) Educational Topic: Real vs. Nominal Returns:

Nominal returns and real returns measure two different things, and confusing them often leads to investors systematically misjudging performance and valuation. Nominal return is the percentage gain or loss on an investment before accounting for inflation, while real return adjusts that nominal return for changes in purchasing power. Real return is equal to nominal return minus inflation.

Real returns matter because investors should be more concerned with what their money can buy than how many dollars they have.

More dollars is a great outcome, but what those dollars can buy is the key question.

DKI Takeaway: One of the best recent examples of this came in 2024 when the Nikkei (think of it as the Japanese S&P 500) hit an all-time high. That’s great, right? Nope – the previous high of around 40k yen came in 1989, 35 years earlier. Now think about what 40k yen would buy you in 1989 vs what that same amount would buy you today. Had you held all those years from high to high, you’d show a nominal return of 0%, but a real return that was severely negative when measured in purchasing power.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages