The US figures out that our foreign policy is subject to CCP approval and works out a deal with Australia to develop rare earth mining and refining assets. China responds by ceasing soybean purchases from the US. All of this is creating discomfort in multiple places, but how dependent do you want to be on China? Alibaba claims they can produce LLMs using 80% fewer Nvidia chips. The DeepSeek claims from just 9 months ago weren’t real. Is this one true? Tesla missed earnings estimates. Shareholders don’t care and are focused on future products. The press (intentionally) misunderstands the Musk pay proposal. To get the headline $1T, he has to create never-before-seen in the history of the world shareholder value. We get another Oracle / AMD deal. Nvidia is an amazing company, but it’s easy to see why more of its customers want a second supplier. In our educational section, we explain ROE and ROIC. Don’t know what those are? No worries – we explain and give you the third metric that I prefer.

This week, we’ll address the following topics:

- The US partners with Australia to increase secure rare earth supply. China turns to Brazil and Argentina to avoid US soybeans. The free trade crowd is unhappy, but right now, our foreign policy is subject to CCP approval.

- Alibaba claims it can develop LLMs with an 80% reduction in $NVDA chips. DKI has seen this movie before and we think it’s a clear “maybe”.

- Tesla missed earnings estimates and shareholders don’t care as they focus on FSD and robotics. The $1T Musk pay package is intentionally misunderstood by the press.

- Oracle and AMD partner (again) for AI computing. Nvidia remains the market leader, but more companies want a second source of high-end GPUs.

- In our educational topic, we discuss return on equity (ROE) and return on invested capital (ROIC). I don’t like either so if you read on, you’ll see what I prefer.

Great work by the DKI interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem. Regardless of classes, exams, pledging, or football season, they continue to deliver. As you read on, let’s applaud their meaningful contributions to the 5 Things each week.

1) Supply Chains are Shifting for Both the US & China:

The US and Australia just agreed to joint investments in critical minerals and rare earth processing, both aiming at overcoming the staggering hold China has on rare earth production (covered in last week’s 5 Things). Both President Trump and Australian PM Anthony Albese committed at least $1B each toward developing rare earth & critical mineral projects totaling up to $8.5B. The goal is to develop new mines and refineries that will ramp up rare earth production and processing to reduce dependence on China. We recently explained how important these rare earths are to a wide range of applications, including clean energy, advanced electronics, and defense systems. They’re used in everything from wind turbines and EV motors to radars and guided missiles. With China showing its willingness to curb exports, it’s better to act proactively in increasing supply than wait for more bad news.

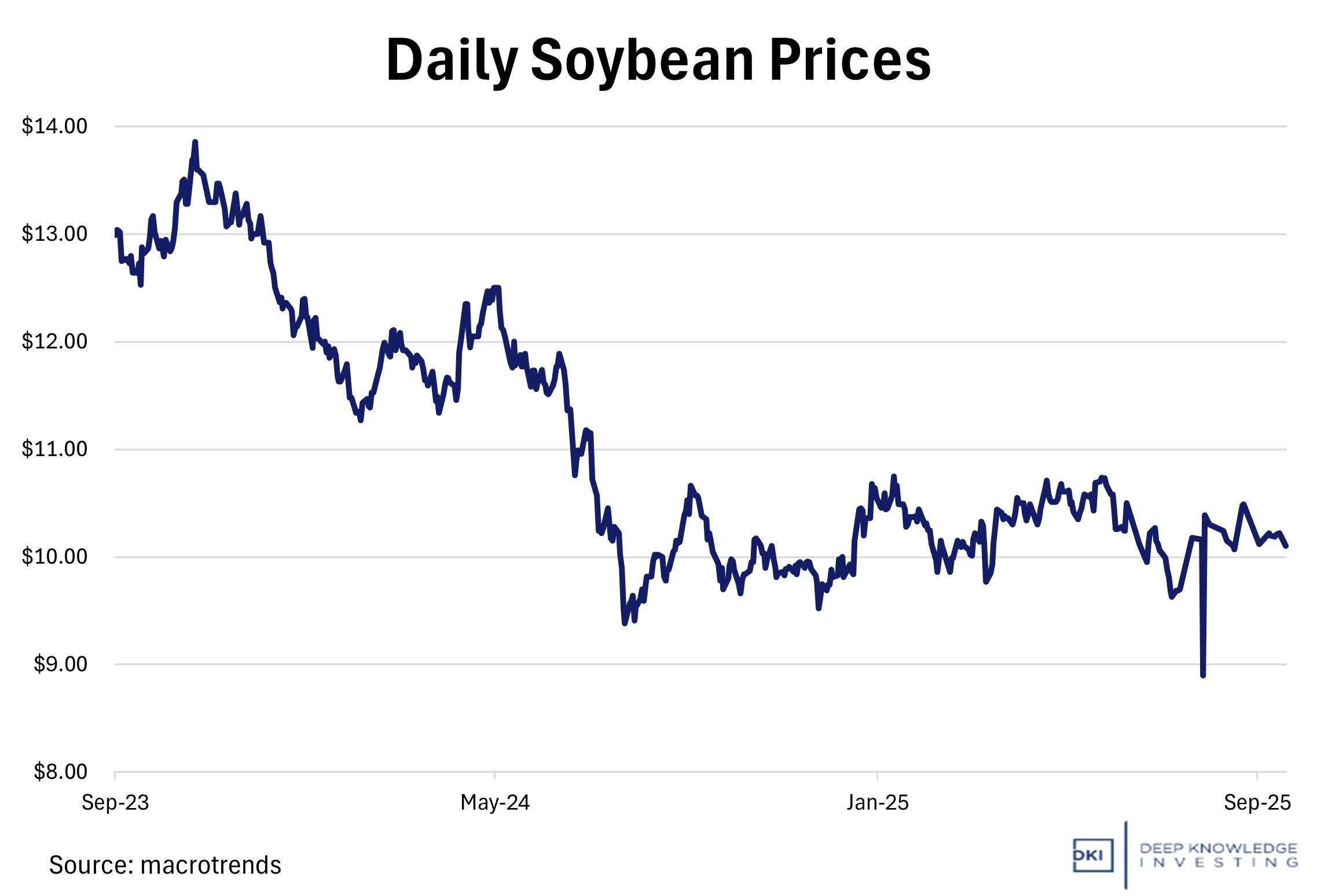

Almost simultaneously, China restructured its commodity sourcing citing “food security” and cut back on US soybean imports. China is the world’s largest soybean buyer, historically sourcing from the US and Brazil. As of this week, China sources soybeans almost exclusively from Brazil and Argentina (85% and 9% respectively), importing no soybeans from the US in September. American farmers have lost access to a huge demand market and have seen an estimated $5.7B in losses through October.

The US doesn’t use enough soybeans to make up for the loss of Chinese demand.

DKI Takeaway: Whether in the form of rare earths or commodities, geopolitical tensions continue to shape commodity markets and supply chains. In the rare earths sector, nations are investing to reduce vulnerability, even if it is more expensive up front. In commodities, China also wants to reduce its own risk. What we’re seeing is both the US and China working to reduce their dependence on each other. US actions will mean more expensive rare earths with reliable supply. No one likes higher prices, but having US trade and foreign policy subject to CCP approval isn’t in our best interests.

2) Alibaba Cloud Unveils “Aegaeon” System, Slashing Nvidia GPU Usage:

Alibaba Cloud recently revealed its new multi-model inference scheduler, Aegaeon, which reportedly reduced the number of Nvidia H20 GPUs required for training large language models by 82% during beta testing. In practical terms, the number of GPUs fell from 1,192 to just 213 while servicing dozens of models up to 72 billion parameters in size. Aegaeon achieves this through two key technical innovations: token-level autoscaling (which allocates GPU compute in real time) and model-packing (multiple models sharing the same GPU instance) rather than reserving hardware per model. While the results come from Alibaba’s vertically-integrated Chinese stack (including custom networking and storage infrastructure), the implications are broader: cloud providers globally may reconsider investing in more GPU hardware when software-driven efficiency gains could substitute for brute-force scaling.

China wants to rely less on US-supplied $NVDA GPUs.

DKI Takeaway: Alibaba’s claimed success with Aegaeon may signal a turning point: AI hardware dependency, which many had assumed would be a linear ramp, is now showing meaningful signs of software-driven deceleration. If major cloud players can serve LLMs with dramatically fewer GPUs, the domino effect hits chip vendors, infrastructure investors, and scaling narratives across the industry. For Nvidia and its peers, this is potentially a red flag for future demand. For cloud providers and AI-first companies, it’s a call to emphasize architecture and software efficiency over pure compute volume. We think there are competing claims and demands here. Earlier this year, DeepSeek threw the AI world into temporary chaos until people realized there’s no shortcut to AI competency. Partially training an LLM just leads to more computing demands in the future. However, China is learning to make do with reduced access to Nvidia’s best chips, something we warned about previously. If the US hyperscalers and AI datacenters start using fewer $NVDA chips, then we’ll know the Chinese claims are robust.

3) Tesla Misses Earnings Estimates – Investors Don’t Care:

On Wednesday, Tesla ($TSLA) reported 2025 Q3 earnings and missed expectations. Tesla reported over $28B in revenue, up 25% from last quarter and above the $26.5B estimate. However, EPS of $.50 missed expectations of $.56 and net income was down 29% vs last year. The Q3 report comes as the company moves to approve a proposed $1T share package for Musk ahead of the annual November meeting. If approved, Musk can pocket as much as 12% more in stock, based on various conditions. Tesla’s stock declined about 1.5% in after-hours trading Wednesday and recovered on Thursday, rising nearly 7%.

If $TSLA misses earnings & the stock rises, then investors are focused elsewhere.

DKI Takeaway: I spent the summer in Europe and saw plenty of the Chinese EV competitors that are taking share from Tesla. The big sales number in 3Q related to the end of US EV subsidies. Sounds bad, yet the stock still rose. Tesla investors are now focused on robotics and FSD (full self-driving) taxis. Elon Musk is a master of finding the next product and some of his most important work will be done under the Tesla umbrella if his pay package is approved. While the $1T headline number seems jarring, let’s look at the conditions: He has to raise the market cap of the company from $1.1T to $8.5T, deliver 20MM Tesla vehicles, get 10MM FSD subscriptions, deliver 1MM robots, and deploy 1MM driverless taxis among other goals. If he can accomplish these things, do you think Tesla shareholders will mind him taking 1/7th of the value created?

4) Oracle & AMD’s Supercluster Partnership:

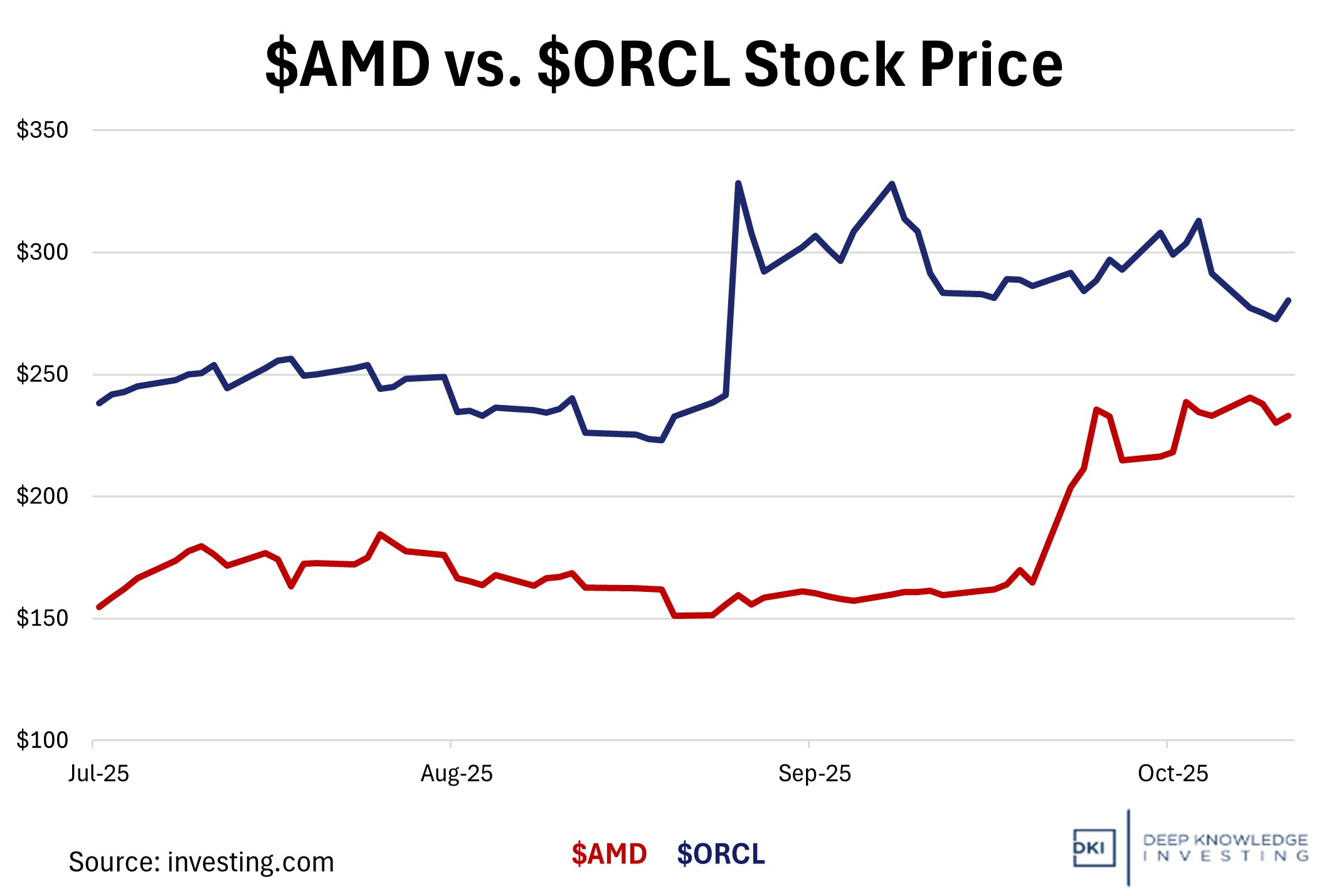

Oracle and AMD just announced an expansion of their cloud partnership aimed at building a next-gen AI supercluster in Oracle Cloud Infrastructure (OCI). This would make Oracle the first hyperscaler to offer a public AI supercomputer powered by AMD’s Instinct MI450 processors. It helps Oracle’s effort to advance OCI in the AI cloud race providing the company with a unique selling point with (likely) better pricing and availability. In order to hedge against dependence on Nvidia, Oracle is ordering 50,000 GPUs from AMD.

For AMD, the deal demonstrates it can challenge Nvidia’s foothold in the AI chip space. Although Nvidia holds roughly 80% of the data center AI chip market, we have seen numerous examples of AMD continuing to ramp up its efforts and performance. AMD will still have to overcome the extent to which many developers are already deeply invested in Nvidia’s CUDA software system.

AMD has recorded some big wins this year.

DKI Takeaway: As the arms race to build bigger and better AI infrastructure continues, it’s computing power that remains the most important resource for tech giants. Billions are being spent on AI hardware, especially in Oracle’s plans: fueling large superclusters with tens of thousands of GPUs. Companies don’t want to be stopped by supply issues, so many are looking at multiple sources of these GPUs, even combining Nvidia’s and AMD’s power. Nvidia remains the market leader in both sales and performance, but more companies want a second supplier and more robust supply chain.

5) Educational Topic: ROE vs. ROIC:

Two common measures of a company’s profitability include ROE (Return on Equity) and ROIC (Return on Invested Capital). Both metrics gauge how effectively a company generates return; however, they differ in the source of capital they focus on.

Return on equity measures a company’s profit relative to shareholders’ book equity. This is calculated by dividing net income by shareholders’ equity on the balance sheet. Since shareholders’ equity is intended to represent the owners’ stake in the company, ROE measures after-tax profit for each dollar invested by shareholders. For example, an ROE of 25% means the company generates $0.25 in annual profit for every $1 of equity. A higher ROE will generally indicate the business is efficient in converting equity into profit.

Return on invested capital, on the other hand, measures profit relative to all long-term capital invested in the company. This can be calculated by dividing NOPAT (net operating profit after tax) by invested capital. Invested capital, in this case, includes both equity and debt, so ROIC shows how effectively a company uses all of its capital to generate profit after tax. A higher ROIC generally means the company is deploying all of its capital in more profitable ways, ideally above its cost of capital (the return investors demand for the risk they take).

Both flawed methods due to book equity not representing investment.

DKI Takeaway: While bank investors like to calculate ROE and consultants favor ROIC, I don’t love either of these metrics. Both rely on book equity which resembles actual invested equity less and less over time and can become an artifact of historical earnings. Plus, GAAP net income (and adjusted net income) often have places clever accountants can hide actual profitability. As a substitute, I like free cash flow as a percentage of a company’s market value. Free cash flow is harder to manipulate than earnings, and market value is what YOU are paying today while book equity is affected by historical net income calculations.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damag