The Crisis Issue

In this week’s 5 Things we examine a possible government debt default, a possible coming recession, the Federal Reserve’s continuing insistence that we’re not getting a pivot, and the possibility that AI destroys humanity (or at least the stock market). Let’s dive in…

1) Nvidia Earnings Good – Guidance Great ($NVDA)

Graphics chip and card maker, Nvidia, announced earnings this week. Revenue and earnings beat expectations, but that wasn’t the big story. Guidance for the current quarter was raised to $11 billion which was 50% above analyst estimates. The stock skyrocketed even after an incredible run so far this year.

NVDA Price Chart from TIKR.

DKI Takeaway: $NVDA is the best manufacturer of chips for AI-driven applications because graphics chips excel at parallel processing (multiple simultaneous calculations). Excitement about AI is what’s driving the increase in sales and estimates. This reminds us of the late ‘90s internet boom. The new technology both impacted our lives, and many overhyped companies saw their stocks collapse a few years later. It’s still too early to pick winners and losers, and Nvidia is producing great results as well as a stock valuation that assumes those great results will continue for many years to come.

2) Debt Ceiling Still Not Resolved (as of this writing):

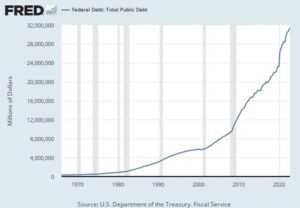

The US hit its debt ceiling months ago, and as the Treasury comes close to running out of “extraordinary measures”, the White House and Congress are just now getting around to starting the last-minute emergency negotiations necessary to get something done. The US is only below the limit because the extraordinary measures include not paying bills in cash while accruing the liability. That’s a fancy way of saying we’re still spending money, accumulating expenses, not paying the bills, and pretending what we owe isn’t debt. A deal may be done by the time you read this.

Now might be a good time to cut spending. Graph from the St. Louis Fed.

DKI Takeaway: If Treasury Secretary Yellen decides to prioritize payments, there is no need for a default. Any default would be the result of a decision by the White House to not pay interest on the debt. There’s a lot of talk about the White House using the 14th Amendment as a way to issue debt above the limit. The 14th Amendment to the Constitution only says that the US can’t repudiate its debt. It does not give the Executive Branch the “power of the purse”. If you want to understand this issue better, the DKI post on it is here.

3) Consumers Ignore the Fed – Keep Spending:

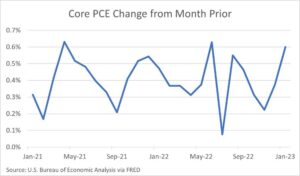

On Friday, we got the new personal consumption expenditures (PCE) data for Friday, and despite the Fed doing all it can to slow the economy, consumers keep spending. The Fed views the Core PCE (PCE less food and energy) as the best predictor of future inflation trends. This month, the core number was up .4% from last month and 4.7% from last year.

This looks more like sticky inflation than transitory

DKI Takeaway: We got data from last week’s retail earnings reports that consumers had started to shift purchases away from discretionary towards necessities. So, consumers are buying fewer goods, but at higher prices. Despite all of that, this makes the long-hoped for Fed “pivot” less likely to happen any time soon and increases the probability of an additional 25bp rate hike.

4) Federal Reserve Minutes – The “Pivot” Isn’t Coming:

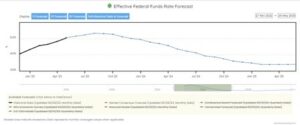

The Federal Reserve released the minutes from the last meeting. In addition to several Fed Governors believing that rate hikes should continue, there was language making clear that as of now, the Fed does not expect to lower rates this year.

Econforecasting.com showing market expectations for lower rates

DKI Takeaway: The Fed keeps saying “higher for longer”, yet the market thinks we’ll have almost 200bp (2%) of rate cuts in the next 12 months. Bond market investors are typically considered “smart money”, but they’ve been wrong on this item for a full year. DKI keeps saying that Powell will live with a recession, but not with entrenched inflation. He wants to be the next Volker, not the next Burns.

5) M2 “Down”, but We Still Have Inflation Not Deflation:

DKI has opined that the primary reason for the inflation of the last two years was the incredible expansion of the money supply. Some have suggested it’s related to supply chain issues, foreign relations, or a variety of other factors. However, as those other factors adjust and normalize, inflation continues to rise meaning these items aren’t the true cause of inflation. With the money supply contracting, shouldn’t we have deflation now?

That’s the “historic” reduction in the money supply at the end. Graph from St. Louis Fed.

DKI Takeaway: Many are suggesting that the contraction in the money supply will lead to deflation and a horrible recession. While that hasn’t happened yet, they could be right as changes in interest rates and the money supply act on a lag. An alternative thesis is we had a massive increase in the money supply and a relatively small decrease. Sure, the direction is down, but look at the chart above and you can see the magnitude of M2 growth versus the recent contraction.

6) Healthcare Expenses Lower Than Expected at HCA ($HCA):

Conversations with many health facility administrators indicated great concern about the cost of labor and supplies which was supposed to lead to small hospitals going out of business and large chains being unable to produce profits.

Salaries and supplies cost down. EBITDA margins above historical norms.

DKI Takeaway: These stories make sense until you look at the data. At large hospital chain $HCA, labor and supply costs are falling below the historical trendline, and the company has had an improving EBITDA margin for years. To us, hospital profits look a lot better than the story being told.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.