The Corporate Earnings Issue

Company earnings this week tell us a lot more about the economy and the health of the consumer. The housing market remains largely locked-up with falling transaction volume. Fed Governors now agreeing with DKI. (I know – I didn’t expect to write that either.) Plus, there’s a new stock writeup on the DKI blog.

1) Home Depot Earnings Disappoint ($HD)

Sales were down 4.2% and same-store sales were down 4.5%. Earnings were down as well. The company gave guidance for full-year sales to decline 2% – 5% with EPS falling 7% – 13% partly due to lower sales and partly due to reduced operating margins.

HD Price Chart from TIKR.

DKI Takeaway: This was HD’s worst revenue miss in 20 years, and one thing in the guidance is particularly concerning. Management noted that much of the miss was due to lower lumber prices. Conditions-based investor, Michael Gayed, tracks lumber pricing and notes that lower prices imply lower home values. Housing makes up 15% – 18% of GDP and a large part of the net worth of many households. $HD results are bearish for the economy and the housing market. That’s a negative for the stock market as well.

2) Mixed Results and Message from Target ($TGT):

Target delivered mixed results with revenue and earnings in the first quarter above expectations. However, second quarter guidance was for declining same store sales and earnings well-below analyst estimates. The company cited massive losses from shrinkage (fancy word for theft), and a shift in consumer patterns away from discretionary purchases in favor of basic needs.

TGT price chart from TIKR.

DKI Takeaway: Retailers in many cities are struggling to figure out how to deal with theft in places where shoplifters aren’t prosecuted, and security physically detaining thieves is likely to lead to lawsuits costing much more than the goods being stolen. Consumers passing on discretionary purchases implies a weakening economy. Furthermore, Target is now facing the potential of a Bud Light-style boycott due to selling provocative merchandise for young children. (You’re welcome to look that up, but DKI isn’t printing it.)

3) Great Quarter at Walmart ($WMT) But a Warning:

Walmart had a great first quarter with revenue up 7.6% and higher EPS both beating analyst expectations. Management increased full-year revenue guidance by 3.5%. Same-store sales were also up a healthy 7.4%.

WMT price chart from TIKR.

DKI Takeaway: Great quarter, but it does come with a warning for the economy. $WMT is benefitting from a shift towards discount retailers due to consumer financial pressure caused by inflation. Further, management noted that there was a shift from discretionary purchases towards food. So, another way to read the results from this quarter is that most of the sales growth came from food price inflation.

4) The Housing Market Remains Locked-Up:

DKI has been saying for the past year that the reason housing market transactions have declined is due to a struggle between sellers who want last year’s prices and buyers who want last year’s mortgage rates. The market will clear at lower prices, but not better affordability because of current higher mortgage rates.

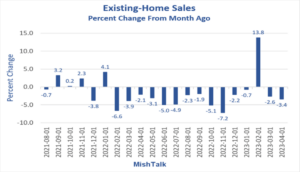

Graph by Mish Shedlock showing transaction volume down 14 times in the last 15 months.

DKI Takeaway: Adding to this problem are people who would like to sell their existing home and buy something smaller, but who feel trapped by their current low mortgage rates. There’s little incentive to sell your home, buy something smaller, and have the same monthly payments. As noted above, lower lumber prices are also indicating market weakness.

5) Multiple Federal Reserve Governors Advocating for More Rate Increases:

This week, St. Louis Fed President, James Bullard is in favor of higher rates to insure against further inflation. That was followed by comments from Dallas Fed President, Lorie Logan, indicating she thinks recent rate hikes have helped get inflation under control, but she notes that a CPI of 5% is still well-above the 2% target. While she reserves the right to change her mind based on new data, as of now, she believes additional rate hikes are necessary.

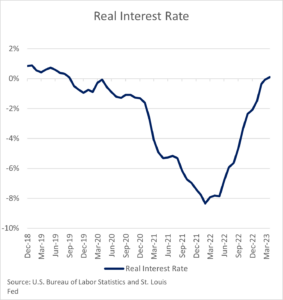

Re-running this graph showing that real interest rates are around zero right now

DKI Takeaway: In last week’s “5 Things”, we pointed out that the real interest rate (the fed funds rate less inflation) is around zero and that the Fed balance sheet still remains at an insanely high $8.5T. Inflation is still high led by services prices which the Fed is struggling to contain. While DKI has been highly critical of the Fed since November 2021, there are now multiple Fed Governors speaking in public who made comments predicted in last week’s “5 Things”. We should check to see if they’ve subscribed to DKI in the last few months.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.