The Macro Issue (Again)

Lots of new macro data this week with less company news. In a trend we’ve been highlighting for 6 months, the data is inconsistent. The good news is whether you’d like to see higher rates, lower rates, a stronger economy, a weaker economy, or a better/worse labor market, there’s something to support your point of view. One other exciting event – there’s a new position we’ve added for DKI subscribers. Let’s dive into the details:

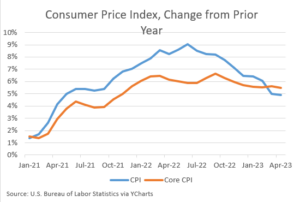

1) April CPI is Lower (Sort of…):

The market was excited by a lower-than-expected April CPI of 4.9%. That’s good news for the people hoping for an end to Federal Reserve rate hikes. Actual details are a bit more complicated. That 4.9% was only .1% below expectations and only .1% below last month. Of greater concern, the core number of 5.5% remains sticky. Both numbers are more than double the Fed’s target of 2.0%.

Energy is pulling the CPI down, but the core number remains sticky.

DKI Takeaway: The disinflation crowd is excited by the second derivative reduction in the rate of change. However, prices are still rising and doing so too quickly. In addition, in a couple of months, both energy prices and the CPI are about to anniversary periods when the comparisons are less favorable for a lower CPI. And services inflation of 6.8% is going to cause concern for Fed Chairman, Powell. More details for subscribers here.

2) Producer Price Index is Declining:

This one is less ambiguous. The Producer Price Index (PPI) is a leading indicator of inflation because price changes in the manufacturing and delivery process make their way into consumer prices a few months later. The April PPI was up 2.3% which is getting close to the Fed’s target.

The overall trend here is clearly down.

DKI Takeaway: If you look hard, the one potential negative here is the services component ticked up slightly while goods declined. DKI has been pointing out weak demand for goods for two quarters while expressing concern about persistent services inflation. Still, the trend in the graph above is clear. The PPI is declining.

3) Initial Unemployment Claims Rising:

Like the PPI, the initial unemployment claims are starting to tell a clear story. Jerome Powell has indicated he’s trying to soften the labor market in order to reduce wage pressure contributing to continued price inflation. The new jobless claims number is continuing a rising trend.

The absolute number isn’t huge, but the trend is clear.

DKI Takeaway: Higher initial unemployment claims, along with a declining PPI, will make it easier for Powell and the Fed to pause rate hikes. DKI continues to believe that rate decreases are not on the table for now. The overall employment market remains strong as of now with 10MM jobs available (almost double the number of people looking for jobs), and a 3.4% unemployment rate.

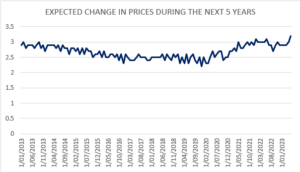

4) Consumer Inflation Expectations Are Rising:

The University of Michigan tracks consumer expectations for future inflation. The May number shows expected inflation over the next 5 years has risen from 3.0% to 3.2%.

Graph from the University of Michigan showing slight increase in consumer inflation expectations.

DKI Takeaway: It’s not a huge increase, but here’s why this matters: Inflation can become a self-fulfilling prophecy. If you believe that prices will rise substantially in the next month, you’re much more likely to buy everything you can afford today. While that doesn’t change long-term demand, it pulls short-term demand forward. This creates additional upward pressure on prices. Consumer expectations of future inflation can lead to actual current inflation.

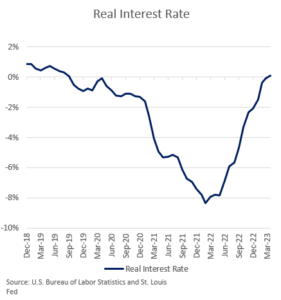

5) The Fed is Less Aggressive Than Most Believe:

Much of the above data shows declining inflation and signs of a weaker economy. It’s not completely clear yet, but there is support for the idea that the Fed should pause rate increases. A lot of people in finance are complaining that the Fed has acted in an aggressive and draconian way and that they’ve already tightened financial conditions too much. We’re skeptical.

Real interest rates are around zero right now

DKI Takeaway: Real interest rates are the fed funds rate less inflation. If we assume the CPI is accurate, the Fed finally just got real rates back to zero. The Fed balance sheet was blown up to almost $9 trillion as a result of endless quantitative easing. After about a year of “tightening”, that balance sheet is “down” to $8.5 trillion which is still a huge number. The Fed may pause to determine the effect of prior rate increases on the economy, but the current stance of zero percent real rates and a huge balance sheet currently are a stimulative stance. The thing that would make me wrong and would change Fed policy: A large number of bank failures.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.