The Inconsistent Data Issue

DKI has been writing about inconsistent economic data since last November. We’re now seeing the ISM, PMI, goods and discretionary purchases all showing weakness. Lumber is down but housing prices haven’t crashed yet despite higher financing costs. Services and employment data all showing strength. Don’t know what all of those things are or how to interpret the data? No problem: We have you covered…

We also welcome new DKI Intern, Tristan Navarino. In his first week, Tristan already began contributing to this edition of the 5 Things. For those of you who are dedicated Dylan Kogan fans, we’re pleased to report he’s graduated from Cornell and is doing some traveling before starting his first big post-graduation job later this summer. Tristan has big shoes to fill and is off to an excellent start.

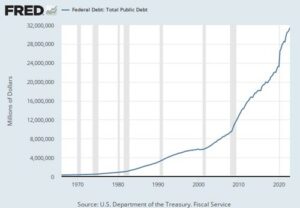

1) We Have a Debt/Spending Deal – Crisis Averted?

Over the previous weekend the White House and the Speaker of the House came to an agreement regarding spending and raising the debt limit. The plan is to overspend by about $4 trillion over the next two years and push the issue out past Biden and McCarthy’s reelection efforts. The legislation has passed the House and the Senate. Massive Treasury issuances on the way.

Let me know when we see those “draconian” cuts. Graph from the St. Louis Fed.

DKI Takeaway: Despite talk about a months-long bitter fight, the two sides were never far apart. Massive overspending will continue and be financed by the money printer. Interest expense will crowd out other spending. The Fed is going to be in a tough spot. For more detail on the issue, check out our non-paywalled post here. Worried about what this means for your portfolio? We have subscribers covered with investments that are designed to protect you in an inflationary environment.

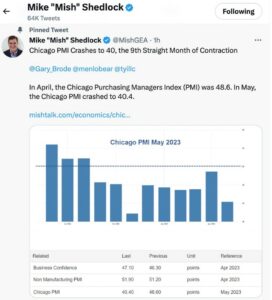

2) PMI and ISM Indicating Recession:

The Chicago Purchasing Managers Index (PMI) fell to 40. Anything under 50 indicates business contraction, and this was the 9th straight month under 50. Supporting this interpretation is the Institute for Supply Management (ISM) reading of 46.9% (again, under 50 means contraction). Prices index was down 9 points and order backlog was down 6 points.

Graph from Mish Shedlock.

DKI Takeaway: We’re starting to see more indications of a weakening economy. DKI has previously pointed out weakness in goods. As of now, services and employment are holding up better. More on that in the next “thing”.

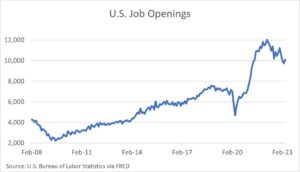

3) Available Jobs Tick Back Over 10MM:

The new JOLTS report, which tracks jobs available, just crossed back over 10MM. A couple of months ago, when the number of available jobs fell below 10MM, many Fed watchers thought it would give the Fed reason to “pivot” to lower interest rates. Either way, employment conditions remain strong.

Down from the peak, but still well above normal

DKI Takeaway: As we noted at the beginning, we’re seeing inconsistent data. Measures of economic activity are declining, but there are still almost 2 jobs available for each person actively looking. That’s going to keep services inflation high and keep pressure on the Fed to delay a pivot. Some have noted that not all of these jobs are being actively filled by companies, an argument we find persuasive.

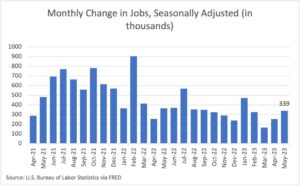

4) Jobs Report Shows a Massive Beat:

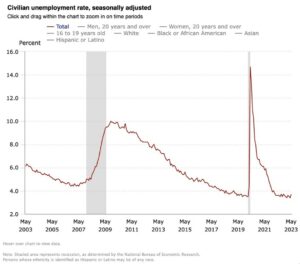

Friday’s jobs report showed nonfarm payrolls up 339k, well above the 190k expected. In addition, prior months’ adjustments added another almost 100k to the jobs total. Despite the huge increase in payrolls, the unemployment rate ticked up from 3.4% to 3.7%.

Expectations were for a decrease. We got a big increase.

Unemployment remains low and the tiny uptick at the end is a positive as well.

DKI Takeaway: This is great news for the economy, but it adds to pressure on the Fed to keep hiking rates (or at least continue to hold them steady). We believe that a robust demand for labor and higher wages are bringing people off the sidelines and into the labor force. People giving up government assistance and joining the labor force is great for the country, the economy, and for newly-employed individuals.

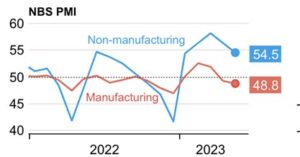

5) China’s PMI is Showing Signs of Stress:

As China slowly exited its Covid-shutdown phase, expectations were for a big quick lift to the economy. Instead, China’s Purchasing Managers’ Index fell from 49.2 to 48.8. Like the US numbers, anything under 50 indicates contraction.

Data from Refinitiv Datastream. Graph from Reuters.

DKI Takeaway: If the China manufacturing weakness lasts, it would be negative for short-term energy prices. The slowdown doesn’t seem to be affecting Macau, the gaming capital of the world, which continues to post record post-Covid gross gaming revenue every month.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.