The Banking Issue

The banks announced earnings this week. We’ll examine the performance of the Too Big to Fail (TBTF) banks vs the investment banks vs the regionals. Does the government have their thumb on the scale pushing deposits and profitability to one sector? Yes, and we’ll discuss why it matters. Plus, bonus points on Chinese economic growth, $LVS earnings, and the housing market.

Some excellent work this week from DKI Intern, Tristan Navarino, who is contributing more to the 5 Things every week including selecting most of this week’s material. Now, on to this week’s “Things”:

1) Strong Quarter from the Big Banks:

JP Morgan ($JPM) had earnings up 72% and revenue up 30% which beat analyst estimates by a large margin. Wells Fargo ($WFC) posted earnings up 69% and revenue up 14% which also exceeded estimates. Bank of America ($BAC) had earnings up 21% and revenue up 9% beating estimates. Citigroup ($C), which is more of a hybrid between a money-center bank and an investment bank had weaker results where the traditional banking and wealth-management groups grew, and the investment banking and trading business declined.

The decrease in deposits we heard about didn’t happen at the Too Big to Fail banks.

DKI Takeaway: The big banks benefitted from higher net interest margins because they could raise rates on new loans and adjustable-rate loans quickly while dragging their feet on providing customers with higher deposit rates. Overall, commentary on the conference calls was mixed with CEOs generally saying the US economy is resilient, but they have some concerns about potential future economic weakness (as do we all). It’s early, but we’re starting to see some data and anecdotes that confirm the banks are tightening credit quality and making fewer loans so it’s possible these CEOs are more concerned about future economic weakness than they’re conveying on investor calls.

2) The Investment Banking Business is Weak Right Now:

We saw a great quarter from Morgan Stanley ($MS) with earnings up 12% and revenue up 2%; both beating expectations. Goldman Sachs ($GS) had a rough quarter with earnings down 49% on revenue down 28%. Goldman earnings of $3.08 fell far short of the $4.28 estimate. With a lot of economic uncertainty, the traditional investment banking advisory and trading businesses are performing poorly.

Traditional investment banking and trading hasn’t been a great business lately.

DKI Takeaway: Morgan Stanley has made a successful multi-year shift towards the consumer-oriented wealth-management business. Goldman Sachs tried to do the same, but their efforts in this area have been less successful and the company is exiting much of its consumer businesses and taking huge write-downs. Because the investment banking business is more cyclical and the wealth-management business is more consistent, Morgan Stanley is trading at a much higher multiple. $MS is at 12.6x next year’s earnings estimate while $GS is trading at 9.6x despite being considered the standard-bearer in the investment banking business.

3) Mixed Results and a Problem for the Regional Banks:

There are too many regional (mid-tier) banks to list here so we’ll focus on a few of the largest ones in the Regional Banking ETF ($KRE). Synovus ($SNV) had earnings down 3% and revenue up 9%, but lowered revenue estimates for the rest of the year. Webster Financial ($WBS) showed earnings up 80% and revenue up 11% on higher deposits (impressive!). East West Bancorp ($EWBC) had earnings up 18% and revenue up 17% also on higher deposits.

Big banks outperforming the regionals (red line at the bottom) by a huge margin. This is partly due to government policy.

DKI Takeaway: While the above results are strong, the regional banks are trailing the big banks in stock market performance. The government has been explicit about backstopping both the large banks and their depositors while being ambiguous regarding any protection offered to the regional banks and their customers. This means that in addition to having a size advantage, the too-big-to-fail banks also have a funding advantage where the government guarantee means they can offer lower deposit rates with greater safety to attract clients. This leads to excessive (taxpayer subsidized) risk-taking by the big banks, and weakness for the regional banks which are crucial for small business lending. This policy will have negative consequences.

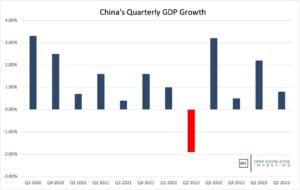

4) China’s Recovery Remains Sluggish:

Quarterly GDP growth in China came in at .8% which was below expectations. The weak report raised concerns for potential US and European recessions as Chinese exports, manufacturing, retail, and private sector results are underperforming. This is consistent with recent weakness in US shipping rates as well.

It’s positive, but barely so.

DKI Takeaway: China’s export-driven economy tell us a story about weak demand in other countries. DKI has been critical of inaccuracies in economic reporting by US agencies. That problem is magnified in China where government “reporting” is often pure propaganda and impression management. Actual GDP may have been down except we’re comparing with 2Q ’22 results which were produced by the same people and may contain the same inaccuracies. A weak economy in China also creates concerns for DKI stock pick $LVS – except results there were fantastic. More detail in the next “Thing”.

5) Las Vegas Sands – Great and Misunderstood Quarter:

Las Vegas Sands ($LVS) operates in the Singapore market and has the largest market share in Macau. Singapore has fully recovered with occupancy at 97%, room rates at all-time highs, and property level EBITDA back at pre-pandemic levels. Since China relaxed Covid-related restrictions in January, Macau is recovering quickly. Some individual properties there are performing at pre-pandemic levels and others are getting there. A shift to the higher-margin mass and premium mass markets is benefitting LVS as is the growth of high-margin non-gaming revenue where the company is a leader.

Lots of renovations happening at multiple properties in both Macau and Singapore.

DKI Takeaway: The shareholder-friendly management team has finally reinstated the dividend. In addition, LVS is renovating and expanding many properties which should provide for both revenue and margin growth in the future. The stock traded down on the fantastic quarter due to some disagreement regarding analyst expectation. FactSet had a much higher average estimate than Yahoo Finance and Zacks. While some discrepancy is normal, the range here was extreme. Our view is if you’re in the stock for the post-Covid recovery play, you just got evidence that it’s happening right now. More detail on the quarter for subscribers is available on the DKI blog.

6) Recent Economic Data is More Negative:

We got some weak economic indicators this week with industrial production negative, manufacturing production negative, and retail sales below expectations.

Credit to Stephen Geiger for the succinct and funny presentation.

DKI Takeaway: Much recent economic data has been mixed with strong consumer spending contrasting with weaker manufacturing numbers. Part of that was due to a shift in demand from goods to services. This week’s data is weaker across the board and if the trend continues, will reduce the probability of a second Fed rate hike later this year.

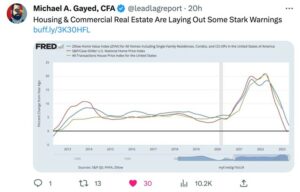

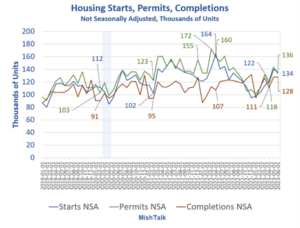

7) The Housing Market is Starting to Weaken:

Despite Shelter costs still rising in the CPI, the Case-Shiller and Zillow home price indexes are showing those price increases are coming to an end. Prices are still high and affordability has gotten worse with mortgage rates around 7%, but it’s not getting worse right now. In addition, housing starts declined last month.

Affordability is still a problem, but it’s not getting worse. HT to Michael Gayed.

The decline in the blue line at the end is an 8% decrease in housing starts. HT – Mish Shedlock.

DKI Takeaway: We predicted lower housing prices more than a year ago. The main reason prices have held up as long as they have is because higher mortgage rates have made it unattractive (and unaffordable) for many to sell their homes and move. People are “trapped” by their current favorable mortgages which has kept supply from entering the market. Still, while the insane price increases of recent years have stopped, prices are still too high even accounting for the wage increases much of the country has seen.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.