Are We Turning the Corner Yet? Well, it’s Complicated.

I’d like to start this week’s “5 Things” with a personal note. DKI intern, Dylan Kogan, will be moving on to focus on final exams and his first big post-graduation job. (100% success rate for DKI interns!) He started by helping with the “5 Things” graphs and during the last couple of months took ownership of DKI’s most-read piece. Without sacrificing quality, he saved me countless hours which is the highest praise I can imagine for a college intern.

Dylan moves on with our applause and appreciation. I believe he’s on his way to a fantastic career in finance and everyone at DKI wishes him nothing but continued success. If you’d like to follow the progress of a smart young man of high character, you can find Dylan’s LinkedIn profile here. Now, on to the show which includes not one but two bonus “things” to celebrate Dylan’s great work…

A lot of economic data was released this week, much of which shows the economy is beginning to slow in response to the Fed’s tightening. However, there is still a long way to go. Cleveland Fed President, Loretta Mester, said on Wednesday she believes services inflation is continuing to prolong inflation (a common theme here at DKI) and reiterated the Fed’s “higher for longer” mantra. Stories and analysis below.

1) Manufacturing and Services Industries Show Signs of Slowing:

The Institute for Supply Management’s index for manufacturing and services industries indicated both slowed in March. Its manufacturing survey declined to 46.3% from 47.7% the prior month. This is the fifth straight month the index fell and the lowest reading since May 2020, when the global pandemic disrupted many supply chains. Numbers below 50.0% indicates a contraction. Meanwhile, the index for the services sector also declined last month, dropping to 51.2% from 55.1% the prior month. This is the lowest reading in the last three months.

DKI Takeaway: Both the manufacturing and services sides of the economy are struggling under the pressure of higher rates. Businesses are responding with layoffs and hiring freezes to offset the higher cost of financing. While the economic outlook of both industries is still cloudy, the Fed’s pressure on businesses will likely increase. Of great interest to both DKI and Fed Chair, Powell, services employment and wages continue to rise at a rapid rate. DKI has been skeptical that the economic weakness we’ve seen so far is enough to prevent the Fed from hiking again.

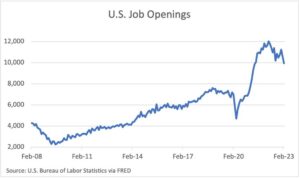

2) S. Job Openings See a Significant Decline to a Still High Level:

The U.S. Bureau of Labor Statistics reported that the number of job openings in February declined to 9.9 million from 10.6 million the prior month. This reading was considerably below economist’s expectations of 10.5 million. This is the fewest number of job openings since May 2021.

DKI Takeaway: The contraction in total job openings signals that the Fed’s tightening may be beginning to have an impact on the labor market, which has been a significant driver of inflation. However, as DKI pointed out last week, job openings remain at both a high absolute level and very high relative to the number of people seeking work. The current unemployment rate is a very low 3.5%.

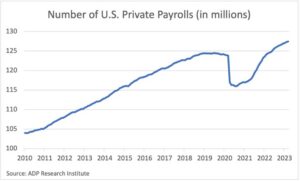

3) Private Payrolls Rose by “Only” 145,000 New Jobs:

Private sector hiring slowed in March, with payrolls rising by 145,000 according to ADP’s report for March. This is down from 261,000 in February and significantly below Dow Jones estimates. The report showed equal-sized gains for manufacturing and services companies. Annual pay rose at a 6.9% rate, which is down from 7.2% the prior month.

DKI Takeaway: While some will interpret this as a sign that high labor demand—which the Fed views as a significant driver of this inflationary cycle—is beginning to ease, 145,000 new jobs is still significant and signals the economy remains resilient. Plus, Fed Chair, Powell, will be watching those huge wage gains as well.

4) Fed Governor Mester Says Higher for Longer Due to Services Inflation:

Cleveland Fed President Mester indicated that she believes the Fed is likely to continue its rate increases, citing persistent inflation. She sees “the fed funds rate moving above 5% and the real fed funds rate staying in positive territory for some time.” Moreover, she said “the disaggregated data show that the inflation stubbornness is due mainly to the prices of services,” signaling that Fed is closely monitoring inflation with regards to services, rather than the broader economy.

Credit to Stack Holder for this humorous tweet and to Rudy Havenstein for the graphics highlighting Fed inconsistency.

DKI Takeaway: She’s right this time, but it is disturbing that the people in charge have been so late to realize what DKI has been pointing out for months. We made this point (again) last week in an article on the most recent PCE numbers here.

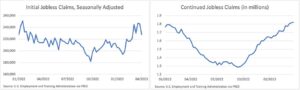

5) Applications for Unemployment Fall. Continuing Claims Flat:

The US Labor Department reports that applications for U.S. unemployment benefits fell 18,000 to 228,000 for the week ended April 1st. This was higher than consensus estimates of 200,000. The prior week data was revised up to 246,000 seasonally adjusted. Continuing claims were also revised up for the week ended March 18th from 1.7 million to 1.8 million.

DKI Takeaway: A slightly higher number of eligible workers are struggling to find work and are instead relying on severance and unemployment benefits to make ends meet. This is a sign that the Fed’s tightening is being felt by businesses. With so much contradictory data on both the economy and inflation, we recommend reading DKI’s Bifurcated Inflation series where we break up inflation and the economy into sectors and show you our thinking in detail.

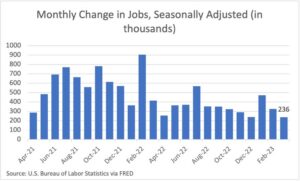

6) 236,000 Jobs Added in March; Unemployment Down and Participation Up:

The Bureau of Labor Statistics announced late last week that the U.S. economy added 236,000 jobs, which just missed economists’ expectations for the first time in 12 months. Jobs added declined from February’s 326,000 new jobs. Services industries such as leisure and hospitality, healthcare, and government accounted for most of the jobs gained, while manufacturing industries reported losses. This is consistent with the PCE report last week and ISM report this week that while we are witnessing contraction in manufacturing, the services industry is still growing. Moreover, the unemployment rate declined to 3.5% in March from 3.6% in February. At the same time, labor force participation was 62.6%, which while higher than previous months, is still below pre-Pandemic levels.

DKI Takeaway: More people are coming off the sidelines and joining the labor market in response to higher wages and high job availability. This would normally be positive news if the Fed wasn’t banking on the opposite to cool inflation. As we’ve been pointing out, the pervasive growth in services industries’ employment and wages continues to stymie inflation reduction.

7) Gold Nears All-Time Highs:

The price of gold is nearing an all-time high, surpassing $2,000 an ounce last week in the wake of higher inflation, weak economic data, and declining bond yields. This reflects growing sentiment that the U.S. economy is nearing a recession and represents a “flight to safety”. It’s also interesting timing given OPEC’s decision to cut production and the decline of the petrodollar. Anything that reduces dollar demand is going to be a positive for gold. If you want to understand this issue better, please check out “The Petrodollar is Dying” on the DKI blog.

Gold Price Chart from Gold.Org

DKI Takeaway: DKI has been recommended investing in gold since 2021 as a hedge against inflation. While stock and bond markets are down, gold has continued to climb. To see DKI’s other investment recommendations, consider a premium subscription here.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.