The “Experts” Have Lost Their Minds Edition

So many of the decisions that impact our financial lives are made by unelected bureaucrats who have never run a business. Think for a minute about how much the price of your home, which is the most valuable asset owned (or rented) by most American families, is affected by decisions made at the Federal Reserve. Unfortunately, it’s common for these “experts” to have no idea how the world works in practice. Please note that this should not be taken as an endorsement for the policies of the elected bureaucrats who have never run a business. Let’s see if we can find several ridiculous things that happened this week:

1) The International Monetary Fund (IMF) Lowers Global Growth Projections:

The IMF just cut global growth projections to 2.8% this year, 3.0% next year, and 3% in five years. While these numbers would seem fine in the US, please remember that the developing world grows at a much faster rate. This is the worst forecast in 30 years. Policies recently developed and advocated at the IMF such as inflationary currency creation, capital controls, price controls, and more loans sent to favored countries (that will never be repaid) are one of the reasons we have slowing growth.

Credit to Stack Hodler for the correct take on the situation

DKI Takeaway: The IMF is creating the problem it’s now “analyzing”. DKI has been warning for years that fiat currency creation backed by “faith and credit” has been abused to the point of no return. That’s why you’re seeing so much inflation. If you don’t already own some gold or Bitcoin, DKI has been recommending them to subscribers since they were much cheaper. Have some protection in your portfolio (even if you’re not a subscriber yet). (Important note: As I was writing this, the IMF urged the White House to cut spending to reign in inflation. We credit the IMF for its smart analysis on this.)

2) NY Fed President Says Rate Hikes Didn’t Cause Bank Failures:

In a speech at New York University, NY Fed President, John Williams said, “I personally don’t think the pace of rate increases was behind the issues at two banks back in March.” In our April monthly letter, DKI covered how Fed rate hikes led Silicon Valley Bancorp ($SIVB) depositors to pull funds and also crushed the value of the bank’s bond portfolio. Williams has a history of remarkable inconsistency in his “predictions”. We’re re-running the graphic below to show you how unreliable Fed officials are in analyzing the one thing they’re responsible for monitoring.

Image courtesy of the hilarious Rudy Havenstein (currenty suspended from Twitter)

DKI Takeaway: I actually agree with Williams on this one. The last decade and a half of zero or nearly-zero rates created the problem. Anything dead now has been dead for a while. The Fed raising rates hasn’t killed anything. It’s just making clear who’s alive, who’s dead, and who’s mostly dead.

3) The Market STILL Doesn’t Believe Jerome Powell:

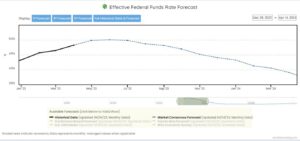

The fed funds rate currently sits around 5% with Fed Chairman, Jerome Powell, indicating the Fed will keep hiking cautiously. Most market participants expect another 1-2 rate hikes taking the fed funds rate to around 5.25%. Publicly released information indicates the Fed does not expect to reduce that this year. (The “dot plot” shows the rate expectations for Fed Governors.) However, the market is expecting the Fed to reduce rates by about 110bp (1.1%) over the next year.

Graph from econforecasting.com shows forecasted fed funds rate declining from 5.0% to 3.9% while Fed is saying they will keep the rate unchanged into 2024. Someone will be wrong.

DKI Takeaway: DKI has been saying for almost a year that the “pivot people” have been premature. They’ve been predicting since last May/June the Fed would reduce rates instead of the constant rate increases we’ve seen. DKI has been critical of Powell, but he’s been consistent in telling everyone that he’s willing to put the US in a recession rather than take the risk of persistent uncontrolled inflation. His mantra in public has been “higher for longer”.

4) Treasury Secretary, Janet Yellen, Still Confused:

On Tuesday, Treasury Secretary, Janet Yellen said “she has not seen evidence of a contraction in credit”. Mortgage rates have skyrocketed. Banks are tightening lending standards. And in a Federal Reserve survey released on Monday, “the share of respondents reporting it’s harder to obtain credit than one year ago climbed to the highest since the New York Fed started conducting its Survey of Consumer Expectations in 2013”.

Janet Yellen evaluating consumer credit.

DKI Takeaway: Our smart friends at Unicus Research have described Janet Yellen as the “Marie Antoinette of our inflation”. We’ve linked this before, but then Yellen keeps saying things that bear no resemblance to reality. We promise to retire the photo and link when Yellen stops saying ridiculous things in public. (Important note: Bloomberg is saying the recent change in bank credit is related to the transfer of assets from failed banks to the FDIC. DKI thinks credit availability is falling, but we want to provide you with full disclosure that this would make Yellen’s claims technically true.)

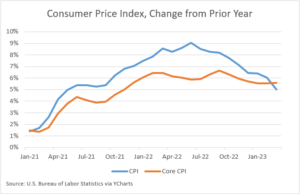

5) March CPI Falls to 5.0%. Core Rises to 5.6%:

For those of you hoping for the Fed “pivot” to lower rates, you’ll find the lower CPI of 5.0% encouraging. For those of you hoping for more inflation and rate hikes, you’ll find the higher “core CPI” of 5.6% encouraging. (Core excludes food and energy). Energy prices were down but that will reverse with already announced OPEC production cuts. Shelter pricing was up, but will start falling as higher mortgage rates make their way through the long home sales process. The important services inflation number that Powell is watching was a still-high 7.1%.

DKI Takeaway: Market participants betting on when the Fed will “pivot” to lower rates (or at least pause) has been the national sport in finance for the past year. A few hours after the CPI report sent stock prices higher, the Fed minutes reversed that by making clear they expect a recession AND still plan to hike one more time. For more detail, see the next “thing”.

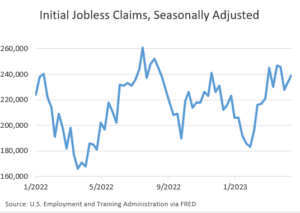

6) Jobless Claims and the Fed:

This week’s jobless claims number was up by 11k to 239k which was above expectations. This is an indication that the Fed’s rate hikes are starting to affect employment which sent stocks up due to the pressure this puts on them to halt rate hikes. This came one day after the Fed released the minutes from their last meeting showing that as of now, they expect to implement one more rate hike and then keep rates flat for the rest of the year. DKI full analysis here.

DKI Takeaway: DKI has been telling you for the past two quarters that Fed Chairman, Powell, is laser focused on employment and services inflation. Services inflation remains high. The labor market is still strong, but beginning to show early signs of weakness. That, plus the clarity provided in the Fed minutes, have alleviated the “pivot” guessing game that’s been going on for the past year. We should see the “pause” after one more rate hike next month.

7) Explanation of Core CPI and Other Popular Metrics:

Every month, the U.S. Bureau of Labor Statistics reports the consumer price index (CPI) and the Core CPI which excludes food and energy price changes. This has caused others to start creating their own indexes excluding ever-more price changes. These alternative versions of the CPI exclude more things that Americans have to buy. To help you follow along, we are publishing the full list of all DKI-approved CPI indexes:

CPI – includes everything

Core – excludes food & energy

Super-Core – excludes food, energy, and shelter

Franzen – excludes everything (constant 0%)

DKI Ultra-Core – Fed estimate of the price of an apple that’s been in Jerome Powell’s refrigerator for 2 months.

That’s the full update.

Round of applause for the smart and funny Caleb Franzen (@CalebFranzen on Twitter)

DKI Takeaway: We told you at the beginning this week would include some ridiculous things. It’s ok to have a laugh every now and then.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.