All eyes were on the bond market this week as the bond vigilantes arrive. Want to know what a bond vigilante is? No worries, we explain and tell you what we’re doing about them. Moody’s downgrades US Treasuries. No one cares. We all knew the US government has a debt and spending problem. Meta’s AI model release is delayed as performance is worse than expected. Google heads in the other direction with plans to make money and devices based on its AI investments. Klarna bad debt rises leading to increased losses and more jokes about securitizing burritos. In our educational section, we discuss the difference between secured and unsecured debt.

This week, we’ll address the following topics:

- The Bond Vigilantes arrive. What do we do now?

- Moody’s downgrades US Treasuries. Want to know why we don’t care?

- Meta’s AI model hits another rough patch. Llama not advancing as quickly as they hoped. The behemoth is looking smaller.

- Google gets more aggressive in AI and starts discussing a business model to earn a return.

- Klarna’s bad debt increases adding to losses. Insert usual joke about burrito-backed securitizations here.

- Educational section: We explain the difference between secured and unsecured debt. Klarna understands this section.

Great week for the DKI Interns. Cashen Crowe did his usual excellent work while traveling to Spain. He sent image updates on Friday morning from a train to Barcelona. Cashen was joined this week by new DKI Intern from Rutgers, Samaksh Jain. Samaksh just traveled to Hyderabad, India, and immediately began contributing to this week’s 5 Things. We’re on three different continents in three different time zones. This seems normal here at DKI. I’ve been trying to convince them to write their own versions of my An Adventure series.

Ready for a week of bonds, bond downgrades, and bond vigilantes? Let’s dive in:

1) The Bond Vigilantes Arrive:

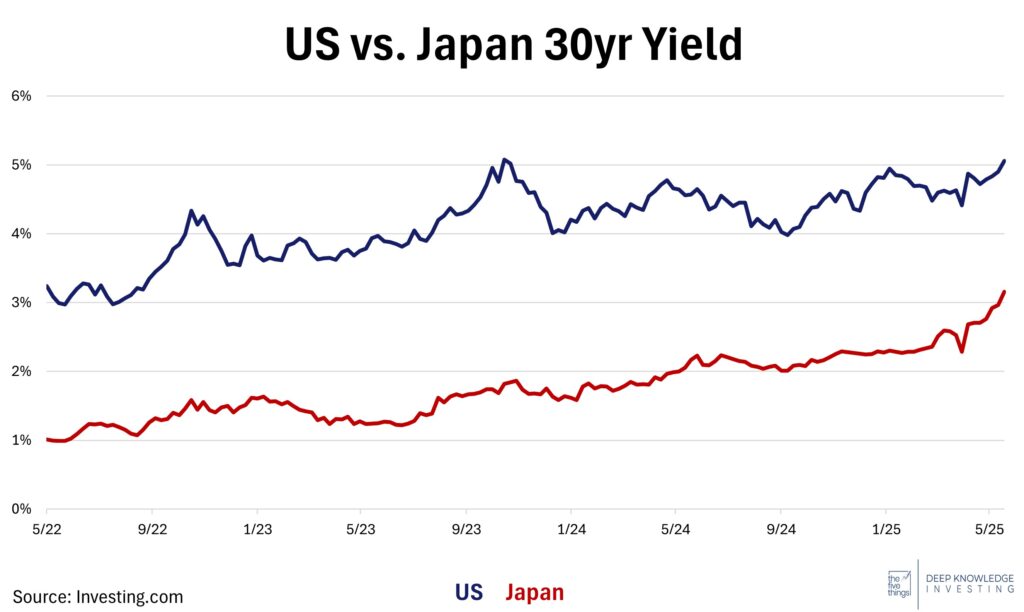

Countries like Japan (260% debt/GDP ratio) and the US (almost a quarter of a quadrillion of on-balance-sheet and off-balance-sheet liabilities) can keep papering over the problem as long as the bond market agrees to keep buying the next round of debt. When the market refuses and bond prices fall leading to higher yields, it’s said to be the work of the “bond vigilantes”. They may not have yet arrived in force but a few of them are peeking in the doorway. This week, Japan had horrible 30 and 40-year debt auctions. The yield on the Japanese 30-year government bond (JGB) rose from 2.59% a month and a half ago to 3.15% at the end of the auction. The 40-year JGB yield rose from 2.58% to 3.62%. The 30-year US Treasury yield rose from 4.39% to 5.09% in the same time frame. The US 20-year bond auction this week had a large “tail” which is a fancy finance way of saying there were few enough bidders that the ending yield was higher than expected. These are massive moves in long-dated government securities. Add extra emphasis for the fact that this just happened in the world’s reserve currency; the place investors go when they want to seek safety. Our question to bond owners: Are you feeling “safe” right now?

The graph is a long time-frame, but the increasing recent slope is big for bonds.

DKI Takeaway: Some would think that these higher yields would bolster the dollar. (Higher yields make owning these bonds more attractive and you have to buy dollars so you can pay for the bonds.) Yet, the dollar price of gold was up following the weak auction and Bitcoin hit multiple all-time highs in the week. The strength in these dollar alternatives indicate a weak dollar. Our financial system is unsustainable and DKI spent all of 2024 telling you that no matter who won the November election, the overspending and dollar debasement would continue. When Treasury auctions have fewer buyers and yields spike, this increases the borrowing costs of the government at the same time that the amount borrowed rises. Interest expense skyrockets and we print dollars to pay the difference. That leads to higher budget deficits, more inflation and higher bond yields. Wash, rinse, and repeat. The good news is DKI subscribers were well prepared for the week’s events. If you want to know what we were doing right, there’s more detail at this non-paywalled post; It’s the Bond Market – Here’s What We Do.

2) Moody’s US Downgrade Is Meaningless:

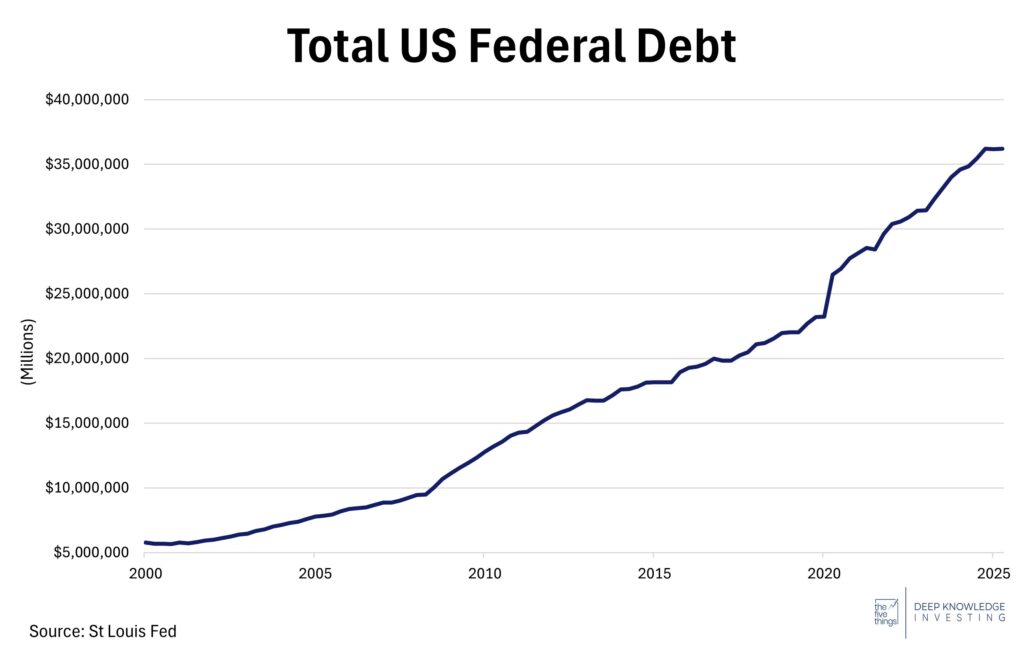

Moody’s is one of the three big bond rating agencies. This week, it became the last of the three to downgrade US Treasuries from its highest Aaa rating to the slightly lower Aa1 rating. There were some hysterical headlines, but the market shrugged and largely ignored the insult. DKI agrees with the market on this one. The entire investing world already knows that the US has over $36 trillion of debt and that interest expense is skyrocketing. Many also know there are about $200 trillion of unfunded liabilities for programs like Medicare, Medicaid, and Social Security. The Republican-led Congress is in the process of signing off on more multi-trillion-dollar deficits, following in the footsteps of the fiscally irresponsible Democrats. As we said all last year; we can’t vote our way out of our financial problems. Treasury yields are rising because we all know the government’s finances are horrible. For more reasons we don’t care about the Moody’s downgrade, read on:

Lyn Alden constantly says “nothing stops this train”. She’s right. The trend won’t end.

DKI Takeaway: Moody’s timing was also suspicious. Standard & Poor’s downgraded US Treasuries in 2011 and Fitch followed in 2023. Moody’s was years late and they delivered the downgrade while Congress was in-session debating this year’s big spending bill. The timing led many to reasonably conclude that this was a political shot against the current White House. Finally, we remind everyone that all three ratings agencies have a conflict-ridden business model where they are paid by the companies they rate. One result of that was all three agencies completely missing on their sub-prime property loan ratings during the run-up to 2008.

For the sharp pencil people in the crowd who correctly note that the US can’t default because we can print more dollars to repay any debt: That’s technically correct, but the bond market is expressing concern that the dollars used to pay those debts will have little value.

3) Meta AI Hits a Rough Patch:

Meta has delayed the release of its Llama 4 “Behemoth” model for the second time, and is now aiming for a launch later this year. Initially expected in April, then June, the rollout has been postponed amid internal concerns that the performance gains are not sufficient to warrant deployment. The model, reportedly featuring 400 billion parameters, more than five times the size of Llama 2’s largest version, was positioned to compete with OpenAI’s GPT-4 and Google’s Gemini 1.5. However, internal reviews cite poor inference efficiency, underwhelming accuracy improvements, and growing skepticism among Meta’s engineers. The delay has fueled leadership frustration and increased scrutiny of the company’s broader AI roadmap.

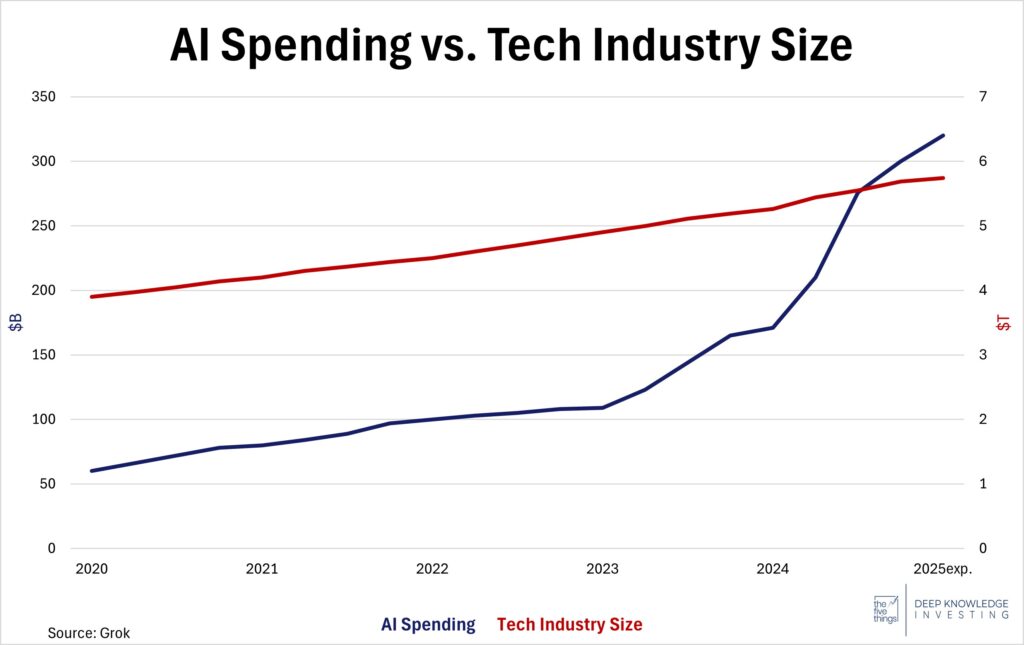

These challenges show the possible inefficiency of further scaling, which could end up delivering diminishing returns. The US-based hyperscalers are facing the possibility that scale alone is no longer a guarantee of meaningful progress in generative AI. While Meta is allocating up to $72 billion in capital expenditure this year, much of it directed toward AI, internal doubts about Behemoth’s readiness raise questions about the payoff from these investments.

I’m sorry Dave. I don’t have enough information. (Hal in 2001 A Space Odyssey)

DKI Takeaway: Meta’s repeated delays in releasing the Behemoth model reflect the growing difficulty of achieving meaningful improvements in large language models. This situation mirrors similar delays faced by other AI leaders like OpenAI and Anthropic, indicating a broader industry trend that sometimes, throwing more energy at a problem doesn’t generate better intelligence. Markets may be too quick to price in broad-based AI monetization with these high capital expenditures, but these setbacks underscore the importance of scrutinizing AI development timelines and setting realistic expectations for breakthroughs in the near term. DKI has previously expressed concern that many of the companies spending tens of billions of dollars on AI don’t yet have a business model to earn a return on that spending.

4) Google Pushes Forward with AI at I/O:

Google’s annual I/O (Input/Output) conference just provided a new look into the future of AI within the company. Labeled “AI at the scale of human curiosity,” Google is pushing forward with further AI integration between the company’s products. Advancing its Gemini model, Google showcased new investments into software with ability to monetize in ways like charging for AI infrastructure and charging for advanced capabilities. Google also announced new investments in hardware, ranging from smartphones to smart glasses.

Overall, the I/O conference showed positive strategic signals in terms of AI advancement and monetization capabilities. However, initial market skepticism of such aggressive advancement led to a decline in Alphabet’s stock, but shares rebounded the next day, rising 5%.

The DeepSeek scare was in Jan. and spending is only rising.

DKI Takeaway: Google is indicating to investors that they aren’t afraid to double down on AI tech. The expansion of AI integration across a wide span of products reflects their motivation to keep moving in the direction of AI. Some are noting that Google seems to be showing successful AI advancement, while Meta is having trouble with scaling their models of similar AI language. We add that Google has more pressure to succeed in this area as AI-powered answers are a huge threat to Google’s profitable search business. At a minimum, Google is thinking openly about how to monetize its investments in this area. DKI has been commenting for a year that many of the AI hyperscalers are spending tens of billions of dollars without a disclosed business plan to earn a return.

4) Klarna’s Credit Loss Dilemma:

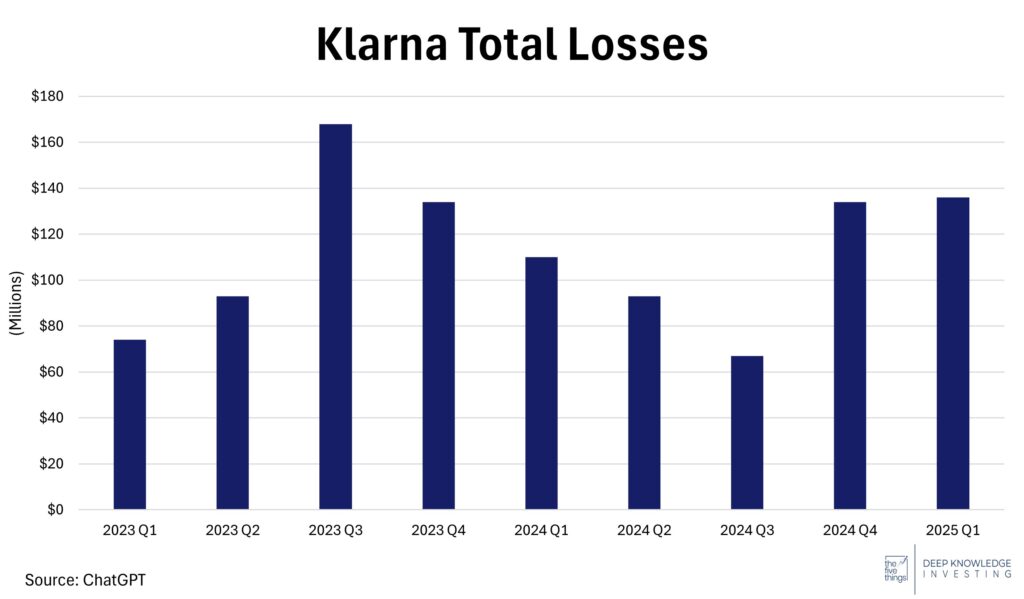

Klarna, one of the largest buy now, pay later (BNPL) payment processing companies, saw a 17% rise in consumer credit losses, reaching $136MM. More consumers are beginning to fall behind on their payments, creating a tense situation for Klarna, as they already delayed their US IPO last month. Though the company’s credit losses as a share of total volume are under 1%, this increase creates a dramatic effect on Klarna’s bottom line due to its business model utilizing high volumes of low-profit transactions.

With these losses flowing through the income statement, Klarna saw a 110% increase in total losses year over year, from $47m to $99m. Likely recent increases in delinquencies will lead to higher losses in future quarters.

These losses are the equivalent of bad debt charge-offs. We think early delinquencies are rising as well.

DKI Takeaway: There’s been a lot of joking about future securitizations of Chipotle burritos. (We want the tranche from people who paid extra for guacamole.) Unfortunately, like many jokes, there’s at least some truth to it. This is compounded by Klarna’s inability to repossess on defaulted items leading to 100% losses on bad accounts (unless someone figures out how to repossess a burrito or makeup from Sephora). Though Klarna cited macroeconomic troubles as the leading reason for delaying IPO, the sharp rise in losses is probably adding to the uncertainty of reaching their goal of raising $1B.

5) Educational Topic: Secured Debt vs. Unsecured Debt:

Debt comes in two forms: secured and unsecured. The difference between the two comes down to whether the borrower agrees to risk belongings of their own to ensure repayment, otherwise known as collateral. Secured debt is backed by assets that the creditor is entitled to if the borrower is unable to repay, whereas unsecured debt has no assets tied to the loan. If a borrower is unable to repay a loan on unsecured debt, the creditor is typically only able to seek repayment through legal actions, like sending balances to a collection agency.

Securing a loan with assets that can be repossessed or claimed has more risk for the borrower, but will result in a lower interest rate due to some security for the lender. Because unsecured debt creates a higher risk for lenders, they will typically respond with higher interest rates or shorter repayment periods to address that additional risk. A borrower will not always be able to choose between secured and unsecured, as it typically comes down to the type and size of the loan.

Home mortgages and car loans are almost always asset-backed. Burritos and makeup can’t be repossessed so losses on those are 100%.

DKI Takeaway: A classic example of secured debt is an auto loan. The loan is secured by the vehicle, and it can be repossessed if a borrower fails to make their payments. On larger loans, secured debt makes it easier for individuals with worse credit to borrow, as lenders can secure the debt with the purchase itself. A classic example of unsecured debt would be a credit card balance, as nothing is tied to the loans that are given to the account holder. As mentioned in point #4, Klarna’s loans are unsecured, meaning there is nothing that borrowers put up against the loan.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.