Macau Gaming is Strong, Fed Struggles to Slow Economy Outside Real Estate, And More Crypto Fallout

Lots of varied news this week. Again, we congratulate DKI Intern, Dylan Kogan. Every week his contribution to the “5 Things” grows. Fantastic to see a college student become a meaningful contributor.

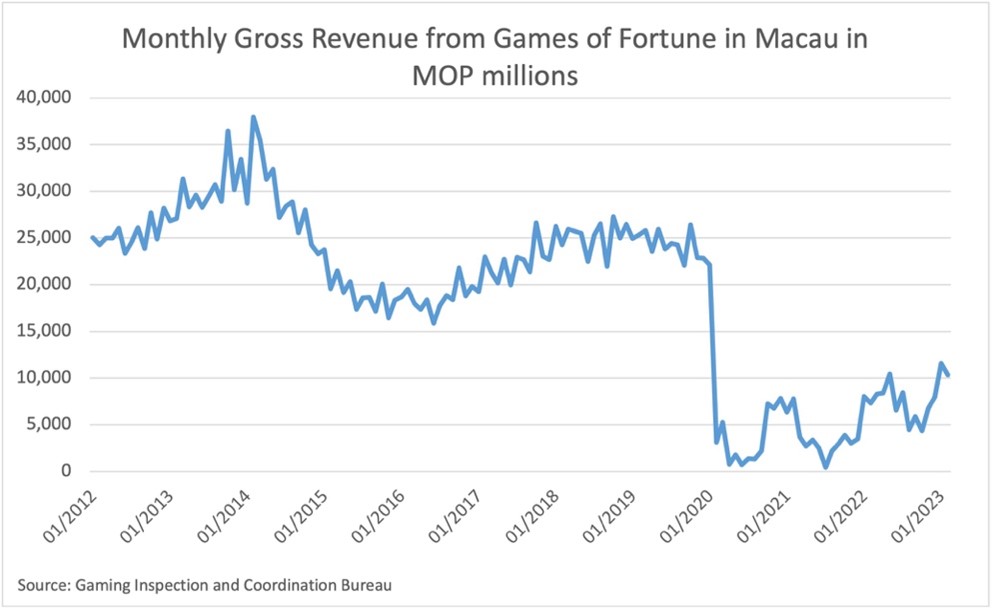

1) Macau’s GGR Exceeds Expectations:

Macau’s gross gaming revenue (GGR) was MOP10.3 billion or US$1.3 billion in February, which is up 33% from the previous year. This figure topped J.P. Morgan analyst expectations for MOP9.5 billion (US$1.17 billion). This is the second consecutive month Macau GGR has been above MOP10 billion. February is a shorter month and Chinese New Year, a popular time for vacationing in the region, was in January this year. Moreover, the new year fell in February last year, which means tough comparisons for last month, and an adjusted annual increase could be even higher.

DKI Takeaway: This is continued positive news for Macau casinos, including DKI stock pick $LVS, on the heels of eased Covid-19 restrictions in China.

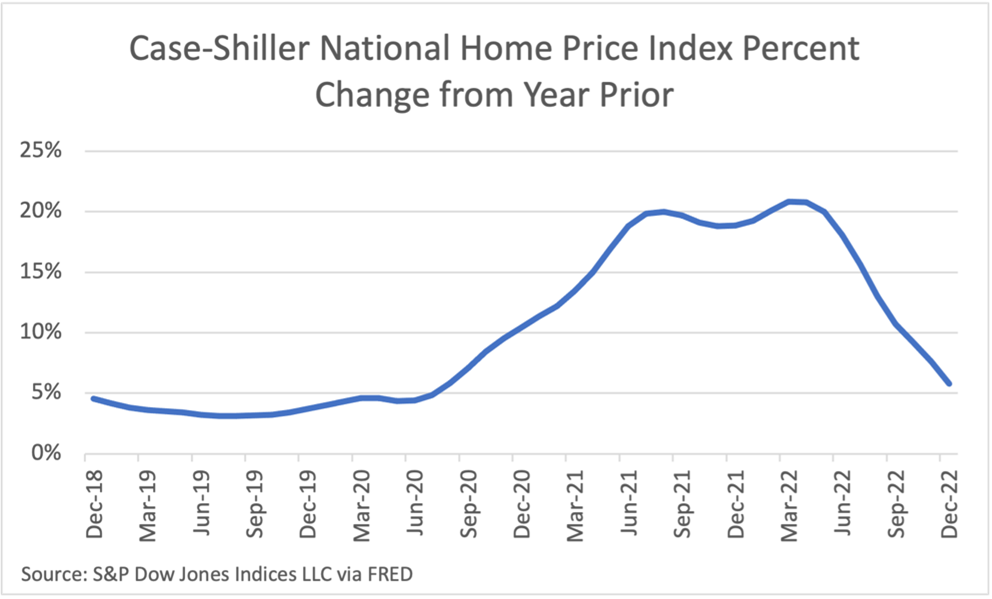

2) Home Price Increases are Slowing Down:

In response to the higher mortgage rates we spoke about last week, the annual increase in home prices slowed for the last month of 2022. The Case-Shiller index, which reports on home prices, showed home prices increased 5.8% from the previous year. This is down from the 7.6% annual gain seen in November 2022. Prices peaked in June 2022 and are down 4.4% since. This means that home prices are still rising vs last year, but have started to decline in recent months.

DKI Takeaway: Home prices were too high relative to what home buyers could afford in the current mortgage market with rates now around 7%. The Case-Shiller is a lagging indicator, and higher borrowing costs will continue to have an adverse impact on home prices.

3) Fed Officials Signal Faster Rate Increases:

Two Fed officials, Neel Kashkari and Raphael Bostic, have signaled they prefer higher rates due to persistent inflation and strong jobs numbers. Kashkari, the Minneapolis Fed President and a voting member of FOMC said last Wednesday that he was “open-minded” about the Fed raising the lending rate by 25bp or 50bp (.25% – .50%) after the next FOMC meeting. He said “Given the data in the last month—higher inflation than we expected and a strong jobs report—these are concerning data points suggesting we’re not making progress as quickly as we’d like.” Meanwhile, Atlanta Fed President Bostic argued for a 50-bps increase and the need to keep rates in a range between 5-5.25% into 2024. The market currently anticipates a 25-bps increase following the FOMC meeting on March 21st-22nd.

Image from Rudy Havenstein.

Image from Rudy Havenstein.

DKI Takeaway: The Fed “pivot” is not happening anytime soon as both Kashkari and Bostic have expressed. The Fed is going to tank the economy before it begins to reverse course. Read the inconsistent comments in the image above and see why we lack confidence in the Fed’s decision-making process.

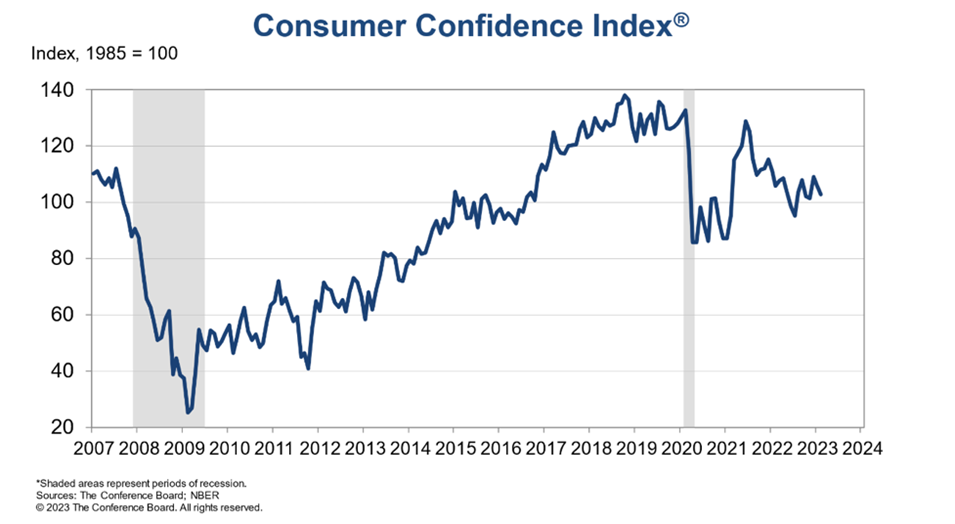

4) Consumer Confidence Wanes:

Consumer confidence declined in February according to Conference Board. Its Consumer Confidence index, which measures consumers’ optimism about their finances, declined in February from 106.0 to 102.9. Economists were anticipating an increase in confidence to 108.5. Despite strong jobs numbers, consumers are increasingly pessimistic about the future of the economy. The Conference Board’s survey showed consumers are bullish in the near term about job prospects and income, but that confidence waned when looking out as little as six months.

Graph from the Conference Board.

DKI Takeaway: Consumer spending is, in part, responsible for continued strength of the economy. With higher prices and rising rates, consumers may begin to hold back on large purchases, finally issuing in a contraction. We’ve already started to see this in reduced purchases of goods.

5) Crypto Slides on Silvergate Fallout:

Silvergate Bank, a major bank to cryptocurrency businesses, announced Wednesday that it will not meet the extended filing deadline for its annual financial statements. Following the news, major cryptocurrencies Bitcoin and Ethereum were down 4.59% and 4.15%, respectively. The bank, which accepts U.S. Dollar deposits from major crypto firms, experienced a bank run in the wake of the FTX bankruptcy scandal, after which it lost nearly 70% of digital-asset-related deposits in the fourth quarter of 2022. Last week, several crypto companies including Coinbase, Galaxy Digital, and Circle, announced they will no longer bank with Silvergate. To recapitalize, the firm sold a large share of its bond portfolio at a loss. The firm is also grappling with an investigation into its relationship with FTX. Silvergate’s woes are felt throughout the crypto ecosystem as many crypto exchanges use its real-time payments network. Moreover, concerns over U.S. regulation of the ties between crypto firms and banks grow as more firms witness significant losses.

DKI Takeaway: While this drop in Bitcoin and Ethereum is likely an immediate response to Silvergate’s financial woes, we will point out that in assets denominated in fiat (traditional government-issued currencies) there are also bank failures and bankruptcies. We remain long-term bullish on Bitcoin.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.