The Higher for Longer – Plus Faster Version

Jerome Powell does his version of the Six Million Dollar Man telling Congress rates will be higher for longer, and faster than many hoped. A stronger than expected economy continues to disappoint asset gatherers hoping for a return to bubble valuations.

DKI continues to applaud intern, Dylan Kogan, who weathered school exams and delivered his typical excellent contribution to this week’s 5 Things to Know. Nice work Dylan!

1) January Job Openings Still Huge:

The Bureau of Labor Statistics reported that the number of job openings declined to a still-high 10.8 million in January. This comes after December’s job openings were upwardly revised to 11.2 million. January’s number exceed consensus estimates for 10.5 million job openings. The report indicated hirings increased to 6.37 million accompanied by small increases in layoffs and quits.

DKI Takeaway: The labor market is strong with more than 10MM jobs still available. There is still a mismatch between supply and demand for labor, which the Federal Reserve correctly believes is leading to pervasive services inflation.

2) Fed Chair Jerome Powell Tells Congress Higher for Longer – Plus Faster:

Federal Reserve Chair Jerome Powell spoke before congress last Tuesday, during which he reiterated that interest rates are headed higher and for longer in response to economic data, which has persistently come in hotter than central bank policy makers have liked. Powell further indicated that he was prepared to increase the pace of rate hikes and potentially add another 50bp this month. Following his speech, markets priced in terminal rates between 5.5% and 5.75%, according to CME Group.

Hold on a minute – Powell to people hoping for 25bp rate increases

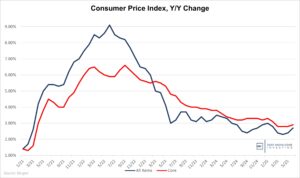

DKI Takeaway: Higher and for longer plus faster. If you want to better understand how we think the Fed will view inflation, you can see our series on Bifurcated Inflation which starts here.

3) Consumer Credit Shows Curbed Borrowing:

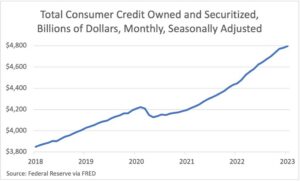

The Federal Reserve reported that total U.S. consumer credit rose 14.8 billion in January, representing a 2.7% monthly gain—the smallest monthly increase since November 2020. This was below the $25 billion gain economists had anticipated. Revolving credit—like that taken out on credit cards—rose 11.1% in January. Non-revolving credit—such auto loans—rose 1.2%. Credit is drying up for big-ticket purchases like cars and education, but consumers are still relying on credit for day-to-day purchases.

DKI Takeaway: Credit is rising and savings rates are declining. Consistent with what we’ve been saying before, banks are increasing reserves in anticipation of higher delinquencies. The overall environment has been positive for DKI stock pick $ENVA.

4) Silicon Valley Bank Facing an Old-Fashioned Bank Run:

Last Wednesday, Silicon Valley Bank (SVB) became one of the first banks to succumb to the Fed’s tightening when it announced the company will book a $1.8 billion after-tax loss on sale of investments. The tech-focused lender is heavily invested in treasuries which have lost value as the Fed has raised rates. Bond prices move inversely to interest rates. Banks typically do not have to realize these loses unless they are forced to sell due to a reduction in deposits, which is exactly what happened at SVB. Previously, many of the tech firms that bank with SVB were thriving thanks to near-zero rates. SVB saw deposits decline as its customers went elsewhere for higher yield, prompting the need for cash. (As this piece was in edit, regulators shut down the bank.)

The stock is going lower once its no longer halted. (Edit – going out of business)

DKI Takeaway: SVB is just one of the first banks forced to realize its losses on securities. As of December 31st, 2022, U.S. banks had unrealized losses of $620 billion on available-for-sale and held-to-maturity securities. This is why SVB’s problem is causing concern across the banking sector. DKI had its own near-miss with the company. Details here.

5) 311,000 Jobs Added in February and Unemployment Rises:

U.S. employment rose by 311,000 in February and the unemployment rate rose to 3.6%, according to the Bureau of Labor Statistics. The number of new jobs significantly exceeded analyst expectation of 225,000 jobs. Average hourly wages also grew 4.6% in February from a year earlier. This signals an economy which remains strong, even as inflation persists, and interest rates move higher.

DKI Takeaway: What is most interesting about this report is that despite the number of jobs increasing, unemployment also increased. This tells us that increased wages have pulled people off the sidelines—people who have retired or chosen not to work—and back into the workforce. We cover the issue in greater detail here.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.