The Fed didn’t cut rates as expected, but the new dot plot and some hawkish comments by Chairman Powell caused the market concern. We explain the multiple reasons why DKI isn’t worried about Fed projections. The GENIUS act is heading towards approval and Americans are about to be introduced to the benefits of stablecoins. They could save you money, provide more convenient financial services…and completely disrupt the banking and credit card industries. The government is looking at restructuring subsidies away from wind and solar and towards hydro, geothermal, and nuclear power. DKI subscribers were well-positioned for this. It’s not too late for you to do the same. Recently, Amazon and Microsoft contracted for access to nuclear power for their AI datacenters. Nvidia tops them by investing in a partnership that’s going to build small modular reactors to power AI data centers. Do you own enough uranium? DKI bought more two weeks ago. Finance professionals talk about hedging all the time. In our educational topic, we unravel this complicated topic for you and make understanding hedging easy.

This week, we’ll address the following topics:

- The Fed doesn’t cut and the dot plot gets hawkish. Want to know why we think this doesn’t matter?

- The GENIUS act makes progress towards approval and Americans about to learn more about stablecoins. The market opportunity is huge while implementation is uncertain. We explain.

- New proposed legislation is negative for solar and wind, but positive for nuclear. DKI subscribers profit!

- Amazon and Microsoft just bought access to nuclear power. Now, Nvidia is investing in it and helping to build SMRs (small modular reactors) for more AI datacenters.

- In our educational topic, we help you understand different types of hedges and how they can help you reduce losses in your portfolio.

I’m so proud of our interns, Cashen and Samaksh. They’ve taken over ownership of The Five Things. Much of the topic selection, image generation, and research you’re about to benefit from comes from their efforts. Great job by both of them! I also want to thank Robb Fahrion and the team at Flying V. Robb continues to make suggestions and pour resources into the video version of this publication. If you want to hear us discussing these issues and get some additional detail, come check out our growing YouTube channel. It would be great if you wanted to subscribe or leave us a “like”, but hey – do what you want. We’re not the boss of you!

Ready for a week of financial analysis powered by nuclear power? Let’s dive in:

1) Fed Meeting:

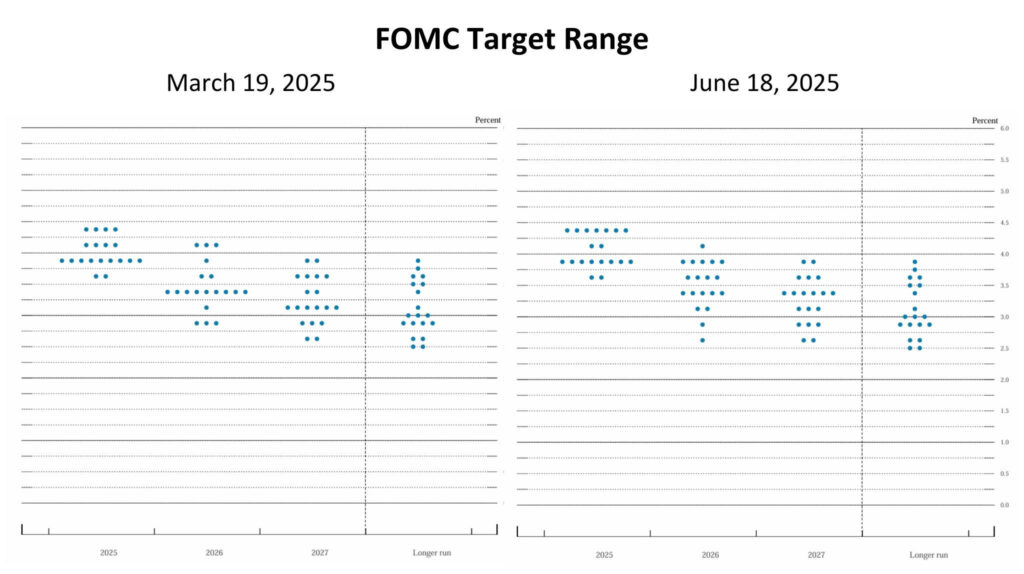

The Federal Reserve concluded its June meeting on Wednesday, and as everyone expected, kept the fed funds rate unchanged. That wasn’t the whole story though. June is one of the four meetings each year where the Fed provides the “dot plot”. That’s a chart where each Fed member shows where they expect interest rates to be at the end of the next three years. While this dot plot showed that the median expectation was for two 25bp (.25%) rate cuts by the end of the year, the details were more hawkish. The number of Fed Governors who expect no rate cuts this year almost doubled from four in March to seven now. In addition, Chairman Powell dropped this bomb during his press conference: “We expect a meaningful amount of inflation in coming months.”. Sure, it was temporary and tariff-related, but that was the last thing the market wanted to see. At DKI, we’re completely unconcerned.

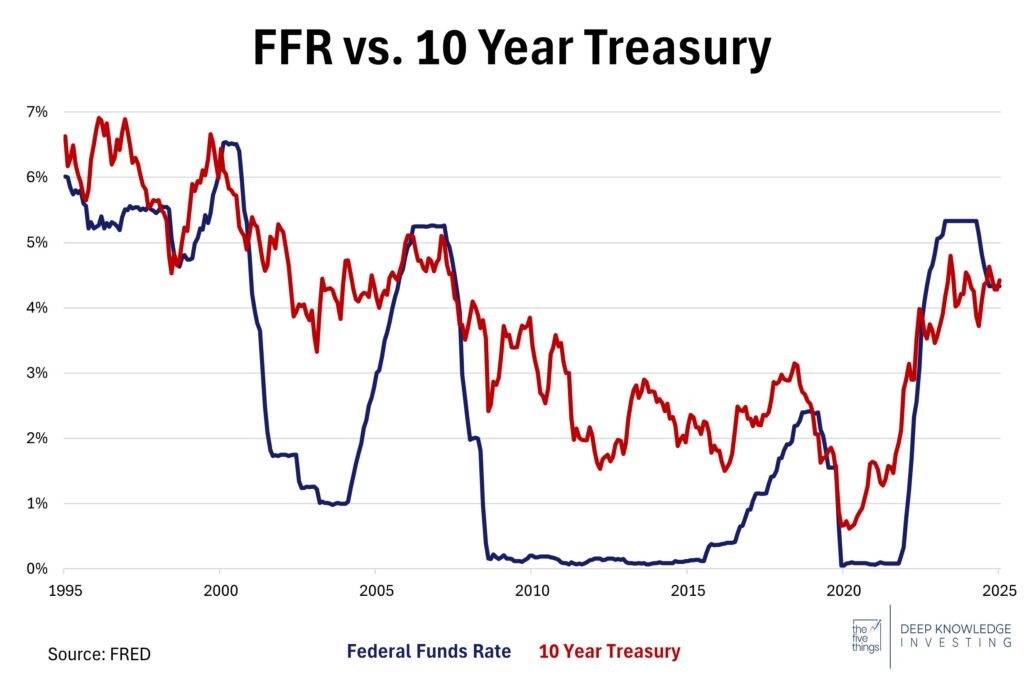

That last rate cut led to higher 10-year yields. Powell and Bessent want to avoid that.

The median is unchanged, but the dots got more hawkish.

DKI Takeaway: While the market didn’t like the hawkish tone coming from the Fed, we’re not concerned. First, the Fed has been terrible at predicting its own year-end fed funds rate. We’ve tracked this, and with six months to go in the year, their projections aren’t worth a lot. To his credit, Chairman Powell admitted they had a lack of confidence in their projections during his press conference. We admire his honesty and agree with his conclusion. Much of the Fed’s concern comes from projected tariff inflation which has yet to arrive. Second, Congress is overspending by so much that there’s not much the Fed can do. When they cut rates by 100bp (1%) starting last September, the yield on the 10-year Treasury rose by about 100bp as the bond market started to price in higher future inflation. Demand for Treasuries will rise and fall with geopolitical conflict, but long-term inflation and Treasury yields will rise with continued massive deficits from Washington DC.

Finally, the DKI portfolio is heavily hedged. We’re making money off of outperformance instead of a few stocks in one industry determining the direction of the market. If that’s of interest to you, you’re welcome to subscribe.

2) Senate Gives the Green Light for Stablecoins:

The Senate just passed the “Guiding and Establishing National Innovation for US Stablecoins Act,” setting up the first framework for using stablecoins, a type of cryptocurrency whose value is pegged to another currency or commodity, as a form of payment. The legislation provides a regulatory framework for dollar-based stablecoins which are fully backed by liquid reserves of cash or short-term treasury bills. The GENIUS act is intended to promote innovation in payment systems while ensuring the same level of customer protection.

This legislation has fueled some debate surrounding credit card fees and the dominance of companies like Visa and Mastercard when it comes to payment fees. With stablecoins having the potential to wipe out billions in swipe fees, it could bypass the need for Visa and Mastercard altogether. Retailers like Walmart and Amazon have even been considering ways to create their own stablecoins to avoid credit card fees costing them billions per year.

This has the potential to remake the banking system and save you money.

DKI Takeaway: The GENIUS Act ultimately could bring more competition and lower costs in payment systems. With merchants able to save money on processing fees, savings could be passed onto consumers in the form of lower prices or discounts. In the long term, stablecoins may coexist with both cards and cash, giving consumers the ability to choose what works best for a purchasing situation. The Act also has some implications for unbanked Americans, allowing them to participate more fully in digital commerce and find new ways to manage money.

Both this legislation and the potential to change the way Americans save and spend money are new and final implementation is uncertain. That’s true both legislatively and commercially. The Wall Street Journal reported that Amazon and Walmart are considering issuing their own stablecoins while a high-level bank executive told me that the GENIUS act prevents exactly that kind of activity. It’s going to take some time for the market to resolve this one, but we’re excited about the opportunity.

- Solar Stocks Plummet While Nuclear Gains on Senate Tariff Bill Amendments:

The Senate’s version of President Trump’s “Big Beautiful Bill” proposes a substantial rollback of solar and wind tax incentives: credits would shrink to 60% in 2026 and vanish entirely by 2028; significantly ahead of the current 2032 deadline. Solar stocks immediately fell. Enphase dropped roughly 15%, while Sunrun and SolarEdge declined more than 20% as investors braced for a slowdown in residential and commercial installations. The sector also faces mounting headwinds from higher interest rates, sagging consumer demand, and changes in net metering across states. Industry groups are now mobilizing political pressure to preserve incentives as their businesses largely depended on government subsidies.

In contrast, the bill extends tax credits for nuclear, geothermal, and hydropower through at least 2036. This shift led to immediate gains in related equities: the Global X Uranium ETF jumped over 35%, and shares of other nuclear energy firms also rallied. The legislation reflects a growing policy pivot toward “clean, firm” power that can provide consistent baseload, signaling bipartisan recognition that grid stability requires more than intermittent renewables. It also aligns with broader infrastructure support already in place for nuclear including federal funding for advanced reactor licensing under laws like the ADVANCE Act.

It’s been a rough 12 months for solar stocks which depend on government subsidies.

DKI Takeaway: The Senate’s markup signals a decisive pivot away from intermittent renewables and toward “clean baseload” energy like nuclear and geothermal. The solar sector may face a painful adjustment curve (slower growth and rising project costs), whereas nuclear stands to benefit from prolonged policy incentives. For investors, the key will be identifying high-quality names in these sectors, while monitoring whether the final legislation preserves loopholes such as power-purchase agreement incentives that could safeguard solar viability. In short, policy is tilting the playing field, and portfolios should be repositioned accordingly for what may become a long-term shift in U.S. clean-energy strategy.

DKI notes that this is the risk of building an industry based on government subsidies. It’s market discipline that ensures long-term survival while government largesse can shift more quickly. DKI increased our already-large uranium position two weeks ago and it’s up more than 12% in that short time. I can’t promise we’ll always see positive results that quickly, but knowing what we’re doing in real time is worth the subscription price.

3) Nvidia Invests in TerraPower as AI Pushes Nuclear into Spotlight:

Nvidia’s venture arm, NVentures, recently joined a $650 million funding round for TerraPower, the nuclear startup backed by Bill Gates, bringing its total private capital above $1.4 billion, alongside a $2 billion DOE grant. TerraPower is developing its first Natrium small modular reactor (SMR) in Kemmerer, Wyoming, a 345 MW sodium-cooled fast reactor with integrated molten-salt energy storage capable of boosting peak output to 500 MW for several hours. Construction has begun on non-nuclear infrastructure, with regulatory approval expected from the NRC in the next year, and commercial operations targeted by 2030. Nvidia’s investment signals a strategic link: its AI infrastructure demands energy that is consistently available while political and social demands focus on energy that is carbon-free. TerraPower is embedding Nvidia’s AI tools for everything from predictive maintenance to reactor design optimization.

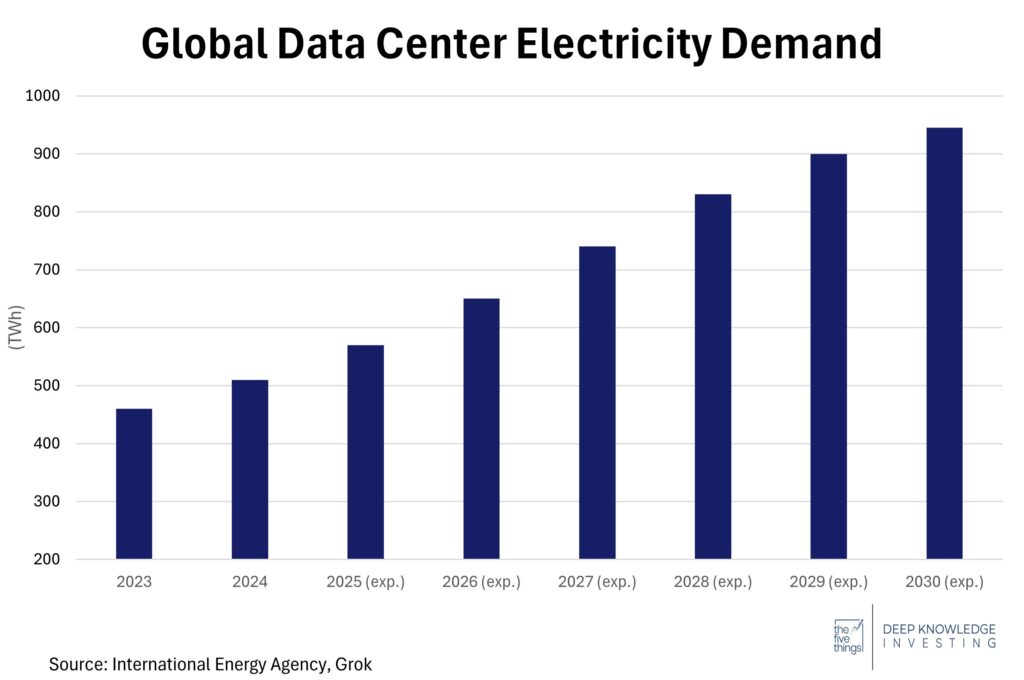

This is just from data centers. Now add in millions of EVs and half the planet that wants to have better living conditions. Energy demand will rise for years.

DKI Takeaway: Nvidia’s backing of TerraPower furthers the strategic fusion of AI and nuclear energy after deals from other tech giants like Amazon and Microsoft, positioning SMRs as the energy backbone for power-hungry, carbon-free data centers. This isn’t just green branding: Nvidia gains direct access to reliable, high-capacity energy for its AI workloads, while TerraPower obtains cutting-edge AI expertise to accelerate SMR safety, efficiency, and deployment. For investors, this is more than a clean-energy narrative; it’s a strategic triangulation between AI, energy independence, and politically-driven environmental goals. The key question now is whether this model becomes repeatable; if Nvidia’s involvement here leads to more AI-energy partnerships, this could catalyze an entirely new ecosystem at the intersection of computing power and carbon-free power. DKI has disclosed highly-profitable positions in Talen Energy ($TLN) and uranium which have benefitted from this thesis.

4) Educational Topic: Understanding Hedging:

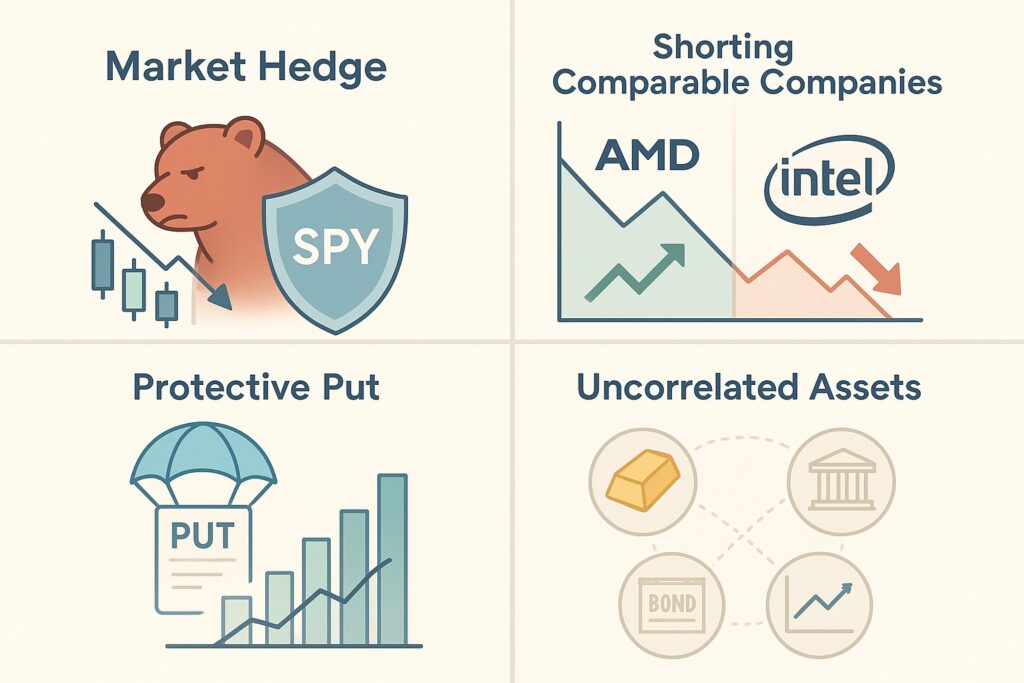

In investing, hedging refers to using one investment to offset the risk of another. Many consider it as an insurance policy for a portfolio, as offsetting positions could gain value if a primary investment loses value. DKI has listed 4 common hedging strategies and how they can mitigate risk.

- Market Hedge: Shorting a Market Index:

A market hedge involves taking a position that benefits from a declining stock market to protect a portfolio from downturns. This strategy can mitigate the risk of a broad market decline without having to sell investments. One way to do so would be to short the S&P 500, or with a tech-heavy portfolio, short the NASDAQ.

- Shorting Comparable Companies:

Another hedging approach would be to short a company with high correlation to a current investment, also known as pairs trading. For example, if you are bullish on a semiconductor company like AMD but worried about risks in the industry, you might short Intel, a major competitor in the same industry. A short position can offset the risks of a long position. Many investors choose this strategy when they want to isolate the specific strengths of a chosen company while limiting industry risk.

- Buying Put Options Against Long Positions:

Buying put options on stocks you own is a common hedging strategy because it’s a way to buy insurance against personal holdings. If the owned stock declines in price by a significant amount, the investor will have profits from the put option to offset the losses of the long position. Investors using this strategy can still hold a stock position that has declined while having an extra layer of risk protection.

- Buying Uncorrelated Assets:

Diversifying into uncorrelated (or negatively correlated) assets that don’t move in sync with the rest of a portfolio is another hedging strategy. This mitigates risk by reducing reliance on one set of market conditions. Bitcoin, gold, and other commodities can be useful hedges as they may move differently than the market during periods of high inflation or market panic.

None of these are free, but all can be valuable.

DKI Takeaway: Though hedging strategies can provide protection against losses and create peace of mind, they aren’t free. Hedging includes costs and will typically reduce gains if the hedge moves opposite to a rising portfolio. However, hedging is a valuable strategy as significant downside protections can outweigh some limits on upside gains. Investors must be able to weigh their risks to determine if any hedging strategies at all are worth using.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.