Last week, we told you that President Trump was monetizing access to the US consumer market. He did that again by resetting the US trade relationship with Japan. Japan has had trade barriers up for US goods for a long time, and are now potentially contesting the terms of the announced agreement. The terms may shift again. Yet again, China displays contempt for US intellectual property rights and causes mayhem when state-backed actors hack Microsoft assets and get access to data from US agencies. Las Vegas Sands crushes earnings estimates led by record results at Singapore’s Marina Bay Sands. The results from the newly-renovated Londoner are encouraging as well. Talen Energy buys electrical generation assets a week before a new power auction sets much higher prices. There’s a lack of supply which will raise energy bills for Americans. DKI subscribers have tripled their money in this name so have some cushion. Oklo and Vertiv partner on a creative new way to use small modular reactors to cool AI datacenters. DKI has been positive on nuclear power and uranium for years so we’re excited by the possibilities. In our educational topic, we explain short squeezes and how Gamestop put big hedge funds out of business.

This week, we’ll address the following topics:

- President Trump continues to leverage access to the US market. Despite terms that were worse for Japan than before “Liberation Day”, Japan breathes a sigh of relief (maybe).

- Chinese state-backed hack compromises Microsoft and US agencies. What’s the over/under for the number of times we have to write about Chinese sabotage in 2025?

- Las Vegas Sands ($LVS) crushes earnings estimates. Marina Bay Sands profitability sets new records. The Londoner is renovated and open.

- Talen Energy ($TLN) surges on $3.5B power plant play and a blowout auction. Your electric rates will rise due to people using ChatGPT to make funny photos. DKI premium subscribers are comforted by making 3x their money in this stock in about a year.

- Oklo and Vertiv partner on nuclear-powered datacenters. It’s an innovative potential solution to help alleviate the already-arrived energy shortfall.

- Educational Topic: What’s a short squeeze? Yes, we discuss Gamestop ($GME).

Outstanding work this week by DKI’s interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem. They continue to do the heavy lifting for the 5 Things with their excellent research and writing. Another round of thanks for the team at Flying V who have made vast improvements to the video version of the 5 Things. Robb, Nazim, Anton, Alex, and Jonalyn all have their hands on this. Come check out the new video edition.

1) President Trump Continues to Leverage the US Market with Japan:

President Trump and Japan’s Prime Minister (Mr. Japan) recently signed a major trade and investment deal, leading to lower tariffs on Japanese goods as well as Japanese investments and purchase orders. Tariffs on Japanese imports will be lowered from the 25% – 28% range to 15%, and Japan will invest $550B into the US, creating a new US directed investment fund. The investment fund will target specific industries like semiconductor manufacturing, energy infrastructure, rare earth, pharmaceuticals, and more with the US keeping most of the profits (maybe). Japan has also committed to open its market wider to US agriculture, energy, and defense products. The country has a huge rice shortage and spiking rice prices so importing US product is a popular and necessary move there.

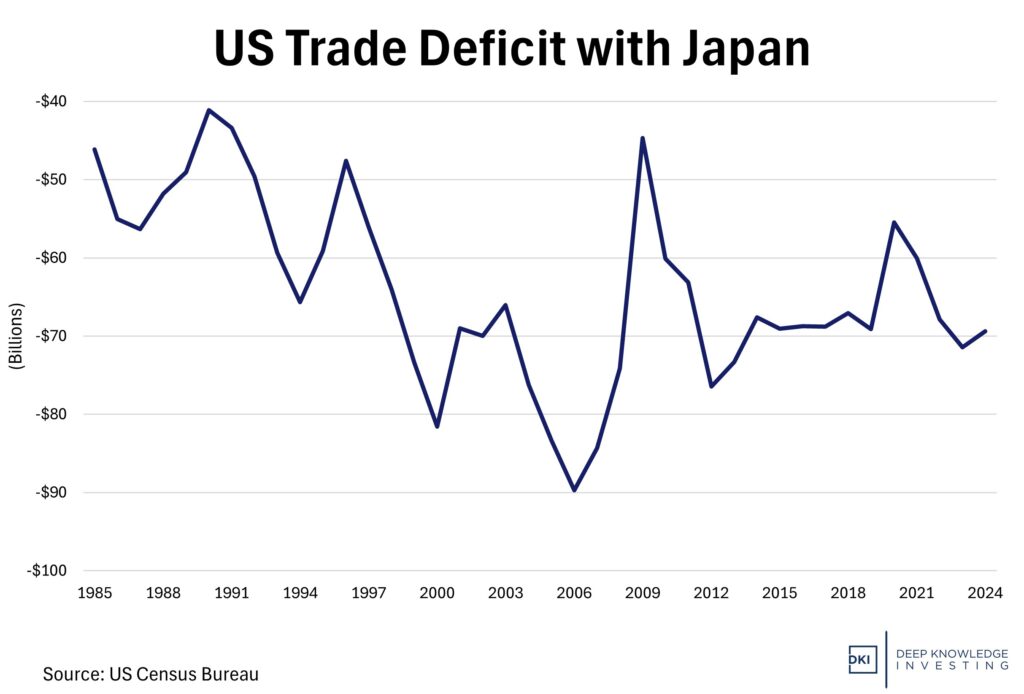

Trade between the two countries totals $230B with a $70B US deficit. The tariff is aimed at narrowing the trade gap and generating billions in revenue while incentivizing Japan to commit to US markets. The Japanese stock market reacted positively to the deal with indexes and automakers soaring on the news that they wouldn’t be locked out of the huge US market. The US market continues to grow more attractive to foreign entities, and President Trump continues to use access as leverage to open foreign markets to US producers.

Trade balance with Japan has been negative for a long time and Japan has had barriers to access their markets.

DKI Takeaway: As mentioned last week with the recent US Indonesia trade deal, President Trump is effectively leveraging the US market as a monetized asset, allowing countries to pay to not only reduce tariffs; but also, to participate in trade with the US. Two-way trade agreements are shifting towards transactional and result-oriented deals, and the President is successfully targeting more reciprocal trade relationships. Monetizing access to the huge US market will continue to provide leverage for the US in future trade deals. The free trade fiat economists are complaining, but the US has been selling off its manufacturing capacity for more than four decades. That trend is unsustainable and threatens national security. Something needed to change.

Update: On Friday, there are reports that the US/Japan deal is at risk due to disagreements regarding the share of profits each country will receive from Japan’s investment in the US. We expect the US negotiating team will respond by suggesting new terms that are less-favorable for Japan.

2) Chinese State-Backed Hack Compromises Microsoft and US Agencies:

This month, a sophisticated cyber-espionage campaign exploited zero-day vulnerabilities in on-premises Microsoft SharePoint servers to breach at least 400 organizations globally. These included U.S. federal agencies like DHS, the Department of Energy, and the Nuclear Security Administration. Attackers were linked to three China-based groups, Linen Typhoon, Violet Typhoon, and Storm-2603, which used both data-exfiltration and ransomware deployment strategies, marking a dangerous evolution in severity. Microsoft and CISA have issued urgent patches and recommended enabling AMSI, Defender, rotating machine keys, and restarting affected services, pointing to the risk this flaw presents for organizations relying on self-hosted SharePoint. The attack underscores the growing scale of Chinese cyberattacks that are now targeting hundreds of entities with ranged offenses and the persistent vulnerability of legacy on-premise infrastructure.

Yet another reason to decouple from China.

DKI Takeaway: This breach is a stark reminder that in cybersecurity, no system is invulnerable, especially against sophisticated, politically motivated attacks. Even with aggressive patching, long-dormant vulnerabilities persist in critical infrastructure. The rise in Chinese state-linked hacking, blending espionage with ransomware, shifts cybersecurity from a technical challenge to a strategic imperative. The silver lining lies in the defensive market: cybersecurity firms offering zero-trust solutions, supply chain monitoring, and rapid patch deployment will likely see sustained demand. However, for public-sector and enterprise consumers of SharePoint, it’s a wake-up call: corporate cloud adoption and proactive incident response plans are no longer optional; they’re essential. This is yet another example of China abusing US intellectual property and inserting the capability of damaging US assets, something DKI has been illustrating regularly in the 5 Things. Let’s examine if cheaper things are worth the risk. What do you think?

3) $LVS Crushes Earnings Expectations:

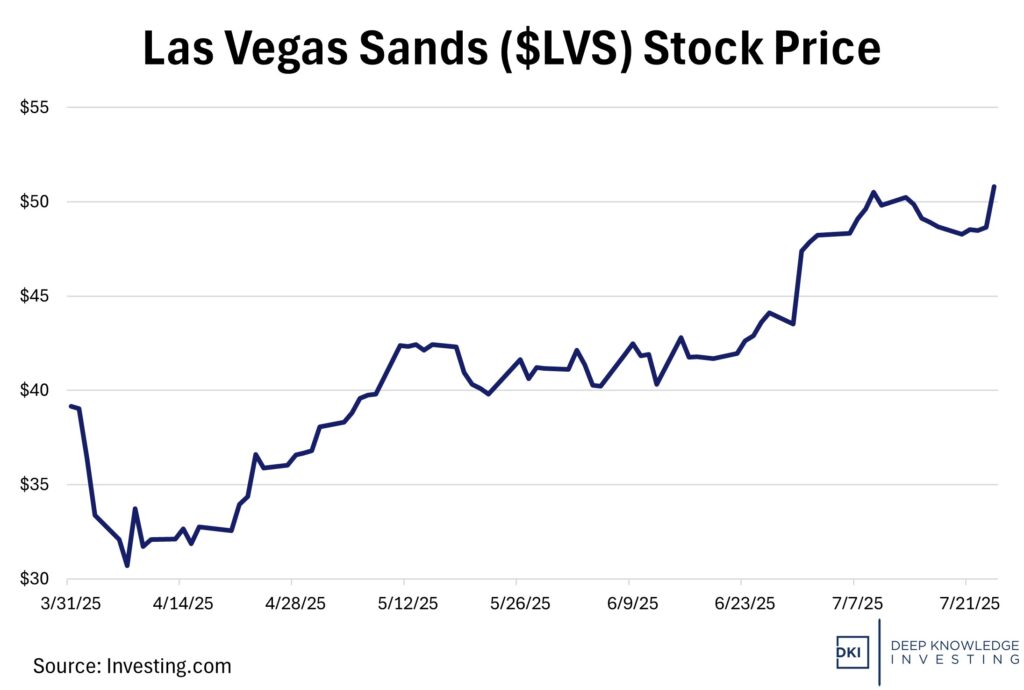

Las Vegas Sands ($LVS) had a fantastic second quarter, something DKI told premium subscribers to expect earlier this month. Revenue of $3.2B was up 15% from last year and beat analyst estimates of $2.8B. Adjusted Property EBITDA was up 24% to $1.3B. Adjusted EPS of $.79 was well above analyst expectations of $.53 and last year’s $.55. Sands’ management has always been shareholder-friendly, and in addition to maintaining the dividend, they bought back another $800MM of stock at prices well below the current market price. The Marina Bay Sands in Singapore did a massive $768MM in EBITDA. Even excluding the $107MM in above-expected “hold”, the adjusted $661MM was a new record. “Hold” refers to the amount of player bets retained by the casino. In Macau, the newly renovated Londoner doubled EBITDA despite not being fully open for 1/3 of the quarter. Sands achieved great results despite a few Macau properties underperforming. Management acknowledged this on the call and have already implemented new pricing plans to regain market share.

Macau visitation is up. The Londoner is fully open. The MBS is posting new records.

DKI Takeaway: Earlier this year, people worried about Macau visitation, but that’s quickly approaching pre-pandemic levels. Then, they worried that China would retaliate against US-based concessionaries due to President Trump’s tariffs, but China never hinted that they’d take aim at good corporate citizens. Not only have $LVS and $WYNN been excellent partners, any action against them would end foreign investment in China, something the country desperately needs. Finally, people worried that results at Las Vegas Sands were falling, but that was due to temporary and largely-completed renovations. Want to know what we’re doing with the stock? We welcome you to subscribe to find out.

4) Talen Energy Surges on $3.5B Power Plant Play and a Blowout Auction:

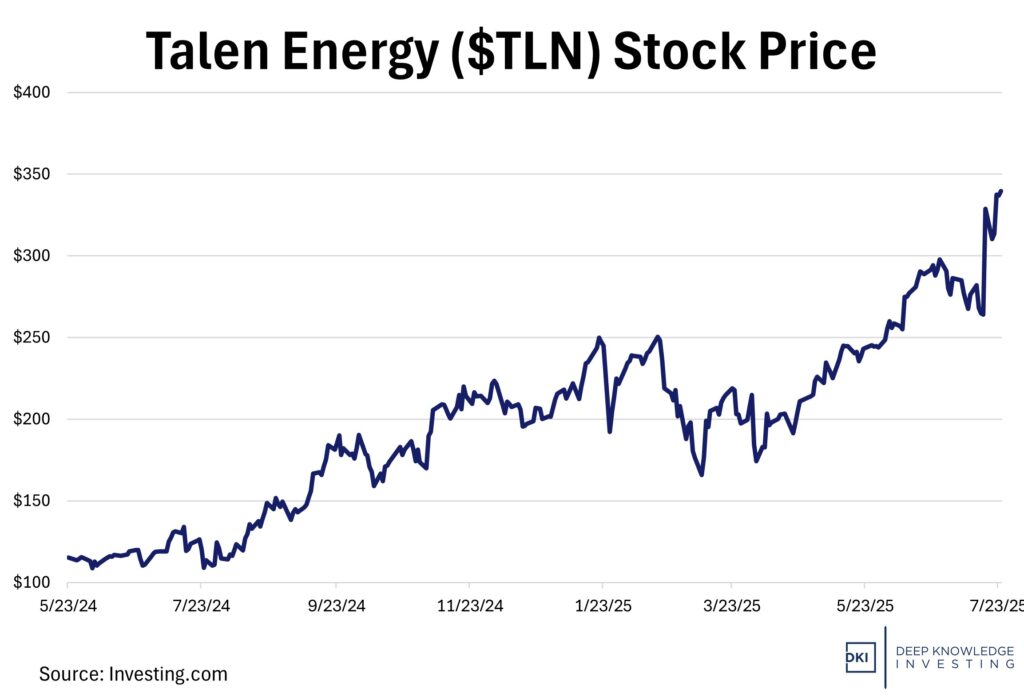

A week ago, Talen Energy ($TLN) stock rose by 24% as the company announced a plan to buy two natural gas power plants for $3.5B. Not coincidentally, these plants are both located in the nearby Pennsylvania-New Jersey-Maryland interconnection market where a day earlier, the White House announced plans to make Pittsburgh an AI hub with huge investments made in new datacenters. Each individual datacenter can use as much electricity as an entire city and requires constant up-time. Even small power outages will cause problems. The power demands of the hyperscalers have created a shortage of electricity supply in the market, something that benefitted Talen this week.

DKI subscribers have tripled their money in this stock.

DKI Takeaway: Last Wednesday, Talen stock rose another 8% on news that the Pennsylvania-New Jersey-Maryland interconnection market is out of capacity. AI datacenters, each of which can use enough electricity to power an entire city, have taken up all excess supply. As a result, rates in that auction skyrocketed benefitting Talen. When your summer air conditioning bills are huge, you can blame everyone using ChatGPT to make funny images. The good news is you can hedge your electric bill by owning $TLN. This is also a positive for DKI’s large uranium position. DKI’s premium subscribers have tripled their money in this stock in just over one year. As always, we highlight the fantastic work done by Enrique Abeyta who introduced the idea to us. If you want to see him discuss his successful thesis, here’s our webinar with him from last year. Thanks Enrique!

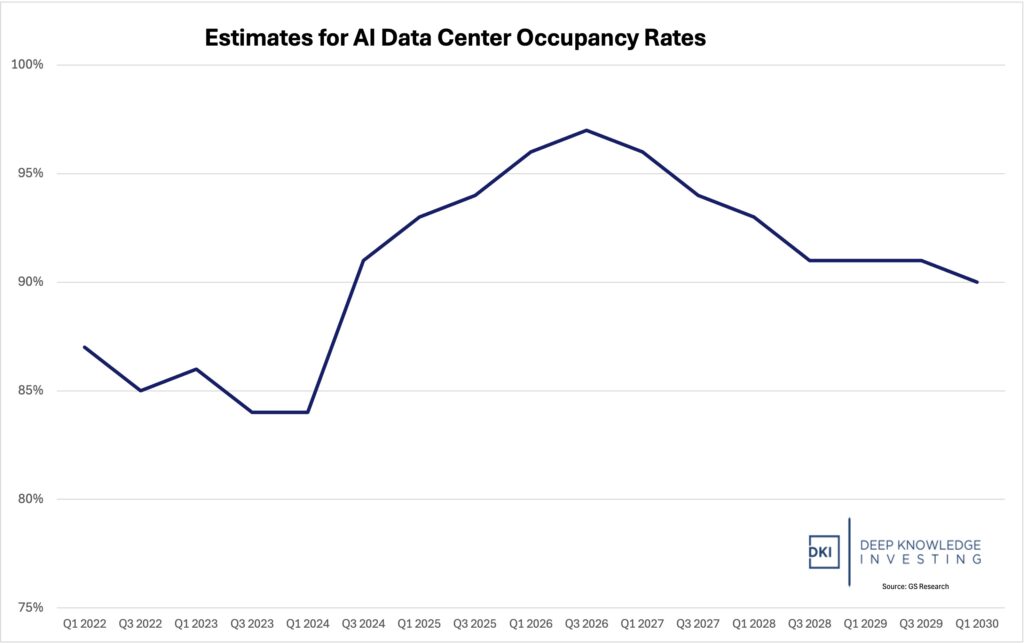

4) Oklo and Vertiv Partner on Nuclear-Powered Data Centers:

Oklo, an advanced nuclear technology company developing small modular nuclear reactors, and Vertiv, a global provider of critical power and cooling infrastructure for data centers announced a new collaboration to co-develop integrated power and cooling systems for hyperscale and colocation data centers in the United States using electricity and steam from Oklo’s on-site nuclear power plants. By leveraging heat from Oklo’s reactor to run Vertiv’s cooling equipment, the partnership aims to make data centers more energy-efficient while delivering reliable, clean power for energy-hungry AI and high-performance computing needs. A pilot of this solution is planned at Oklo’s first Aurora microreactor, and the companies will develop reference designs for future nuclear-powered data centers.

The power needs are far beyond our current infrastructure.

DKI Takeaway: Surging demand from AI and cloud computing is straining data center power capacity (as discussed in our previous “Thing” on Talen Energy). Oklo and Vertiv’s solution is something that small nuclear reactors can use to help fill this gap by delivering on-site, always-on clean energy. This may signal how advanced nuclear is moving from concept to practical infrastructure for the tech industry. If the project succeeds, it could revolutionize data center design and give both companies an edge; however, regulatory and execution risks remain high. If successful, this will be a positive for DKI’s uranium position.

5) Educational Topic: Understanding a Short Squeeze:

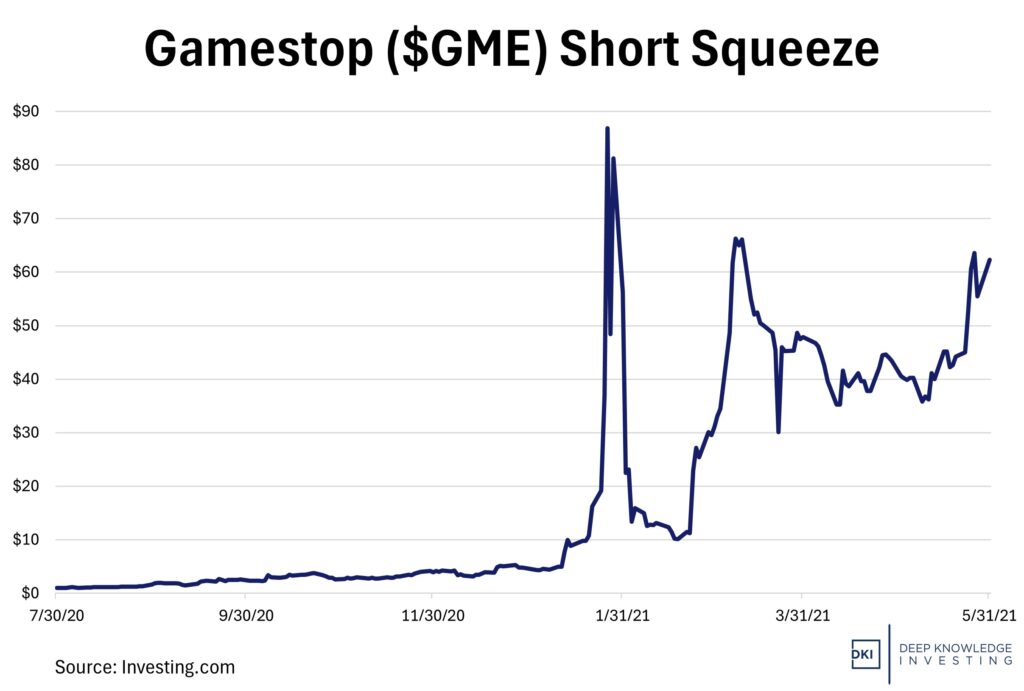

A market phenomenon known as a short squeeze occurs when a heavily shorted stock suddenly experiences a huge price increase. This surge forces short sellers to buy their shares back at a higher price to cover their positions, ultimately driving the price of the stock higher. In turn, that causes margin calls at more institutions that are short the stock causing another round of buying. The price increase actually causes more investors to have to buy the stock.

This week, we saw an example of a short squeeze when Kohl’s stock at $10 spiked to over $21 at the market open. Kohl’s short interest was approximately 53 million shares, representing about 49% of its 112 million share float. This high level of short interest made Kohl’s substantially vulnerable to a short squeeze.

Roaring Kitty’s Reddit account caused multi-billion-dollar hedge fund losses on no change in company fundamentals.

DKI Takeaway: The most notable example of a short squeeze is GameStop ($GME), which soared over 1,500% during two weeks in January 2021, causing short sellers to lose roughly $5B and contributing to hedge funds like White Square and Melvin Capital closing their funds. Nonetheless, short squeezes do not reflect company value. There was no change in company fundamentals that caused the stock price to rise. It was due to Roaring Kitty’s posts on his Reddit account urging retail investors to buy the stock. All it takes is a spark to flip the trade, especially with the support of millions of retail investors and a large supply of short-sellers forced to cover or face firm-ending losses.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.