The big news of the week was President Trump delaying tariff implementation for 90 days, a possibility I outlined for DKI subscribers the previous Sunday. Tariffs remain in place for China which responded with public insults and by increasing their own tariffs. They threatened to watch fewer Hollywood films, something I expect is of zero concern to anyone in the White House, and to violate the IP rights of US companies operating in China, something it was already doing. The Fed got a little extra breathing room with a lower CPI. We explain why this doesn’t matter. Dean Smith of FolioBeyond describes concerns about potential stagflation. In addition to the basis trade falling apart, junk bond spreads are showing signs of stress. Don’t know what the basis trade or junk bond spreads are? Don’t worry – we explain. Oil prices are responding to weaker economic forecasts and higher inventories. We focus on what comes next. Finally, in our educational “Thing” we explain different kinds of securities in the capital structures of most public companies.

This week, we’ll address the following topics:

- Tariffs for One. 90 Day delay for everyone but China.

- CPI comes in light, and there’s nothing the Fed can do.

- Guest “Thing” – Stagflation: Could the 70s happen again? Are tariffs to blame?

- Junk bond yields surge as selloff intensifies. Are you watching the default rates?

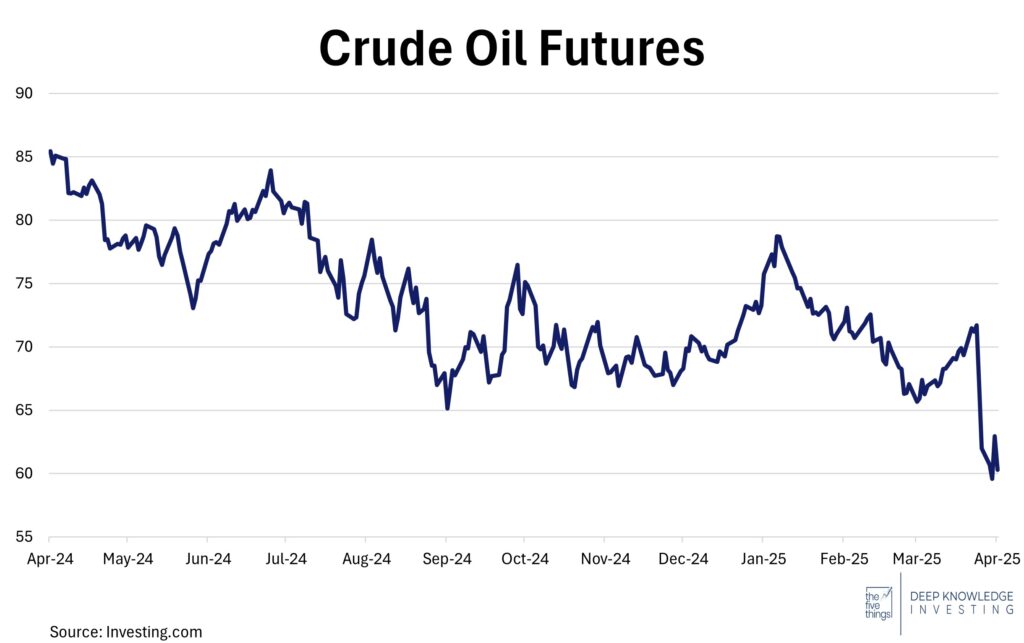

- Oil prices are responding to greater fears of economic turmoil and higher inventories. What comes next?

- Educational Topic: Bonds vs. Preferred Stock vs. Common Stock: Ever wonder what these are? We explain.

This was another great week for DKI Intern, Cashen Crowe, who has taken over solid ownership of the 5 Things. He’s handling much of the topic selection, research, and image generation. In particular, he has a great handle on finding topics for the educational Things we’re doing every week. We hope to have him on this week’s video version to explain the capital structure to investing beginners.

We’re also pleased to announce that Matt Pettit, MBA student at the London Business School, joins DKI as an analyst. Matt impressed multiple people here with his stock analysis skills. He’s already a contributor to this week’s 5 Things as well as providing some excellent analysis on the tariff situation in this week’s discussion with Alex Macris.

Ready for a week of tariffs for China? Let’s dive in:

1) Tariffs for One:

As I write this on Friday, April 11th, it’s hard to believe President Trump announced the new tariff plan just last week. Last Sunday, I wrote a blog post for DKI premium subscribers explaining how I was thinking about portfolio exposure. I explained that there were three likely scenarios in the near future; a market-crushing implementation of the higher tariff levels, negotiating lower tariffs with the 50 (now more than 70) countries that are offering lower tariffs on US goods, and a 90-day delay of tariffs for those negotiations. I wrote that the last one would send the markets soaring. We got a combination of options 2 & 3 which created a record-setting turnaround on Wednesday. Equity indexes went from down big to up huge. Much of those gains were wiped out the next day as markets absorbed continuing escalation between the US and China, and realizing we now face another 3 months of uncertainty. For those of you who want to understand the tariff situation better, please check out DKI’s discussion with Alex Macris who explains how the Trump Administration is viewing and calculating tariff levels. It’s available on X and YouTube.

Bond market stress is why Bessent is in charge now.

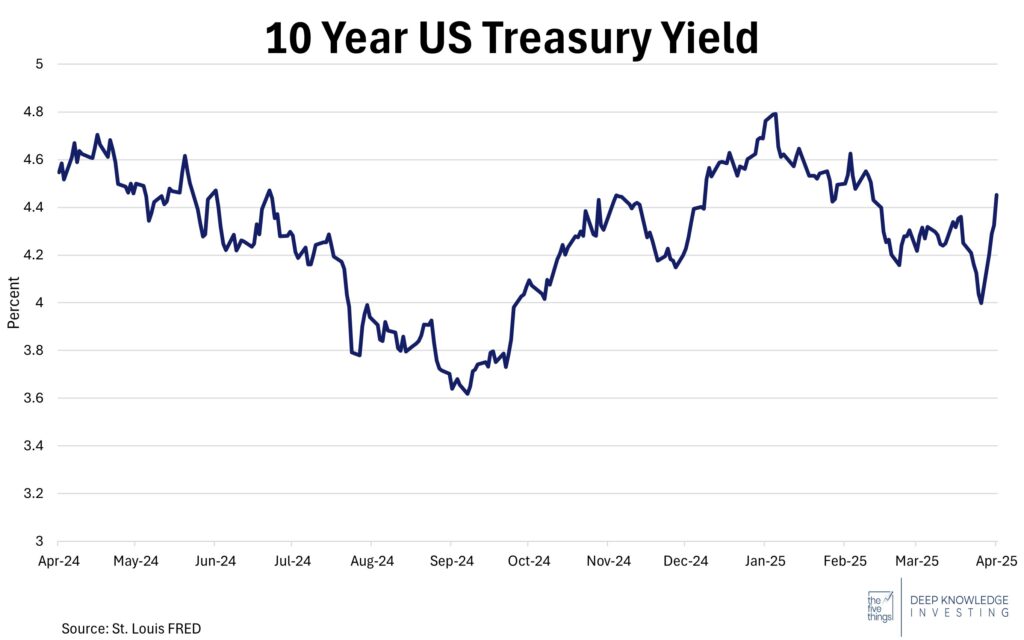

DKI Takeaway: After seeing the yield on the 10-year Treasury dip below 4% last weekend, the bond market is now repricing the risk in the US dollar. International trade uncertainty has reduced the value of the dollar in international Fx markets, and increased the yield on US Treasuries. Part of the move may have been related to foreign government selling and part was due to stress on the “basis trade”, a highly leveraged trade to try to take advantage of small differences between current rates and futures. There was widespread speculation that fears of a subsequent bank failure due to excess leverage on an unwinding trade led to the 90-day tariff delay. As I wrote on X, Whether you agree with the tariff strategy or not, can we agree that having too big to fail institutions that alter national policies is a bad idea? Let them fail, or make them reduce systematic risk. China increased its tariff rates and its threats. They raised their own tariffs, lobbed some childish public insults, and threatened to stop respecting the IP of US companies operating in China. That last move tells you a lot about the business ethics of the CCP.

2) CPI Comes in Light. Fed Sidelined:

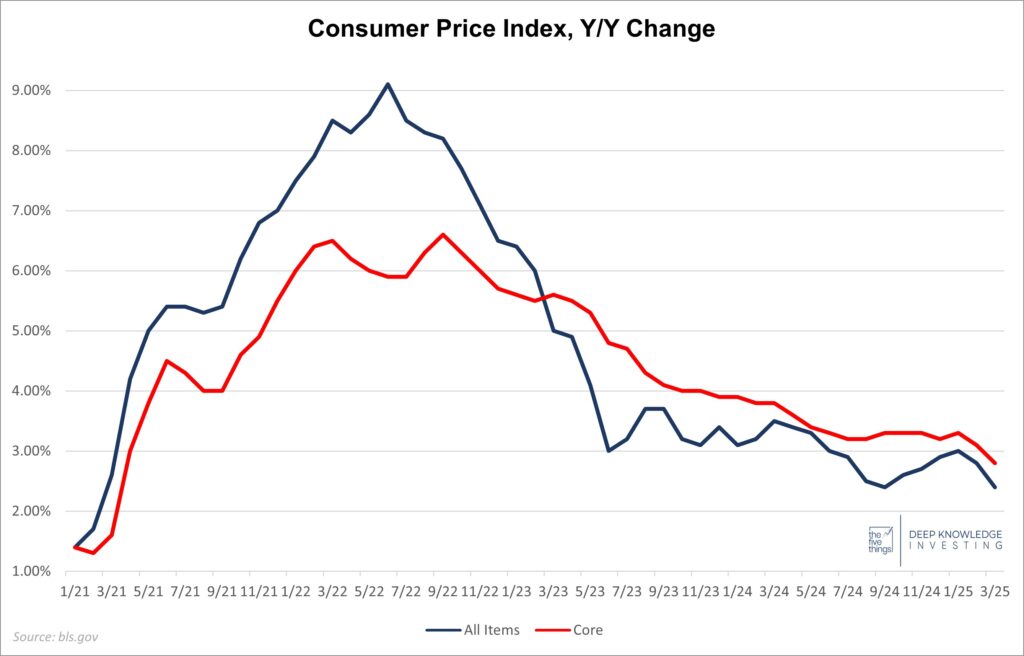

The March Consumer Price Index (CPI) of 2.4% was well-below last month’s 2.8% and the monthly decrease of 0.1% indicated a small amount of deflation. The still-sticky Core CPI was down as well at 2.8%, and is now below the lows of last year. Lower fuel prices were a big tailwind. We’re finally starting to see some more realistic numbers in the constantly-understated food category with monthly increases in the 0.4% – 0.5% range which annualizes to 4.9% – 6.2%. Housing costs continue to rise. Best case scenario there is it will take a few months for potentially lower mortgage rates to work through the long sales cycle in real estate.

March showed meaningful improvement largely due to energy costs.

DKI Takeaway: As for Chairman Powell and the Fed: I don’t think they’ll cut rates at the upcoming meeting, but this week’s soft CPI print definitely gives them more breathing room than they had at the beginning of the year. The one big concern is that the Fed doesn’t matter as much anymore. Their balance sheet is still huge and the real rate is still below 2%. More importantly, inflation is now being caused by overspending from Congress as opposed to too-low Fed rates. I don’t expect Congress to reduce spending, but will point out that rates on the 10-year Treasury rose after the Fed started cutting. They only control the overnight rate and the bond market is likely to look at any rate reductions as a warning about future inflation.

3) Dean Smith of FolioBeyond on Possible Stagflation:

Stagflation: Could the 70s happen again? Are tariffs to blame? There is a famous expression among economy watchers that goes: “Economic expansions don’t die of old age, they are murdered.” The usual culprits are external shocks, like the oil supply shocks of the 1970s, or more often gross errors by fiscal or monetary authorities. If current readings can be believed, there is a brutal murder taking place in DC right now.

For the last three years the Federal Reserve has been trying to tame an inflation that was almost entirely self-induced by a massive explosion in Federal spending and transfer payments under the last administration. Unfortunately, they started at least a year too late. This allowed inflation expectations to become deeply embedded. Currently, US households’ 5-year inflation expectation is now at the highest rate seen in some time.

File this under “it’s all fine until it’s not”.

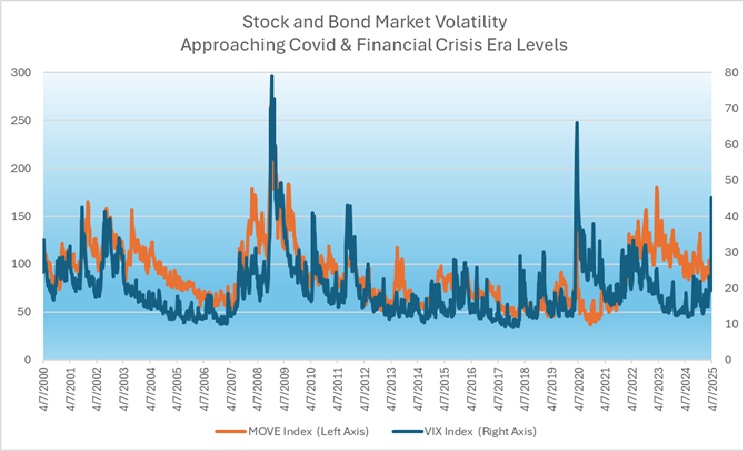

FolioBeyond Takeaway: The on-again/off-again tariffs are contributing to an extraordinary level of market volatility. Some of the largest moves in both equity and fixed income markets—both higher and lower—have occurred just in the last few weeks. With the threat of a global trade war looming, businesses and consumers have been rapidly revising downward their spending and investment plans, and the wild swings have called into question the safe haven status of US treasury bonds. Gold continues making fresh all-time highs.

This combination of slowing or even declining economic activity with persistent inflation was given the name “stagflation” back in the 1970s. It’s an ugly word to describe an ugly scenario: falling employment and output, accompanied by high and increasing prices. Many economists would have believed that scenario was forever behind us. One would have thought policy makers would have learned the painful lessons from when Fed Chair Paul Volker took short term rates to more than 20% in 1979. There is a growing risk of a new stagflationary period beginning this year. In fact, it may have already begun; economic data are backward looking. If so, markets could be especially treacherous over the near to medium term, if policy makers don’t react forcefully and soon. Jay Powell’s recent use of the term “transitory” to describe the current environment doesn’t instill a great deal of confidence. Now is the time for investors to preserve, protect and defend their investments.

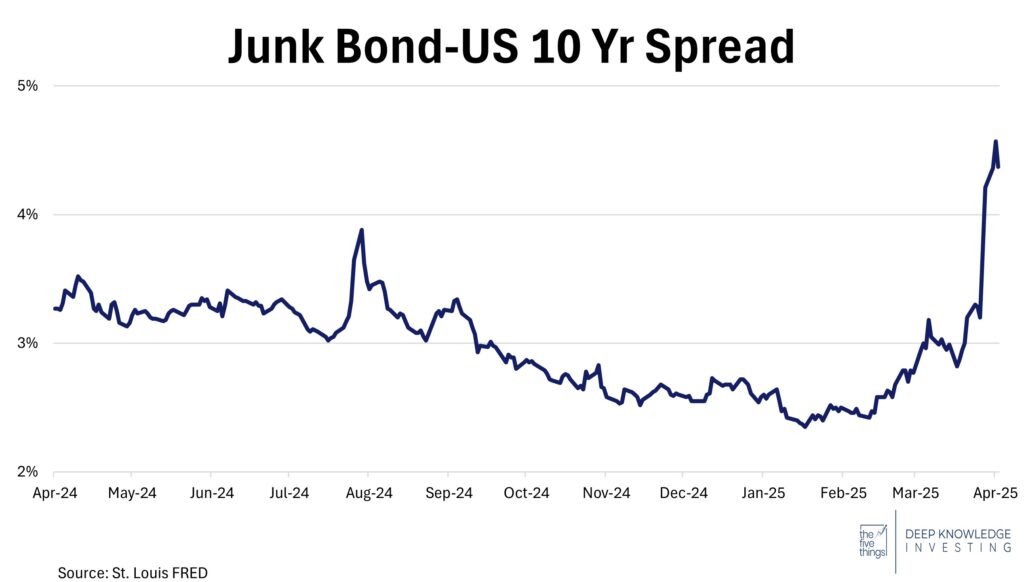

4) Junk Bond Yields Surge as Selloff Intensifies:

Junk bonds are corporate bonds that are below the investable grade level. Their yields have been surging following Liberation Day, marking the biggest selloff in the junk bond market since the 2020 Covid-related sell-off. An easy rule of thumb to contextualize yield is that it is a measure of risk. Higher yields suggest that the underlying assets, corporate-issued bonds in this case, are riskier—namely because they will experience a credit crunch from deteriorating economic conditions due to a reduced margin of safety.

Junk Bonds are often referred to as the ‘canary in the coal mine’ for an economic downturn because investors are quickest to flee higher-risk assets in cases of uncertainty or turmoil. That flight is in full swing. According to the ICE BofA US High Yield Index, junk bond yields rose 111 basis points (1.11%) between April 2nd and April 7th. The spread between junk bond yields and the US 10-year treasury yield ripped 116 basis points higher over that same 5-day period. Spreads are the yield premium a particular bond offers relative to a risk-free U.S. Treasury. This higher spread signifies a higher premium demanded by investors to hold those bonds.

It’s not just the equity market that went risk-off.

DKI Takeaway: As junk bond yields rise, it will be important to keep an eye on default rates. Those will give us a good sense of just how intense any economic contraction may be. President Trump’s 90-day pause on tariffs saw a rally in stocks, but a similar rally in the bond market did not occur as traders are still in the throes of a substantial deleveraging process. In an environment of pronounced uncertainty, we’re seeing increased volatility. In fact, one of the week’s most volatile instruments was the $VIX, a measure of expected future volatility.

5) Oil Futures on Edge—What’s Next?:

US Benchmark WTI crude oil futures are facing the continued pressure of escalating trade tensions and economic slowdown concerns, plummeting to four-year lows and down roughly 20% since tariff announcements. In addition, crude inventories have been steadily rising as OPEC producers are raising output, likely putting the US into a surplus. Often being viewed as a bellwether for the broader economic horizon, greater concerns of an economic slowdown has investors paying more attention to the message being sent by oil prices. President Trump’s tariff pause provided momentary relief, but the decline continued thereafter.

No insightful caption needed here.

DKI Takeaway: Beyond the energy sector, the slide in oil futures is indicating concern regarding future economic turbulence. (As noted in the previous “Thing”, so is the $VIX.) Trade policy negotiations will continue to impact oil futures and give investors a look into what might be next. To that end, for the next couple of months, energy is likely to be more correlated with the overall market than in recent years. OPEC’s decisions on future output will impact markets and oil demand. We remind investors of the old (and correct) saying that the cure for low oil prices is low oil prices.

6) Educational Topic: Bonds vs. Preferred Stock vs. Common Stock:

A company raising capital for business expenditures often utilizes corporate debt securities and equity securities. Understanding the difference between them and the risks involved is important to helping an investor decide how they want to try and profit from a business’ success (or failure).

- Corporate Bonds: A loan to the company in exchange for interest payments and a promise to receive the money back at a point in the future. Income potential from bonds is predictable, and risk is lower. Bonds are a good choice for a conservative investor who wants steady, predictable income, but come without ownership or voting rights. Bonds are the first paid in a liquidation, but since interest payments are fixed, your real (after inflation) return might be lower than what you hoped.

- Preferred Stock: An equity security often characterized as a hybrid between a bond and a stock, usually in between the two when it comes to risk and upside potential. Preferred stock typically pays a dividend which may be higher than the dividend on common shares. In the case of a liquidation, the dividends and par value of the preferred stock is paid before that of the common stock. These securities typically have an ownership stake in the company, but no voting rights. Many preferred stock issuances are convertible into common stock at a pre-determined ratio.

- Common Stock: An equity security with unlimited upside potential and limited liability. Though the highest in risk and last to receive value in a liquidation (if any), investors can profit from dividends and increases in the share price. A great choice for investors seeking long-term capital appreciation who are comfortable with market risk. Common stock represents ownership in the company, and typically has voting rights. These rights may be diluted by super-voting share classes often owned by founders/management.

DKI Takeaway: In the event a company goes bankrupt and liquidates, all assets are sold off to pay debts, and then lenders and investors are paid in a specific order: bondholders first, then preferred stockholders, and the remaining to common stockholders. In the event you choose to hold common stock in a heavily indebted company, it’s important to see what assets they hold to pay down their debts so you can better understand the risk of where you sit in the capital structure. The vast majority of my personal portfolio is in common stocks, but your expertise and risk appetite might be different from mine.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.