The PPI is the producer price index, and is a measure of wholesale prices. In general, higher producer prices make their way into higher consumer prices. The April PPI was up 0.5% from last month which was much higher than the 0.3% expected. It also reversed the direction of last month’s decline. The yearly PPI was up 2.2%, also an increase from recent levels (chart below). The Core PPI, which excludes food and energy, was up 0.5% vs last month which was well above the 0.2% expected. Core was up 2.4% vs last year, also an increase from last month.

For most of the past couple of years, services inflation has exceeded goods inflation. That’s because people bought a lot of electronics and other home goods early in the Covid lockdowns. Once people felt more comfortable returning to concerts, restaurants, and travel, demand for services rose quickly at the same time many people had finished building out home offices and home entertainment systems. That trend has been inconsistent in recent months, but continued this month with services prices up 0.6% for the month vs 0.4% for goods.

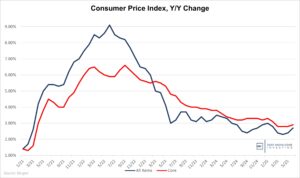

We’ve seen a series of higher than expected inflation reports in recent weeks, and that’s a big part of why more Fed Governors are saying they might not need to lower the fed funds rate later this year. There have been occasional comments that they might need to raise rates this year. While I disagree with Chairman Powell that the current fed funds rate is “restrictive”, I don’t think they’re going to raise rates at the next couple of meetings and will remain in wait-and-see mode. Changing the fed funds rate anytime close to the November election will result in the appearance of political advocacy, something the Fed would prefer to avoid.

The conclusion: Higher for longer (still) with no near-term rate changes.

IR@DeepKnowledgeInvesting.com with any questions.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.