Chairman Powell leans dovish in his annual remarks causing risk assets including Bitcoin, gold, equities, and energy to trade up sharply. DKI disagrees with the (potential) decision to cut rates, but still profits from it. The White House will be pleased, but don’t expect the President to start praising Powell in public. Copper tariffs are reversed causing a decline in prices. The intention is to provide enough raw material for growth while encouraging domestic fabrication. If you’re in favor of economic growth and increasing local manufacturing, it’s not a bad plan. DKI addresses concerns that Bitcoin is too volatile to be a currency. We ask whether you want to gain purchasing power with high (but decreasing) volatility, or do you want a 100% guarantee of losing purchasing power slowly? Softbank invests $2B in Intel. The White House debates what it wants in exchange for its CHIPS Act investment then takes decisive action. Looking at this issue from all sides, we can’t find a reasonable path to a good policy. If you have ideas, let us know – or send them to 1600 Pennsylvania Avenue. (I am asserting my right to occasionally not have an opinion.) In our educational topic, we explain what a futures contract is, why people use, them and one catastrophic and hilarious risk. (I admit that was a click-bait sentence, but we’ll deliver.)

This week, we’ll address the following topics:

- Chairman Powell paves way for rate cuts. Hints at stagflation among some cryptic comments on the labor market. DKI disagrees with the policy and still profits.

- Copper tariffs are reversed leading to a decline in futures prices. The current policy is intended to encourage raw material supply needed for growth and also to encourage domestic fabrication.

- Some say Bitcoin is too volatile to be a currency, but vol is falling quickly. Lawrence Lepard points out that Bitcoin is stable. It’s the dollar that’s volatile.

- Softbank takes a $2B position in $INTC. The US government contemplates what it wants for its CHIPS Act grants. DKI sees no good solutions here – any suggestions?

- In our educational topic, we explain the basics of futures contracts. It’s not as complicated as it seems.

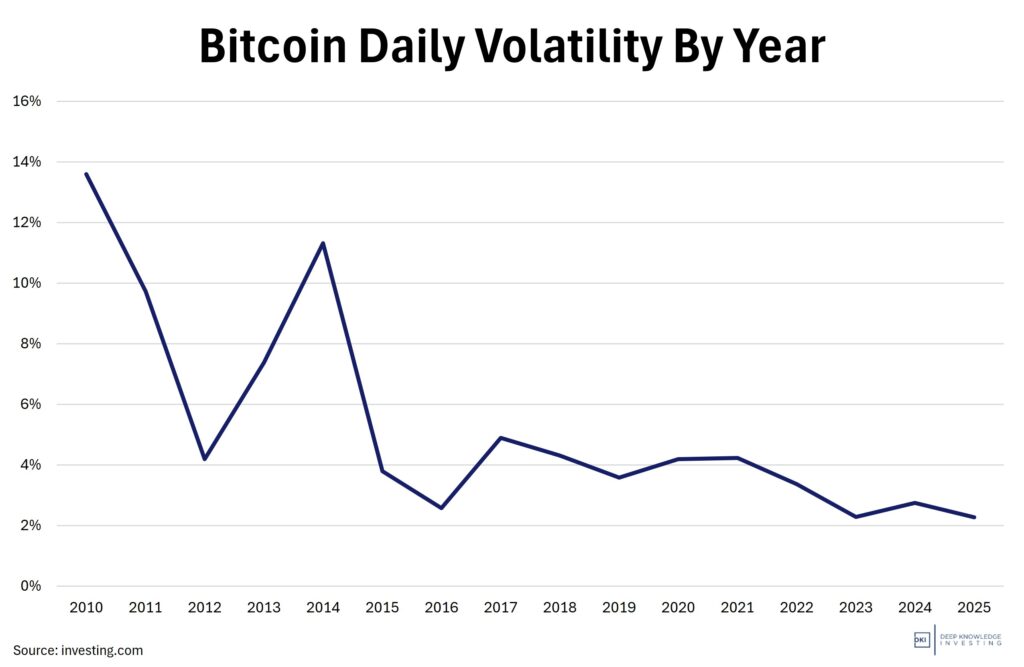

As usual, the DKI interns come through for us. Cashen Crowe has taken firm ownership for organizing the 5 Things and is responsible for ensuring we have good topics delivered on time. Math major, Gideon Rotem, did the volatility charts showing people that Bitcoin has a path to becoming a currency and adding something new to the conversation. Samaksh Jain has been working directly with me on stock ideas producing impressive reports. He’s been “cheating” by using AI, something I strongly encourage.

1) Powell at Jackson Hole Hints at Rate Cuts:

Federal Reserve Chairman, Jerome Powell, gave his last Jackson Hole speech and expressed concern about a weakening labor market. As usual, the Chairman indicated continued concern that tariffs could lead to higher inflation, something that was signaled in last week’s PPI report. In weighing the balance between a potentially weaker labor market (that would call for lower rates) and potentially higher inflation (that would call for higher rates), Powell leaned towards protecting the labor market. He indicated that a tariff-related spike in inflation would be one-time in nature (transitory?) leading him to conclude the balance of risks were currently in favor of lower rates. He also had an interesting comment on the labor market noting that we were seeing both lower demand for labor as well as reduced supply. That appeared to be a nod towards the impact of repatriations.

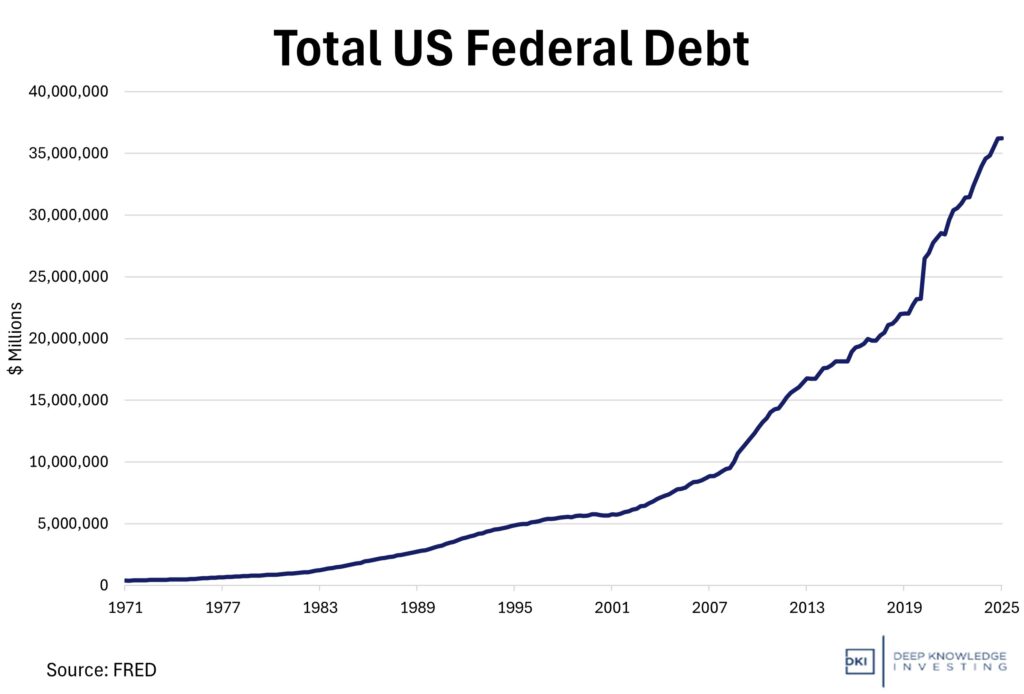

Nothing the Fed does will change this. Congress needs to spend less. They won’t

DKI Takeaway: Powell’s remarks were well received by the market and the White House will be pleased as well (although we don’t expect the President to start praising his Fed Chairman in public). I continue to believe that rate cuts with the CPI still well above the 2% target (which is 2% too high) will be both unwise and ineffective. Even if the Fed cuts the overnight rate, it’s likely the bond market will factor in higher future inflation and lead to a steeper yield curve with higher long-term rates. Fortunately, at DKI, we don’t need to agree with policy to benefit from it. Our positions in high-growth small-cap stocks along with our positions in energy, Bitcoin, gold, silver, and uranium were all up sharply.

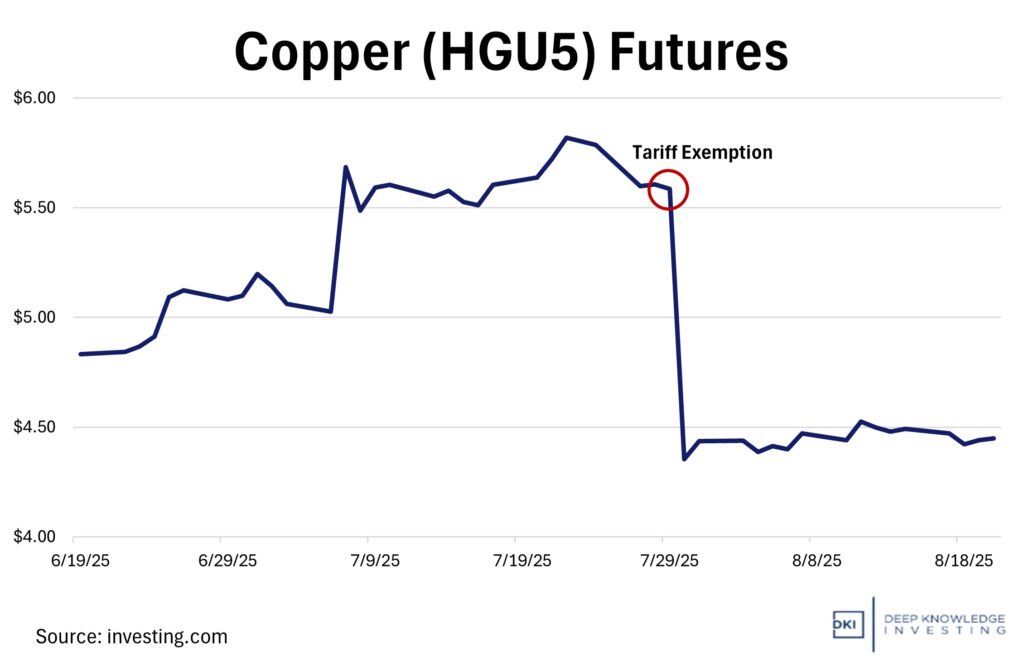

2) Copper Futures Plunge Following Tariff Reversal:

Announced on June 30th and set to go into effect on August 1st, President Trump reduced tariffs on copper from the previously-planned 50%. The White House exempted basic copper inputs like ores and concentrates, limiting the 50% tariff to semi-finished goods such as pipes, tubes, wires, and other components. The reversal enables raw copper, a key component of economic growth, to come into the US tariff-free while encouraging domestic finishing. Copper futures on COMEX reacted to the news with a 17% plunge after weeks of price increases.

In addition to the tariff reversal on copper, the Trump administration also released plans to expand scrutiny on Chinese steel, copper, and lithium under the Uyghur Forced Labor Prevention Act barring goods made with forced labor from entering the US. The US will continue to hold Chinese companies accountable for forced labor, minimizing the risk of participation in morally-questionable parts of the Chinese supply chain. Stress on the EV market could be expected as Chinese steel and lithium continue to remain critical industrial inputs. The move is designed to address unfair trade issues and human rights objectives.

Elimination of big tariffs leads to an increase in supply.

DKI Takeaway: This tariff relief should motivate US copper fabricators to create copper components in the US by penalizing imports on components. Raw copper is still coming in tariff free leading to continuing competition for US copper mines and smelters. The import ban on Chinese materials made from forced labor also reflects an attempt to shift trade policy and protect American supply chains. While there is a legitimate debate on the proper role of tariffs in addressing economic concerns, it’s hard to argue against not buying products made with slave labor.

3) Bitcoin Volatility and the Path to Becoming a Currency:

We had a thread on X get a lot of attention this week and it addressed an important issue. I often talk to people who say there’s no use case for Bitcoin because it’s too volatile to be used as a currency. They ignore that it’s becoming a store of value like gold, and ignore the flight to Bitcoin in countries with extremely high inflation rates. While I don’t agree that there’s no use case and I think there are important reasons to own Bitcoin, if we’re going to be persuasive, we need to address the arguments being made. Bitcoin has been volatile vs all fiat. Prices tend to be posted in fiat not Bitcoin adding to this perception. The problem with the argument against Bitcoin is it’s static. Let’s look at the dynamic picture:

The trend is clear. Institutional adoption will drive this further.

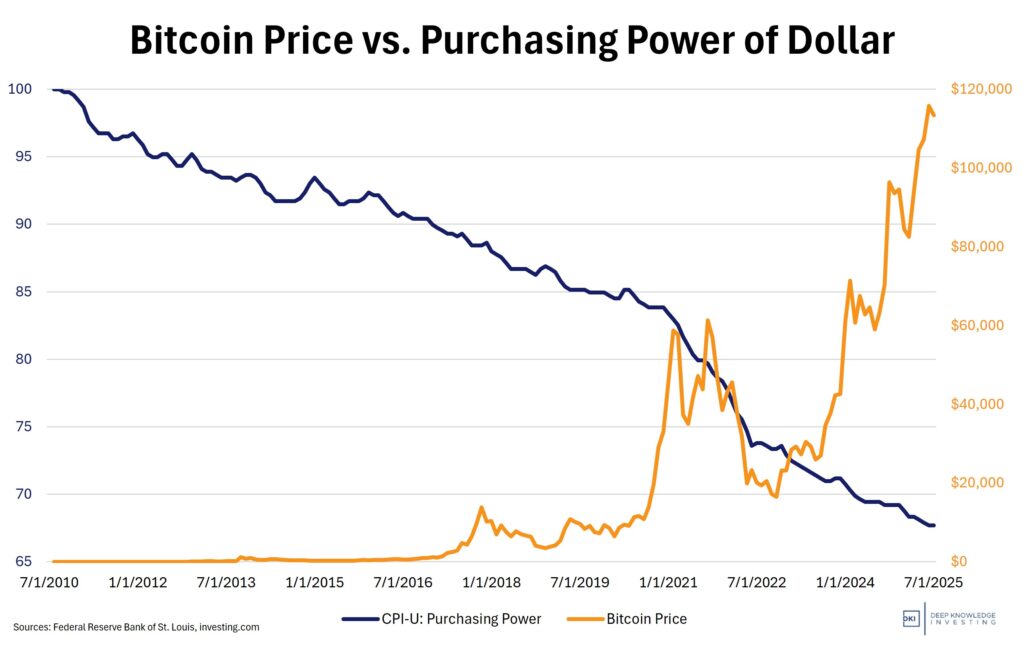

The dollar has lost 33% of its value since Bitcoin started trading – more if you think the CPI is understated. (The CPI is understated.)

DKI Takeaway: The annualized volatility is down from over 250% to under 50%. You might say that 50% volatility is high, but take a look at the price vol. of the Magnificent 7 or various commodities. I acknowledge that this kind of price movement makes it hard to use as a currency at the moment if you’re accustomed to thinking in dollars, euros, pounds, or yen. But if you’re in pre-Mieli Argentina, Lebanon, or other countries with an inflation problem, this looks good. Among many great comments, this one from Lawrence Lepard stood out: “Actually, it is the dollar in Bitcoin terms that is quite volatile. Bitcoin is stable.” I’ll leave you with one question: Do you want to gain purchasing power with high (but decreasing) volatility, or do you want a 100% guarantee of losing purchasing power slowly?

4) Intel’s Investor Comeback with Softbank:

This week, SoftBank announced a $2 billion investment in Intel ($INTC) causing the stock to rise 7%. Soon after, Intel announced it is seeking additional equity infusions from other large investors to strengthen its balance sheet. The optimism faded quickly, as shares proceeded to fall by 7%. Later, President Trump signaled interest in taking an equity stake in Intel, converting grants already pledged under the Biden-era CHIPS Act into stock. Commerce Secretary Howard Lutnick confirmed the government’s goal of securing a stake (approximately 10%), arguing that taxpayers should get ownership rather than issue “giveaways.” The administration says that the stake would be non-voting, aimed at strengthening domestic chip manufacturing. The developments come after President Trump initially called for Intel CEO Lip-Bu Tan to resign earlier this month over concerns about past China-linked investments. President Trump later reversed his stance following a White House meeting, now backing Tan.

Intel wants more capital, and is getting the government as a partner.

DKI Takeaway: If the U.S. sets a precedent of purchasing stakes in public companies, it could incorporate political risk into valuations. Investors will need to discount not just fundamentals, but also potential government influence on strategy, capital allocation, and leadership across entire sectors. Subsidies are becoming less frequent as direct investment seems to take the stage, with equity stakes showing potential to create more downside protection. This is a complicated situation. Taxpayers aren’t thrilled about giving money to corporations. Government-controlled equity stakes is a guarantee of non-financial DEI-style meddling. And having all of our high-end chips made in Asia is a national security problem. The execution here is going to be difficult.

Update: Late on Friday, it was announced the US government will take a 10% stake in Intel which would rise if the company spins off its foundry business. It will be interesting to see if the government tries to get equity stakes in other CHIPS beneficiaries years after the deals were struck.

5) Educational Topic: Understanding Futures Contracts:

A futures contract is an agreement to buy or sell a commodity (or financial instrument) at a predetermined price on a set date. The contract essentially “locks in” the price today for a transaction that will happen later in time. Just like securities, these contracts are standardized and traded on regulated exchanges.

Commodities are the most common underlying assets for futures contracts, with the most common commodities being wheat, metals, and energy products (like oil). However, financial instruments can also serve as the underlying asset, such as stock indexes, interest rates, currencies, and even cryptocurrencies. Since futures contracts are a type of derivative (value comes from underlying asset price), buyers of futures contracts don’t own the asset itself but instead an agreement related to the price of the asset.

While futures prices are fundamentally linked to the price of the underlying asset, the contracts also are affected by future expectations. A futures price will generally represent what the buyers and sellers believe the price will head to in relation to the expiration date. For example, if traders believe that gold will become more scarce next year, gold futures will be higher priced than the spot price of gold.

Valuation can be complicated, but the contracts tend to be simple.

DKI Takeaway: Two important terms in futures markets are contango and backwardation. Contango is when futures prices are higher than the current spot price with backwardation is the opposite. Futures are also risk management tools and can be used to hedge against price fluctuations in an underlying asset. The hedger will give up some potential upside (if prices move in the favorable direction) to avoid a potentially larger downside. The futures markets tend to attract speculators. An investor who believes a drought is coming may buy wheat futures to lock in profit possibility for more expensive futures later on. It’s important to know if you want to take delivery or not. Every young trader is warned of the occasional story of someone thinking they had big profits in a futures contract, but who only thought in terms of abstractions instead of physical goods. They were later surprised by a call asking where they wanted a huge quantity of actual physical oil, wheat, or other goods delivered.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.