The US and the EU reached a trade deal that was a one-sided adjustment in favor of the US. Somehow, reporters keep failing to mention the continent’s previous trade barriers against the US and the resulting large trade deficit. The Fed stays on “pause” an unpopular move, but I agree with them, or at least I did until I saw the employment report revisions. Two Fed Governors dissent leading many to believe they’re signaling to President Trump that they’ll be compliant if selected to Chair the Fed. I continue to believe the Fed is irrelevant in bringing down borrowing rates, and that will depend on Congress to cut spending, something that isn’t going to happen. Is everyone ready for more inflation? Samsung lands a big chip deal with Tesla. We’re excited the chips will be produced in the US. AMD raises prices on its GPUs despite competing with market leader, Nvidia. Can they overcome customer lock-in? Union Pacific and Norfolk Southern will attempt to combine and create the first transcontinental railroad in the US. It’s going to be a heck of an antitrust fight. Finally, in our educational topic, we discuss the risk/reward of buying stocks on margin.

This week, we’ll address the following topics:

- The US and the EU reached a trade deal. Yet again, President Trump succeeds in monetizing access to the huge US consumer market.

- The Fed stays on “pause”. President Trump isn’t happy, but I think this was the right call by Powell based on the data he had at the time. Two Fed Governors dissent/audition which is unusual.

- Samsung lands a big AI chip deal with Tesla $TSLA. It’s a big win for Samsung and indicates confidence in their coming US fab plant.

- $AMD goes head-to-head with $NVDA and raises prices almost 70% due to high demand. Can they overcome the CUDA instruction set-based customer lock-in?

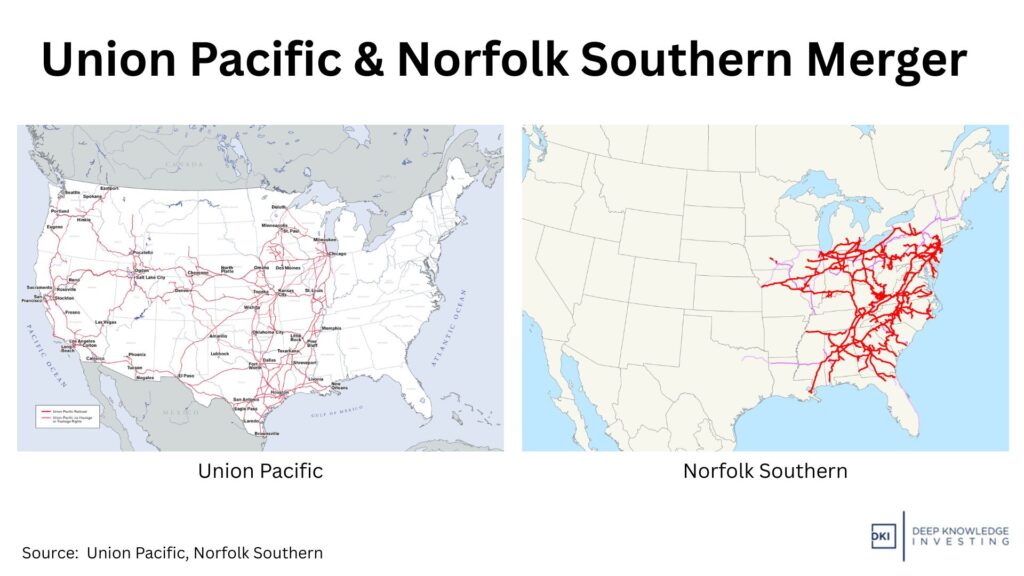

- Union Pacific $UNP announces a massive transcontinental merger with Norfolk Southern $NSC. The deal will be challenged but this White House isn’t big on antitrust enforcement.

- Educational topic: The risk/reward of buying stocks on margin.

DKI’s interns took a big step forward this week as Cashen Crowe, Samaksh Jain, and Gideon Rotem engaged in a flurry of ideas. There was a big competition/collaboration this week as all three interns pushed excellent ideas for this week’s “Things”. Great to see the intensity they have as they attack the work. As always, what you’re about to read reflects their hard work and meaningful contributions. Robb Fahrion continues to lead Flying V’s efforts to improve the video version, available on YouTube every week.

Ready for another week of trade deals and not trade deals? Let’s dive in:

1) EU Trade Deal:

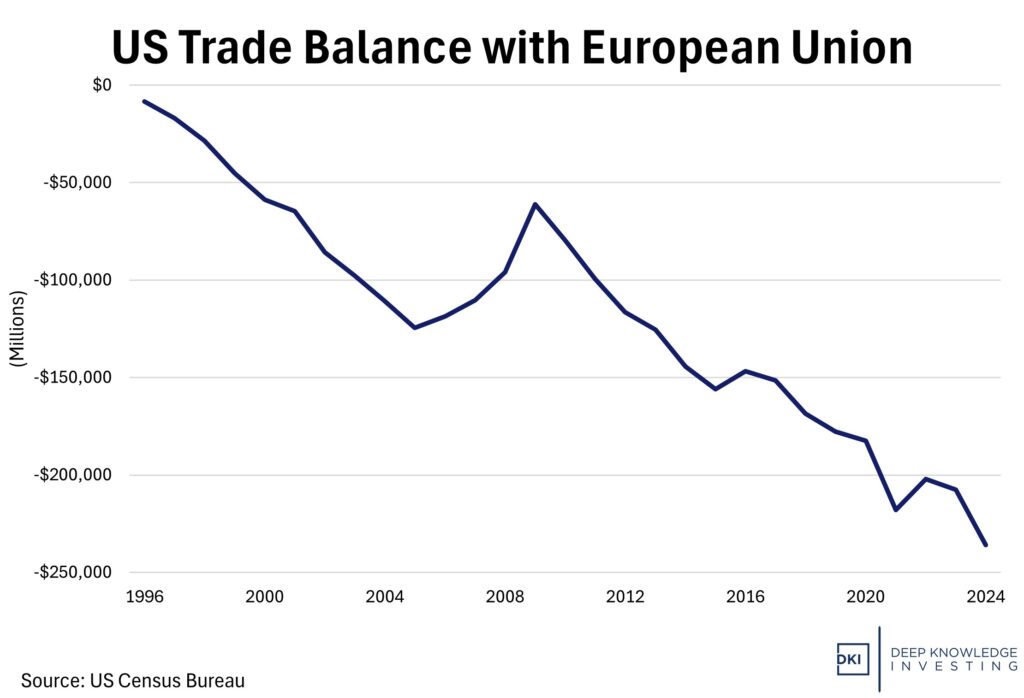

The US and the EU reached a major trade agreement rebalancing the relationship between the world’s two largest economies. After months of negotiation, the deal has laid the groundwork for tariffs, market access, and economic cooperation. The US will charge a 15% EU export tariff on most products, with tariffs on American goods dropping below the current average of 1%. Additionally, the EU will eliminate all tariffs on US industrial goods exports.

This deal represents a dramatic change in transatlantic trade policy as prior efforts (like the TTIP) have made zero progress. The deal also put purchase commitments in order, securing EU plans to buy more American products, reducing the increasing deficit with the union. Worth noting, many believe the EU is doesn’t have enough demand to

purchase the promised energy commitments.

That’s a big deficit the US is trying to address.

DKI Takeaway: This marks the third week in a row that we have covered a landmark trade deal between the US and a major trading partner. Perhaps the most important so far, this deal shows Trump’s continued approach of “managed trade,” using bilateral bargaining to rebalance trade. This is especially important for countries that the US has been falling into deeper trade deficits with every year.

Two weeks ago, I praised DKI’s interns for writing that President Trump was monetizing access to the US’ huge consumer market. President Trump’s negotiations with the EU were a testament to that approach. The WSJ had a great article on these negotiations where it was clear that European leaders thought they’d be able to manage their way through and try to get tariffs down to zero. Once they saw the kinds of deals the President struck, they realized that wasn’t an option and shifted to trying to “contain the damage”. The article noted that “Tariffs of 15% are ‘certainly a challenge for some,’ European Commission President Ursula von der Leyen said. ‘But we should not forget it keeps [the EU’s] access to the American market.’”

As I write this, the US has imposed 10% – 15% tariffs on dozens of nations who didn’t complete a trade deal with the Administration on time and raised tariffs to 35% on Canada. I think the Canadian tariff will be temporary. Negotiations with Mexico and China continue. The probability that we feature tariff news in next week’s 5 Things is very high.

2) The Fed Stays on Pause:

The Federal Reserve concluded its July meeting and to the surprise of no one, left interest rates unchanged. I think it was the right move, or at least I did until I saw the employment report on Friday. The economy seems to be doing well-enough and inflation remains above the 2% target (which I continue to insist is 2% too high). DKI has been outspoken and out-of-consensus in saying the Trump tariffs wouldn’t lead to disaster, but I do think the insistence of some that it will take a few more months for tariffs to work their way through the complicated supply chain leading to higher inflation then is a reasonable concern. Powell continues to provide a measured presence talking about the good and bad of the economy always highlighting uncertainty. The big news is that for the first time in decades, the normally unanimous Fed had two Governors voting against the no change in policy decision. Whether they think it’s time to lower rates or whether they’re trying to impress the President with their accommodating stance and eager to replace an outgoing Chairman Powell is unknown.

Powell holds firm for now. Unpopular opinion, but I think he’s right.

DKI Takeaway: My position on rate cuts is unchanged. They would have no good effect. Last September, when the Fed cut in a futile attempt to lower borrowing rates, the yield on the 10-year Treasury rose as the market priced in expected higher future inflation. As long as Congress keeps overspending, we’ll have further currency debasement which we all experience as inflation. Both parties overspend.

Many people believe the Fed controls interest rates. The Fed only controls the overnight rate, and the bond market sets the rate for the rest of the yield curve. As I’ve written before, President Trump is wrong to insist on a lower overnight rate as I don’t think it will help his cause. Chairman Powell has been wrong on inflation for years as he kept the fed funds rate far too low for far too long. He was very late in hiking and early in easing. What do you think? Would you cut now?

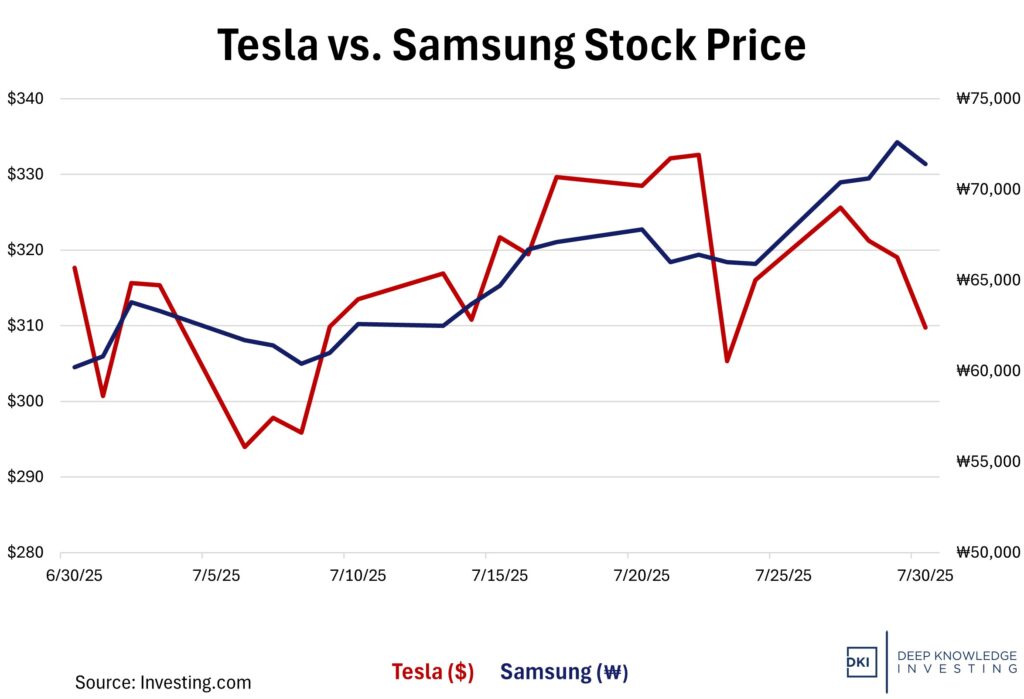

3) Samsung Lands $16.5B AI Chip Supply Deal with Tesla:

Samsung secured an eight-year, $16.5 billion contract to manufacture Tesla’s next-generation AI6 chips at its new Texas fabrication facility, set to begin production in 2026. These high-performance chips will power everything from Tesla’s autonomous driving systems, Optimus humanoid robots, and its AI data centers. Elon Musk confirmed Tesla’s involvement and stated that actual production volumes could exceed this baseline figure, emphasizing that Samsung has agreed to let Tesla assist in optimizing manufacturing efficiency. Samsung, whose foundry business has been pressured by yield issues and weak customer traction, gains vital credibility and production scale; while Tesla secures a domestic AI chip supply chain (Taylor, TX) and gains leverage over timing and cost control.

Samsung shareholders seem happy about the deal.

DKI Takeaway: This deal represents more than a supply contract; it’s the emergence of a cooperative model where chip design, fabrication, and operational oversight merge. For Samsung, the partnership offers a much-needed validation for its foundry pivot, and for Tesla, it locks in supply while avoiding traditional vendor lock-in with firms like TSMC. DKI suggests tracking three key metrics: whether Samsung can hit high yields on its 2nm AI6 platform; how effectively Tesla embeds its operational rigor into production; and whether this partnership becomes a template for vertical integration across AI chipmaking. If this collaboration is executed well, it could redefine how leading AI firms internalize hardware production and reset expectations for foundry economics in the decade ahead.

4) AMD Raises the Price of GPU’s, Confident in Competing with Nvidia:

AMD recently reported plans to steeply increase the price of their flagship AI processor. The accelerator, originally priced at $15,000, is now going to cost roughly $25,000. Even with a 67% increase, the price still comes in below Nvidia’s closest related GPU. $AMD has a history of undercutting Nvidia on price, so the news comes as a surprise. AMD’s price hike suggests increasing demand and higher confidence that buyers will pay more for their hardware.

Choose your fighter!

DKI Takeaway: In Q1 2025, AMD’s data center segment (which includes AI accelerators) produced $2.3B in revenue, up 80% year-over-year, largely due to the increasing demand for the MI300 series. This newfound pricing confidence is coming during a broader company transition toward data center and AI products. AMD believes its performance and growth warrants the price hike and that demand remains at these higher prices. The big issue for AMD is facing vendor lock-in for Nvidia’s customers. Their proprietary CUDA instruction sets are the industry standard meaning AMD customers either need to use AMDs unfamiliar instruction set or use an emulator that degrades performance.

5) Union Pacific Plans Landmark $85B Transcontinental Merger with Norfolk Southern:

Union Pacific and Norfolk Southern unveiled a joint agreement on July 29 to merge in an $85 billion deal, combining Union Pacific’s western network with Norfolk’s eastern network into the first coast-to-coast freight railroad in U.S. history. The combined route system would span over 50,000 miles across 43 states and connect roughly 100 ports and 10 international interchanges. Union Pacific projects $2.75 billion in annualized synergies, with accretion to earnings beginning in the second full year after closing. Operating metrics drawn from both firms estimate a combined EBITDA of around $18 billion and free cash flow of $7 billion. The merger, planned to close by early 2027, will be heavily scrutinized by the Surface Transportation Board, tasked with evaluating its impact on competition, service reliability, and public interest, especially as unions and shippers raise concerns over consolidation and cost escalation.

Easy to see why they wanted to merge and why there are antitrust concerns.

DKI Takeaway: This merger could fundamentally reshape U.S. rail economics, but the mix of upside and risk warrants a cautious outlook. Eliminating redundant interchanges (notably around Chicago), expanding intermodal flows, and reducing transit times directly address lost volume to trucking. These efficiencies potentially strengthen rail’s value proposition and support more resilient supply chains. However, reduced competition could spur rate hikes, erode service quality, and provoke regulatory conditions that dampen synergy realization. We’d look for regulatory outcome and STB conditions, integration execution (especially maintaining safety and labor relations), and the response of rival railroads like CSX or BNSF. If operational excellence holds and regulatory hurdles are clear, the combined entity could deliver sustained earnings growth, yet failure in execution could turn this emblematic deal into a regulatory and service headache.

6) Educational Topic: Understanding Margin Investing:

When some investors are very confident in a position or their portfolio, they might choose to use leverage to increase exposure to their positions. This is known as margin investing. It allows investors to amplify gain and loss potential by borrowing money against existing positions and increasing position size beyond the initial capital. Through leverage, margin investing gives investors the opportunity to experience higher returns in comparison to an investment without margin. However, an investor could also experience deeper losses if the portfolio value declines due to interest charges and losses on larger positions.

For example, if an investor has $10,000 and their broker has a 75% margin requirement, the investor’s purchasing power can increase to $13,333. If their positions increase in value, the investor would profit from the full $13,333 exposure, enhancing returns even after paying interest. On the other hand, if their stocks decrease in value, their loss is equally amplified. If the loss is great enough, the investor may receive a margin call, forcing the investor to deposit more money or sell off assets to restore the account to the broker’s required level.

Make sure you have reason for confidence in your positions. Research matters!

DKI Takeaway: Though you can use margin for both long and short positions, a margin account is required to short stocks. Ultimately, margin investing can enhance investors’ profits, it is also powerful enough to wipe out capital quickly. That’s especially true if you’re shorting meme stocks like we highlighted in last week’s 5 Things. Margin requirements and interest rates will differ from brokerage to brokerage, meaning it is important to examine the terms before placing any trades using margin. With many moving parts when it comes to margin investing, it is imperative to approach with caution and a thorough understanding of risk.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.