Overview:

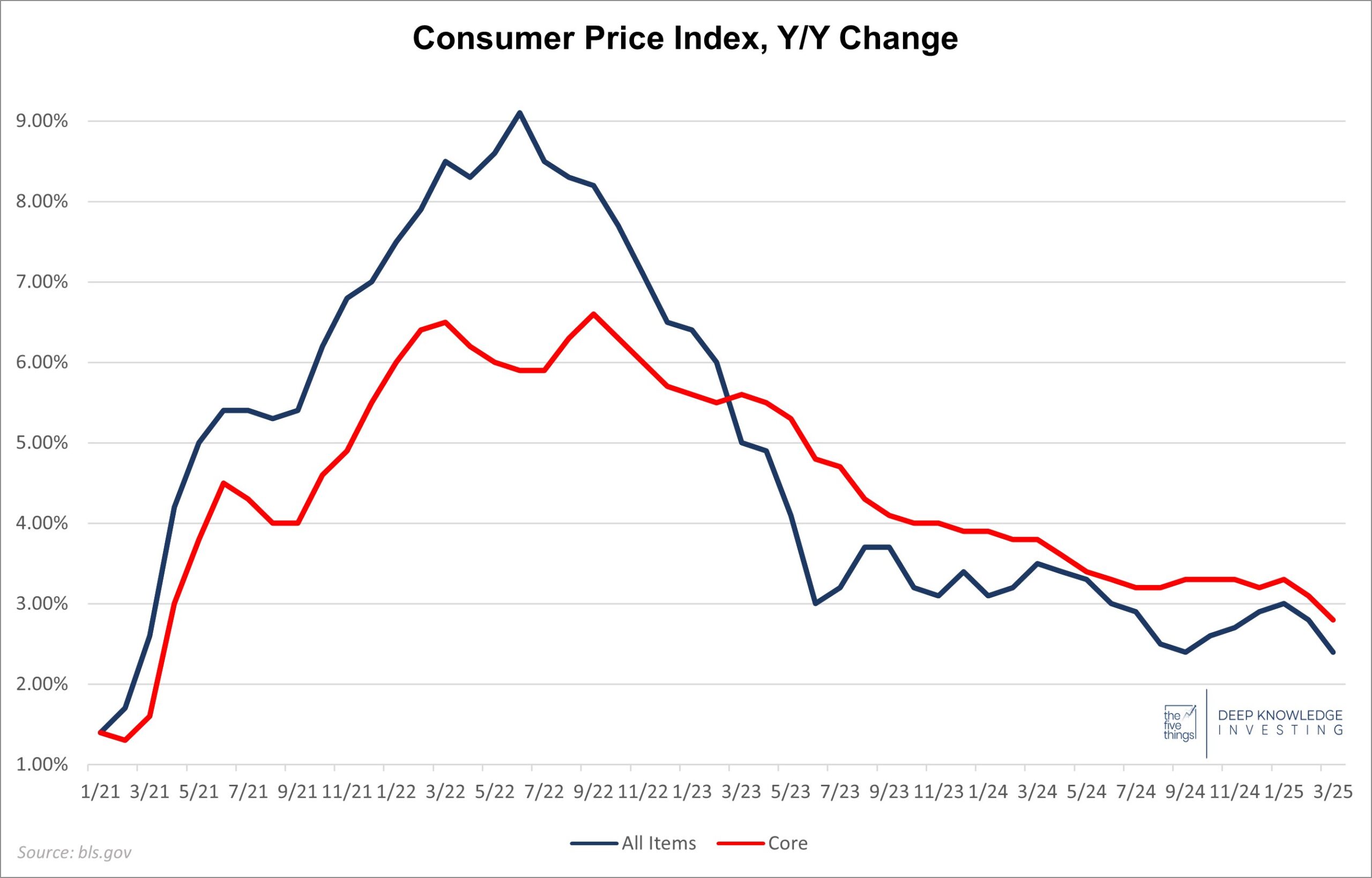

Today, we got the March Consumer Price Index (CPI) report which showed an overall increase of 2.4% for the last year and -0.1% for the month. That’s a big decrease from last month’s 2.8%, below expectations of 2.5%, and the monthly number represents deflation. Small deflation, but it’s in the right direction. The Core CPI which excludes food and energy was up 2.8% vs last year and up 0.1% for the month. That’s below last month’s 3.1%, below expectations of 3.0%, and the monthly number was a very small increase. Let’s go through the details:

That represents real progress.

A big 40bp increase this month, but still below 2%.

Food:

Food inflation came in at 3.0%, representing a large increase from recent numbers in the 1% – 2% which I thought were understated. Food at home was up 2.4%, a 50bp (.5%) increase from last month. Food away from home is now up 3.8%, an increase from the last few months. I normally write about how I’m skeptical that this part of the CPI is being accurately reported. In March, the monthly increases in the food category were 0.4% – 0.5%. That annualizes to 4.9% to 6.2%. Looks like we’re getting closer to believable.

It appears that the larger increases in food away from home are starting to wear on consumers. We’re seeing that in the growing push back against the big tipping requests. Frustrated waitstaff are posting on social media that if you’re not going to tip at least 20%, then you don’t deserve to eat out. They may get their wish, but be unhappy with the result; fewer customers showing up at the restaurant. They need to come in order to tip.

Everyone’s favorite personal inflation metric is eggs. The Trump Administration made efforts to secure supply for more imported eggs, and prices seem to have come down recently. Some on social media are still trying to push an egg inflation narrative, but they get shut down when other posters note that these are special organic eggs. DKI recommends the packages of 5 dozen eggs at Costco for egg value. (Macro analysis, stock picks, and egg recommendations: We’re a full-service firm.)

We continue to note that both the rate of increase and price levels for food purchases are creating stress in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families.

Energy:

Energy has been an overall tailwind for the CPI following the huge increases in 2022. Energy prices were down -3.3% vs last year and down a huge 2.4% for the month. Gasoline was down 9.8% y/y, and down a massive 6.3% in March. Fuel oil was again a big mover showing a 7.6% decrease for the year, and a 4.2% decrease from February. President Trump is trying to bring down energy prices. That’s happened, but not necessarily in the way he hoped. Concerns about a worldwide recession due to tariff plans have reduced energy prices. Worldwide markets are projecting a decrease in future demand. Energy was THE reason for this month’s lower-than-expected CPI, although the Core number is down as well.

In last month’s CPI report, we wrote this:

Some discussed tariff plans may have the opposite effect so this one is a little harder to predict. We also note widespread predictions of a recession which tend to reduce near-term demand by a small amount. That reduction tends to be enough to bring down pricing at the margin. This scenario, lower CPI due to recession-reduced energy demand would not be positive for equities.

That turned out to be prescient.

Vehicles:

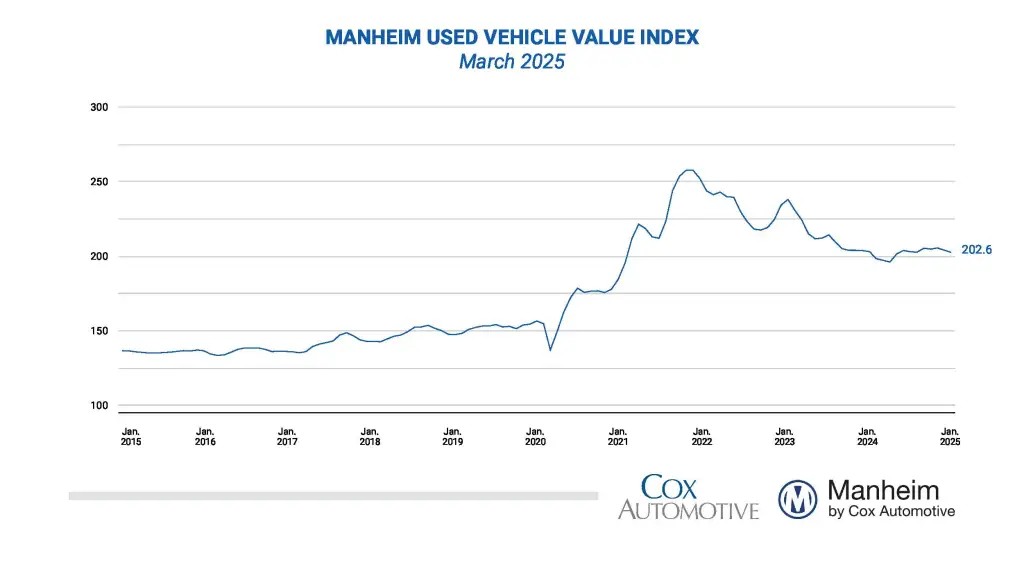

New vehicle pricing was flat. The monthly changes there have been very small for months. Used vehicle pricing was up 0.6%, but down 0.7% vs February breaking a streak of six straight months of increases. The decrease in used car pricing was off of a huge increase. Much of the Covid-related run-up in used car prices has been alleviated, but at this point, further pricing improvements have stalled. There’s also a substitution effect. As new cars become increasingly unaffordable, that increases demand and pricing for used cars.

We seem to have found a new plateau.

Services:

Services prices were up 3.7%, an improvement from last month’s 4.1%. Much of the increase has been caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. In addition, we’re about to start seeing the effect of a reduction in government employment in the next few months. For the last few years, job growth has been in government jobs or jobs heavily funded by the government. DOGE is likely to put this trend in reverse, although without much loss in national production.

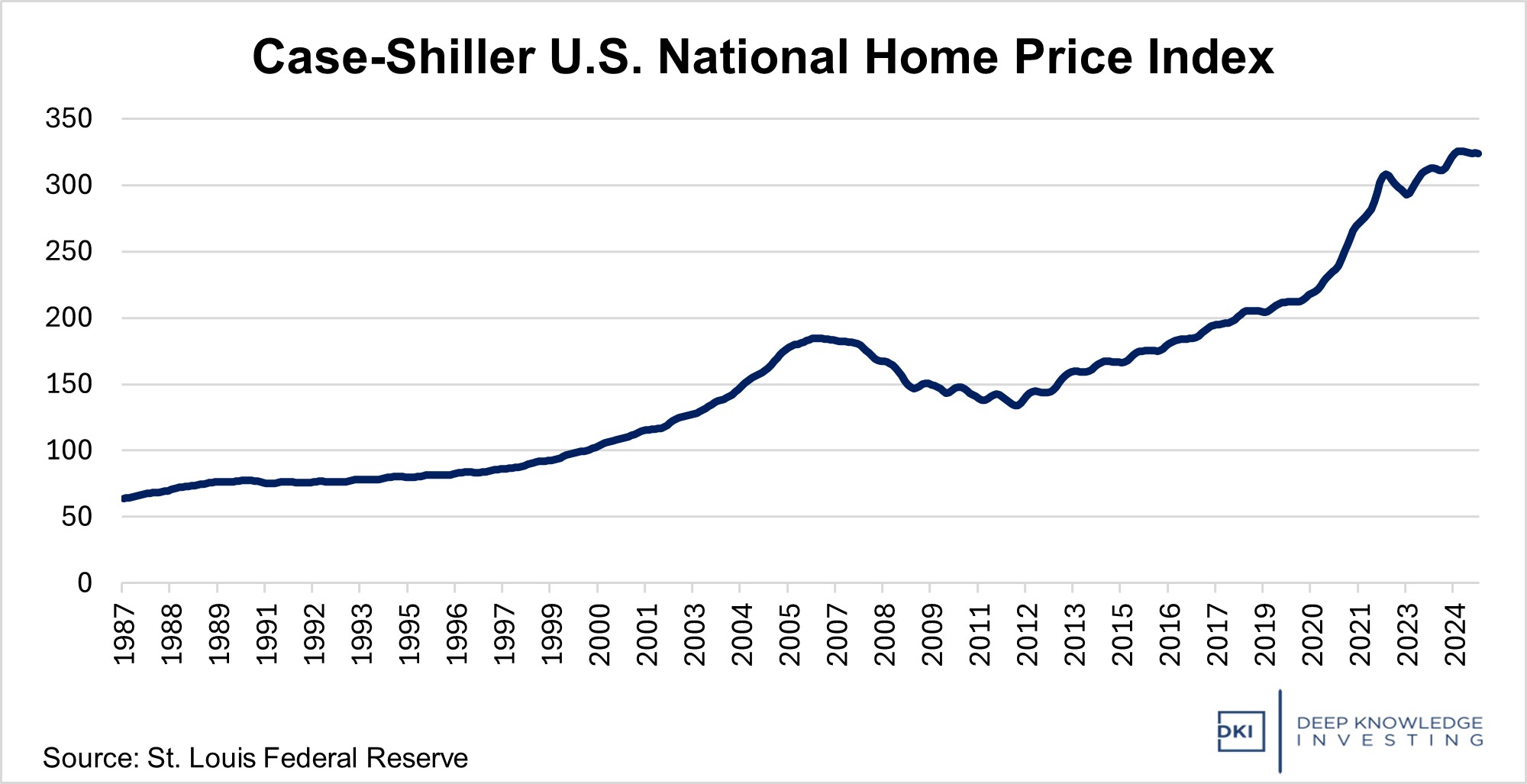

Shelter (a fancy word for housing) costs were up 4.0% which was a small decrease from last month, but still painful for hopeful homeowners and renters.

The Trump Administration is trying to reduce the yield on the 10-year Treasury because due to some unwise political gamesmanship by former Secretary Yellen, they have to refinance another $7 trillion in the next 12 months. As the 10-year yield has come down in the past couple of months, mortgage rates are also falling. Typically, as financing costs decline, we see increases in pricing. That may not be the case this time as people who felt locked-in to their homes because they didn’t want to give up low-cost mortgages may put additional supply on the market. If lower rates lead to more supply, it would lead to improvement in housing affordability, something that’s been particularly painful for young people right now. The tariff stress of the past week has increased the yield on the 10-year so Secretary Bessent will be trying to address that again, but possibly without much QE help from the Fed this time.

Still getting more expensive – just at a slower rate.

Analysis:

Concerns about a tariff-related recession has the market expecting more Fed rate cuts now than at the beginning of the year. Today’s softer-than-expected CPI increase makes that outcome more likely and gives the Fed a bit more breathing room. Despite stress between the Fed and the White House, it’s possible that Chairman Powell would use quantitative easing to buy some of the new Treasury debt. This would increase demand, reduce borrowing costs, and put less pressure on the budget. I don’t think more QE at this point is a good idea. However, me thinking something is a bad idea doesn’t stop Washington DC from doing it so I mention the possibility.

DOGE is working on cutting huge amounts of government spending. For a long time, increases in government debt have outpaced increases in GDP. That means we’ve been in a private market recession for a while and the government is still using stimulus spending to create the illusion of economic growth. While I come across a lot of people worried about a recession, I’m not so concerned if the reason for a “recession” is a reduction in wasteful government spending and theft.

Last month we wrote:

I also think there’s a lot of optimism about a CPI that was 0.2% below last month and 0.1% below expectations. The market was worried just four weeks ago by a higher-than-expected 3.0% CPI with a 0.5% monthly increase (which annualizes to 6.2%). It’s hard to come up with one inflation number for an economy as large as the United States, and definitely not something you can do to 0.1% accuracy. At this point, the market has been reacting to very small changes in general statistics.

This month, we see real progress. The CPI is still too high. That’s especially true for the very-sticky Core number. But the monthly numbers, including a decrease in the all-items figure, is much better.

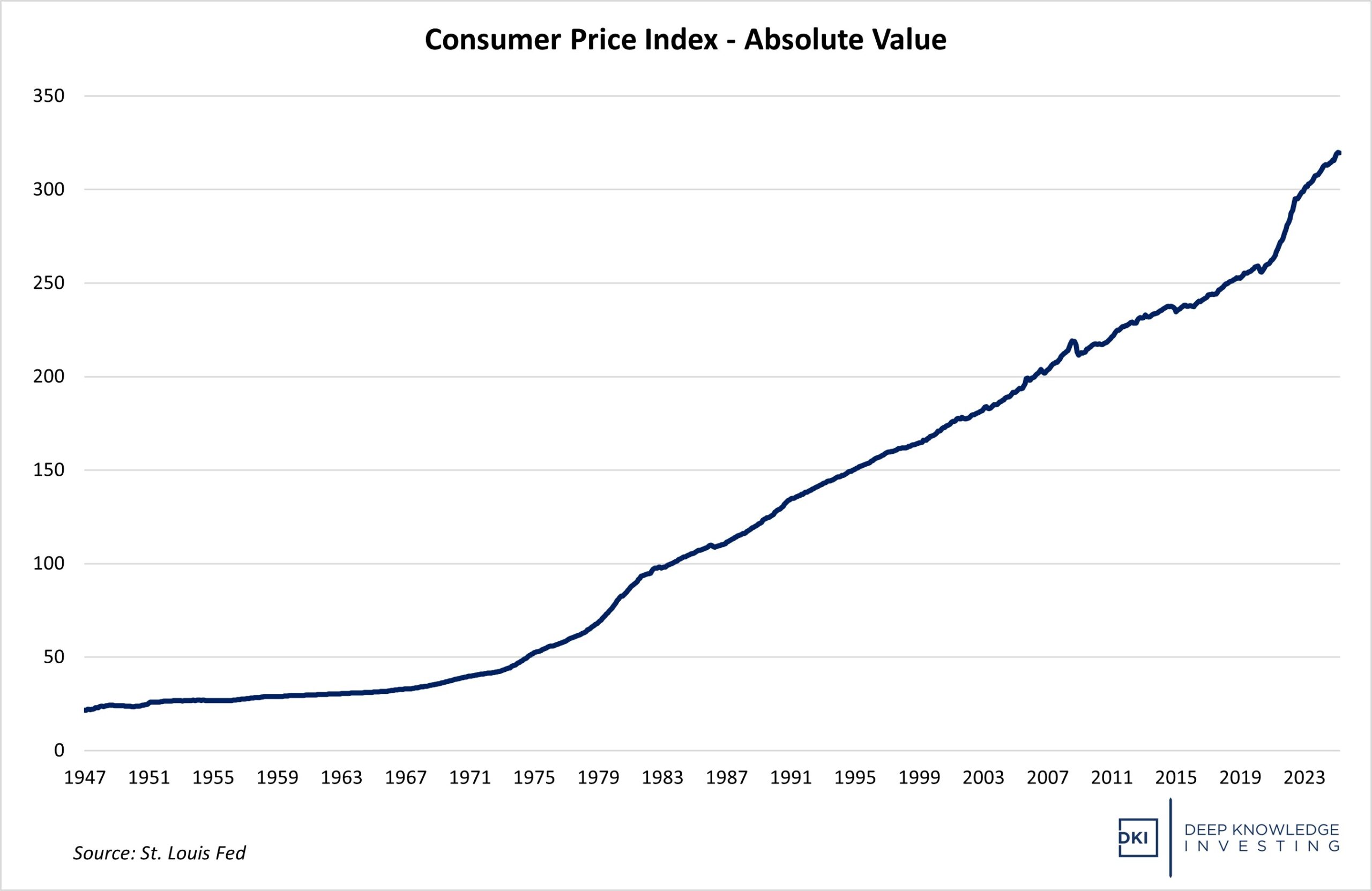

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

Conclusion:

Tariffs are the big story right now. While the FinX community is screaming about the benefits of free trade, it appears to me that people are underestimating the possibility that President Trump’s threats will land us with LOWER tariffs all-around. Over 70 countries have approached the White House in the past week to negotiate. It’s reasonable to assume they will be offering to reduce tariff rates on US products for favorable rates for their exports. There are deals that can be made which will result in reduced tariffs. We have the next 90 days to see what will happen.

Alex Macris and I will be discussing this issue and focusing on what we think people are missing in the tariff discussion. We’ll be livestreaming on my X account: https://x.com/Gary_Brode and on the Deep Knowledge Investing YouTube channel. That’s today at 2pm Eastern Time. You’re welcome to join us.

One positive trend we’re seeing is a meaningful increase in the savings rate for Americans as well as more investing in the stock market by retail investors. As more people become concerned about the economic future, saving and investing more looks like a smart choice.

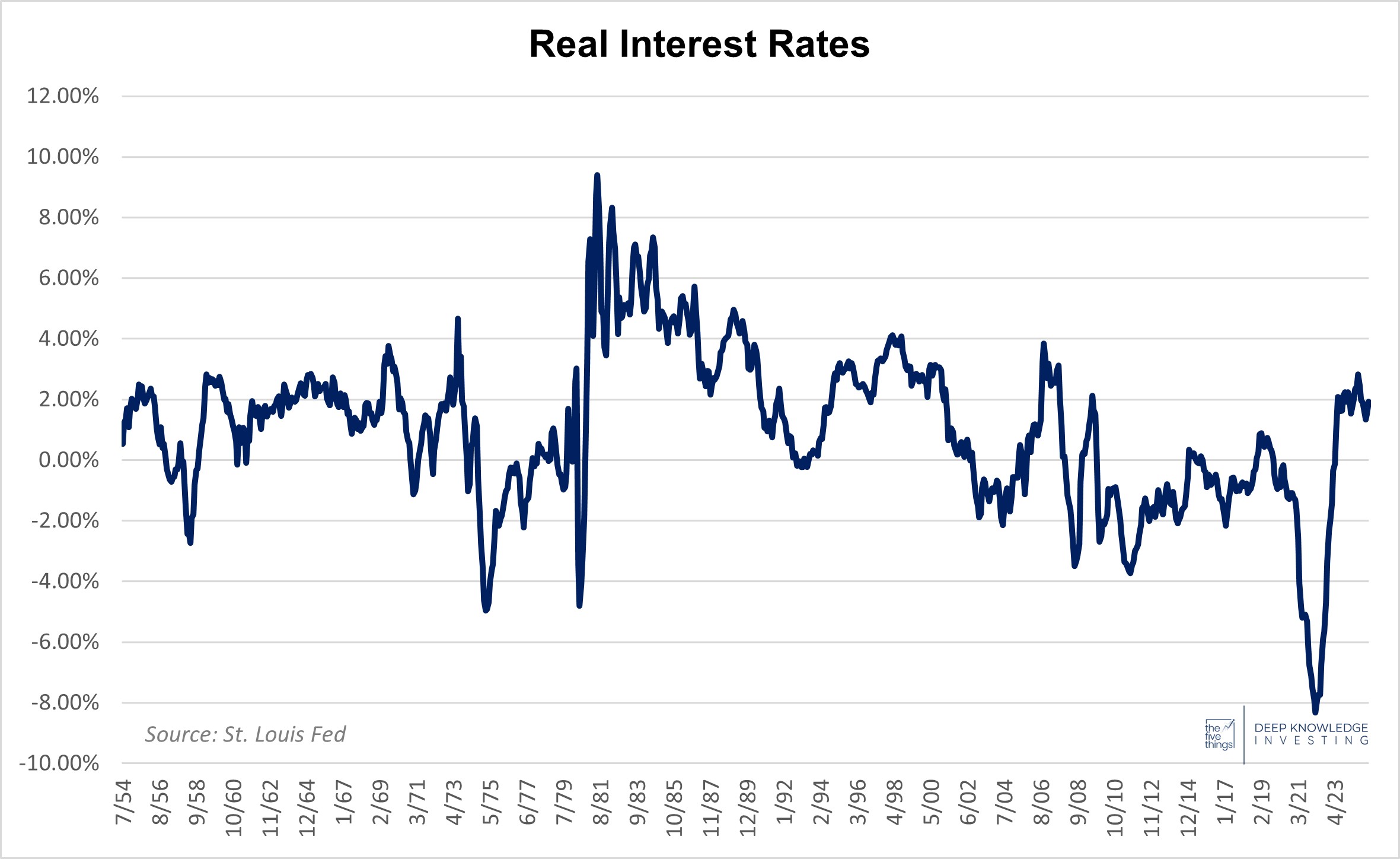

As for Chairman Powell and the Fed: I don’t think they’ll cut rates at the upcoming meeting, but today’s soft print definitely gives them more breathing room than they had at the beginning of the year. The one big concern is that the Fed doesn’t matter as much anymore. Their balance sheet is still huge and the real rate is still below 2%. More importantly, inflation is now being caused by overspending from Congress as opposed to too-low Fed rates. I don’t expect Congress to reduce spending, but will point out that rates on the 10-year Treasury rose after the Fed started cutting. They only control the overnight rate and the bond market is likely to look at any rate reductions as a warning about future inflation.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.