DKI has been warning about a weak private sector for more than a year, but consumers kept spending down their savings and taking on more debt. Recent data indicates we might be reaching the end-point of that practice as debt peaks and sales are weak. The Federal Housing Administration appears to be paying the mortgages of people to ensure they don’t fail and may be offering mortgages that don’t require payment at all. DKI readers: Do you think this is “free” or is it simply keeping housing off the market raising prices for everyone else? The Federal Reserve completed its March meeting and left the fed funds rate unchanged. That was expected. The decrease in economic projections was more of a surprise. We go through the details. Uranium traded lower on DeepSeek speculation. DKI thinks people are mis-reading both the effect of DeepSeek as well as future power needs. Finally, in our educational thing, we help readers understand the relationship between bond yields and prices. If you’ve ever found this confusing, we can help.

This week, we’ll address the following topics:

- Cooling retail sales, plus downward revisions, plus weakening consumer credit. We’ve been saying for a year that the productive private market economy is weak.

- FHA is subsidizing delinquent borrowers and no-payment mortgages. Apparently, despite the advanced age of much of Congress, no one in Washington DC can remember 2008.

- March FOMC meeting surprises no one – until investors saw the change in projections.

- Uranium trading lower on DeepSeek affected projections. We question those assumptions.

- Educational Piece: Bond Price and Yield Inverse Relationship

DKI Intern, Cashen Crowe, continues to grow in his role here at DKI. He’s learning quickly and has an admirable attitude even when traveling. Josh Reaves dismisses my suggestion to use an HP 12C calculator to calculate bond prices and just writes a python script to graph the entire curve. Gen Z for the win. Nice work, Josh!

Ready for a week of weak retail news? Let’s dive in:

1) Lower Than Expected Retail Sales and Downward Revisions:

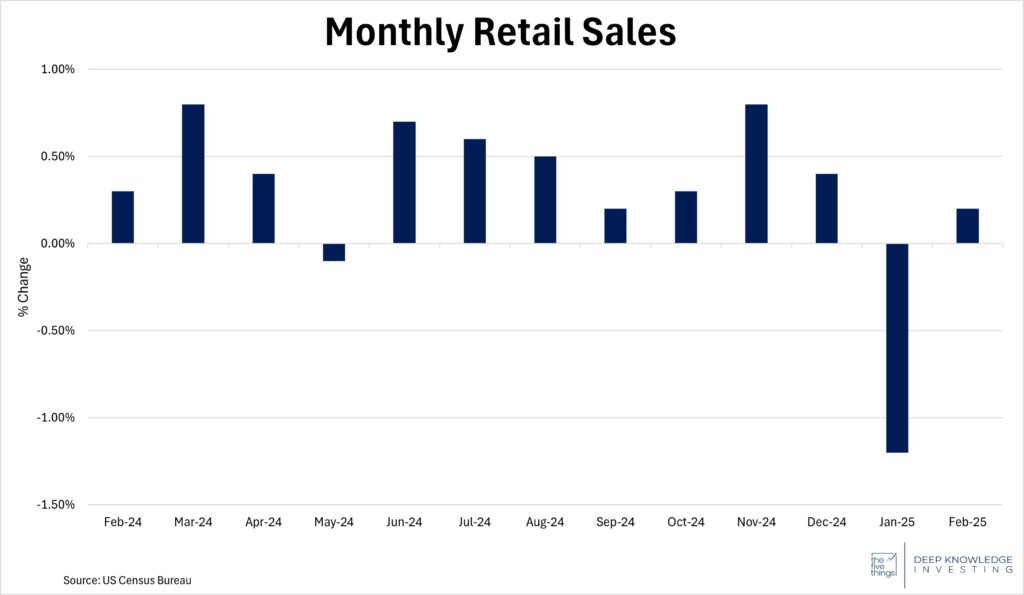

Retail sales growth for February came in at 0.2%, far below the expected 0.7% increase. While February numbers continued the theme of consumers tightening their wallets, January retail was revised down to a 1.2% decline from an already bad 0.9% decrease. More alarming, the February sales number was up 3.1% from a year ago meaning the weakness is recent. This is also an indication of continued inflation despite economists touting “disinflation” (a reduction in the rate of inflation) when the prior Administration was in the White House. Much of the recent decline in spending has been seen at department stores, bars, and gasoline stations. It’s also been characterized by a shift from discretionary spending to necessities.

Most of the 3.1% yearly increase is inflation. The trend since Nov. is concerning.

DKI Takeaway: This weakness in retail sales growth is a sign that the productive private economy is suffering. The federal government masks the symptoms by releasing misleading January numbers and relentlessly spending debt-funded taxpayer dollars. Inflation and interest rates have eroded consumer savings, making it hard for some to even make car or mortgage payments; something DKI has covered at length in prior versions of the 5 Things. As a result, discretionary sectors are taking the hit. Consumer sentiment, being at the lowest point in two years, could also be a contributing factor for keeping their money on the sidelines. Finally, with recent news that DoorDash is allowing consumers to finance their food delivery orders, it’s reasonable to conclude that there is increasing stress in the system.

2) FHA (meaning you) is Subsidizing Delinquent Borrowers and No-Payment Mortgages:

A storm reminiscent of the Great Financial Crisis is brewing at the Federal Housing Administration. FHA mortgages 90+ days delinquent sit at 7.05%, surpassing the 7.02% rate seen before the 2008 subprime bubble burst. Delinquencies jumped from 145,080 in Q3 2024 to 192,067 in Q4 2024, rising 32% in just one quarter.

The FHA is worsening the issue by encouraging risky behavior and not collecting payments. They offer “FHA loans with down payment assistance,” covering all down payments and closing costs. Borrowers with credit scores as low as 500 can secure low-interest loans with minimal financial commitment.

Predictably, delinquencies follow. In February, the FHA spent $250 million to bring 173,000 missed payments current, keeping borrowers out of foreclosure. This amounts to a taxpayer-funded, no-down-payment mortgage with effectively no payments required for five years.

It seems that “affordable housing” means you get a house and others pay the bills.

DKI Takeaway: This echoes the events leading to the 2008 housing collapse. Providing homeownership opportunities (read: free houses) to borrowers with little repayment ability only delays inevitable foreclosures. Taxpayers bear the burden of $250 million a month, propping up delinquent loans instead of allowing market corrections. Without reform, history may/will repeat itself. For those of you who think the government should be providing a lucky group of people with free houses, DKI will remind you that not only are you paying for this through more inflation, this action prevents houses from entering the sales market. If you’re a young person who can’t afford to buy a house, this is just one of the reasons why.

3) March FOMC Meeting Went as Expected – Except the Projections:

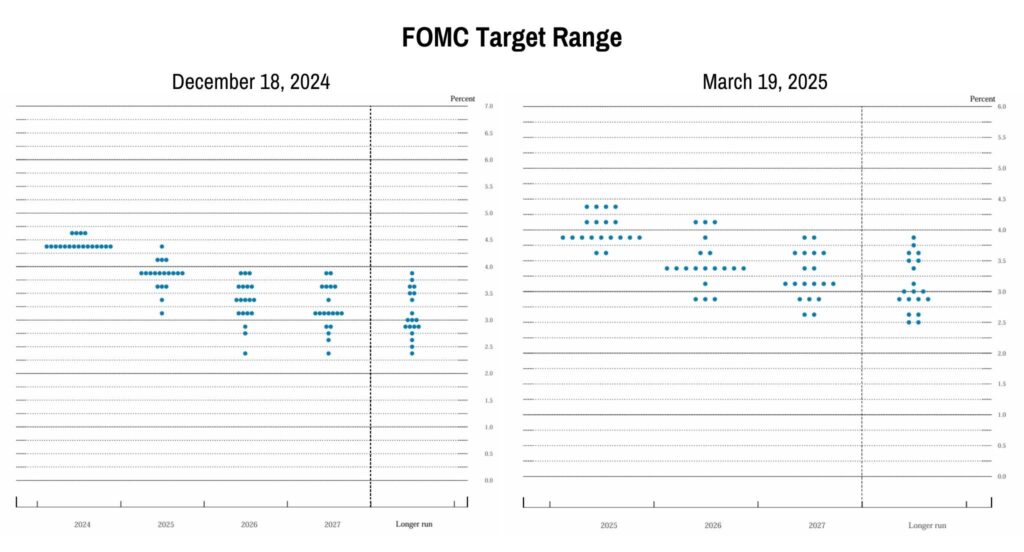

On Wednesday, the Federal Reserve announced it would hold interest rates steady at 4.25% to 4.50%, maintaining its forecast for two rate cuts in 2025. This decision comes amid ongoing uncertainty about the economy, with rising inflation and tariffs complicating the outlook. The Fed’s inflation projections increased from 2.5% to 2.7%, while GDP growth expectations declined from 2.1% to 1.7%. The expected employment rate was raised from 4.3% to 4.4%. We note that if the lower GDP and higher unemployment is due to a reduction in government waste, that would be a net benefit to the economy.

Fed Chair Jerome Powell emphasized the difficulty of assessing inflation driven by tariffs, adding complexity to future rate cut decisions. However, he noted that if the labor market “weakens unexpectedly,” the Fed could ease policy sooner. Chairman Powell also pulled out the T-word; describing tariff-related inflation as “transitory”. Incredibly, I agree with him.

Still expecting 50bp of cuts in 2025, but the outliers are more hawkish now than they were in December.

DKI Takeaway: The decision to pause was no surprise to anyone, and the Fed will continue its data-driven “wait and see” strategy. All eyes will be on next week’s PCE report; the Fed’s key inflation gauge, which will be a key factor in next steps. If inflation remains far from the 2% target, rate cuts could face further delays. Additionally, employment data and broader economic growth will heavily influence future policy decisions. The big news from the press release was language talking about increased future uncertainty for the economy and a reduction in quantitative tightening. That means the Fed is going to reduce the rate at which it removes stimulus funds from the economy.

4) Uranium Price is Down, but Long-Term Outlook is Strong:

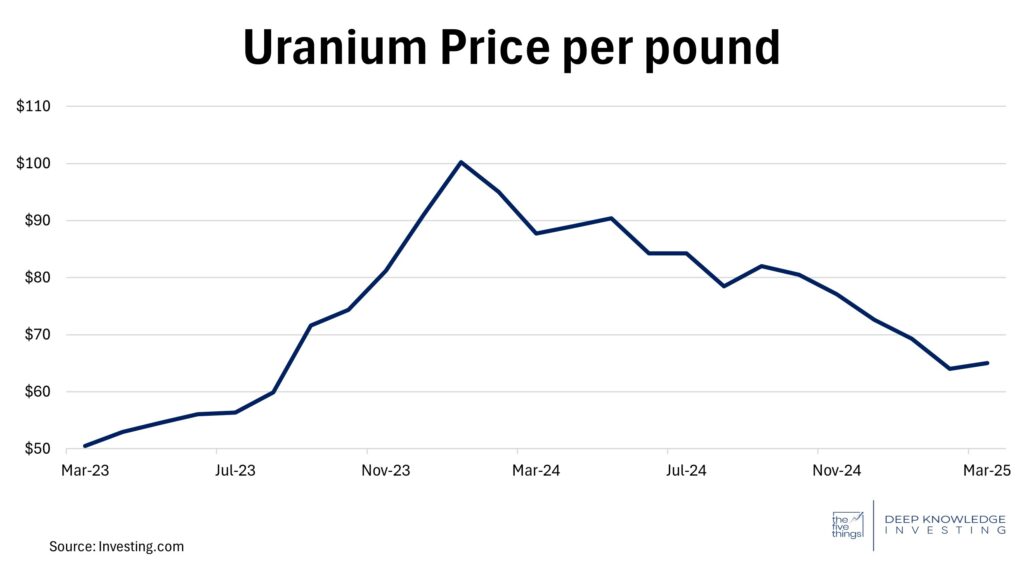

The spot price of uranium has been declining sporadically over the past year and is currently trading around $70 per pound. The spot price was approximately $106 per pound just a year ago.

After riding a wave of AI demand frenzy last year, uranium prices have fallen since DeepSeek launched its new model. The questionable claims of a significant reduction in power requirements for its inference model sent some energy prices into freefall. Geopolitical tensions have impacted the situation with a Russian ban on enriched uranium exports to the U.S. This causes the U.S. to rely on Canadian exports of Uranium which aren’t able to meet demand. Canadian producer, Cameco, has been intentionally underproducing for the past few years; something DKI has covered in prior versions of the 5 Things.

Special permits to import enriched uranium from Russia have been in place since 2022, but these permits are due to expire in 2027. In the meantime, worldwide stockpiles have been decreasing each year; something that can’t continue forever.

DKI thinks with or without AI datacenters, we’re going to need more power.

DKI Takeaway: Despite these factors pushing the price of uranium down, the fundamental outlook remains strong. Demand for nuclear energy is increasing rapidly, especially as President Trump plans to “unleash commercial nuclear power”. DeepSeek’s claims of reduced power usage are misleading. Their inference model uses less power to train, but much more power to answer each subsequent query. Even without new AI datacenters (an assumption we find improbable), the US and the world need more electrical generation. Remaining excess stockpiles have fallen just as more nuclear plants are due to begin construction leading to a future supply shortage.

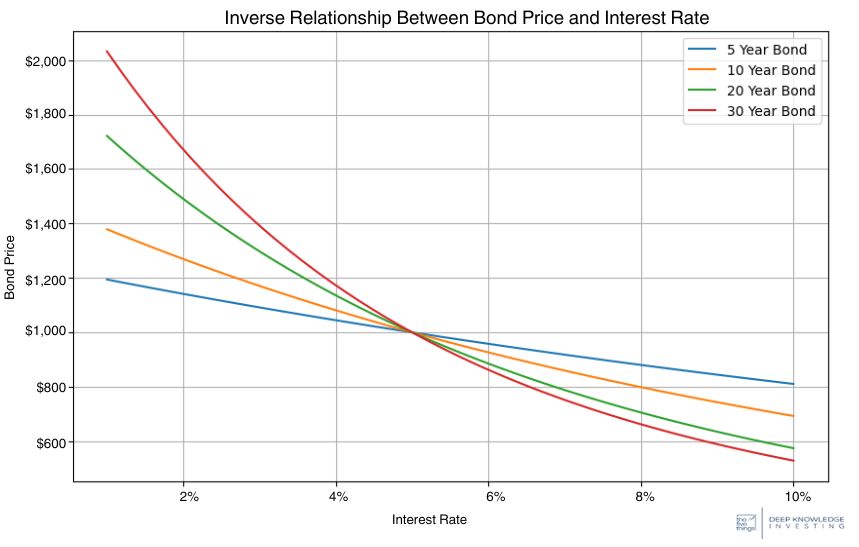

5) Educational Topic: How Do Interest Rates Affect Bond Yields and Pricing?:

A key concept that confuses many learning about the fixed-income market is the inverse relationship between bond yields and prices. When bond prices rise, yields fall, and vice versa. This happens because as market interest rates change, the present value of the bonds’ future payments changes. The value of the bond is the sum of the present value of all interest payments plus the principal you receive at maturity.

If interest rates rise, newly issued bonds offer higher yields, making older bonds with lower yields less attractive. As a result, the prices of bonds with lower yields drop.

Let’s look at a 10-year Treasury note with a face value of $1,000 and a 5% coupon rate as an example. That bond will pay $50 in interest annually. If market rates rise by 50 basis points (0.5%), new bonds will yield 5.5%, paying $55 in interest. To stay competitive, the older bond would need to drop in value to $962 assuming it still has 10 years to maturity.

Price is inversely related to yield. I would have done this on my HP 12C. DKI Intern, Josh Reaves, wrote a python script to calculate bond prices. Gen Z FTW!

DKI Takeaway: Imagine you purchased a 10Y note in January of 2021, when the yield was about 1%. New 10Y notes have a yield of 4.25%, paying about 3.25% more in interest. Your older bond is much less desirable and would have a lower market price to compete with the higher yield and value of newer bonds. This is why understanding the Fed and other interest rate factors is crucial when investing in bonds. Without that awareness, you risk getting burned when rates rise. Worth noting: Sometimes, market participants say that bonds are “up” when they mean yields are up. In that scenario, bond prices would actually be falling. This language is imprecise, but common.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.