Gary Brode of Deep Knowledge Investing and Robb Fahrion of Flying V Group discuss the 5 Things to Know in Investing This Week: The Opposite Day Issue

This week, we’ll address the following topics:

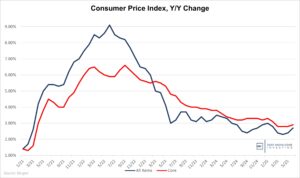

– The CPI comes in hot. Does this mean “higher for longer”?

– The PPI comes in hot. Does this also mean “higher for longer”?

– Retail sales came in weak while manufacturing exceeds expectations. This reverses our prior trend of weak manufacturing and strong consumer sales.

– Shockwave Medical ($SWAV) beats earnings expectations. The company isn’t just taking share. It’s growing the market.

– Macau visitation for Chinese New Year well above expectations and rivaling the pre-pandemic 2019 numbers. Great news for Las Vegas Sands ($LVS).

– Japan officially enters recession. The currency isn’t doing so great either. DKI has been highlighting problems with the Japanese central bank for well over a year.

– Tracy Shuchart thinks oil remains range-bound this year. Does that mean there’s no opportunity? Of course not! Ready for a new week of reversals? Let’s dive in:

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.