Maybe we should have called this The Energy Issue. President Trump is trying to cut through decades of red tape by building nuclear reactors on military bases. If you want to electrify everything and have AI datacenters without more carbon-based energy, nuclear is the only option. Do you own enough uranium? 90% of US companies plan to reshore production or shift to US-based suppliers. It’s not easy, but right now, there’s more public support than many think. Nvidia loses billions of dollars of sales to China due to export restrictions…and still crushes the quarter. Remember how DeepSeek was going to kill demand for AI infrastructure? That isn’t happening. Jensen Huang had some politely-worded advice for President Trump. Curious? Then, read on for more details. The President threatened Apple with tariffs if they don’t reshore manufacturing. The worst part is the US has lost the capability to make high-end electronics. I hope that changes. In our educational topic, we explain what beta is. DKI focuses on alpha. No need to be confused – we explain below.

This week, we’ll address the following topics:

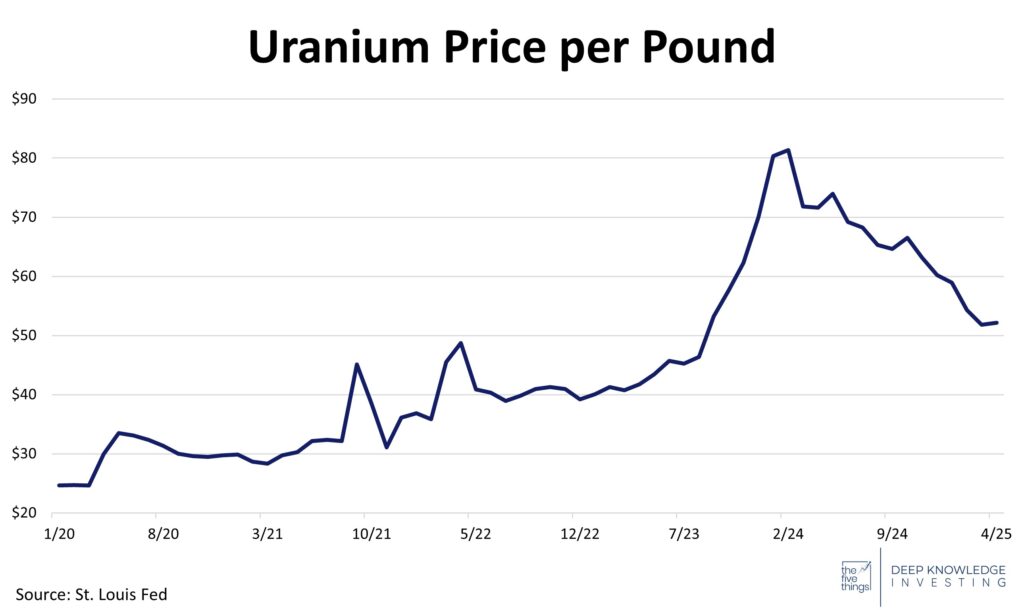

- President Trump puts in a bid on uranium. Where is the market going to get enough supply?

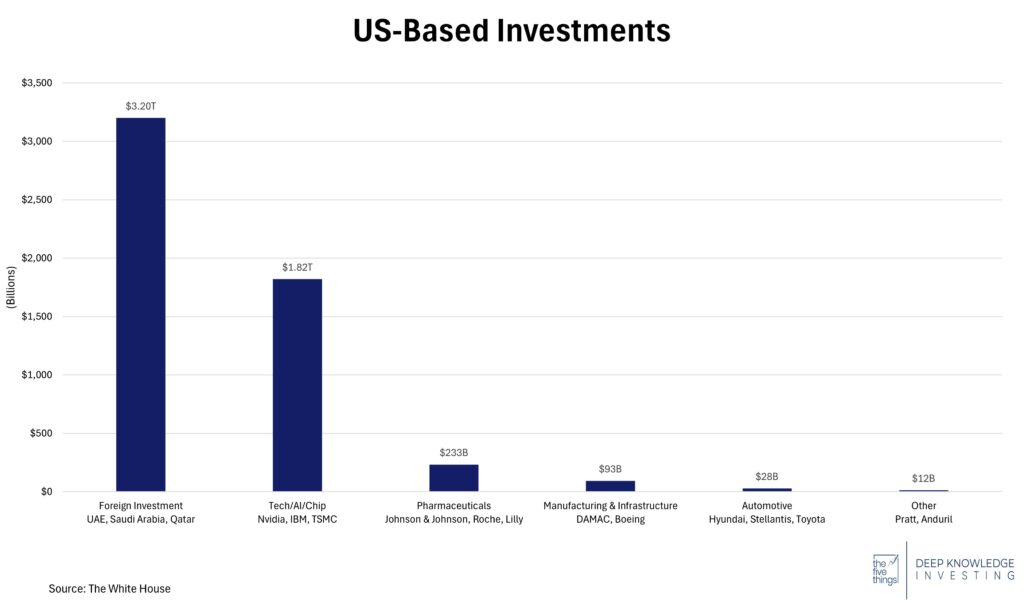

- 90% of US companies plan to reshore production or shift to domestic suppliers. That’s better participation than I expected.

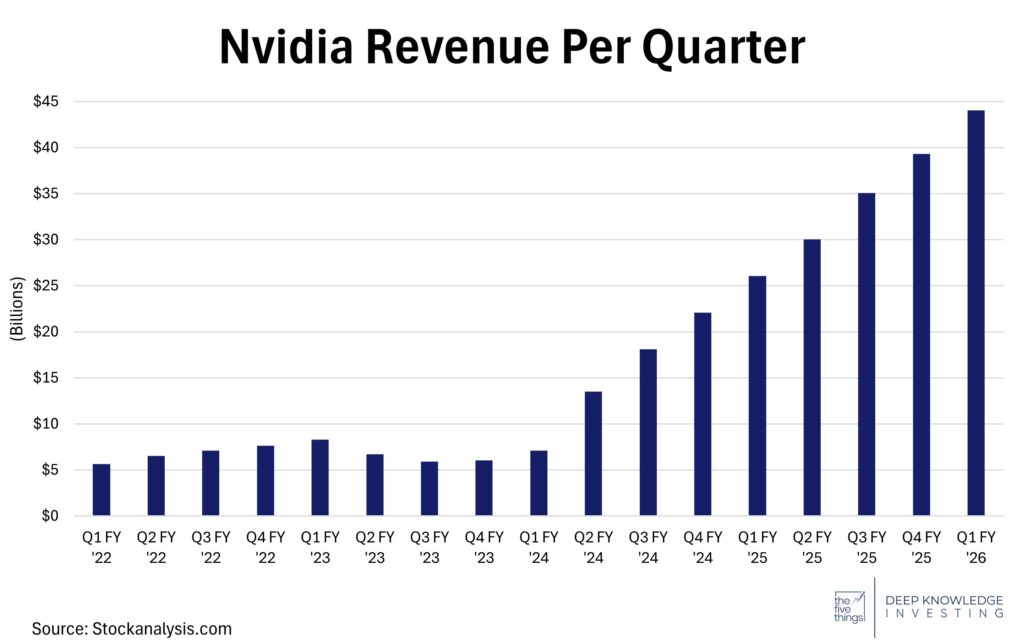

- Nvidia $NVDA loses billions of dollars in sales due to China export restrictions. Still posts massive growth this quarter.

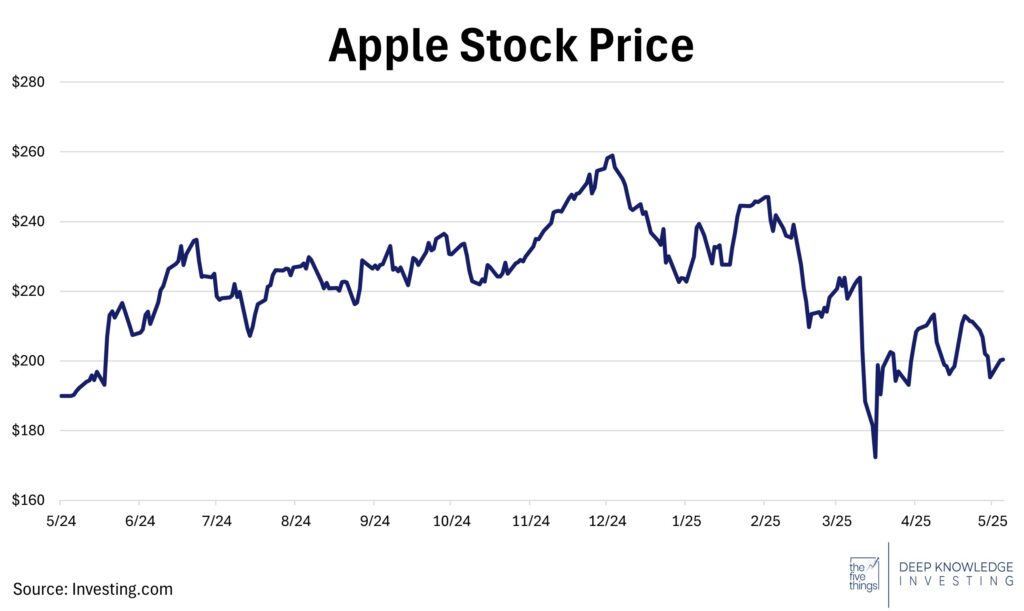

- Apple $AAPL is threatened with tariffs if it doesn’t onshore manufacturing. The worst part is the US no longer has a workforce able to do this kind of work.

- Educational topic: What is beta and how does it help you analyze your portfolio?

1) President Trump Puts in a Bid on Uranium:

US nuclear regulatory policy combined with the effectiveness of environmental activists have ensured that in the last 40 years, only two nuclear plants have been planned and built. While there have been six other plants that have been completed in the last 40 years, they were started earlier and took decades to build. This week, President Trump found a way around the regulatory red tape. He intends to build plants on military bases.

The fact is the US needs more power generation capacity and building more carbon-based energy production isn’t politically viable. If you want reliable power that isn’t carbon-based, the answer is nuclear. If you want to have AI data centers, that means nuclear power. If you want to have lots of EVs and the electrification of everything, that means nuclear power. If the President follows through, we’ll have more nuclear plant construction.

If you think this is volatile, just wait until the existing stockpile is depleted.

DKI Takeaway: My thesis on uranium is simple. Current demand exceeds current production. The difference has been supplied by now-dwindling stockpiles. There should be approximately two years of stored supply left at current demand rates. After that, we’ll need to increase supply or cut demand. This is happening while reactor lives are being extended, multiple decommissioned plants are being recommissioned, and the world is building new plants. New demand should come online before new supply does. When that happens, the only thing that can adjust is the price. President Trump’s move is an effort to secure US energy independence; something he’s talked about for years. There’s more demand coming and the US government can outbid anyone for supply.

2) US Companies Accelerate Reshoring Plans:

A recent Allianz Trade survey found that 90% of U.S. companies now plan to reshore or shift to domestic suppliers in response to the April 2 global tariff announcement, citing greater supply chain control and trade policy uncertainty. It’s going to take some time for that many companies to adjust supply lines. For now, many are instead turning to “friend-shoring,” redirecting production to lower-cost partners such as Mexico, Vietnam, India, and Thailand. Persistent labor shortages, supplier constraints, and cost pressures continue to complicate onshoring efforts, with over half of surveyed firms planning price hikes to offset tariff-related expenses.

Trillions of dollars in purchase orders and new manufacturing capacity. It won’t happen overnight, but is still welcome.

DKI Takeaway: Fiat economists keep insisting that tariffs will lead to massive inflation, but there are historical examples that demonstrate otherwise. Despite hysteria regarding projections of higher inflation, Friday’s PCE data showed continued disinflation (a reduction in the rate of inflation). The US has been selling off its manufacturing sector for more than 40 years and that’s not a sustainable trend. While companies wrestle with the challenge of moving more production and purchasing onshore, consumers are more supportive than the “experts”. A recent Epoch Times poll indicates that a majority of their readers believe that tariffs are a “fair and necessary step to protect US industry, bring back manufacturing jobs, and chart a path towards long-term economic independence.” While the Epoch Times’ readership leans to the right, the respondents indicated they were still in favor of tariffs even at the expense of higher short-term inflation and higher consumer prices.

3) Nvidia’s Surging Relentless Growth:

Nvidia $NVDA recently posted its earnings for the first quarter of fiscal 2026, reporting revenue of $44.1 billion. That represents 69% growth year over year. Nvidia’s data center revenue had sales of $39.1 billion and grew 73% from last year. Results exceeded optimistic analyst projections and demonstrated resilience in posting huge growth despite a $4.5 billion inventory hit due to export restrictions to China. Profit margins are high and continue to rise which is even more impressive for a hardware manufacturer.

Despite general uncertainty among some tech leaders about the continued growth of data center investment, Nvidia’s results indicate the AI boom continues. (It wasn’t that long ago that everyone was convinced DeepSeek was going to throw the trend into reverse.) Data center sales are exploding, and companies are pouring billions into AI model training which is fueling Nvidia’s growth.

From a little over $5B per quarter to almost $45B in 2 years?!

DKI Takeaway: Nvidia faced a $4.5 billion inventory charge and estimated $8 billion of lost sales due to expert curbs to China and still produced fantastic results. Macroeconomic uncertainty and fears of a worldwide recession aren’t slowing AI investment. CEO, Jensen Huang, says that export controls haven’t been successful, as it’s leading to Chinese firms investing in domestic alternatives which is increasing their AI capability. While we understand the strategic reasons behind trying to limit China’s access to the best chips for AI development, Huang has a point. Trying to encourage China’s reliance on US suppliers for critical technology might give the US more leverage in future negotiations.

4) Tariff Trouble for Apple: Is US Manufacturing Feasible?

On May 23, 2025, President Trump proposed a 25% tariff on Apple products not manufactured in the U.S., sharply escalating pressure on the company to shift production stateside. Currently, over 90% of Apple’s assembly operations are based in China, and reshoring even a fraction of that footprint would carry immense cost and complexity. Estimates suggest that bringing just 10% of production back to the U.S. could require $30 billion over three years. Analysts project that an iPhone fully made in America could cost upwards of $3,500, highlighting the magnitude of the manufacturing cost gap. Apple has made large domestic commitments, including a pledged $500 billion investment over four years. However, its focus is on chip design, AI, and data centers, not high-volume device assembly. The proposed tariff raises the stakes but also underscores the physical and economic realities that continue to anchor Apple’s supply chain abroad.

If the market believed Apple was going to onshore, the stock would be down more.

DKI Takeaway: The threat of a 25% tariff may make for a compelling headline, but it’s unlikely to materially change Apple’s manufacturing calculus in the near term. The U.S. lacks the infrastructure and skilled labor base to absorb iPhone-scale production, and the cost difference remains prohibitively high. While Apple may accelerate token reshoring efforts or expand in countries like India and Vietnam to hedge political risk, large-scale U.S. assembly remains improbable. For investors, the bigger story is the geopolitical risk premium now embedded in global tech supply chains. Apple’s profit margins and pricing power could come under pressure if tariff threats turn into policy. I think the most likely outcome is moving more production from China to India and Vietnam while doing some assembly in the US. Taiwan Semiconductor building new fab plants in the US will help as well.

5) Educational Topic: Understanding Beta:

Beta is a measure of how your investments compare to the market. It’s calculated by comparing a stock’s returns to the market over time. For example, a stock with a beta of 1.4 would tend to be roughly 40% more volatile than the market, rising or dropping 40% more than the market does. A beta of 0.6 would be the opposite, meaning the stock would drop or rise roughly 40% less than the overall market. By definition, the market has a beta of 1.0.

If you’re wondering why some of the big tech names have small betas, it’s because they make up the largest portion of market performance.

DKI Takeaway: In general, beta allows investors to calculate what part of their performance is related to overall market movements and what part is due to good or bad stock-picking (alpha). Fund managers who charge for performance always want to show their performance is related to alpha as investors don’t like to pay for results they could get by buying an S&P 500 index fund. Some alternative investments might have a negative beta, indicating a stock moves the opposite direction of the market. Negative beta positions can be used to hedge other positions.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.