The new CPI was a win for the disinflation crowd as the all-items inflation metric falls to 2.3%. On the other hand, we’ve been above the 2% target for 50 straight months, and I think the target is 2% too high. The market celebrated a temporary tariff truce with China as both sides agree to lower barriers for 90 days while they talk. It was reported this week that China snuck power generation-killing capacity into the equipment used with solar panels. I’m hoping that comes up in the negotiations. Macau table gaming is becoming more profitable as casinos offer more bad bets that are growing in popularity. Maybe it’s related to my profession, but I never find losing money to be fun or entertaining. The lesson: It’s better to own the casino than to gamble in one. President Trump travels to the Middle East and secures $2T in investments. Included in that is $30B for AI equipment and data center capacity provided by $NVDA and $AMD. In our educational topic, we explain what the fed funds rate is and why investors care about it.

This week, we’ll address the following topics:

- CPI falls. Still above target. Congress not going to help.

- The US and China declare a temporary tariff truce. Wrong actions by China indicate they have the capacity to shut down US power generation.

- Macau is the largest gaming market in the world. Profits are rising on bad bets by players.

- Saudi Arabia agrees to buy $30B in AI hardware from $NVDA and $AMD. That’s one way to reduce the trade deficit.

- Educational topic: What’s the fed funds rate and why should you care?

As usual, DKI Intern, Cashen Crowe, comes through with excellent work this week…while taking his final exams. I read an article this week about how Gen Z is failing at their first jobs due to lack of preparation, bad attitudes, and poor work ethic. My experience with the Gen Z DKI Interns has been the opposite. Next week, Cashen is taking off to Europe for a few weeks. Given my love of travel, I always like to see our young interns managing to work on the road. I’ve been writing my “An Adventure” series while traveling. What do you think – should we have Cashen write an “An Adventure – Intern Version” about his travels?

Ready for a week of disinflation and temporary tariff truces? Let’s dive in:

1) CPI Falls but is Still Above Target:

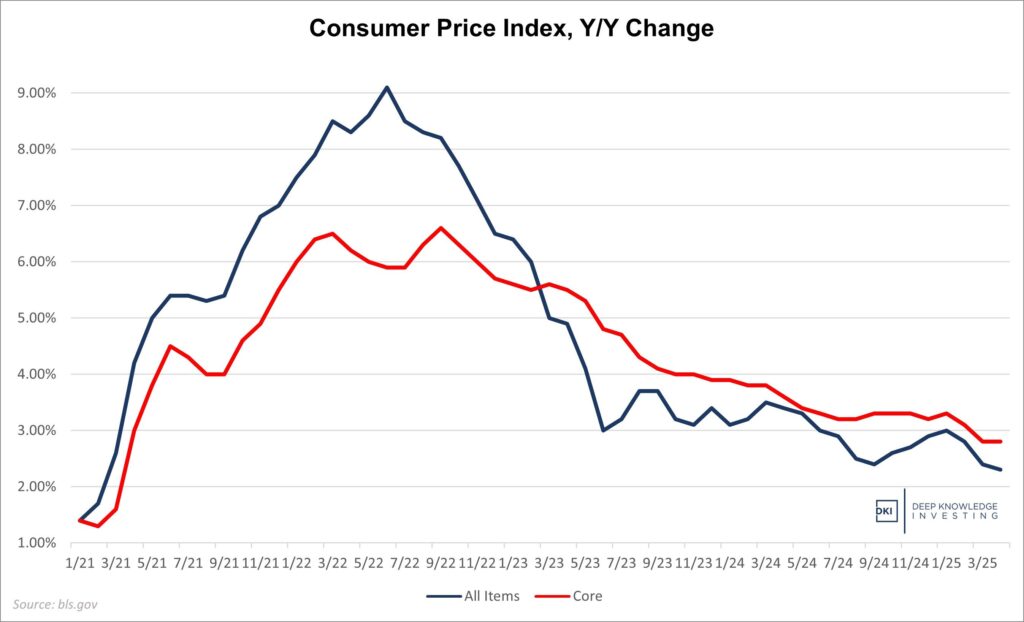

The April Consumer Price Index (CPI) came in at 2.3%. That’s still above the 2% target which is 2% too high, but is the lowest figure in years. The Core CPI, which excludes food and energy, was a still-sticky 2.8%. Food was up 2.8% which I still think is understated. Food away from home was up almost 4% leading more people to eat at home. Energy prices, down 3.7%, continue to be a tailwind. Services prices were 3.6% higher, continuing to be driven by increasing nominal wages. Shelter, a fancy word for housing, was up 4.0% which accounted for more than half of the month’s CPI increase. I think it’s going to take lower interest rates or a recession to bring down housing prices.

Meaningful improvement – a win for the disinflation crowd.

DKI Takeaway: The Fed kept rates flat at last week’s meeting and this week’s lower CPI print will increase pressure on them to cut soon. The difficulty they’ll have is a lower overnight rate is likely to lead to higher 10-year rates as the bond market prices in expected increases in future inflation. There is little the Fed can do right now without spending cuts from Congress, something I do not expect to see despite a lot of click-bait headlines saying otherwise. Given that inflation is being caused primarily by Congressional overspending, and that they’ll flood the economy with more stimulus funds if we have a recession, we’re prepared for more inflation.

2) A Ceasefire on Chinese Tariffs:

The US and China recently came closer to a trade agreement, leading to a 90-day reduction in the new extraordinary tariffs while working towards a permanent deal. This will lower US tariffs on China’s goods to 30%, with China’s dropping theirs on US imports to 10%. This tariff semi-truce will give both countries the opportunity to relieve some pressure on international trade, with an estimated $600B in paused shipments likely to resume.

While the deal features meaningful action from both sides, there are still plenty of underlying issues that led to the tariffs in the first place. The US will have to consider the double-edged sword that is the trade war with China. We need to restart domestic manufacturing, but the transition away from cheap Chinese goods could be painful for a while.

Combatants return to their own corners for now. It won’t be their last fight.

DKI Takeaway: We have seen the upside of threatened tariffs, with trillions of dollars of new investments in US manufacturing and purchase agreements, and other countries lowering their barriers against US goods. However, the US still has distance to cover. President Trump will be under immense pressure to find a deal that works, or he’ll have to explain to Americans why he walked away from the negotiating table. Doubts about a better deal could lead to more stockpiling from US companies, potentially adding to the trade deficit in the next quarter.

Making things even more challenging, it was reported this week that China has snuck rogue communication devices in solar inverters and batteries that could be used to shut down US power systems. While we understand why some Americans are worried about the pain of decoupling from inexpensive Chinese goods, there are huge costs to doing business with people who engage in this kind of behavior. We again urge China to apologize for this wrong action and to change course.

3) Bad Bets by Players Are Increasing Casino Profits in Macau:

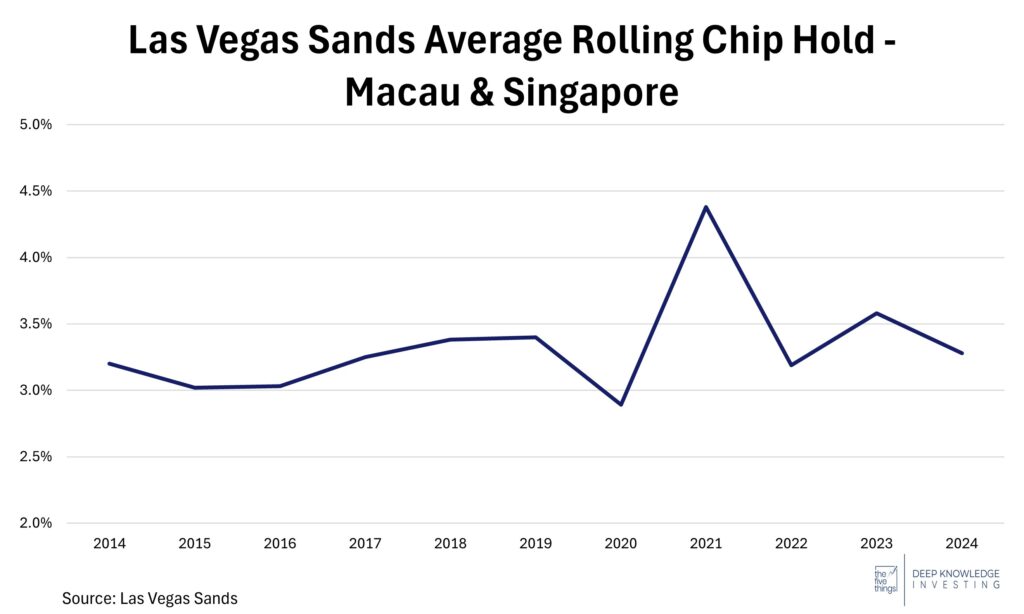

We’ve all seen films where math geniuses and card counters try to beat the casinos in blackjack. Experienced players know the best bets to make at all table games. However, in Asia, many players bet based on superstition instead of statistics. In recent years, Las Vegas Sands increased the expected hold range from table games. That means that players were making more unprofitable/bad bets leaving the casinos with extra profits. The recent increase in side bets has put that trend on steroids.

The hold has been trending higher.

DKI Takeaway: Inside Asian Gaming reports that side bets on baccarat are making up 5% of bets but almost 50% of profits. Side bets like wagering on whether the player or dealer will get a pair on their first two cards or betting on the margin of victory (the Dragon Bonus) are becoming more popular in Macau. These bets are more advantageous for the house and worse for the player which is why they’re about 10x more profitable than standard betting. I’ve invested in casino stocks for more than a decade, but never expected growth to come from worse play by Asian gamblers. Smart tables, which track player bets, are providing casinos like Las Vegas Sands ($LVS) with more data enabling them to earn higher profits.

4) Nvidia and AMD Building AI Empires:

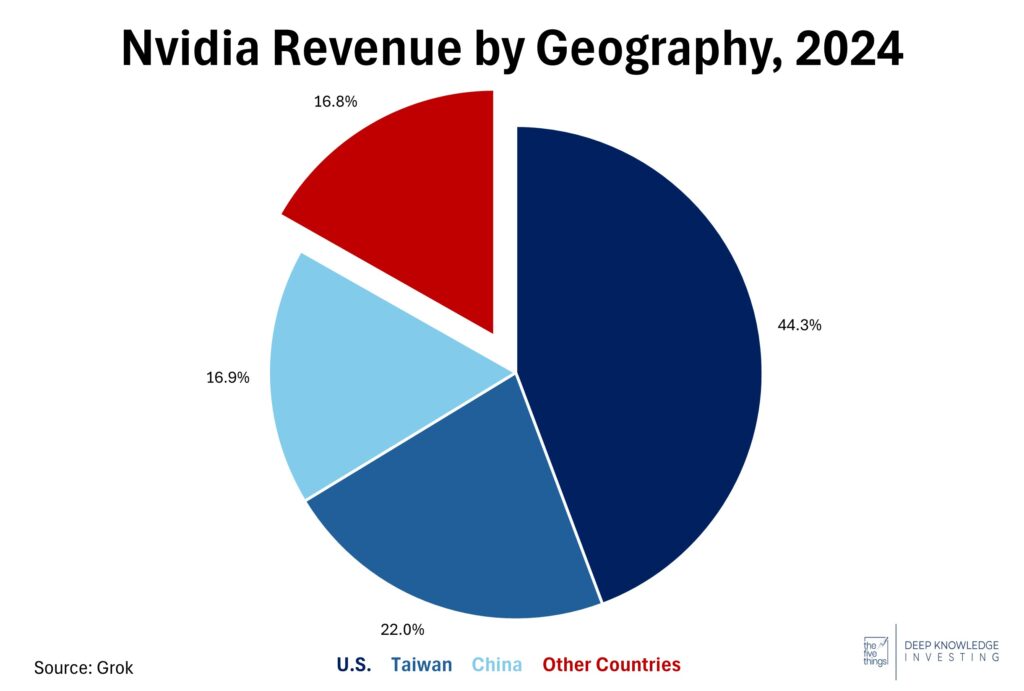

Saudi Arabia recently unveiled partnerships with Nvidia ($NVDA) and AMD ($AMD), supplying chips to the Saudi AI initiative, Humain. The deal is estimated to exceed $30B over the next 5 years. Humain is part of Saudi Arabia’s sovereign wealth fund aimed at diversifying its economy and working towards establishing Saudi Arabia’s position in the tech race. Nvidia’s partnership lays out a plan to provide 18,000 Blackwell chips and Nvidia’s cloud GPU services to Saudi Arabia as they begin to create the region’s largest AI computing data centers. AMD also got a slice of the pie, securing a $10B deal to provide 500 MW of computing capabilities over the next 5 years, giving Saudi Arabia a more “open by design” approach to AI computing access.

This comes shortly after President Trump reversed the AI Diffusion Rule, giving US chipmakers the green light to increase exports, especially in the Middle East. As they look towards decreasing their dependence on oil, Saudi Arabia is moving full steam ahead to become the Middle East’s hub for AI infrastructure.

The “Other Countries” slice was $10.3B. It’s about to get larger.

DKI Takeaway: Giving Saudia Arabia and other Middle Eastern countries access to US AI tech also limits China’s ability to put more of their technology in the region, establishing the US as a more influential trading partner. Guarantees that these Nvidia chips won’t end in Chinese hands is part of the agreement. Overall, this deal demonstrates that demand for AI hardware is a worldwide priority and will continue to increase international sales as a percentage of revenue for many US tech companies. It’s also a big win for President Trump who just secured $2T of investment commitments from Saudia Arabia, the UAE, and Qatar.

5) Educational Topic: Understanding the Federal Funds Rate:

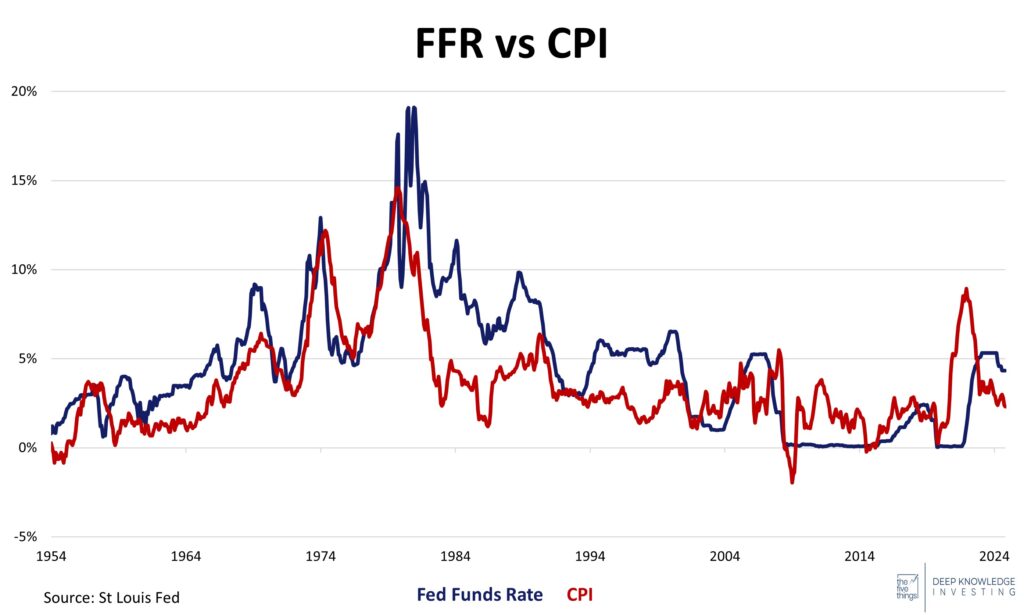

The Federal Funds Market represents a portion of the Fed’s reserves, where banks lend to the Fed or to other banks, most often overnight. The Fed can also loan funds to banks overnight. Banks rely on this system to meet liquidity requirements in short amounts of time. The interest rate for these loans is called the Federal Funds Rate, and it is viewed as an essential benchmark for all other interest rates in the economy.

The bond market sets interest rates for everything from one week to 30 years, but typically, those rates get set based off of the fed funds overnight rate. With a “normal” yield curve, interest rates rise as duration does. Someone lending money for one year typically demands a lower interest rate than the institution taking the additional risk of lending for 30 years. When interest rates rise a lot as duration increases, the yield curve is said to be “steep”. When long-term rates are below short-term rates, the yield curve is said to be “inverted”.

Lower rates tend to encourage building and investing, but can lead to inflation and uneconomic wasteful expansion. Higher rates tend to slow the economy and bring inflation under control. Higher rates also encourage a greater degree of caution and certainty when building new capacity.

When the CPI (a proxy for inflation) rises, the Fed raises the fed funds rate.

DKI Takeaway: The FFR serves as a marker for the Fed’s view on the economy. When the Fed is worried about inflation, they raise the fed funds rate. They lower when the economy is weak. We pay attention to the fed funds rate because it represents the cost of time and risk. It’s the most important metric in the economy and the stock market often trades off of changes in the FFR. We also think that just as the market sets the interest rate for everything longer than overnight, it should also set the price of overnight lending. Better that the collective wisdom of the crowd replaces the decisions of a few unelected bureaucrats; most of whom have never run a business. All together now: #EndTheFed.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.