In 2021, Chairman Powell and Secretary Yellen said inflation was transitory. In 2023, political commentator and MMT enthusiast, Paul Krugman, said we had defeated inflation. In 2025, the PCE (the preferred inflation metric of the Fed) has made no real progress in the past year and the Core PCE is rising again. Retail investors are responding to concerns about an uncertain future by saving more and investing more. Seen a certain way, professional investors are currently selling their stock to retail. It’s yet another version of Wall Street vs Main Street. We’ll see who comes out on top in this edition. Winner gets Turtle Wax and Rice-a-Roni. The loser gets third prize. Hyundai decides to invest billions of dollars in US manufacturing claiming they’ll create 100,000 jobs in the next few years. We understand the concerns of the anti-tariff crowd, but think these kinds of investments need to be part of the conversation. $AMD gives disappointing guidance and gets downgraded due to an inability to catch up to $NVDA and worries about AI datacenter growth. We agree with part of that. Finally, in our educational “Thing”, we explain dividend reinvestment plans and help you understand how to determine if enrolling in one is the right move for you.

This week, we’ll address the following topics:

- The Core PCE rises again. Paul Krugman said that we’ve defeated inflation…in 2023!

- Retail investors are putting more money in the stock market even as institutions reduce exposure.

- Hyundai announces it’s going to manufacture more in the US. Claims it will lead to 100,000 new jobs in the next three years.

- $AMD is having trouble keeping up with $NVDA. We’re skeptical regarding a lack of AI datacenter demand.

- Educational Thing: Should you consider an automatic dividend reinvestment plan, or receive your dividends in cash?

DKI intern, Josh Reaves, received an incredible opportunity and will be moving on. He goes with our thanks and our appreciation for his high-quality work. While it’s always difficult to lose someone as smart as Josh, for a student, the reason to take on an internship is because it opens more and better doors in the future. The DKI community is always pleased when an intern gets that next great opportunity because it means we’ve succeeded in our responsibility to them. Next man up, Cashen Crowe, has made incredible progress in just a short time at DKI and much of what you’re about to read reflects his diligent research and exhibit preparation. Like Josh, we see Cashen’s rapidly developing skills as a demonstration of the value DKI places on preparing our interns to succeed.

Ready for a week of more inflation? Let’s dive in:

1) PCE is Rising Again:

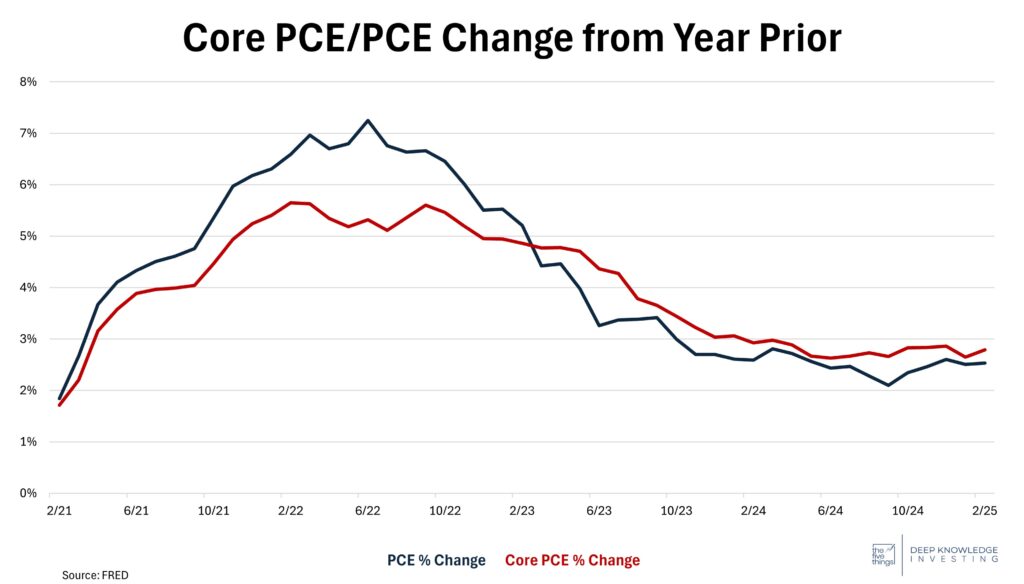

Partisan narrative producers who call themselves economists spent the past two years telling us that we had won the war against inflation at very little cost. That was always a lie. This week, we got the Personal Consumption Expenditures (PCE) report. The PCE is the favored inflation metric of the Federal Reserve because it more closely matches consumer experience. The February PCE was up 2.5%, consistent with last month and with expectations. There’s been no significant improvement here in the past year. The Core PCE, which excludes food and energy was up 2.8% which was above last month’s 2.6% and expectations of 2.7%. The monthly increase in Core was 0.4% which annualizes to 4.9%. Like the all-items PCE, there’s been little progress made in the past year.

This is not getting better.

DKI Takeaway: Consumer spending was up 0.4% which was below expectations of 0.5%. The optimistic spending projections were related to January’s horrible -0.2%. More interesting to me is that the personal savings rate has risen in each of the past two months while Americans’ expectations for the economy continue to fall. It looks like more people are starting to save for a “rainy day”. Income was up a strong 0.8% so people are spending more, but also saving more. Seems like a rational response to me. The potential difficulty comes if DOGE succeeds in cutting wasteful spending and employment. We’d see reduced government spending which would make clearer the weakness in the productive private sector combined with continued inflation. That’s going to create a dilemma for the Federal Reserve.

2) Confidence Overcorrection – Retail Investors Stay Bullish:

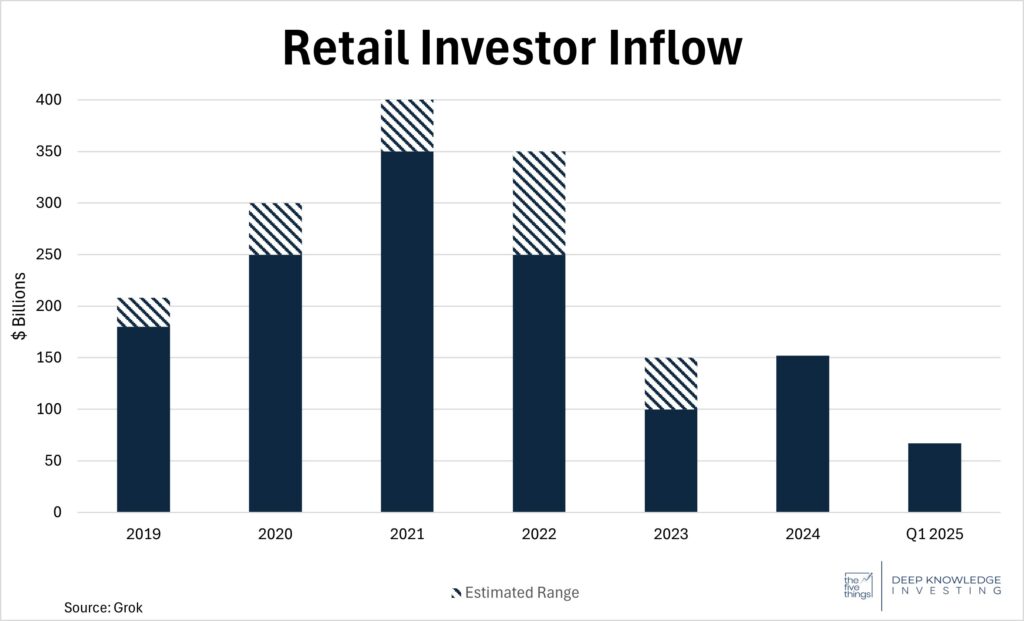

As professional money managers slash their exposure to US equities, retail investors remain confident, continuing the high fund inflows from the end of last year. Retail investors have pumped $67 billion into US equities and ETFs so far this year, nearly matching the $71 billion they invested in Q4 2024. The divergence between retail traders and institutions is underscored as retail dip-buying demand seems to remain on the rise.

Volatility caused by tariff announcements and broader economic concerns have given many retail investors opportunities to buy stocks at discounts from recent highs. Just last week, Tesla and Nvidia combined saw $5.1B in retail buying. Retail investors are consciously betting the risks won’t derail the market entirely, and momentary losses aren’t seeming to steer them away.

That smaller bar on the right is just for Q1.

DKI Takeaway: Looking ahead, investors should keep a close eye on economic updates such as the tariff decision on April 2. That could either validate their dip-buying or reward the caution of institutions. Some investors may be looking further into the future where many of the recent announcement of investments into US manufacturing make many hopeful for coming domestic economic expansion. I also think it’s interesting that the savings rate is rising while retail investment in the stock market is rising as well. It appears that Americans are saving and investing more which seems like a good strategy to me.

3) Hyundai Rides Wave of Foreign Investment into the U.S.:

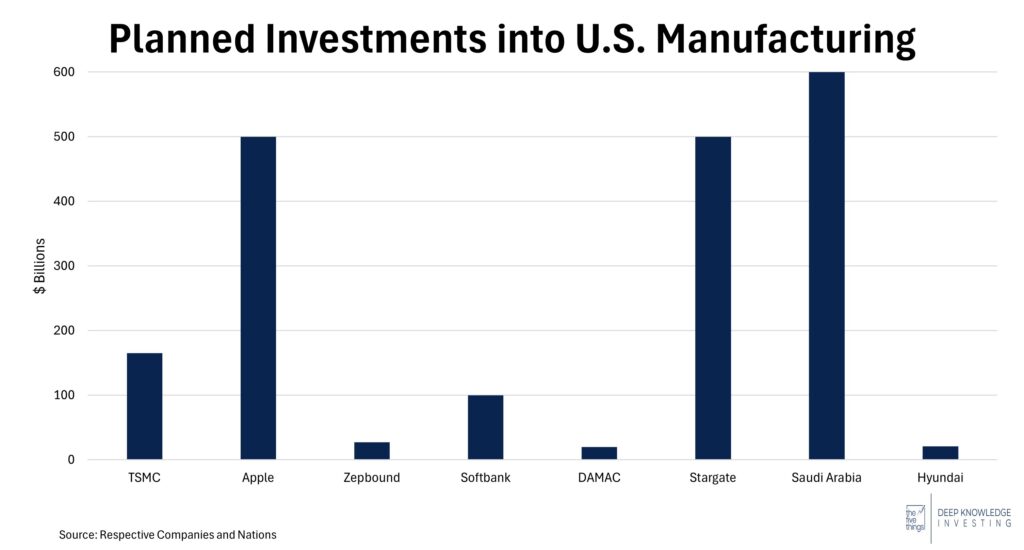

Hyundai Motor Group is committing $21 billion to U.S. manufacturing, with a new $5.8B Louisianna steel plant in the works. US trade policy continues to motivate companies to grow roots in the US and secure tariff relief as President Trump emphasizes that US-made steel won’t face tariffs. With steel playing a vital role in auto production, automakers are looking to avoid the costliness of foreign imports. President Trump has also announced a 25% tariff on imported cars and auto parts, further emphasizing the urgency for automakers to join the wave of investment into the US.

It’s going to take some years, but this leads to more manufacturing jobs.

DKI Takeaway: By 2028, Hyundai’s investments will be responsible for roughly 100,000 new direct and indirect US jobs. DKI recently covered the influx of committed investments into US manufacturing, and it doesn’t seem to be slowing. New trade policy is reshaping domestic productivity, allowing for competitive production within the US. We’ve been advocating for a more complete public discussion of this complicated issue. Many in the pro-tariff crowd only want to talk about the potential new jobs. The other side only wants to talk about the potential higher-costs. While DKI is in favor of free trade, we also see the personal downside and national security issues of continuing to outsource so much manufacturing. We’d rather see the country trying to encourage more manufacturing jobs than increasing social programs which encourage people to not work.

4) AMD’s Outlook Falls Short:

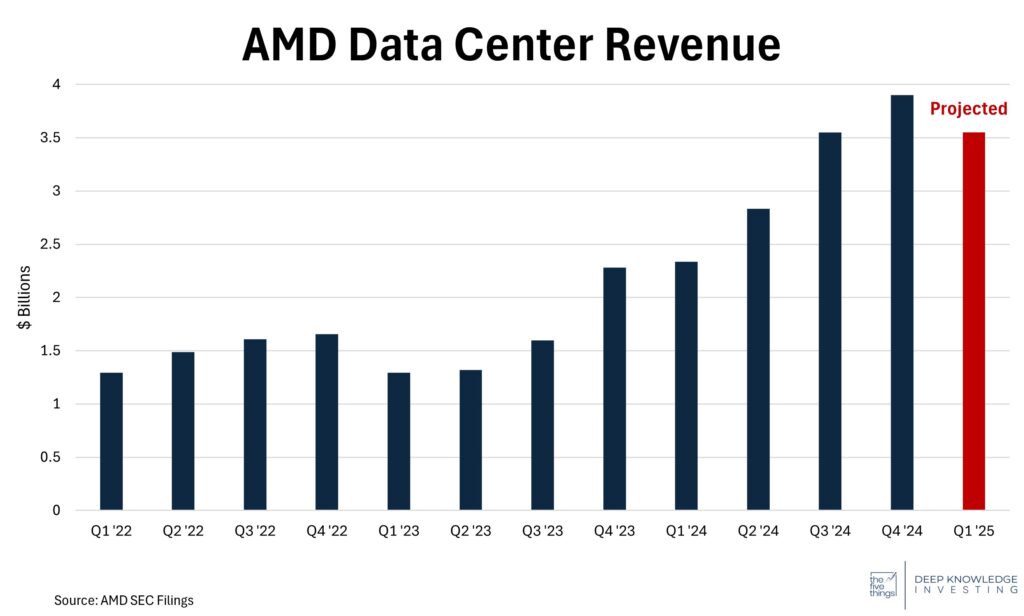

Jefferies recently downgraded $AMD. They cited weak GPU performance relative to $NVDA, potentially declining AI datacenter demand, and future potential competition from $INTC. Disappointment from AMD’s outlook on its data center business highlights the widening gap between them and Nvidia. With declining data center revenue, AMD is facing lower share prices and continued investor doubt.

With their aggressive plan towards developing stronger server CPUs, and the best CPUs for gamers, new GPU products are what will make a difference in the company’s share of the AI space.

Revenue declines are not what investors in the AI space want to see.

DKI Takeaway: Though remaining a powerful player in the AI space, the downgrade reflects the market’s changed mood on $AMD. AMD is still a powerhouse in CPUs for servers and gaming computers. Right now, the market is punishing the company for the gap between them and Nvidia as well as on worries of less datacenter demand. We agree on the first point, but aren’t convinced that AI datacenter growth is about to decline. As covered in the 5 Things multiple times this year, we believe the story that DeepSeek will destroy the AI hardware business is overstated and misunderstood.

5) Educational Topic: The Pros and Cons to Dividend Reinvestment Plans (DRIP):

The best way to allocate dividend payments depends on the goals of an investor. Some choose to use a dividend reinvestment plan (DRIP), which allows investors to automatically reinvest dividend earnings into additional shares of the issuing company. Is this the best way to go?

Benefits of DRIPs: When reinvesting dividends into the issuing company, the investor can produce compounding returns, when newly purchased shares begin to pay more dividends. Additionally, DRIPs sometimes offer share discounts and reduced investment fees, giving the investor a small bump in returns. Lastly, DRIPs don’t require any management, allowing investors to invest without the stress of deciding how to allocate newly arrived capital.

Drawbacks of DRIPs: DRIPs, however, aren’t always an investor’s best choice. There may be a lack of liquidity and control when it comes to reinvestment plans. Not being able to control when the reinvestment is made means you buy more shares regardless of the price on the date the dividend is paid. Dividend reinvestments are taxable by the IRS and are treated as they would be if collected in cash. (Please note that DKI is not a tax advisor. Check with your tax professional regarding your personal circumstances.) Finally, DRIPs are specific to one company only, prohibiting an investor from dispersing the dividends across multiple investments.

A dividend reinvestment plan can be a good way to keep investing if you’re willing to give up some control over price and timing.

DKI Takeaway: To a beginning investor, it might be tempting to take the cash dividends and not reinvest, but the best time to begin investing is at a younger age. DRIPs offer an easy, low-cost way to reinvest dividends for long-term growth. Compounding growth for a longer time will result in larger dividend payments that might be better collected in cash when an investor reaches an older age and is using their account to fund a retiree lifestyle. Plus, if you wouldn’t buy the stock at current prices, you might consider whether you want to own it at all.

Here’s the video version: https://www.youtube.com/watch?v=kA2Ty5Aw8Iw

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.