Meta signs a deal to secure reliable carbon-free nuclear power for its AI data centers following in the footsteps of competitor, Amazon. DKI has been buying more uranium. Do you own enough? The big music labels take steps to ensure they (and their artists) get paid for music used to train generative AI models. We’re wondering if writers and newspapers will get similar compensation. President Trump doubles down on steel tariffs. Free trade economists go crazy again yet somehow ignore the support foreign governments provide their steel industries. Should we just not make anything? Credit card and consumer credit usage increases. Credit delinquencies increase. Banks take larger loan loss reserves. Is anyone else concerned about this? In our educational topic, we help you understand the quirks of different market indexes. Want to understand the real meaning when the newspapers tell you the Dow is up today? We have you covered.

This week, we’ll address the following topics:

- Meta goes nuclear, but we mean the good kind.

- The big 3 music labels make deals for AI use of their artists’ music. This is better than suing college kids.

- President Trump doubles down on steel tariffs. The usual suspects do the usual dance.

- Banks increase loan loss reserves as more leveraged customers go more delinquent on higher balances. This concerns me.

- Educational topic: Understanding market indexes. There are some strange quirks.

I get a lot of positive feedback on The 5 Things so let’s give credit to some people who do the heavy lifting. Cashen Crowe (University of Tennessee) did his usual excellent work while traveling to multiple countries. He handled this week’s edits from Eastern Europe and returns to the US this week. New Intern, Samaksh Jain (Rutgers University), somehow managed to turn in high-quality research and writing while traveling back from India and dealing with multiple time-zones. In just a couple of weeks, he’s become a contributor here. I’m writing this from Lisbon and am thrilled that the entire team takes on the DKI attitude of “work from everywhere, just get things done”. Robb Fahrion from Flying V continues to pour resources into The 5 Things with team members Jonalyn, Alex, Nazim the Dream, and Anton all helping with distribution, video, editing, and SEO. I get my name on the door, but there’s a large dedicated team all contributing their specific skills to the written and video versions. Thanks all. I appreciate you!

Ready for a week of nuclear-powered AI? Let’s dive in:

1) Meta Goes Nuclear:

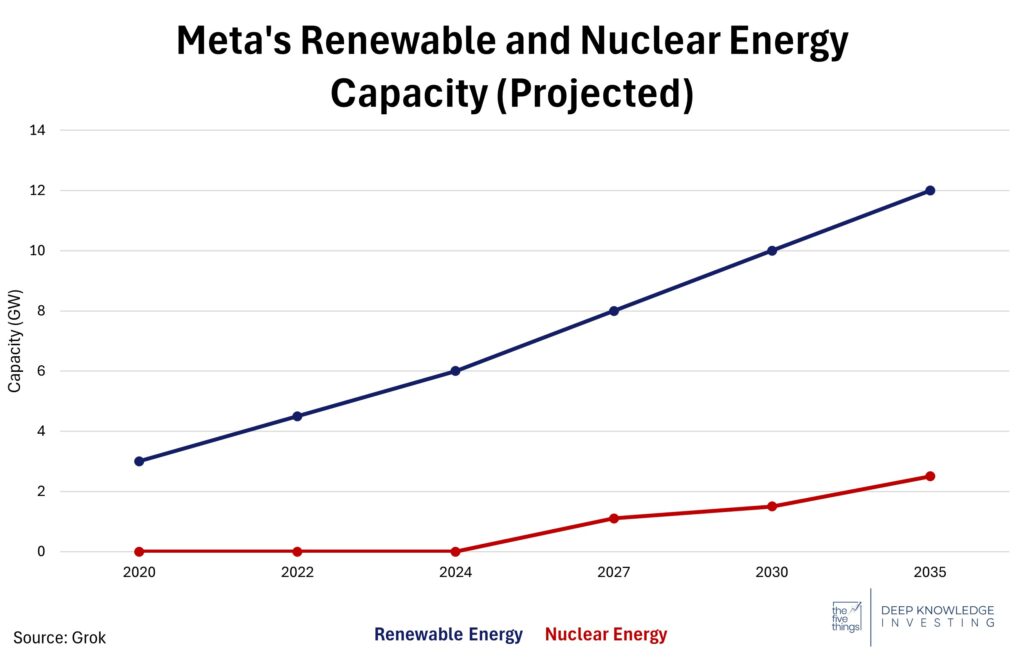

Meta $META (formerly Facebook) just signed a 20-year Power Purchase Agreement (PPA) with Constellation Energy, securing a multi-decade contract for nuclear power. This meets Meta’s stated desires for carbon-free electricity for AI applications. Constellation is providing the energy from the state-subsidized Clinton Clean Energy Center in Illinois, which will eventually transform into a private-market plant.

Some individual data centers are research labs that demand enough power to supply entire cities. Tech companies like Meta are also under social pressure to source that power without increasing carbon emissions. This multi-decade deal provides Meta the ability to do exactly that while supporting the expansion of AI and cloud computing. The deal also is significant for Constellation, as the Illinois plant, which is currently being propped up by government subsidies, will be supported by Meta starting in 2027, justifying future investment in the plant.

Some talk about “sustainable” energy. Credit to $META for investing the cash.

DKI Takeaway: Last week’s edition of The 5 Things mentioned the importance of nuclear power when it comes to the future of data centers and AI, and Meta is following Amazon in securing long-term nuclear power for that purpose. Energy supply remains the issue. With many tech companies trying to secure supply of nuclear power, the need for more supply validates DKI’s positive thesis on uranium. President Trump’s efforts to create more nuclear power on military bases will help by providing additional supply, and hopefully, a roadmap for faster rollout of small modular reactors. We believe a “nuclear renaissance” is on the horizon? What do you think?

2) The Music Industry is Betting Big on AI:

Universal Music Group, Warner Music, and Sony are in active discussions with AI music startups like Suno and Udio to license their catalogs for use in generative AI models in order to ensure artists and labels receive compensation each time their work is used in training models and creating new tracks. These negotiations come amid ongoing copyright lawsuits and increasing pressure for a legal framework that balances innovation with artist rights. Labels are reportedly pushing for systems like YouTube’s Content ID, enabling royalties, tracking, and in some cases, potential equity stakes. Success here could not only resolve existing lawsuits; but also, set an industry-wide precedent for how creative rights are managed in AI innovation. This could establish a new revenue stream and legal framework for music in machine learning.

Check check. Is this thing on? T1000 please report to the parking lot. Your lights are on.

DKI Takeaway: Music labels are making a calculated pivot. Their shift converts uncertainty into structured negotiation rather than litigation. This strategy reflects a more mature approach. Big Three labels are defending copyright, and aiming to retain control while participating in new monetization models. While the deals may come with compromises, such as limited artist opt-outs or narrower margins, they mark a transition toward codifying IP ownership in the AI era. For investors, the key development is that intellectual property is emerging as a foundational input in AI training; an asset class with enduring value, especially as the competitive dynamics between content creators and AI developers continue to evolve. DKI finds it interesting that the industry that tried to protect its IP from digital piracy by suing college students is now attempting collaboration and mutual benefit. We’ll see what happens with the authors whose written work is being used to train the LLMs.

3) President Trump Doubles Down on Steel & Aluminum Tariffs:

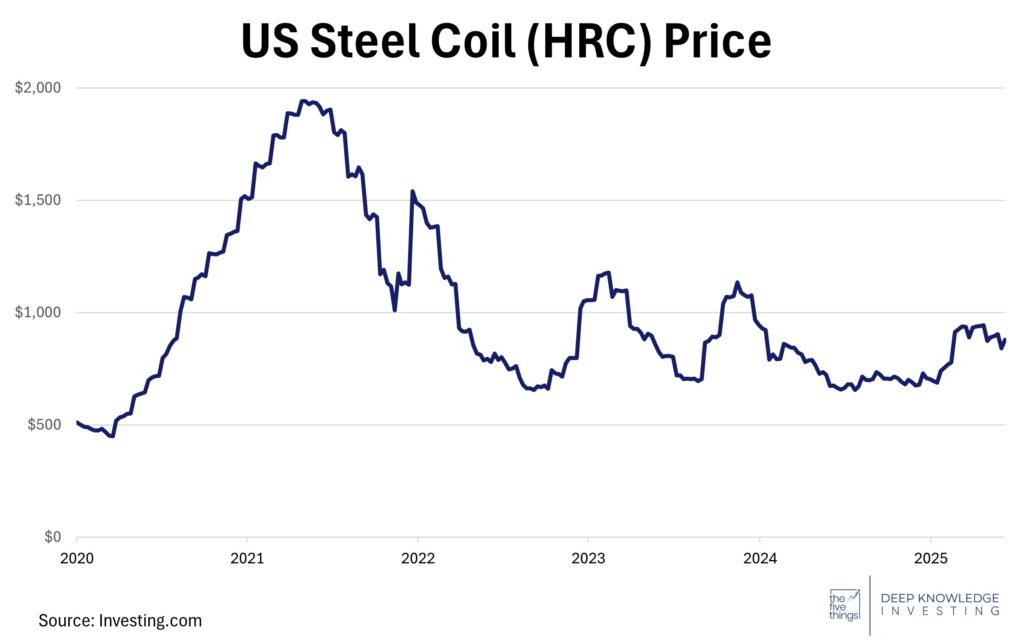

President Trump announced on June 4th, that tariffs on imported steel and aluminum will increase from 25% to 50% (excluding the UK), declaring the move necessary for national security and to strengthen the domestic metals industry. The policy immediately boosted American steel stocks, with Cleveland Cliffs rising 28%; however, it rattled automakers causing GM stock to fall 4.3%. Analysts warn the tariffs could raise vehicle production costs by $2,000–$7,000 per car, threatening to pass those increases to consumers via higher prices. Automaker executives have criticized the timing and scale of the hike; warning that the sudden cost escalation is making planning and investment decisions nearly impossible.

Steel prices have been range-bound for years. Can domestic supply make up for reduced imports?

DKI Takeaway: Cue the usual hysteria from fiat economists who only seem concerned with US tariffs. China, India, the EU, and Japan all support their domestic steel producers and somehow, the EU and Japan manage to produce high-quality vehicles while China is becoming a force in EVs. The move to protect domestic steel production is related to national security. Automakers are facing market pressure from EV competition and are now concerned about higher steel prices reducing margins. Lovers of the old Detroit muscle cars will point out that new cars have 20% – 30% less steel and much higher prices. What will solve this potential problem is greater production by US steel makers who have been facing subsidized competition for years (and yes, benefitting from some policy measures as well). The new deal between US Steel and Nippon Steel is designed to ensure an increase in capacity; something the Detroit automakers will welcome.

4) Major Banks are Preparing for Credit Stress:

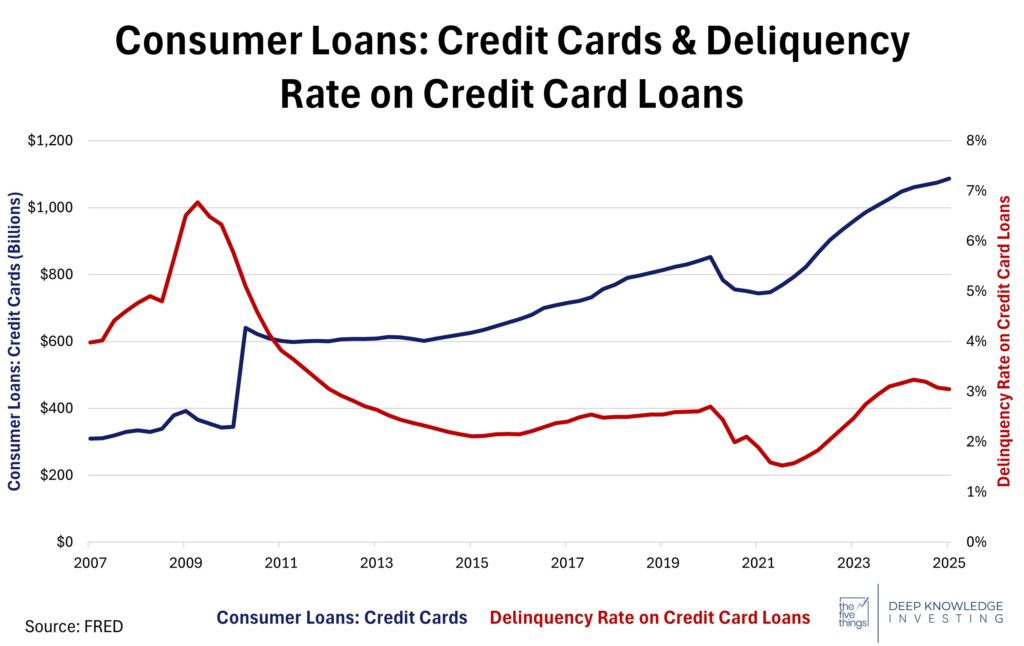

Major US banks are adding to loan loss reserves to prepare for potential growing credit stress and expectations of higher delinquencies. Though these reserves aren’t as large as they were in 2008, the steady build shows concern that American consumers have spent their Covid “stimmies” and are now facing pressure from higher prices. Banks have also mentioned that collections have become more difficult, adding to the need for larger loss reserves.

Credit card delinquencies have been rising following a period of relatively low defaults. The current 3% delinquency rate isn’t high on an absolute basis, but the recent increase has bank execs worried about the trend. Americans are carrying larger balances and expressing less confidence in their ability to pay them down, ultimately creating a tense situation for major US banks.

Credit usage is up a lot. Delinquencies have nearly tripled in recent years.

DKI Takeaway: The early signs of consumer stress are already apparent. Cash balances have dwindled and even dollar stores are seeing margin compression. Adding to concerns about higher delinquencies is the increasing use of buy now pay later (BNPL), the delayed payment plan popular among young people which are starting to affect credit scores. We think there are two problems making the situation worse. First, wages haven’t kept up with inflation in decades and more people are using credit and BNPL to afford groceries. That’s a structural problem. The second is our educational system intentionally avoids teaching students about budgeting or finance. Too many young people use BNPL and are later shocked when they receive bills. We’re doing what we can to help educate people, but the banks are right to prepare for escalating credit problems.

5) Educational Topic: Understanding the Major Market Indices:

A stock market index tracks the performance of a group of stocks and serves as a measure of market trends and performance. The three largest US indices are the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite. Understanding the difference between the three can allow investors to understand the significance of financial reporting.

(DJI): The Dow Jones Industrial Average is a price weighted index of 30 large US companies. This means that each stock’s influence on the index is determined by its price, and a high-priced stock in the index will move the index more than a lower priced stock. The companies chosen are usually industry leaders with solid reputations and growth prospects.

(SPX): The S&P 500 is a market-cap weighted index made up of 500 large US companies, meaning each company’s weight in the index is determined by its total market capitalization. As a result, the Magnificent 7 stocks make up roughly 33% of the index weighting while the other 493 companies account for 67%. The companies included must have a minimum market cap and meet trading liquidity and sector balance requirements.

(COMP): The Nasdaq Composite Index is also a market-cap-weighted index of common stocks listed on the Nasdaq exchange. Ranging from blue chip to small cap stocks, the Nasdaq is heavily weighted towards technology companies which make up roughly 59% of the index.

Choose your fighter!

DKI Takeaway: All three serve as benchmarks for portfolios and funds, and give investors a way to get a quick snapshot of market performance. However, understanding how each one is created and what it consists of will help you make sense of the financial news. Overall, the Dow’s price weighting makes the index relatively unreliable. A company that does a 2 for 1 stock split loses half its influence in the Dow. The S&P 500 is a proxy for industrial America, but because the 10 largest stocks make up 35% of the index, performance is dictated by a small number of companies. Similarly, the Nasdaq is heavily influenced by tech companies so there’s an even greater amount of industry concentration here than in the other indexes.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.