Google signs an agreement to buy fusion energy. It’s even more efficient than the fission reactors which are our best current and future source of power. The technology isn’t ready yet, but investment in the sector is increasing as we get closer to harnessing this new energy source. It still doesn’t change our thesis on uranium. BlackRock shortens the duration on its Treasury portfolio. The yield curve just isn’t proving enough upside to take the longer-term risks. We agree. Jerome Powell wins the applause of central bankers in Sintra, Portugal by blaming President Trump’s tariffs for not lowering the fed funds rate. DKI notices that the applauding central bankers come from countries with tariffs on American goods. We wonder: if tariffs cause inflation and cripple GDP then why do these central bankers not criticize their own governments? Banks pass stress tests and return more capital to shareholders. We also notice that banks passed stress tests in 2008 as well. The real world never matches the models at the ends of the bell curve…when there’s stress. Our solution: tell the banks now there won’t be another bailout. It would fix the problem and therefore, won’t happen. Finally, in our educational topic, we explain the relative advantages of dividends and stock buybacks.

This week, we’ll address the following topics:

- Google has an agreement to buy fusion energy. Want to know why this doesn’t change our mind about uranium?

- BlackRock shortens the duration on its Treasury portfolio. With even Jerome Powell claiming he doesn’t have confidence in Fed projections, it’s hard to blame them.

- Powell blames President Trump in front of central bankers in Europe. European central bankers support Trump-like policies at home. Thank you for your attention to this matter.

- Banks pass stress tests and increased capital return to shareholders. They passed stress tests in 2008 as well.

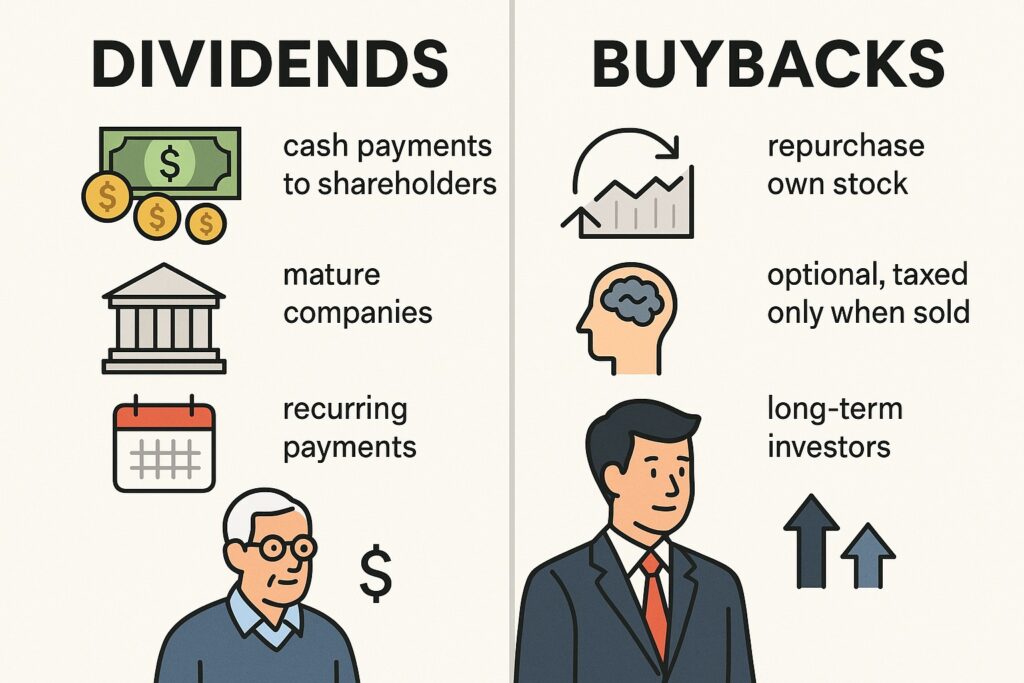

- In our educational topic, we discuss the relative advantages of dividends and stock buybacks.

As usual, DKI’s interns come through with excellent work this week. Cashen Crowe and Samaksh Jain already operate pretty independently, and new addition from Dartmouth, Gideon Rotem, is going to be a contributor early in his tenure at DKI. I see so many complaints in the news saying that our young people are unmotivated, fragile, and irresponsible. If you feel that way, try spending a day with DKI’s group. They’re relentless, ask for critical feedback to help them improve, and acknowledge their rare errors with humility and grace. Much of what you’re about to read reflects their research and efforts.

1) Google’s Landmark Fusion Energy Deal:

Google just struck a power purchase agreement (PPA) deal with Commonwealth Fusion to purchase 200 megawatts of electricity from a future fusion power plant. The company’s first fusion plant being built in Viriginia is expected to be the first of its kind connected to the grid, targeted for the early 2030’s. With this deal, Google is betting on a type of power that has only been used for nuclear weapons being developed into a viable (non-explosive) power source within the next 5-10 years.

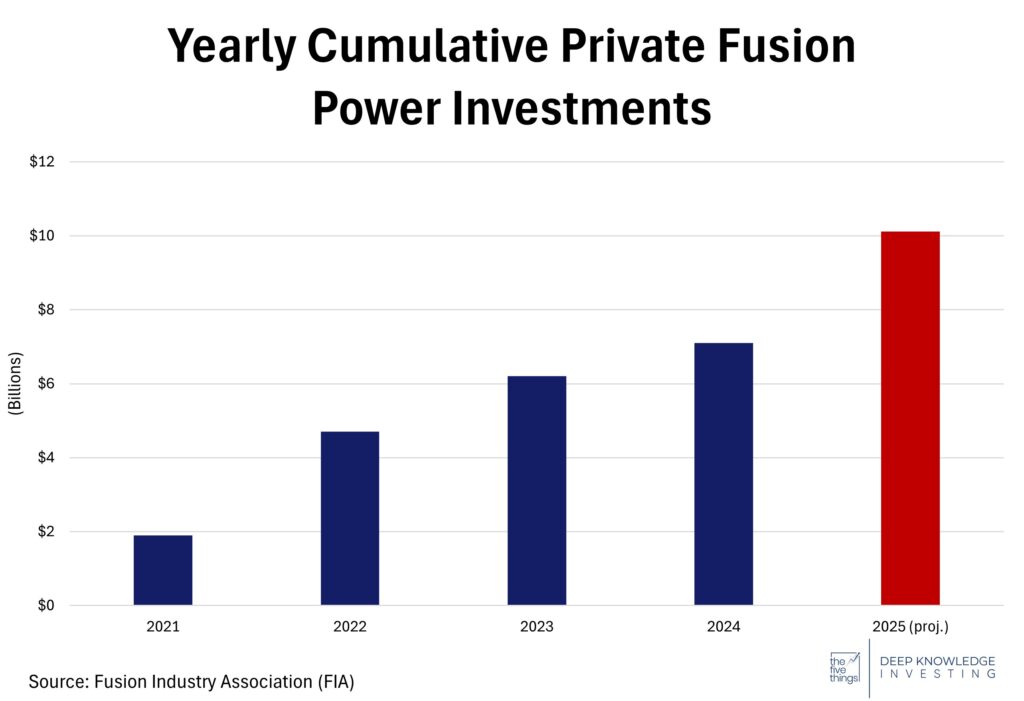

Nuclear fusion offers the prospect of “unlimited, clean power” that is even more efficient than current fission reactors. If fusion can be commercialized, it would change the entire energy landscape, explaining the billions in capital flowing into private fusion investments. Creating a controlled, sustained fusion reaction is difficult. Scientists claim it is essentially like “making a star on Earth,” requiring light atoms to be heated to over 100 million degrees Celsius so that they can fuse into heavier atoms which release energy.

Money is being invested now because this could be viable in the 2030s.

DKI Takeaway: With Google predicting 5-10 years and other researchers saying 30, the timing of fusion energy being commercialized is difficult to predict. Commonwealth, backed by Google, is aiming to deliver this promise by the early 2030’s, while and some believe that fusion reactors could be mainstream by 2040. Even though nuclear fusion uses hydrogen isotopes as fuel, this does not affect DKI’s positive thesis on uranium. Continued demand for uranium above the current supply will cause a shortage long before the first viable fusion reactor is built.

2) BlackRock Bets on the Short Term:

The BlackRock Investment Institute recently signaled a major shift in its investment strategy. Now favoring short-term investments over previous long-term bets, the company’s July outlook expressed growing concern about macroeconomic indicators they believe were more stable in the past.

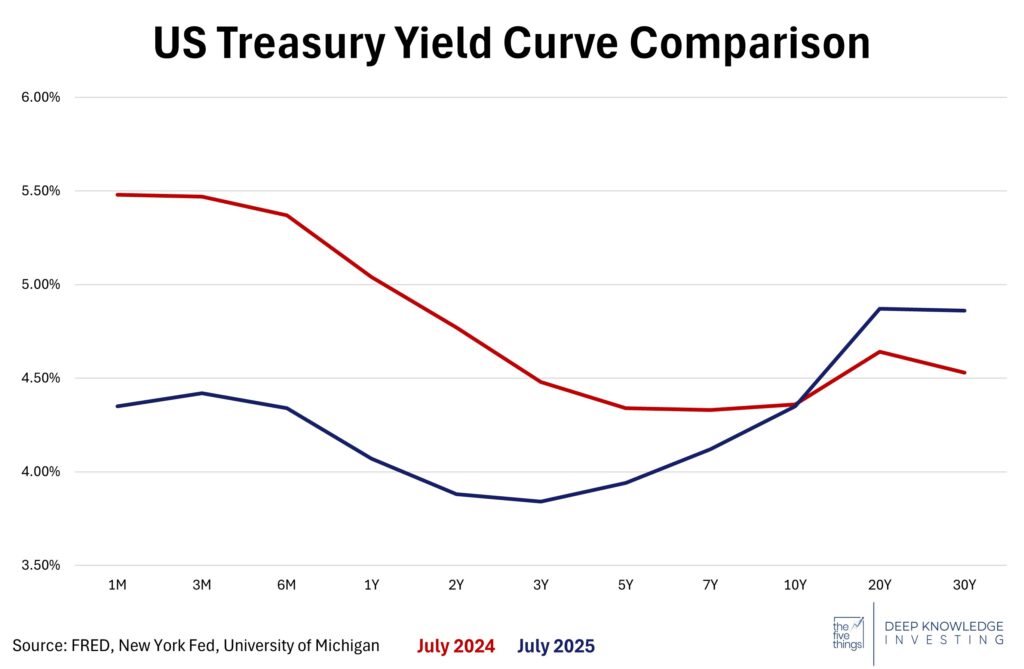

With the Fed openly expressing doubt about their own shifting projections, there is less certainty surrounding interest rates. Inflation is down, but has been above target for years. With less certainty about the future, BlackRock is buying more short-term treasuries and fewer long-term ones despite the slope turning positive.

The yield curve went from negative to positive, but some still want the short end.

DKI Takeaway: Though this shift highlights a broader trend in macro forecasting, it is understandable. While tariffs haven’t been anything close to the economic disaster most economists predicted, there is still an attitude of “wait and see”. One reason the yield on the 10-year has come down is investors are pricing in an expected reduction in the fed funds rate. That, plus added long-term economic uncertainty, is pushing more investors into lower duration bonds. DKI still prefers uncorrelated assets like gold and Bitcoin against Treasuries. They won’t deliver the predictable return of government bonds, but those bonds have a low or negative real return. So, we’ll ask you: Would you prefer to lose money slowly or make money inconsistently?

3) Powell Discusses US Tariffs at ECB Forum:

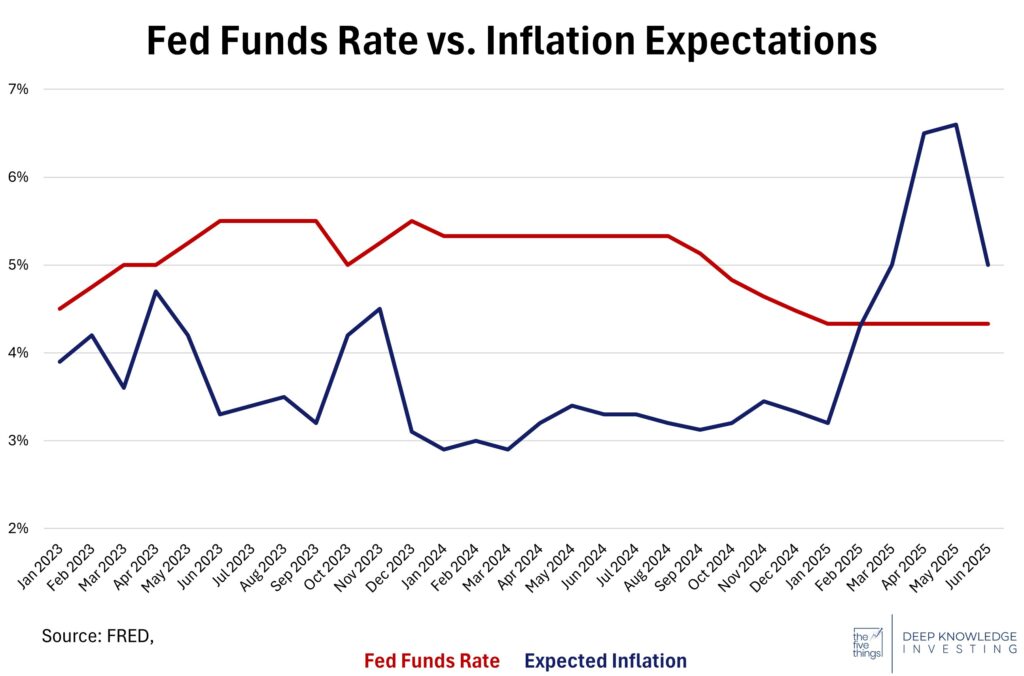

At the ECB’s Forum in Sintra, Portugal, on July 1, Federal Reserve Chair Jerome Powell notably suggested that tariffs imposed by the Trump administration were preventing the Fed from cutting interest rates. He stated that the central bank delayed rate cuts “when we saw the size of the tariffs…and essentially all inflation forecasts for the United States went up materially as a consequence.” Powell emphasized that the Fed has taken a methodical, data-driven approach, resisting political pressure to cut rates prematurely. His remarks were met with applause from international counterparts, including ECB President Christine Lagarde and Bank of England Governor Andrew Bailey, despite those same countries maintaining tariffs on U.S. goods. DKI finds it curious that these top bankers and economists believe that US tariffs will create inflation and slow economic growth, but somehow, manage with these same inflation-causing growth-killing restrictions in their own countries.

“Tariffs are terrible” went to “no big deal” pretty quickly.

DKI Takeaway: Powell’s stance reveals a dual reality: tariffs are increasingly being labeled by central banks as macroeconomic shock factors despite no meaningful issues so far. By attributing rate-hike delays to potential tariff-driven inflation, Powell reasserts monetary independence and claims to rely on a data-first policy framework. However, the applause from foreign peers, many of whom levy tariffs of their own, highlights a hypocrisy: they oppose U.S. protectionism when it hits them, yet support their own countries’ tariffs and government support of their industries. These countries established trade barriers to protect jobs and domestic manufacturing capacity. They shouldn’t be surprised when the US does the same.

4) Major Banks Passed the Fed Stress Test, does it Matter?

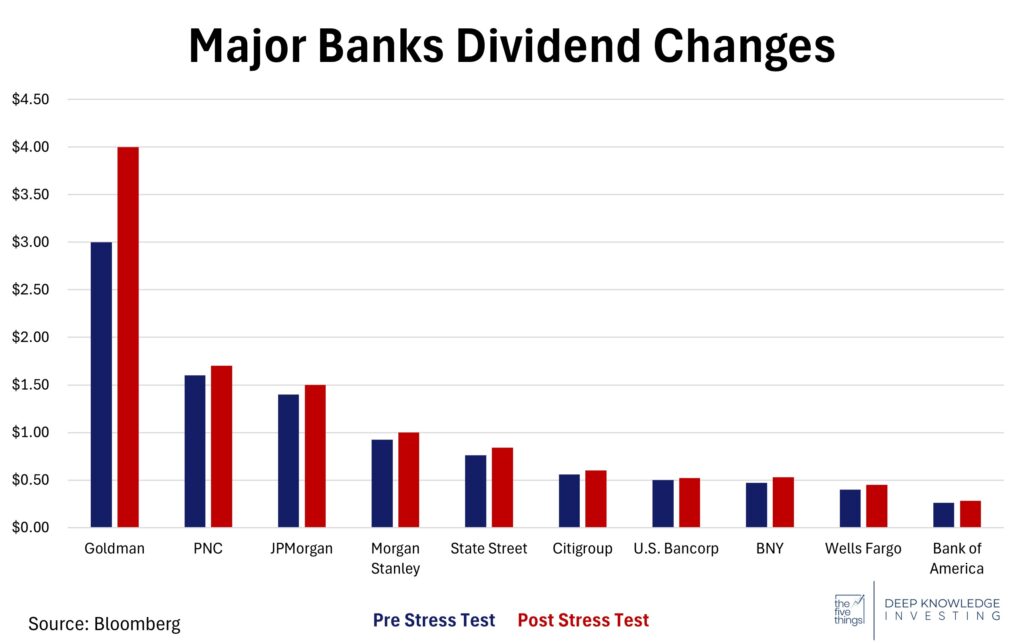

Major U.S. banks have sailed through the Federal Reserve’s 2025 stress test, which checks whether they have sufficient capital to withstand a severe economic recession. All 22 banks remained above the required capital ratios. The stress test is often seen as a way for banks to receive the green light to return more money to shareholders. With boosted confidence, many banks subsequently announced dividend increases and initiated share buyback programs. This test is less intense than last year’s, something we find surprising. The hypothetical economic scenarios were less severe and presented the banks with a lesser challenge.

The changes weren’t huge, but they all went in the same direction.

DKI Takeaway: For income-focused investors, this is good news. Stronger payouts and further commitment to shareholder value are always welcome. However, the stress test is not indicative of extreme banking resilience. Before the 2008 financial crisis, banks “passed” similar tests, with some not surviving the real-world test and others requiring government bailouts. Today, credit stress is rising and banks are setting aside larger amounts of money to cover defaults. They may have passed the test, but the banks aren’t increasing reserves out of confidence. Either way, we have low confidence in these tests. DKI’s solution is to inform the banks that there will be no further bailouts. They can take on additional risk, if their shareholders are willing to take it with them.

5) Educational Topic: How Companies Return Capital to Investors:

When it comes to sharing financial success, companies do so by returning capital. The two primary ways this is done are dividends and share buyback programs. The two methods have different advantages for investors.

Dividends are a cash payout to investors. Distributed from a company’s profits to shareholders on a regular schedule, dividends give more certain timing of cash flows. Many investors will favor dividend paying stocks as a form of income, and they can rely on the recurring payments. A company that pays dividends generally signals that the company is financially healthy and confident in the future.

Share buyback programs are when a company uses excess cash to buy back and retire outstanding shares, leaving remaining shareholders with a larger stake in the company. Unlike dividends, buybacks do not distribute cash to all investors at the same time. Investors receive the benefit when they choose to sell their stock. When shares are repurchased, metrics like price-to-earnings can go up, which is likely to lift the stock’s value over time. Shares are usually repurchased when the stock is undervalued, or the firm has more cash than needed for growth. Like dividends, buybacks signal confidence in the company’s future.

Both good options with different timing and tax consequences.

DKI Takeaway: Even though dividends come from after-tax corporate profits, shareholders still owe taxes on dividend payments. This is why some investors may choose to hold dividend paying stocks in tax-advantaged accounts like a Roth IRA. Dividend Reinvestment Programs (DRIP) are favored by some investors, often allowing for greater compound returns at the cost of some flexibility Overall, buybacks allow investors to have a choice in the timing of when the cash is received which provides more control. That enables investors to delay selling stock until potential gains are long-term which can have tax advantages.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.