The consumer price index rises for the second straight month, but that’s primarily due to shelter prices which have been rising since 2020. Fiat economists are now saying we’ll see tariff-based inflation starting in October. They might be right, but we’re noticing the constant shifting of the goalposts in their doom predictions. Nvidia wins approval to sell their powerful H20 chips to China. The US will get rare earth metals again. And China has a lessened incentive to develop its own AI chipmakers. DKI thinks it’s a good deal and that the US needs another source of critical rare earths. JP Morgan and Citi want to be early on stablecoins. DKI thinks as consumers get comfortable with a new technology that allows instant no-fee funds transfers, the banks’ business models will start looking fragile. President Trump signs a new trade deal with Indonesia that includes guaranteed sales of tens of billions of dollars of US products to Indonesia with 0% tariffs (more if you include purchase orders for 50 Boeing planes). This may be the model for future trade deals. We’re glad to see the President advocating for US companies. Finally, in our educational topic, we explain the impact foreign currency moves have on your potential investments in other countries.

This week, we’ll address the following topics:

- CPI increases due to shelter (again). Tariffs not an issue yet. Powell’s going to stay on “pause”.

- Nvidia CEO, Jensen Huang, meets with President Trump and wins the right to sell H20 chips to China. Tough call, but DKI thinks it was the right move. What do you think?

- The GENIUS act is about to pass and JP Morgan and Citi are ready to issue stablecoins. DKI thinks instant fee-free transfers are a huge threat to the banks. We have a position in the portfolio to reflect this.

- President Trump lands a deal with Indonesia which includes tens of billions of dollars of purchase orders of US goods. It could be the model for future deals.

- In our educational topic, we discuss the impact of currency moves on your returns when investing in foreign stocks.

Ready for a week of higher shelter prices and more international sales? Let’s dive in:

1) CPI Increases, but Not Due to Tariffs:

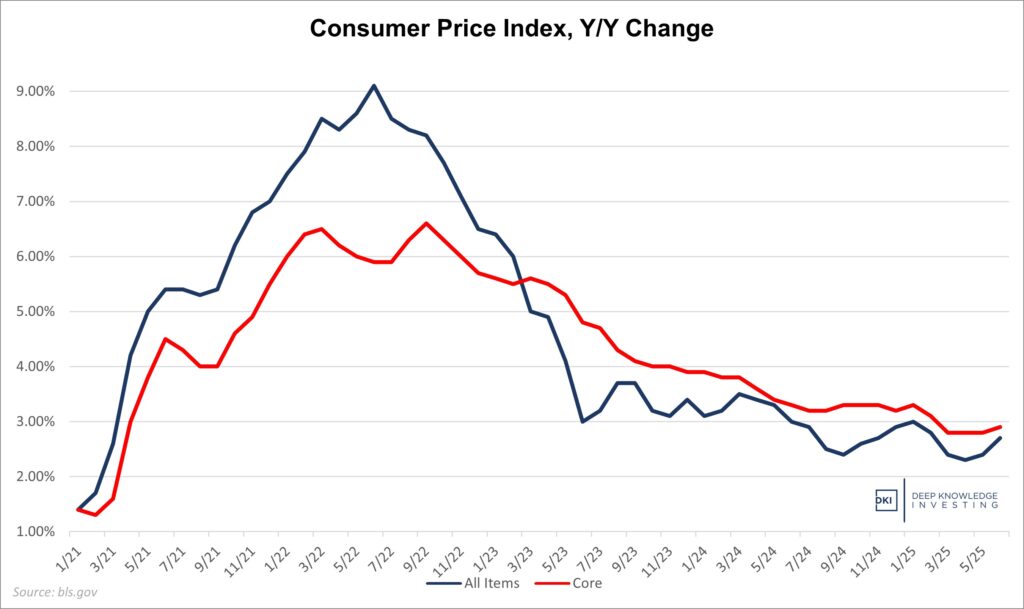

Last week, we got the June Consumer Price Index (CPI) report which showed an overall increase of 2.7% for the last year and up 0.3% for the month (annualizes to 3.7%). The annual number is up 0.3% from May and 0.1% above expectations. The monthly is up 0.2% and consistent with expectations. The Core CPI which excludes food and energy was up 2.9% vs last year and up 0.2% for the month. The yearly Core number was above last month’s 2.8% and in line with expectations. The monthly was 0.1% above last month and 0.1% below expectations. Food inflation increased to 3.0%, a number I still believe is understated. Gas prices and fuel oil have decreased and vehicle prices were roughly flat and down from the post-Covid highs. The main reason for the increase in the CPI was shelter which has been on an upward trend for years.

This month’s small increase was due to shelter – not goods.

DKI Takeaway: We continue to see signs of increasing consumer credit stress. As buy now pay later loans are being reported to credit scoring agencies, many Americans are seeing their FICO scores fall. Credit card and auto loan delinquencies are increasing. Those with student loans are now again responsible for making payments leading to further decreases in credit quality for millions. We’ve seen reports from those with student loans complaining that they now have to reduce discretionary spending because the multi-year break from payment requirements has expired. It’s interesting that so many chose to spend this temporary break from payment requirements rather than save or invest the money. Our culture needs to have a change in our relationship with spending and debt. That change should start in Congress.

I agree with current consensus that the Fed will keep rates unchanged at the next meeting. The difficulty they’ll have is a lower overnight rate is likely to lead to higher 10-year rates as the bond market prices in expected higher future inflation. There is little the Fed can do right now without spending cuts from Congress, something I do not expect to see despite a lot of click-bait headlines saying otherwise.

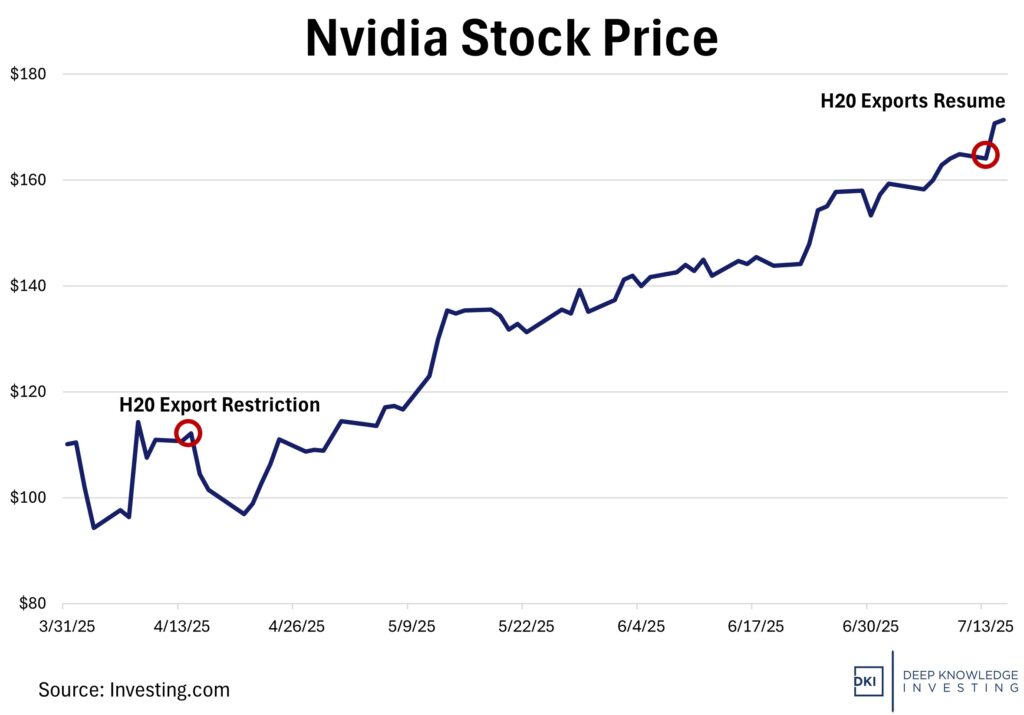

2) Nvidia’s H20 Sales to China are Back:

Nvidia has recently announced they had secured permission to resume sales of its H20 AI chips to China after a meeting between CEO, Jensen Huang, and President Trump. This reversed an earlier April ban. The last two Administrations have banned various exports of Nvidia’s high-end chips used for AI due to national security concerns. The White House thought the H20 was “too far advanced” to sell to an adversary nation like China. Following China’s earlier retaliation this year by curbing exports of its rare earth elements, broader negotiations ultimately led to the H20 ban being reversed and rare earth shipments resuming.

With China exerting such significant influence over the US regarding rare earth elements, it underscores the importance for the US to develop methods for mining and securing its own supply chain of essential material. Doing so lessens the extent to which China has leverage over the US.

The stock market cares about sales to China, but cares more about Nvidia’s total sales.

DKI Takeaway: Overall, making this deal was a tough call, but with the importance of access to rare earth minerals, it was necessary. While there are potential negative side effects that accompany selling this advanced tech to China, there is one huge advantage besides securing supply of rare earths. By supplying China with high-end AI chips, it reduces the incentive for China to develop similar or more powerful tech when facing restricted access. In the past, Nvidia has been adept at producing chips that technically comply with US restrictions, but still provide excellent performance. The new deal provides Nvidia with more leeway in what they can produce and send, provides the US with needed metals, and disincentivizes China from devoting more resources to developing a competitor to Nvidia. It’s not perfect, but it looks like a win to us.

3) JP Morgan and Citi Bank are Making Strides Towards Stablecoins:

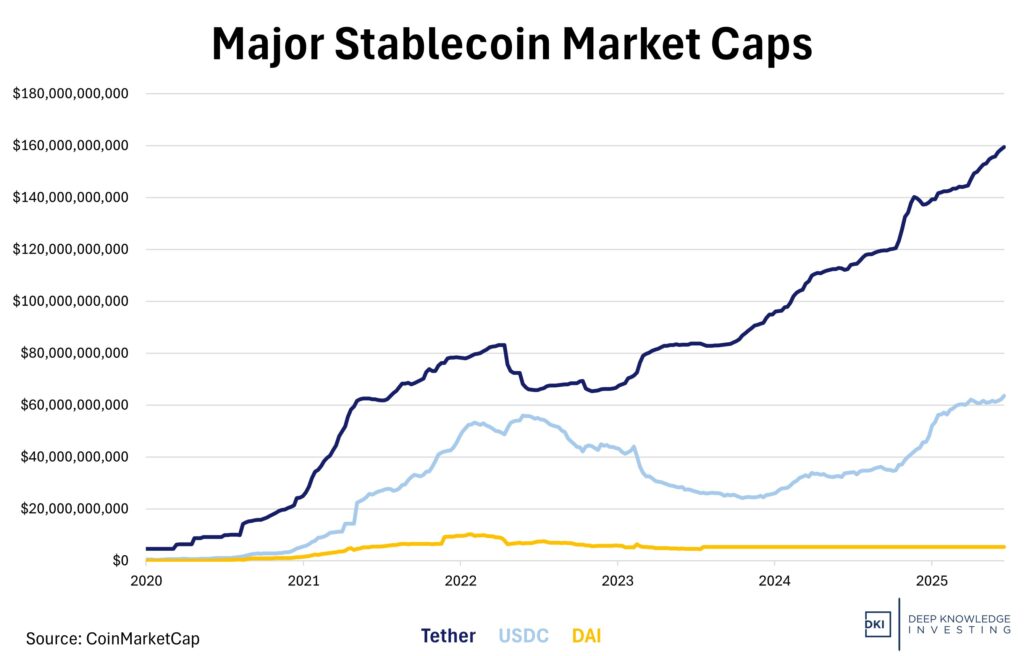

During its Q2 earnings call this week, CEO Jamie Dimon confirmed that JPMorgan is accelerating its efforts in the digital asset space. The bank is expanding its use of its institutional-only deposit token (JPMD) and has officially signaled intent to explore customer-facing stablecoins. Dimon noted it’s less about immediate payoff and more about staying ahead of fintech disruptors; “to understand it, to be good at it.” The bank is even considering a joint stablecoin initiative with other major banks that would be similar in ambition to the Zelle model, but cautions that the core value is in facilitating payments directly.

At competitor, Citibank, CEO Jane Fraser revealed that Citi is actively scoping out its own “Citi stablecoin” primarily for cross-border payments. This effort complements Citi’s existing expansion in tokenized deposits via Citi Token Services, which is live across four jurisdictions and has already processed billions in transactions. Internal research from Citi Institute forecasts massive upside, estimating the stablecoin market could reach between $1.6 trillion to $3.7 trillion by 2030. Fraser also emphasized that recent U.S. regulatory moves like the GENIUS Act and the Fed removing prior blanket approvals have lowered barriers, enabling Citi to engage more confidently.

This trend is going to go parabolic.

DKI Takeaway: This momentum follows the House’s passage on July 17, 2025 of the GENIUS Act, which sets a regulatory framework for dollar-backed stablecoins issued by licensed entities. With this new clarity, banks like JPMorgan, Citi, Bank of America, and Wells Fargo are positioning themselves not as bystanders, but as potential issuers and custodians over the coming year.

The big banks are going to need to find a way to compete in this new financial landscape. Banks make much of their money extracting fees from customers and from earning interest by delaying routine transactions like wire transfers. Stablecoins enable instant no-fee transfers of funds. As consumers get comfortable using this new technology, it’s going to present a threatening new competitor to traditional banks. For those of you new to this kind of finance, we remind you that new regulations on stablecoins insure they are 100% reserved. Your fractional-reserve lending bank can’t say the same. DKI has a position in the portfolio to take advantage of this coming trend. To learn more, just click here.

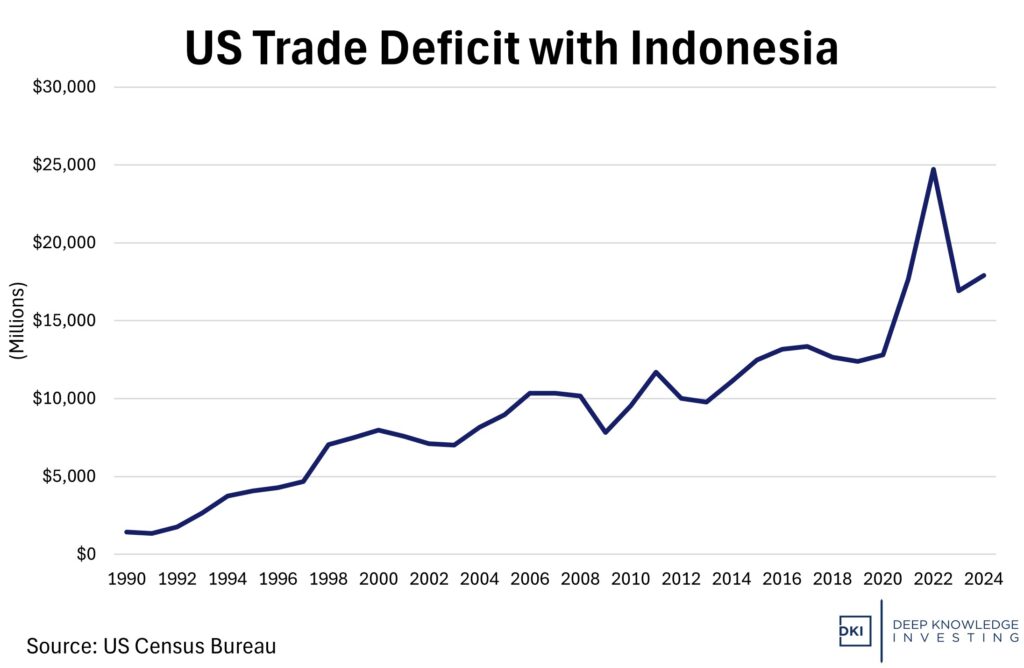

4) President Trump Lands an Unexpected Trade Deal with Indonesia:

President Trump and Indonesia’s President have reached terms on a new tariff deal, lowering President Trump’s original April tariff rate of 32% to 19%. Indonesia’s rate on US imports is 0%. The deal includes an Indonesian agreement to purchase $15B of U.S. energy products, $4.5B of American farm products, and 50 Boeing jets (including several 777s). Indonesia is a major exporter of resources like copper, which opens an avenue for the US to access copper from Southeast Asia. The deal will reduce the 18-billion-dollar trade deficit the US has with Indonesia through both tariff revenue and purchase commitments. As for Indonesia, avoiding a 32% tariff keeps exporters competitive and attracts additional investment.

More deals like this will help with the trade deficit.

DKI Takeaway: This deal is not about trade: It is about President Trump turning the American consumer base into a monetized asset. Indonesia agreed to spend billions to dodge a 32% tariff. There’s no enforcement or timeline: only a promise in exchange for market access. President Trump did not lower tariffs. He sold the privilege of being tariffed less. Expect more “buy your way in” deals ahead. While many in the media are making TACO (Trump Always Chickens Out) jokes, they should be focused on the massive purchase orders he keeps bringing in for US companies.

5) Educational Topic: How Currency Exchange Rates Affect Investments:

While international stocks and bonds can create portfolio diversification, they also introduce the risk of shifting exchange rates affecting investment returns. When investing internationally, returns are dependent not only on the performance of the individual company; but also, on changes in the exchange rate of that company’s currency. With exchange rates moving based on supply and demand, changes in interest rates, or market interference by central banks, an unfavorable foreign exchange (Fx) move can turn the positive returns of an investment in a foreign company negative. A positive move in the currency can produce a double win where you benefit from an increase in the price of a stock in its own market in addition to receiving more dollars from the Fx part of the investment.

Currency exchange rates are influenced by many economic forces like interest rate differences, inflation, and trade balances. Central bank interference in the market also affects exchange rates. In mitigating this risk, some investors choose to hedge the currency risk in foreign investment through futures or shorting that country’s bonds. Though complicated and potentially expensive, it can allow investors to offset exchange-rate risk. Many international funds also offer currency-hedged versions of funds that can help neutralize fluctuations in currency.

When you buy a foreign investment, you also buy that country’s currency.

DKI Takeaway: Diversification is a widely accepted way to mitigate portfolio risk. Foreign holding of excellent companies can be good investments. However, sometimes those investments perform well in their own currency, but not in dollars. Spreading investments across multiple currencies can help hedge risk as one currency may weaken, causing another to rise relative to the dollar, offsetting losses. Additionally, assets like Bitcoin and gold may move opposite to the US dollar, helping offset losses in foreign investments.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.