Small government activists finally get a win as the Supreme Court allows for DOGE-inspired reductions in the Federal Government workforce. Not only is the bureaucracy expensive; but also, uses overregulation to make the lives of ordinary Americans and small businesses difficult. The new tax bill phases out EV tax credits which is sensible for Americans who didn’t like subsidizing the car purchases of the wealthy. This is a win for American internal combustion engine manufacturers and potentially, the government-subsidized Chinese EV industry as well. DKI has a proposed solution to this market manipulation. No need to send this one to the President. He already knows. A late adjustment to the Big Beautiful Bill did save a Ford EV battery plant. We don’t love more government subsidies, but would rather see the government support American manufacturing than more bureaucracy. Amazon turns “Prime Day” into “Prime Week” spreading out the extra shipping labor over a couple of extra days. Shoppers are noticing Amazon marking up product prices then offering “discounts” as an incentive to buy at the same price as the prior week. In our educational topic, we explain the difference between open-end and closed-end funds and show you how we used that information to make a big return for DKI subscribers.

This week, we’ll address the following topics:

- The Supreme Court decides that the government doesn’t have to expand indefinitely. This frees Americans from more costly bureaucracy.

- The quick phase-out of EV tax credits helps the US internal combustion engine manufacturers and may favor Chinese EV makers. DKI proposes a Trumpian solution so thank you for your attention to this matter.

- The Big Beautiful Bill wasn’t entirely hostile to domestic EV makers as Ford gets a reprieve on its new battery plant.

- Amazon’s “Prime Day” becomes “Prime Week”, but Amazon is playing a bit fast and loose with the definition of discount. Shop carefully!

- In our educational topic, we explain the differences between open-end and closed-end funds. We also give you an example of how DKI used a quirk in the structure to make money for our subscribers.

Our interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem continue to perform admirably. Please take a minute to appreciate the meaningful contributions of our young finance professionals to this publication. We also recognize Robb Fahrion and the team at Flying V for all they’re doing to improve the video version. Feel free to check it out at the DKI YouTube channel.

Ready for a week of reduced government interference in your life? Let’s dive in:

1) The Supreme Court Clears the Way for More Layoffs:

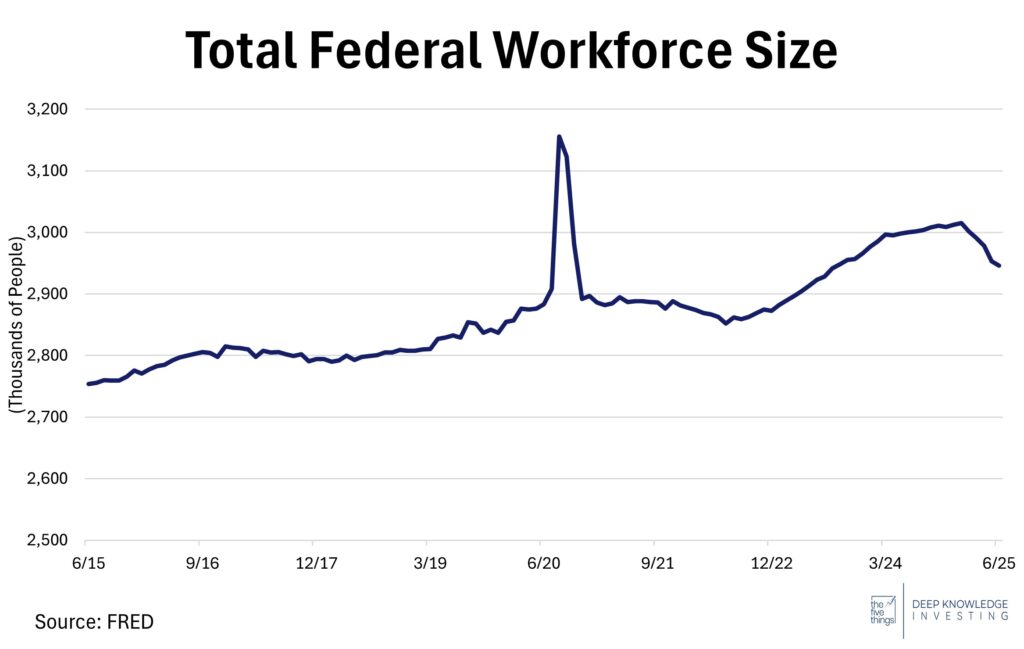

On July 8, the Supreme Court lifted a lower court injunction, allowing the Trump administration to proceed with large-scale layoffs at federal agencies, including the IRS, Agriculture, Health and Human Services, and others, while litigation continues. These cuts, facilitated through buyouts and probationary employee terminations, target a workforce approaching 3 million civilian employees. That’s larger than the population of 26 individual States! (We add that State and local employment is an additional 20MM people and the military is another 2MM for a total of about 25MM government employees.) Proponents highlight potential cost savings of about $25 billion annually for a 10% staff reduction; however, some government advocates warn of potentially offsetting losses claiming that productivity disruptions, severance costs, and service delays could have an impact. IRS and other agency cuts threaten increased tax collection. (I was already sold on the idea. No need to sweeten it.) Regions heavily reliant on federal employment, such as D.C. and northern Virginia, may experience outsized economic effects, reflected in declining consumer spending and local tax receipts. (So, The Hunger Games in reverse? Again, I’m already sold on the idea.)

For all the crying, this recent reduction doesn’t strike us as even close to draconian.

DKI Takeaway: The regulatory State is now threatening Americans with reduced consumer spending in the DC area if we don’t support more wasteful spending?! The Supreme Court ruling ushers in a simple economic calculus: federal payroll reductions will lower government expenses and tighten the deficit immediately, and they also come with substantial long-term benefits. The costs of the regulatory State extend well beyond its incredible budget. Too many unelected bureaucrats have far too great a say in how ordinary Americans manage our lives. These bureaucrats may complain about job losses in areas of the country dependent on government largesse, but the complainers ignore the millions of Americans struggling under crushing regulatory requirements. The country functioned well long before many large agencies existed. Reducing the regulatory State will free people to be more productive unleashing the dual benefits of lower government costs and increased citizen productivity. Somehow the advocates for ever-larger government think their “gains” can’t ever be reversed. For the first time in a while, the smaller-government crowd gets a small win.

2) The End of the Road for EV Tax Credits:

The recent passing of the tax bill has rewritten the rules for electric and ICE (internal combustion engine) vehicles. The One Big Beautiful Bill favors conventional gas vehicles while EV tax credits will be phased out by September 30, 2025. The bill also eliminates penalties automakers face for missing fuel economy targets in production fleets and introduces a new auto loan interest deduction for vehicles assembled in America.

With the US EV market slowing, concerns regarding China’s ability to gain market share overseas have grown. Chinese EV makers are subsidized by their government in an attempt to win market share. However, rather than subsidizing our own EV market and forcing taxpayers to fund others’ purchases, this market distortion caused by the CCP can simply be resolved with tariffs on Chinese EVs.

The data isn’t as bad as the headlines yet.

DKI Takeaway: The government may have wanted to encourage EV use, but asking Americans to subsidize expensive EV purchases by others never made a lot of sense. People who can afford a $90k EV don’t need taxpayer assistance. Phasing out the credits resolves this and returns choice to the consumer. Because the EV tax credits will be available for another few months, we might see a surge in electric vehicle purchases, with a decline thereafter.

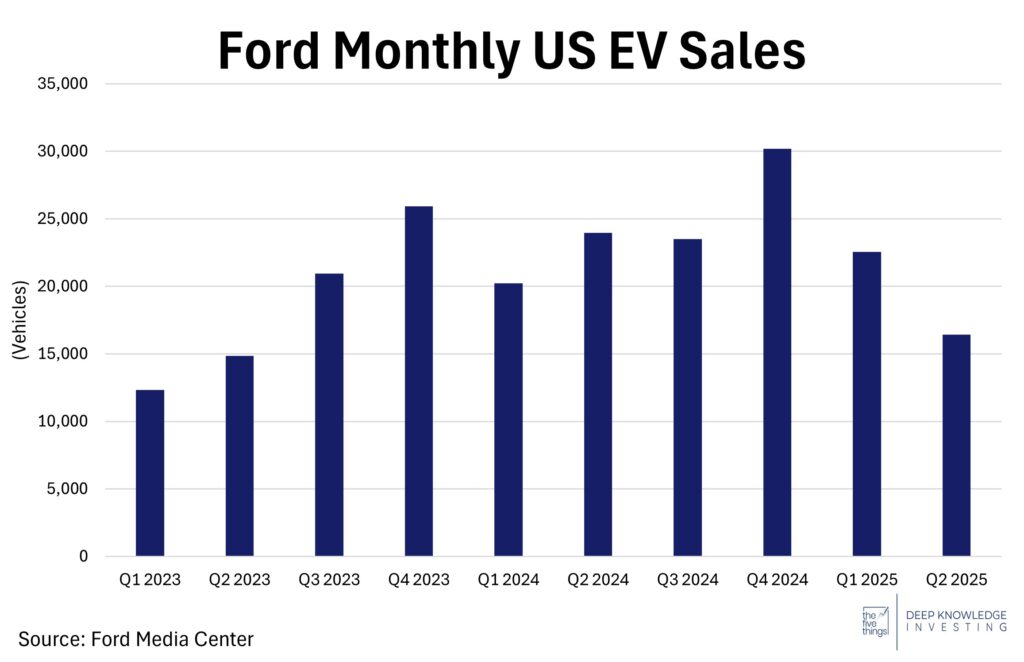

3) A New Outlook for Ford EVs after President Trump’s Tax Bill:

Ford’s $3B Michigan battery plant is back on track after Congress softened restrictions in the recently passed tax bill. The plant, which is currently under construction, faced the risk of losing Ford’s licensing deal with the Chinese tech company CATL. Now, the new bill allows federal production tax credits if U.S. entities can retain “effective control” over their products. Ford qualifies and will receive up to $900MM annually once the plant reaches full operational output (equivalent to ~200k EVs per year).

The factory will produce LFP (lithium iron phosphate) batteries, which are cheaper safer alternatives designed for entry-level EVs. With 1,700 jobs, $1.3B in state incentives, and tax credit-driven support, the project significantly improves Ford’s EV cost structure and mitigates near-term policy risk.

It’s a policy win for Ford, but Americans aren’t lining up for more of their EVs.

DKI Takeaway: This is an example of the difficulties of a policy-based business model. Ford’s multi-billion-dollar plant and business plan was dependent on policy decisions that could have destroyed it during construction. Going from a potential write-down to $900M/year in tax offsets, Ford dodged a major bullet. Projects that seem risky under one administration may gain life under another with compromise. Additionally, this news reinforces Ford’s LFP battery pivot as a serious attempt to scale affordable EVs while protecting margins through domestic production and subsidies.

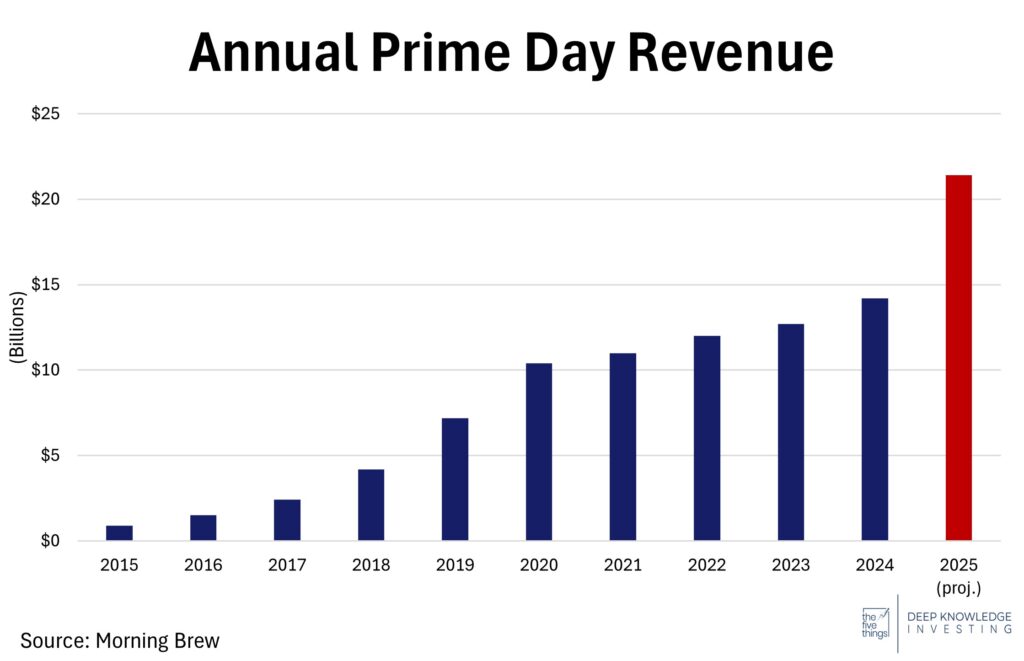

4) Amazon Stretches Prime Day to Prime Week:

What was once a 48-hour Prime Day sales event has now become a “Prime Week,” stretching to four days of sales. Amazon added extra days to the sale to draw in more shoppers and counter rival promotions after slowing growth in annual prime day sales. Still maintaining the name “Prime Day,” the extended duration is expected to match rivals in offering prolonged discounts while spreading out demand to relieve warehouses and delivery networks of order volume pressure.

This year, Amazon had fewer products on sale but had larger advertised markdowns than years prior. This indicates Amazon chose specific products for aggressive discounts rather than the broader discounts of the past. Pricing transparency with Amazon; however, remains controversial.

Sales look better, but the length of Prime “Day” has doubled.

DKI Takeaway: With people starting to take notice of Amazon’s pricing strategy near Prime Day, the deals don’t quite have the advertised value. Many have remarked on Amazon marking up prices shortly before Prime Day, then “discounting” the items. Customers like a good deal, but as word spreads of Amazon showing deep discounts while keeping pricing relatively unchanged risks alienating those same customers. Amazon will also have to see if allowing customers to pace purchases over a longer period can be profitable, or if the original urgency of the shorter sale period may work better.

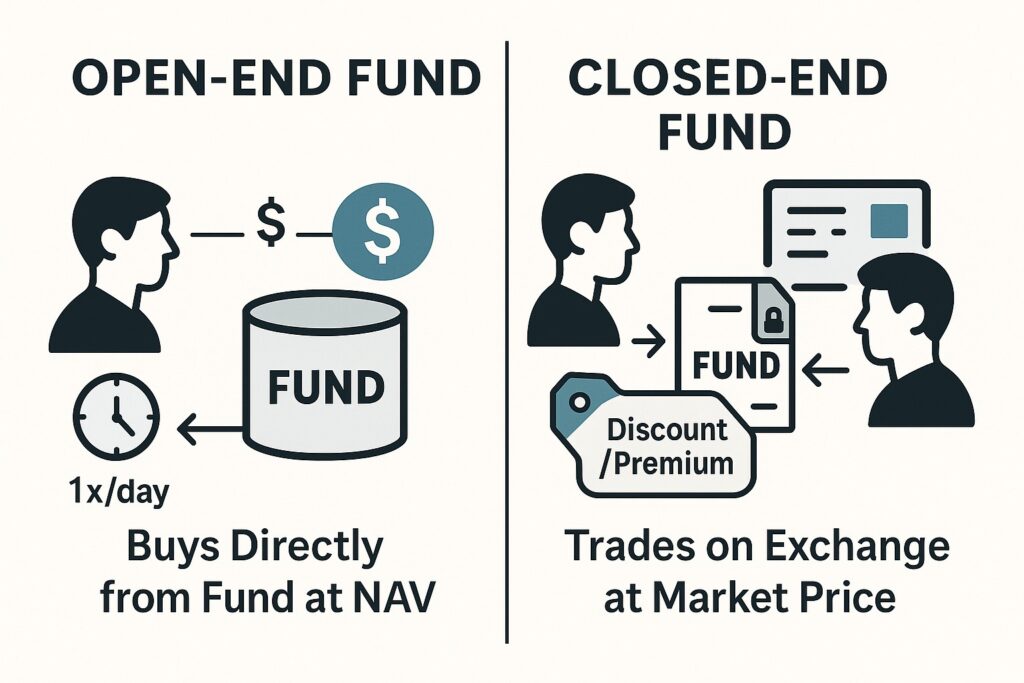

5) Educational Topic: Open-end vs. Closed-end Funds:

An open-end fund is a mutual fund or exchange traded fund (ETF) that issues new shares when investors buy and repurchase shares when investors sell. The share count fluctuates with the size of the fund. The pricing is determined once daily by the net asset value (NAV), which is the value of a fund’s assets minus its liabilities divided by outstanding shares. Open-end funds tend to be liquid and accessible to investors on any trading day.

A closed-end fund issues a fixed number of shares during an initial public offering (IPO). After the IPO, investors can buy and sell shares on an exchange like regular stocks. These shares trade on the open market and thus have varying prices throughout the day. Shares will not be bought back on demand, and due to changes in demand, closed-end funds often trade above or below NAV.

The reasons for some funds trading at a discount/premium to NAV can be interesting.

DKI Takeaway: For investors who prefer liquidity and simplicity, open-end funds are usually the way to go. Investors with more specific investing strategies may choose closed-end funds like a bond fund to utilize higher distributions (often with leverage). Be aware that closed-end funds often use leverage to raise income, which can create interest costs for the investor. The most famous recent example of a fund trading at a large premium then discount to NAV was the Grayscale Bitcoin Trust ($GBTC). At the time, it served as the only pure play exposure to Bitcoin investors could buy in traditional brokerage accounts. As a result, it traded at a huge premium to NAV. Later, when Bitcoin demand temporarily faded, the fund wasn’t able to repurchase and retire shares so the fund traded at a huge discount to NAV. DKI bought large positions in $GBTC when it traded at a 30% discount and profited when the dollar price of Bitcoin rose and when conversion from a closed-end trust to an open-ended ETF caused the discount to close. If you want to know the next time we discover this kind of asymmetrical trade, we welcome you to subscribe.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.