This week, we got a lower-than-expected CPI. Hooray, the Fed will cut! Then, we got a higher-than-expected PPI. Oh no, the Fed can’t cut! There’s some evidence that tariffs are raising prices for now, but not nearly as bad as the fiat economist threatened. The US puts a 15% tariff on $NVDA and $AMD chip exports to China. The purpose of the tariffs was to encourage domestic manufacturing. This is the opposite of that. authID $AUID grows revenue from $.3MM to $1.4MM in one quarter. Recurring revenue was just under $6MM, up from just over $1MM. There were big new customer announcements with more on the way. Perplexity makes a big cash offer for $GOOG’s Chrome. Then $JPM finances a bigger Search.com offer. It’s not big money to Alphabet; but rather, an attempt to take advantage of the antitrust situation. The trade deal with China gets pushed back another 90 days. This surprises no one as any deal with the Chinese will be complicated. We still need to decouple from a “trade partner” conducting asymmetrical warfare against us. (Some of you won’t like that wording, but they’re putting grid-damaging technology in the solar panel equipment they sell us and trying to hack our utility companies.) Want to know more about buying and selling options? Check out our educational topic where we discuss the basics of calls and puts.

This week, we’ll address the following topics:

- The CPI comes in lighter than expected. Fed is going to cut! The PPI comes in very high. The Fed is stuck.

- The US puts a 15% tariff on $NVDA and $AMD exports to China. The tariffs were supposed to encourage domestic manufacturing. Taxing exports is the opposite of that.

- authID $AUID posts massive revenue growth. Even better, the customer contract announcements (recent and coming) are incredible for such a small company.

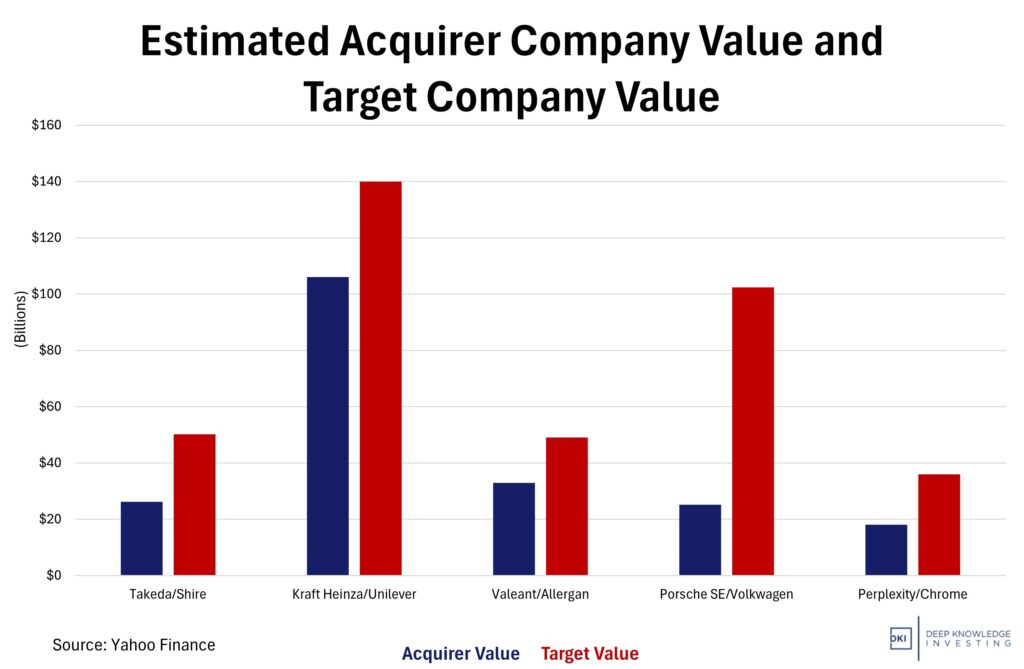

- Perplexity makes a $34.5B bid for the much larger Chrome asset owned by Alphabet $GOOG which is facing an antitrust suit. Search.com responds with a $35B unsolicited bid backed by $JPM.

- The trade deal deadline with China gets pushed back by another 90 days. This deal is going to be more complicated than the others.

- In our educational topic, we explain the implications of buying and selling call and put options.

1. CPI:

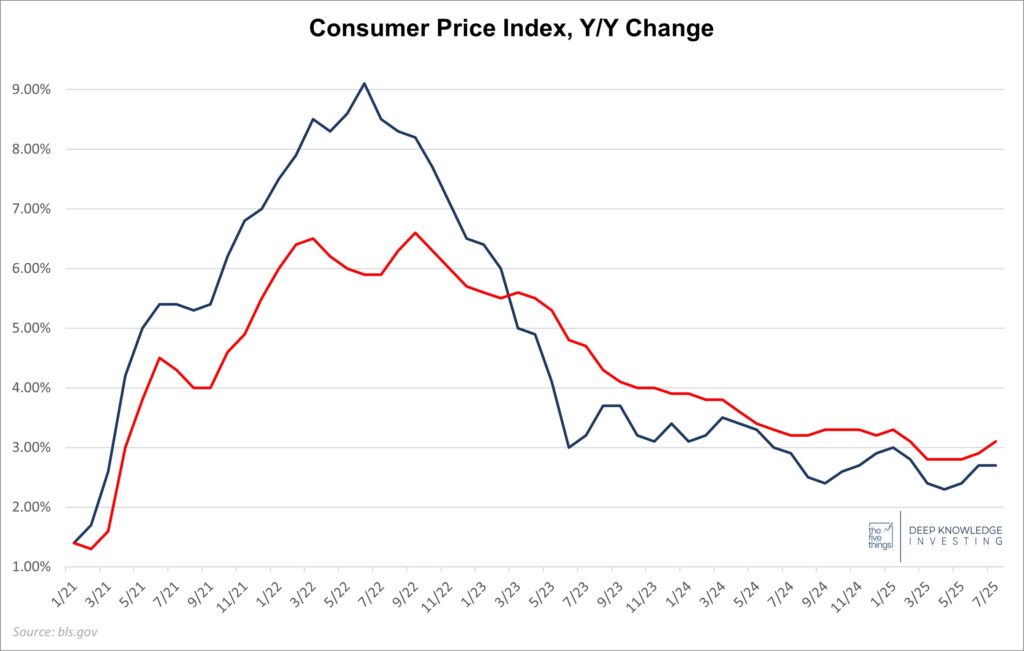

This week, we got the July Consumer Price Index (CPI) report which showed an overall increase of 2.7% for the last year and an increase of 0.2% for the month (annualizes to 2.4%). The annual number is flat from June and 0.1% below expectations. The monthly is up 0.2% and consistent with expectations. The Core CPI which excludes food and energy was up 3.1% vs last year and up 0.3% for the month. The yearly Core number was above last month’s 2.9% and 0.1% above expectations. The monthly was consistent with last month and in line with expectations. Food inflation is still elevated around 3%. Energy prices have continued to be a tailwind; falling by 1.6%. Shelter remains the main reason for the still-too-high CPI.

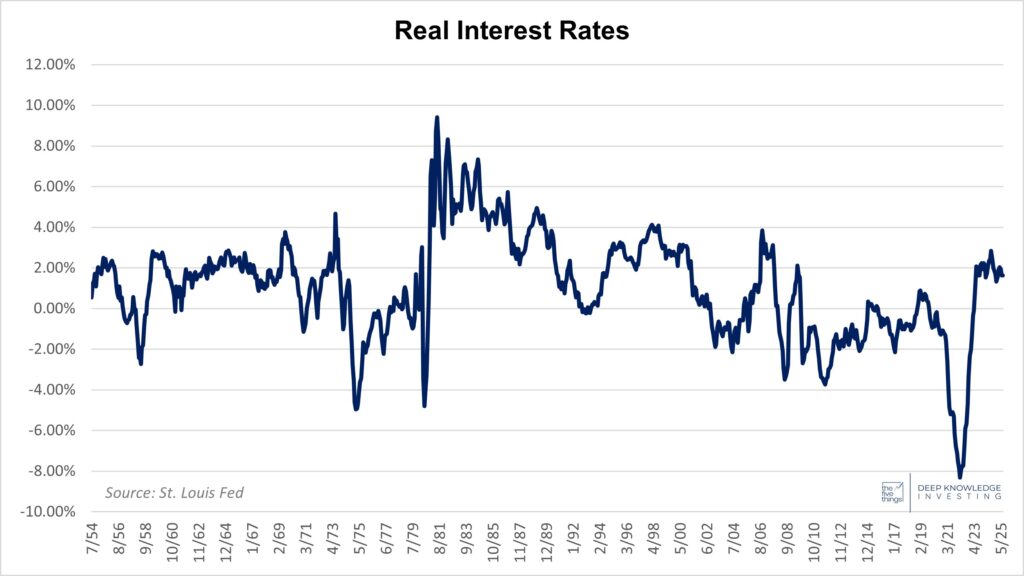

Still well above the 2% target (which is 2% too high).

A real rate under 2% isn’t restrictive as both Chairman Powell & President Trump say.

DKI Takeaway: Despite all the predictions of catastrophe from fiat economists relating to the Trump tariffs, disaster simply hasn’t happened. We were warned the tariffs would lead to massive inflation. That then got altered to a big one-time increase in the price level which would then be stable. Then, there were threats that tariffs would lead to decreased trade and a worldwide recession. None of that has happened. In my opinion, the CPI and the Core CPI in particular are still too high, but there were a lot of people worrying that today’s monthly increase would be 0.4% or higher instead of the much more manageable 0.2%.

In fairness to these economists, many have made the case that it will take a few more months for these higher prices to move through complicated supply chains. If they’re right, we should start seeing the predicted inflation Armageddon in the next couple of months. I continue to believe that people are underestimating the possibility that President Trump’s threats will land us with LOWER tariffs all-around. Talks with other nations aren’t resulting in deals as quickly as many hoped, but recent deals have been struck at levels below where many feared. There have also been trillions of dollars of announcements of new US manufacturing capacity. Increased domestic supply will offset much of the fears of higher tariff-based imports.

I do think we’ll see continued inflation. However, I think the cause of that will be continued overspending in Washington DC. Both parties overspend. Multi-trillion-dollar deficits, skyrocketing interest expense, and massive unpayable off-balance sheet liabilities will all lead to an increase in the money supply. That’s the proper definition of inflation. The DKI portfolio is well-positioned for such things, but owning Bitcoin and gold is the easiest way to profit from the continued debasement of the money supply (which will continue with or without tariffs).

Update: Later in the week, we got a scorching hot PPI report which was both way above expectations and recent levels. The Producer Price Index hits manufacturers first and we should expect to see that reflected in the CPI in the coming months. Point here to the fiat economists who predicted this. Predictions for Fed rate cuts are crashing now.

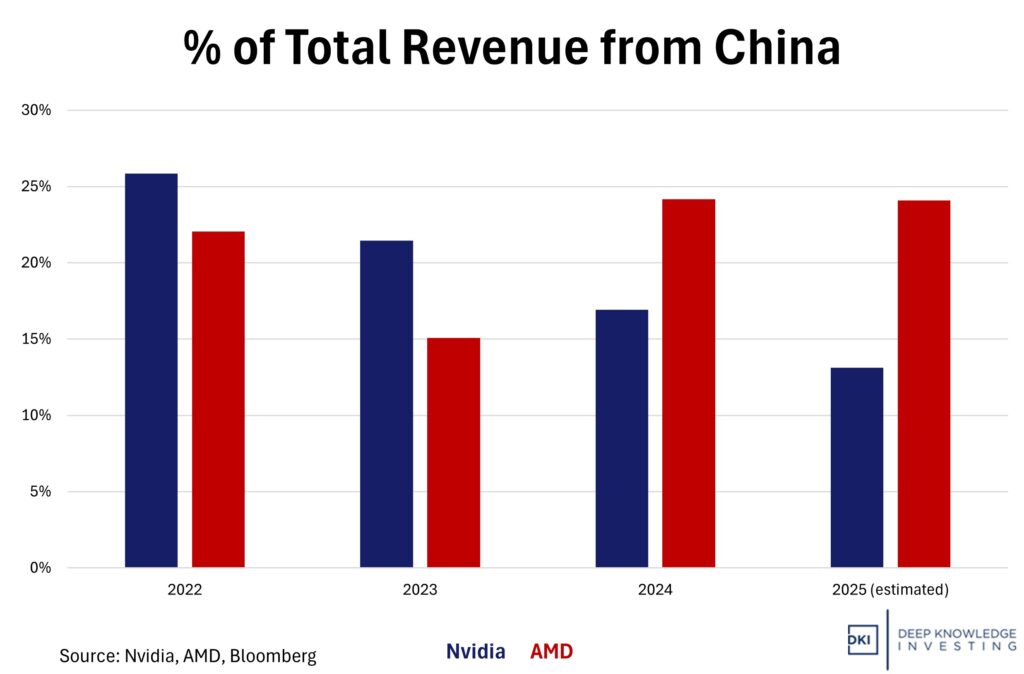

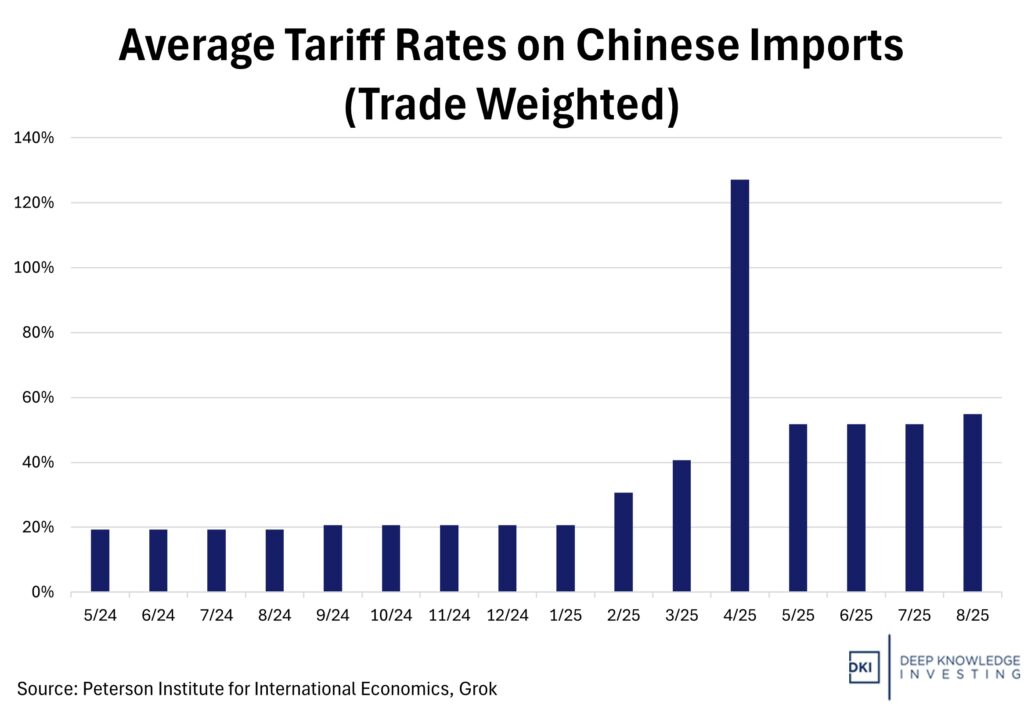

2) Paying to Play – Nvidia and AMD’s China Chip Sales Agreement:

The US has reshaped export controls after finalizing a deal with Nvidia ($NVDA) and $AMD giving permission to sell certain advanced AI chips to China in return for paying the US government 15% of revenue from those sales to China. High performance chips like Nvidia’s and AMD’s are tailored for AI purposes and gives the Chinese market access to near-cutting-edge US tech. As the tech race between the two countries and other adversaries has been growing, concerns have grown over security risks, prompting an export curb earlier in the year to China, closing Chinese access to US AI silicon. After a few months, the embargo was lifted and Nvidia and AMD were granted export licenses again. As a condition for regaining access to the Chinese market, they agreed to the 15% revenue remittance. Right now, China has leverage over the US due to its near-monopoly on rare earth elements. The US needs China to depend on us for something other than endlessly printed dollars. Providing access to US AI might be a bad choice, but closing all access and leaving China to develop their own could be just as bad.

This is significant for both companies and both countries.

DKI Takeaway: While a 15% revenue cut is significant, these AI chips carry staggeringly high profit margins. Estimates suggest the levy won’t have that large of an impact on profit margins, and the companies appear willing to absorb the hit if it is the only way to regain the export licenses. We’ve been more positive on the Trump tariffs than most and understand the tradeoff of national security and influence over China. However, I don’t like this deal. If selling high-end AI accelerators to China is a huge security risk, then we shouldn’t do it. Paying a 15% tariff won’t solve that. The tariffs were supposed to reduce trade deficits and encourage domestic manufacturing. Taxing American companies on their exports does the opposite of that. In this case, there are no alternatives. No non-US company makes high end AI chips yet. But we shouldn’t make it hard for our national champions to export and the precedent could give foreign competitors in other industries an unearned advantage over American ones if this approach is used again.

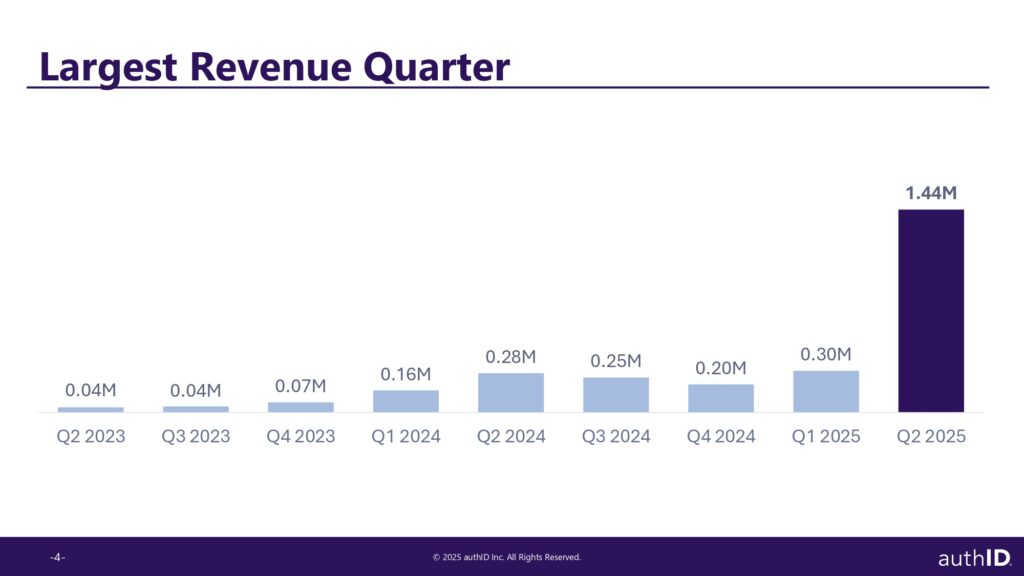

3) authID ($AUID) Crushes the Quarter. New Deals on the Way:

authID, a microcap with the fastest most-accurate biometric security in existence announced second quarter results on Thursday evening. Revenue rose 415% vs last year with annual recurring revenue rising from $1.2MM to $5.8MM. With the higher revenue and much of the intensive technology overhaul done, the cash burn was down substantially from last quarter. The company reiterated its guidance for $18MM of bookings this year. Based on my calculations, revenue this year should come in at a minimum of $4.5MM vs $800k last year and $200k the year prior. The growth rate is both large and accelerating. Depending on the source of last quarter’s deferred revenue and the amount of additional revenue from their new partnership with Prove, this year’s revenue could end up well above $5MM.

That’s not a trend. It’s an inflection point.

DKI Takeaway: The big revenue number and confirmation that this is recurring revenue was a nice surprise. However, the big news was the contract announcements:

- Last year’s Indian contract is expected to pay the full $3.3MM contractual amount.

- The Prove deal already has some of the technology integrated and working with a go-live customer date expected by this week.

- The NEC deal’s IDX platform has incredible capabilities and potential. It enables a company to authenticate employees from vendors and partners on one platform regardless of company, location, or device.

- There is a successful test with tens of thousands of employees at one of the UK’s largest retailers and a global Fortune 500 company that should result in a long-term contract.

- There is a coming announcement of a contract with a Fortune 500 company that is a leader in the benefits space.

- Management hinted at faster completion of other coming contracts, but wasn’t more specific than that.

I don’t think I’ve ever seen such a small company make so many large significant customer contract announcements in such a short time. Take a look at the company – unless you’re satisfied with the current username/password “security” we’re all misusing now.

4) Perplexity Submits Bold $34.5B Bid for Google Chrome Amid Antitrust Pressure:

AI startup Perplexity, a private company valued at around $18 billion, has made an unsolicited all-cash offer of $34.5 billion for Google’s Chrome browser, signaling a calculated move amid U.S. antitrust scrutiny of Google’s dominance in online search and advertising. This comes as U.S. District Judge Amit Mehta weighs potential remedies in the landmark antitrust case, including a forced divestiture of Chrome or breaking Google’s default-search agreements. Perplexity has pledged to keep Chromium open source, to retain Google as the default search while allowing user choice, and commit $3 billion over two years toward development. Sale negotiations seem unlikely and Google remains publicly resistant. Perplexity’s savvy bid aligns it with the antitrust narrative and places it center stage as the only known credible third-party contender. Update: Search.com has entered the unsolicited bidding with a $35B cash offer backed by JP Morgan $JPM.

It’s hard to acquire a company that’s so much larger, but it has been done.

DKI Takeaway: Perplexity’s aggressive bid is a masterclass in strategic opportunism, calculated, bold, and undeniably shrewd. By stepping forward as a potential owner of Chrome, the startup flips the script: no longer just chasing users, it’s chasing influence. This maneuver signals that control over distribution channels like browsers may become as valuable as AI technology itself. Investors should watch three vectors closely: whether the judge forces divestiture and eyes Perplexity as a credible buyer; Perplexity’s ability to scale Chrome’s operations safely; and whether this gambit spurs other AI firms into power plays over online gateways. The real power move isn’t just about winning the bid; it’s about influencing the narrative and positioning for what comes next in the AI-browsing frontier. For newcomers and incumbents alike, strategic deals with browser ecosystems may soon define the next frontier of AI competition. There are also legitimate concerns about how Google uses Chrome to gather data and invade user privacy. There are reasons for the antitrust suit and for consumer protection as well.

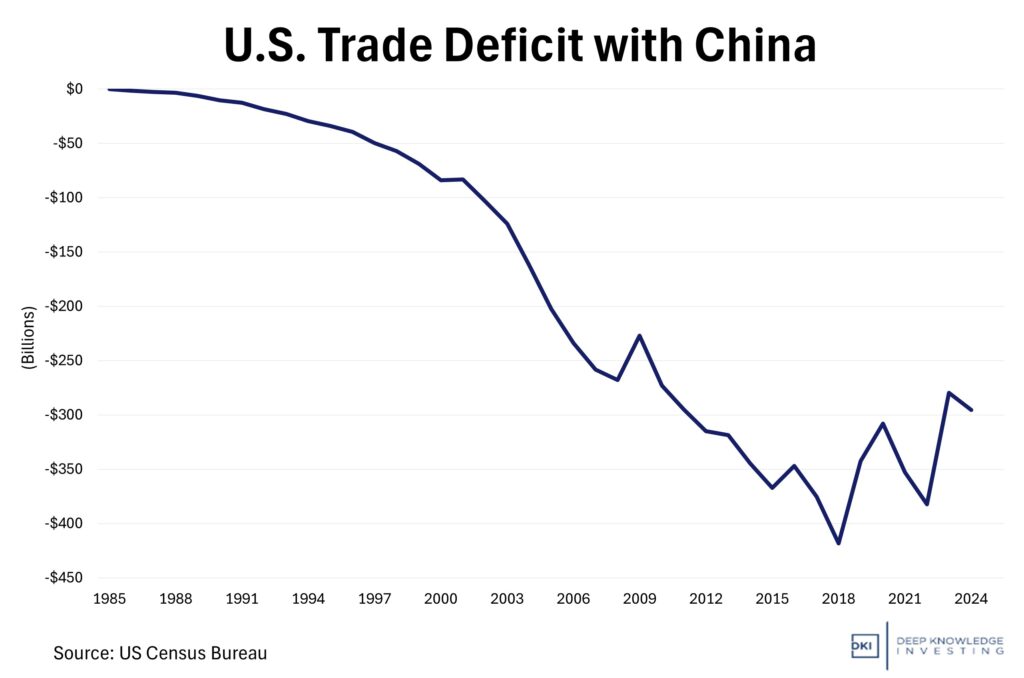

5) President Trump Extends the Tariff Truce with China

President Trump recently signed an executive order extending a 90-day pause on tariff increases against China hours before the previous truce was set to expire. The US putting a deadline for a potential tariff hike on November 10 prompted Chinese officials to pause planned retaliatory measures shortly after. China will keep its tariffs on US goods at 10% and postpone adding to the list of US firms banned from trade with the country. Though the executive order isn’t getting rid of the tariffs, it is essentially freezing tariff levels where they are, preventing a tariff hike to 145% on Chinese goods and a 125% retaliatory tariff by China.

This comes with the destruction of the US manufacturing base and involves importing Chinese spyware and malware. Do we want to depend on China as much as we do?

It will be interesting to see where this finishes.

DKI Takeaway: A persistent core issue at the heart of the US trade agenda is the trade deficit between the US and China. There has been significant progress in reducing the trade deficit with imports from China down 21.7% YoY, and President Trump will continue to work towards closing the gap. Rewarding fair trade with access to the US market and penalizing unfair trade with limited US market access shows the tough and effective policy that continues to be implemented. The current pause keeps a level of pressure that will aid in suppressing the deficit while avoiding a full out tariff war. Many people worry about a loss of access to cheap Chinese goods. We’re more concerned about the decline of the US manufacturing base, and having so much dependence on a trade partner conducting asymmetrical warfare against us.

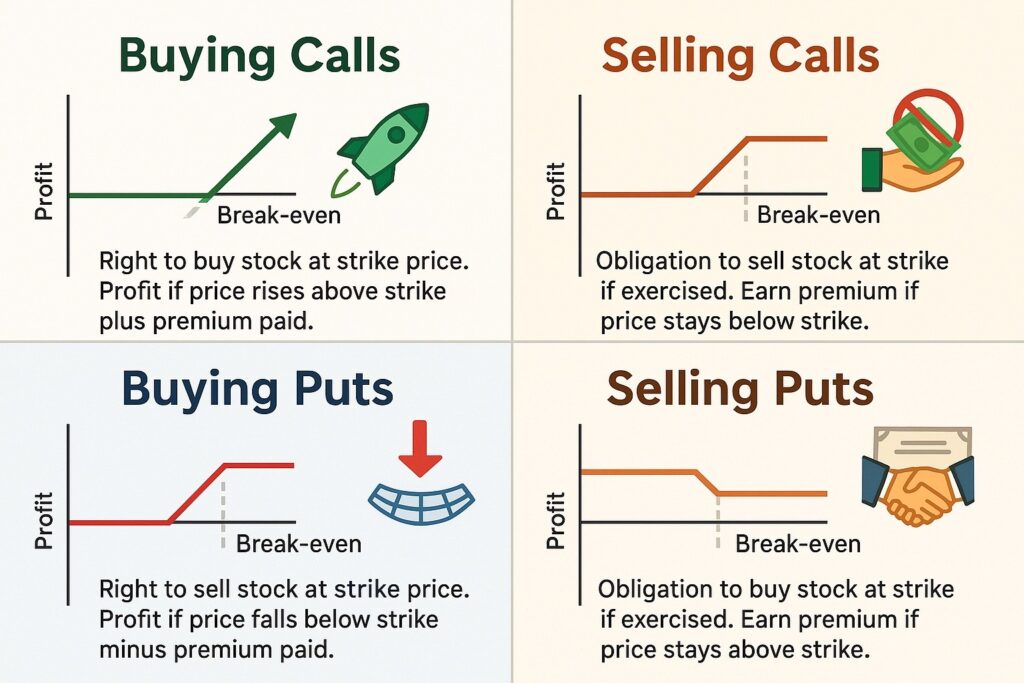

6) Educational Topic: Understanding Call & Put Options:

Call and put options provide investors the ability to modify risk and potentially enhance gains by controlling a larger position with less capital than would be required to buy an asset outright. In an option contract the buyer and seller agree on a strike price, which is the price at which the buyer can buy or sell 100 shares should they choose to exercise the contract. The price of the contract (which is multiplied by 100) is the premium that the buyer pays to the seller. Pricing will depend on multiple factors such as the time to expiration, volatility, the price of the security, the strike price, and interest rates.

A call option is a contract that gives the buyer the right to purchase 100 shares of an underlying security at a strike price on or before the expiration date. The buyer will profit from an increase in price of the underlying security above the strike price and lose money if the stock remains below the strike price plus the option premium. Upside potential is unlimited, and downside potential is equal to the price of the option.

A put option is a contract that gives the buyer the right to sell 100 shares of an underlying security to an option-contract seller on or before the expiration date. The buyer will profit from a decrease in price of the underlying security below the strike price and lose money if the stock price is above the strike price minus the option premium. Loss potential is also equal to the price of the option. Profit potential is typically large, but limited to the return available should the underlying security go to zero.

Call and put option contract holders are not obligated to exercise their contracts and can sell before the expiration date to lock in profits or limit losses. In that situation, it’s almost always more profitable to sell an unexpired option than to exercise early.

For example, an investor purchases a call option with a premium of $2 per share for a total of $200. The seller will gain $200 from this transaction. The contract has a strike price of $65 and a one-month expiration date on an underlying security trading at $50 per share. In this scenario, the maximum loss the buyer can incur is the premium, $200, which occurs when the security is worth less than $65 at the expiration date. (Between $65 and $67, the buyer will lose some of his premium.) The buyer can profit from the positive difference for each share if the security is worth more than $65 at the expiration date, creating infinite profit potential for the buyer and infinite loss potential for the seller who wrote the contract.

Buying risks the price but has large gains. Selling starts with gains & can end in losses.

DKI Takeaway: Some inexperienced investors use options to magnify potential gains and losses on stock positions. Professional investors typically use them to modify risk, to create synthetic shorts (sell a call and buy a put), or to create additional profits while possibly selling a stock they own above the current price (sell a call), or to profit while trying to buy a stock at a preferred price (sell a put). There are many different trading strategies which can depend on timing, catalysts, and whether the investor already owns the underlying stock. As always, we advise proceeding with caution, having a clear investment thesis, and thinking hard about whether you are taking unlimited risk or not. At DKI, we have occasionally used options profitably when positions trade down substantially on news we consider to be temporary or unimportant. Those have tended to work out well because we have a clear understanding of why a position is down and why we disagree with the market reaction.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.