Overview:

The Federal Reserve concluded its October meeting and as expected, lowered the fed funds rate by 25bp (.25%). The market celebrated…until Chairman Powell said that the Fed hadn’t decided to cut another 25bp in December. This caused the market to fall, but I’m not sure under what circumstances he would have said the decision has already been made. There were two other items of note in the press release. First, the Fed has decided to stop Quantitative Tightening (QT). Second, there was some dissention among Governors. Miran voted for a 50bp (.50%) decrease while Schmid preferred no change. Let’s go through the details.

The Stock Market is Focused on Expectations – Not Absolute Inflation:

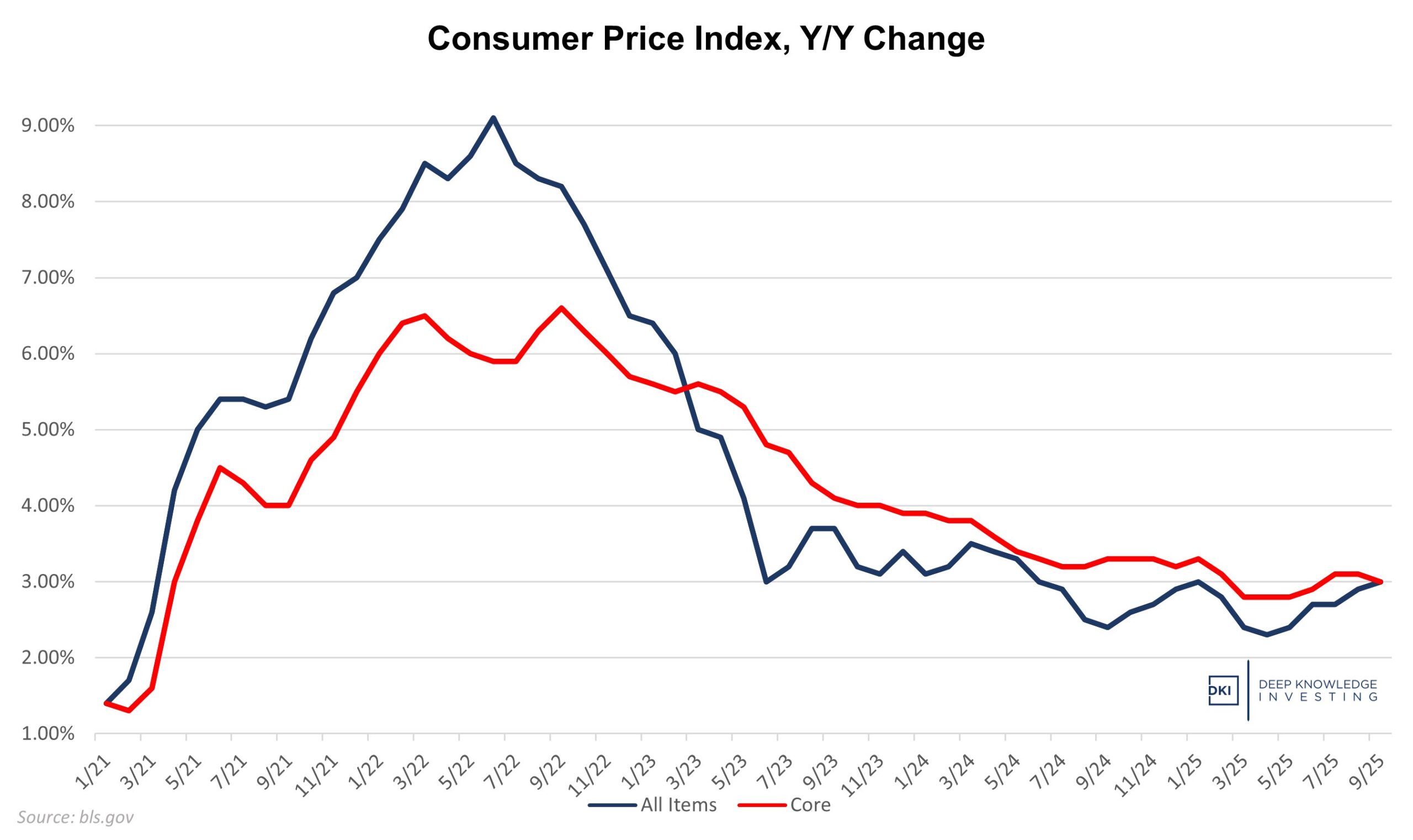

Last week’s CPI came in at 3.0% (both all-items and Core). The market celebrated because the all-items was 0.1% below expectations leading the market to (correctly) decide that meant the Fed had to cut. Strangely enough, the Fed seems to agree and has continued a cutting cycle with the CPI well-above the 2% target. The Fed has now made six 25bp cuts ALL with the CPI above target. Should we conclude the target has changed?

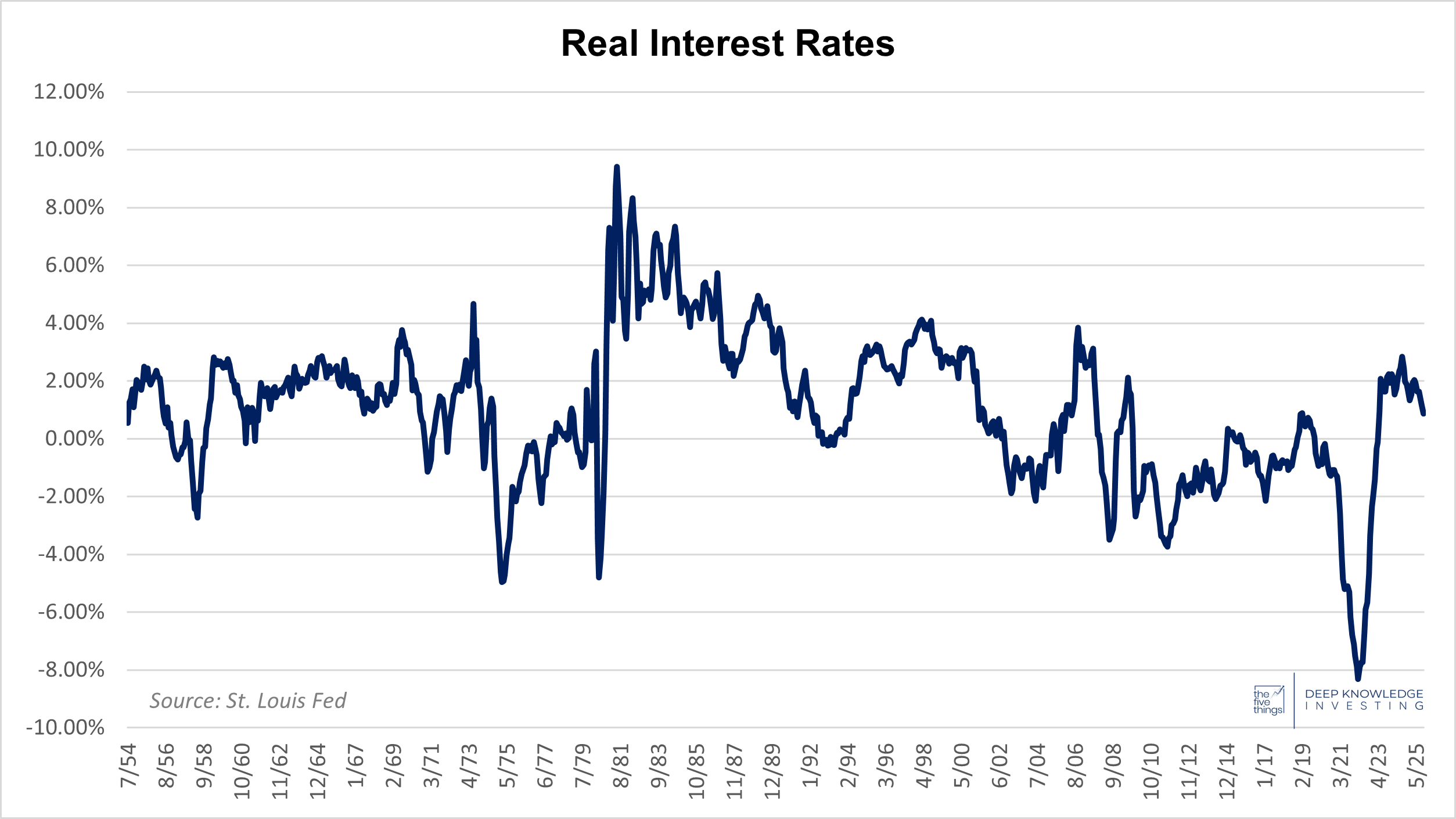

I’d argue that the answer here is yes and this is being done intentionally. Powell previously said that because the CPI had been below target for a while, the Fed’s new policy was to average 2% over time meaning above 2% for a while. We’ve been above 2% for almost five years. Previous Fed Chair, Janet Yellen, famously lamented not creating more inflation. During his press conference, Powell talked about the current fed funds rate being “restrictive”. Let’s look at the results:

The last time the CPI was under 2% was early 2021.

Real rates are UNDER 1%. That’s NOT restrictive.

It’s Worse if You Don’t Believe the CPI:

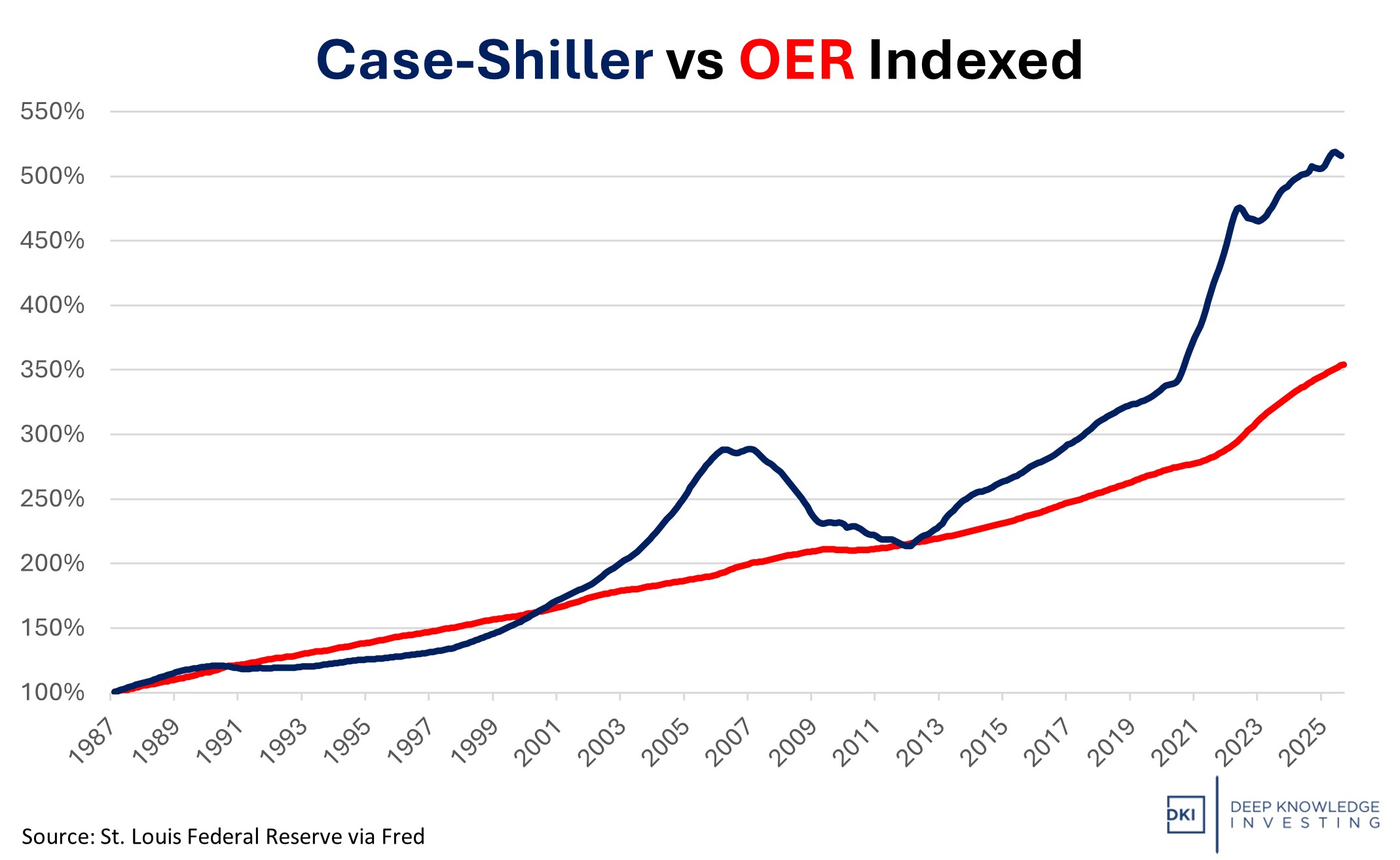

I’ve been pointing out that the CPI is hugely understated since early 2022. The Bureau of Labor Statistics (BLS) says that food inflation has been around 1% – 2% for the past few years. The number of people using buy now pay later (BNPL) for grocery expenses says otherwise. Is your grocery bill up less than 3%? We’ve seen massive understatement of things like health and home insurance.

The biggest area of disparity relates to the massive shelter (housing) sector. The BLS uses a flawed metric called Owners’ Equivalent Rent (OER) which asks homeowners to estimate the rent for the home they own. It trails the Case-Shiller index, which measures transactions (not guesses) by a massive amount:

OER understates housing inflation – which is why the BLS uses it.

The Fed just moved its inflation target from 2% to something in the 3% – 4% range – AND – the CPI is understated. They’re cutting into 5% – 6% inflation.

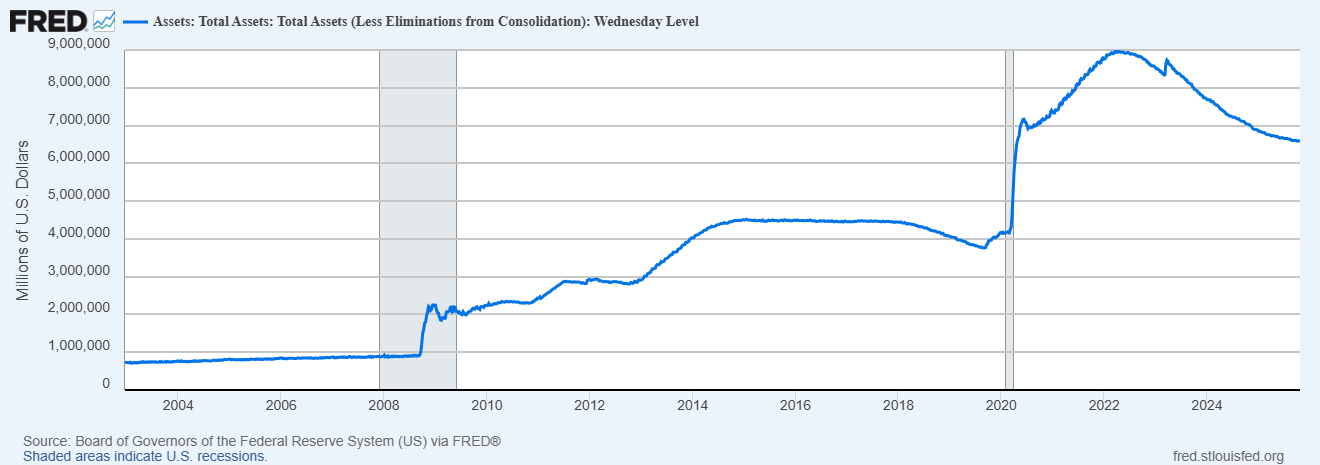

QT is Over – Pushing on a String:

The Fed did a better job reducing its balance sheet than I anticipated they would. In recent years, they’ve cut from $9T to a little over $6 ½ trillion. However, they’re stopping well short of the pre-pandemic $4T level. They’ll have that much less dry powder during the next crisis, and there’s always a next crisis. The Fed balance sheet is like pouring water onto a towel. The towel absorbs more water until it becomes saturated and stops working. Pouring more water on the towel results in no additional benefit. During his press conference, Powell talked about growing the balance sheet over time to match the growth in the economy.

QT was good while it lasted.

Upon re-reading this, I’ve described the situation as less dry powder, a towel that won’t absorb more water, and pushing on a string. I have no additional metaphors for ineffective action. (I’m going to need to publish this before my editor can yell at me.)

The Bond Market is Acting as DKI Predicted:

I’ve been saying for the past year and a half that rate cuts wouldn’t be effective. The Fed only controls the overnight rate. The bond market controls the rest of the yield curve. As I write this, the yield on the 10-year Treasury is UP by 8bp. The bond market is correctly pricing in higher future inflation. If the Fed cut is intended to lead to lower borrowing rates and lower mortgage rates, it’s not working. Instead, what we’re going to get is higher asset prices. We’ve seen that in gold, Bitcoin, and growth equities.

Conclusion:

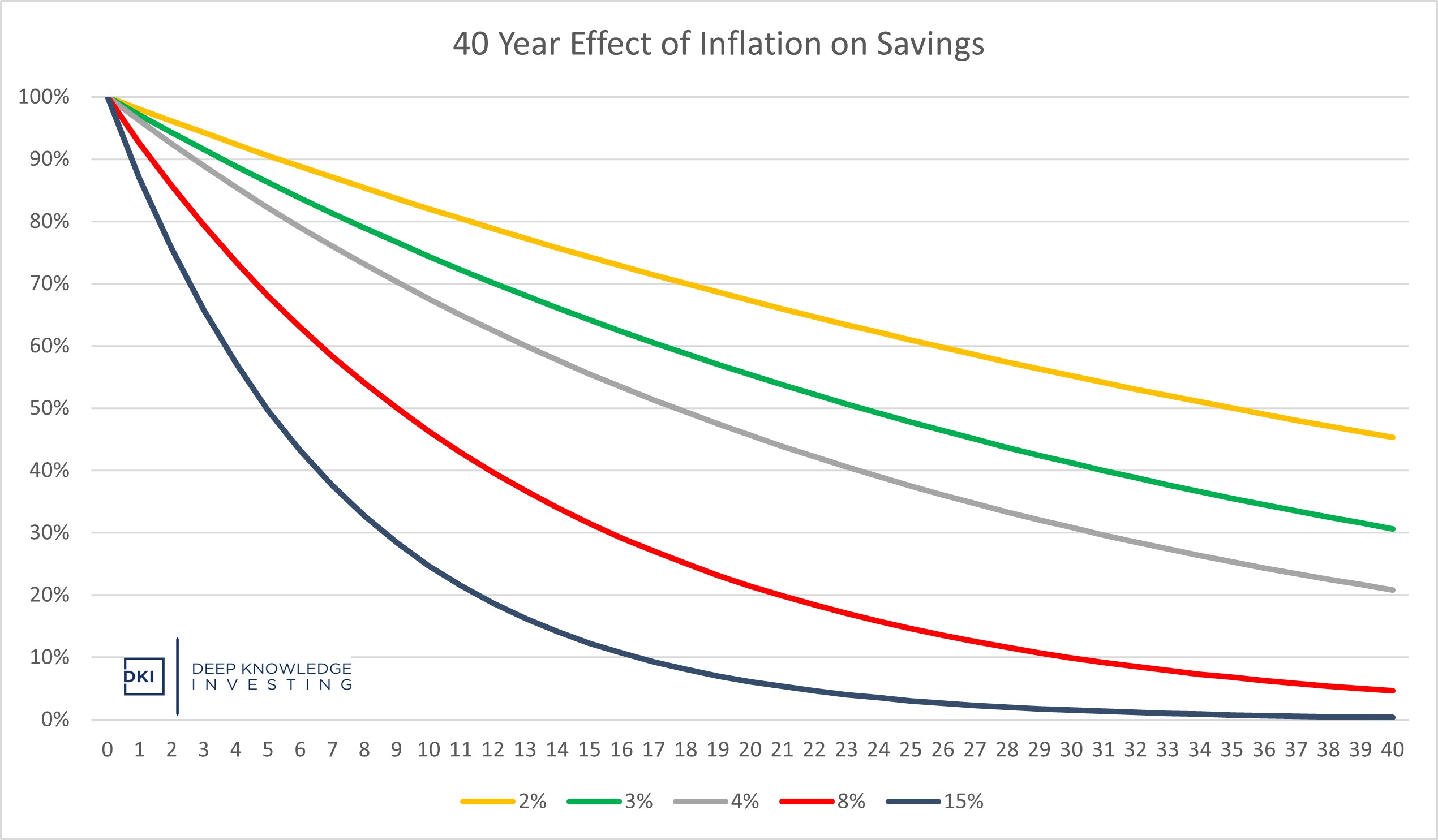

The Fed’s real mandate is “stable prices”. That’s a 0% inflation rate which incentivizes saving and investing. The 2% target is 2% too high. Some of you might say that a 3% – 4% target isn’t a big difference. I both think that the CPI is understated and that the 1% – 2% difference is material:

Going from 2% to 3% – 4% matters.

I read an excellent piece of analysis over the weekend explaining why Americans care more about inflation than unemployment. Raising the unemployment rate to 5%, a number considered high, only hurts 1% of the country. High inflation hurts 99% of the country. While I’ve been critical of Chairman Powell and the Fed, they’re not the real cause of the problem right now. As long as Congress overspends by trillions a year, we’ll have an inflation problem. That’s been an unbreakable trend regardless of whether team red or team blue is in charge. We can’t vote our way out of this.

DKI has an anti-black-pill policy. The fact that I don’t like that our government is debasing our currency is irrelevant. Prepare your portfolio for higher long-term inflation. Own hard assets that can’t be easily replicated. I have fiat-based debt backing hard assets. Just because I disagree with policy doesn’t mean we can’t make money from it. If you want help, just reach out and we can talk.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.