Overview:

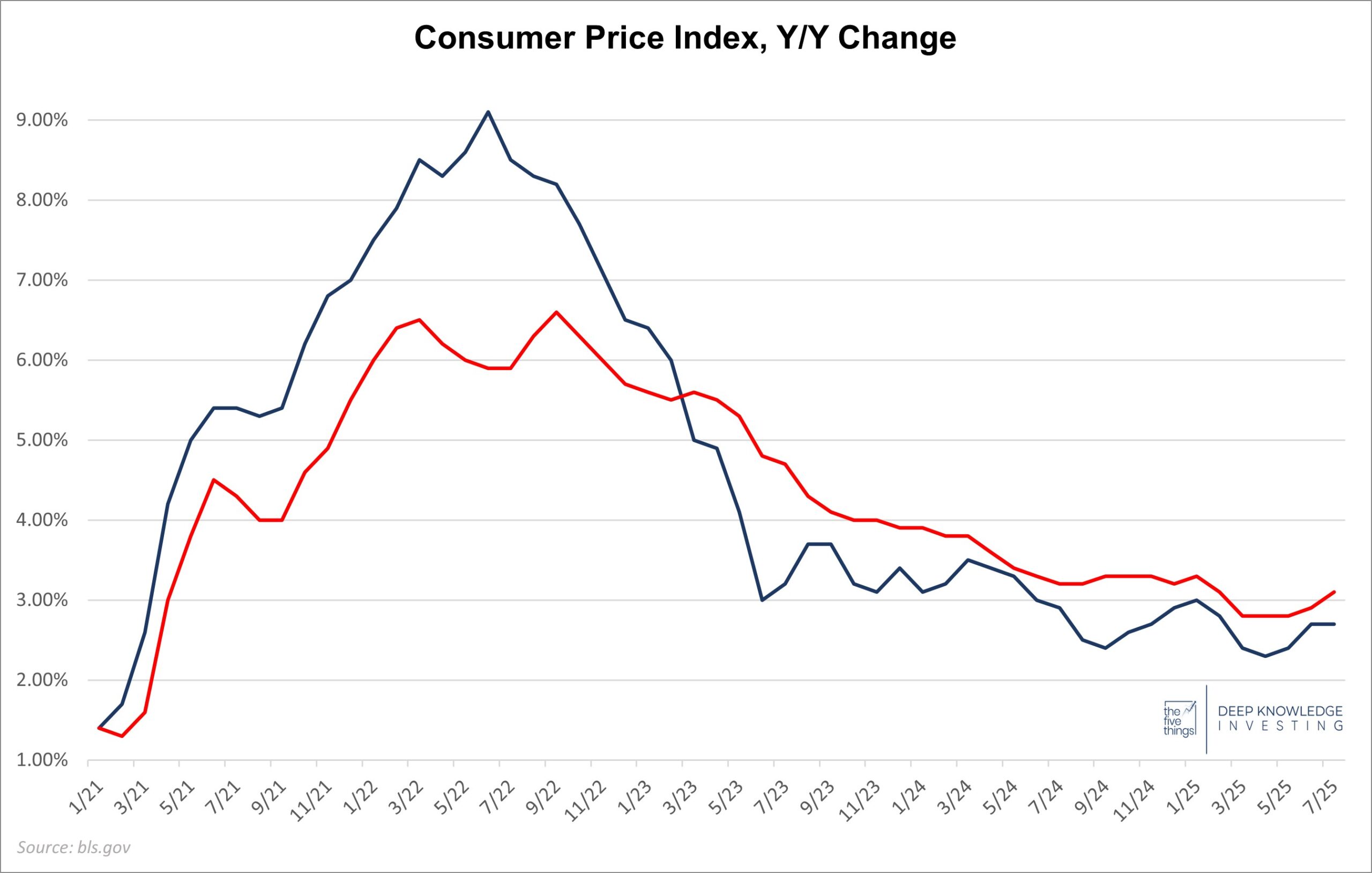

Today, we got the July Consumer Price Index (CPI) report which showed an overall increase of 2.7% for the last year and up 0.2% for the month (annualizes to 2.4%). The annual number is flat from June and 0.1% below expectations. The monthly is up 0.2% and consistent with expectations. The Core CPI which excludes food and energy was up 3.1% vs last year and up 0.3% for the month. The yearly Core number was above last month’s 2.9% and 0.1% above expectations. The monthly was consistent with last month and in line with expectations. Let’s go through the details:

Trending up a couple of months in a row.

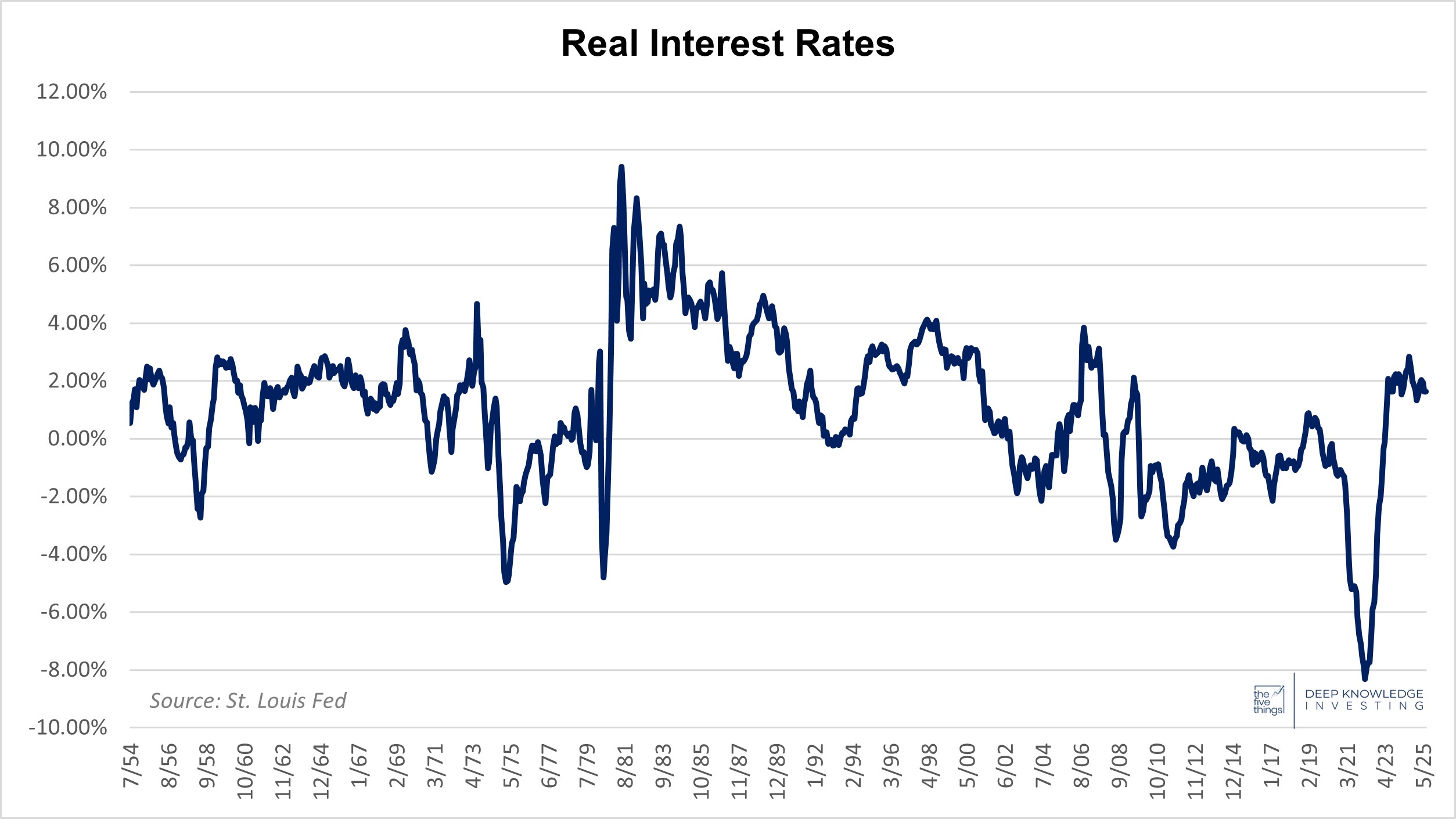

Still below 2%. The Fed is not “restrictive” as many claim.

Food:

Food inflation came in at 2.9%, slightly down from last month and well above the recent 1% -2% numbers that I thought were understated. Food at home was up 2.2%, a decrease from last month. Food away from home is now up 3.9%, slightly above last month. The monthly figures had been up 0.4% in four of the past five months; however, we saw a reversal of that trend this month. Food at home prices were down 0.1% vs June and food away from home was up 0.3% vs June. That’s not great, but not as bad as the prior five months.

We continue to note that both the rate of increase and price levels for food purchases are creating stress in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families. Recent trends show an increase in consumers using buy now pay later for groceries. Financing your groceries in this way is not an encouraging sign for the health of the consumer.

Energy:

Energy prices remain a tailwind, down 1.6% vs last year. Energy was down 1.1% vs last month. Gasoline was down 9.5% vs last year, fulfilling one of President Trump’s big campaign promises. Fuel oil was down 2.9% despite efforts from the White House to further limit supply from Russia.

The President is using tariff pressure on India to try to get them to buy less Russian oil. DKI has said many times that the anti-Russian sanctions in general, and efforts to limit sales of “Russian” oil in particular were going to be and have been ineffective. Adding tariffs to purchasers is a new tactic. We’ll see if that works, but in general, if everything the US has thrown at the Russian economy for the past three and a half years hasn’t worked, it’s time to recognize that they’ve insulated themselves from our pressure/influence.

Vehicles:

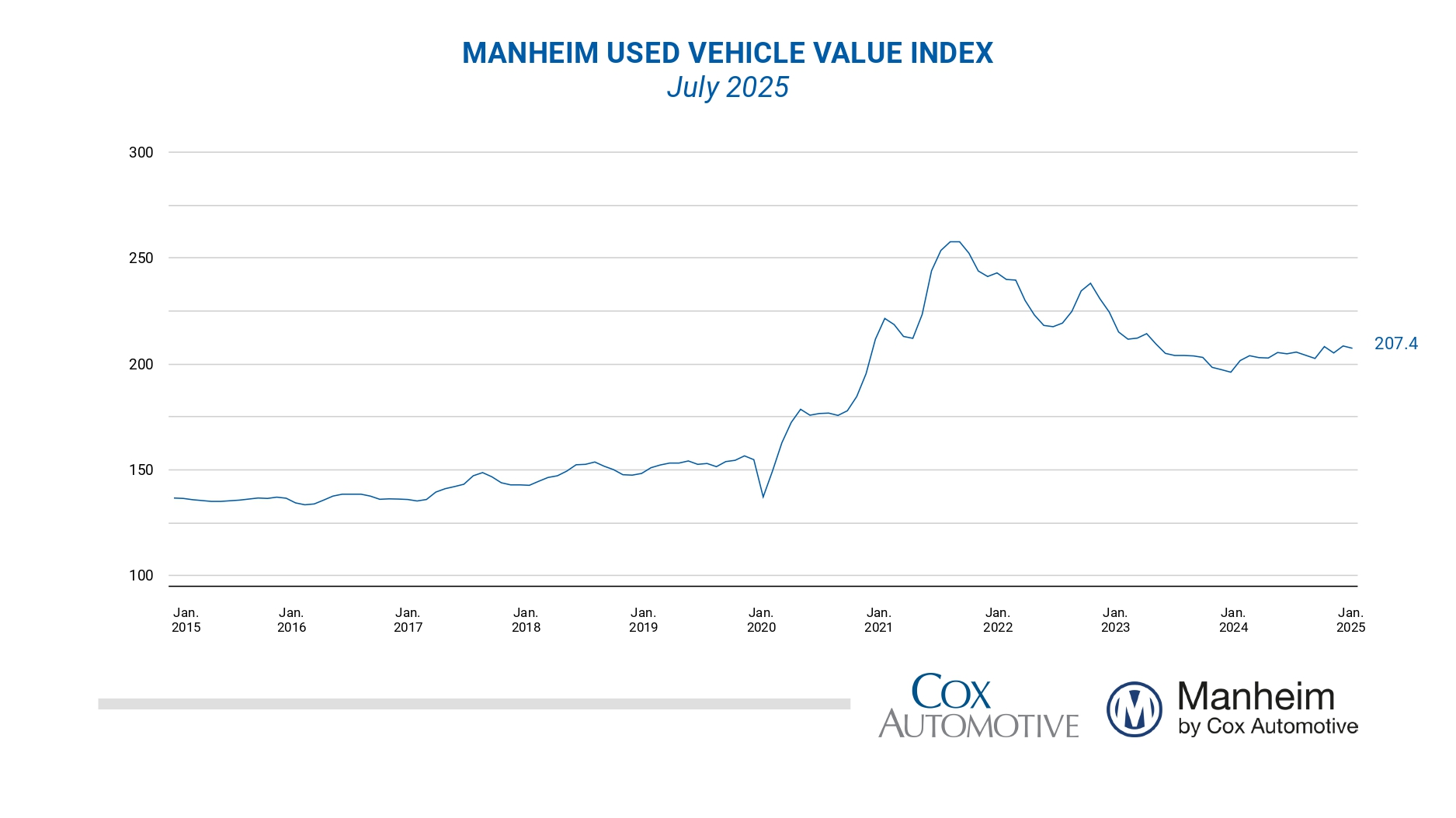

New vehicle pricing flat for the month and up only 0.4% y/y. The monthly changes there have been very small for months. Used vehicle pricing was up 4.8% and up 0.5% vs last month. That reverses four straight months of declines. After years of volatility, car prices have reached a more stable plateau (although one well above the pre-Covid levels). There’s also a substitution effect. As new cars become increasingly unaffordable, that increases demand and pricing for used cars.

After a huge increase and some retracing, we’ve reached a more stable plateau.

Services:

Services prices were up 3.6%, the same as last three months (the definition of “sticky”). Much of the increase has been caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. In addition, recent employment data has been slightly hugely misleading.

The recent firing of the head of the Bureau of Labor Statistics led to wailing that the “integrity” of US data collection was being impaired. In the last three years, we’ve had downward adjustments of 258k, 818k, and 832k jobs. @JamesLavish made a convincing case that the BLS isn’t getting good data. He’s probably right causing me to ask what the BLS has been doing to improve that. The job is to produce good data that’s reliable. The inability to do that is what’s led to a loss of “integrity” and trust.

It’s also worth noting that recent decreases in jobs have been partially caused by decreases in government positions. While DOGE wasn’t able to do everything they wanted to do, any shift from the government to the productive private sector is welcome.

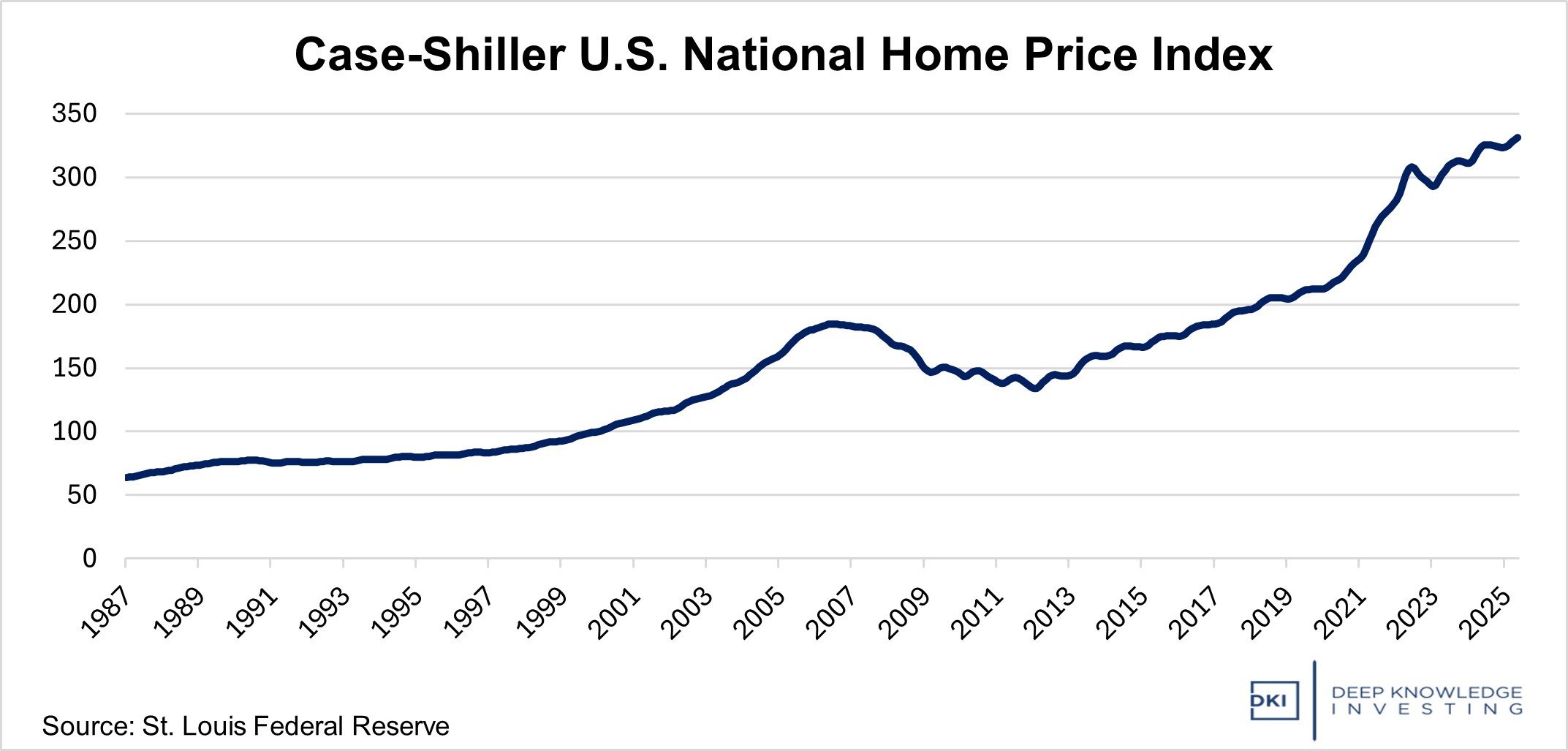

Shelter (a fancy word for housing) costs were up 3.7% which was roughly consistent with last month and again “was the primary factor in the all items monthly increase”. I’m seeing reports of weakness in several large local housing markets, but the overall trend has been continued increases in shelter prices. Worth noting: Because it takes a few months for housing sales to move from contract to completion, this data tends to lag by a comparable time period.

Still the primary reason for the increase in the CPI – not tariffs.

Conclusion:

Yet again, the big increase was shelter. Despite all the predictions of catastrophe from fiat economists relating to the Trump tariffs, disaster simply hasn’t happened. We were warned the tariffs would lead to massive inflation. That then got altered to a big one-time increase in the price level which would then be stable. Then, there were threats that tariffs would lead to decreased trade and a worldwide recession. None of that has happened. In my opinion, the CPI and the Core CPI in particular are still too high, but there were a lot of people worrying that today’s monthly increase would be 0.4% or higher instead of the much more manageable 0.2%.

In fairness to these economists, many have made the case that it will take a few more months for these higher prices to move through complicated supply chains. If they’re right, we should start seeing the predicted inflation Armageddon in the next couple of months. I continue to believe that people are underestimating the possibility that President Trump’s threats will land us with LOWER tariffs all-around. Talks with other nations aren’t resulting in deals as quickly as many hoped, but recent deals have been struck at levels below where many feared. There have also been trillions of dollars of announcements of new US manufacturing capacity. Increased domestic supply will offset much of the fears of higher tariff-based imports.

I do think we’ll see continued inflation. However, I think the cause of that will be continued overspending in Washington DC. Both parties overspend. Multi-trillion-dollar deficits, skyrocketing interest expense, and massive unpayable off-balance sheet liabilities will all lead to an increase in the money supply. That’s the proper definition of inflation. The DKI portfolio is well-positioned for such things, but owning Bitcoin and gold is the easiest way to profit from the continued debasement of the money supply (which will continue with or without tariffs).

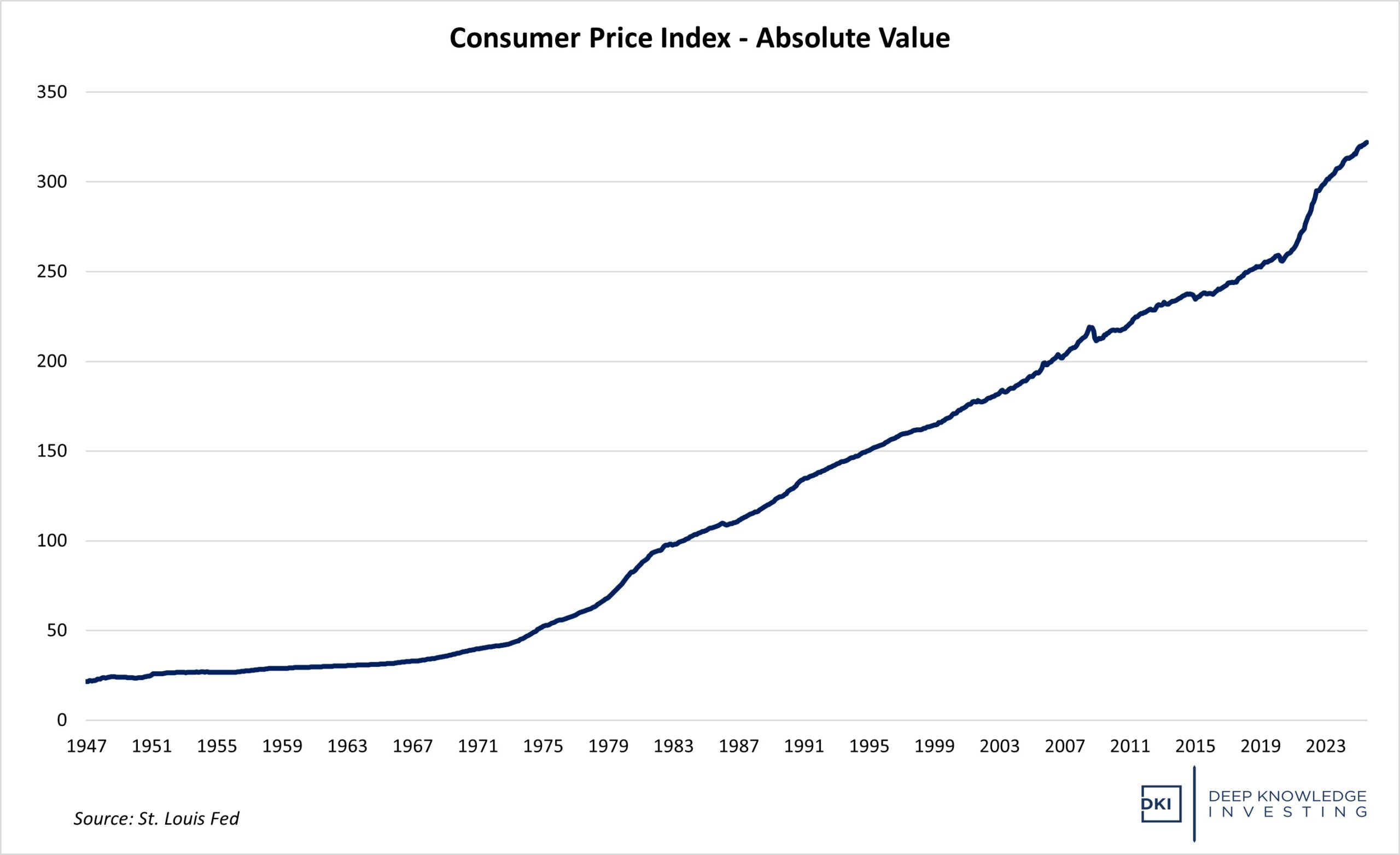

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

We continue to see signs of increasing consumer credit stress. As buy now pay later loans are being reported to credit scoring agencies, many Americans are seeing their FICO scores fall. Credit card and auto loan delinquencies are increasing. Those with student loans are now again responsible for making payments and leading to further decreases in credit quality for millions. We’ve seen reports from those with student loans complaining that they now have to reduce discretionary spending because the multi-year break from payment requirements has expired. It’s interesting that so many chose to spend this temporary break from payment requirements rather than save or invest the money. Our culture needs to have a change in our relationship with spending and debt. That change should start in Congress.

As I write this, equity index futures are up. That’s because the lower-than-expected headline CPI print will ratchet up pressure on the Fed to cut at the next meeting. President Trump is demanding an accommodating dovish Fed and is already starting the process of putting his own more pliable Governors in place. While I disagree with this policy, the job is to predict what’s going to happen and find ways to profit from it. The market is currently saying the probability of a near-term Fed cut is better than 50% and rising. I agree. Powell might be able to hold out for another month by claiming he wants to see one more month of data and noting that the CPI remains above the 2% target (which I maintain is 2% too high). Still, we should expect at least a hat tip of a 25bp cut at one of the next two meetings.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.