Overview:

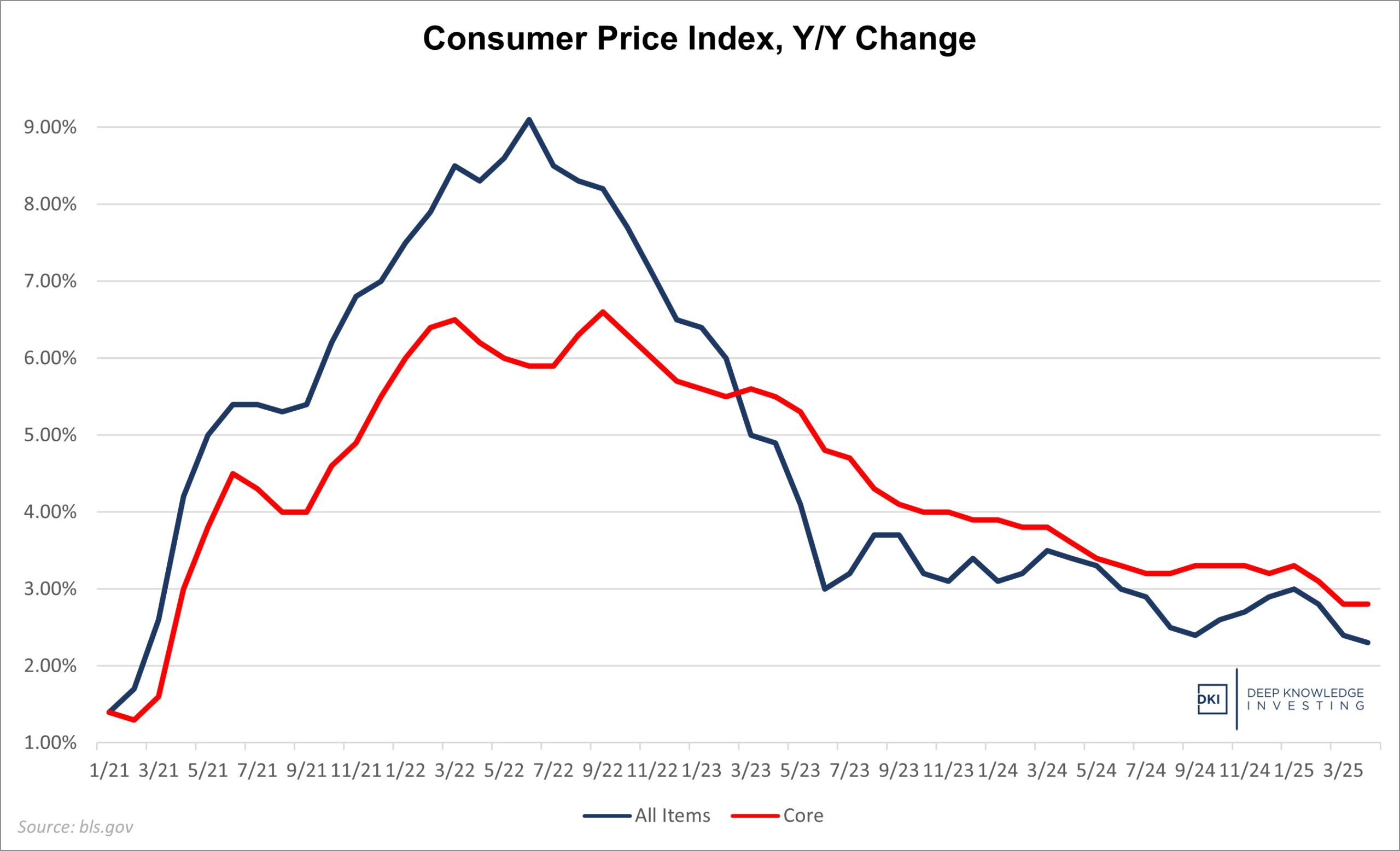

Today, we got the April Consumer Price Index (CPI) report which showed an overall increase of 2.3% for the last year and up 0.2% for the month. Those are both 0.1% below expectations. The 0.2% monthly increase reverses last month’s -0.1% deflation figure. The Core CPI which excludes food and energy was up 2.8% vs last year and up 0.2% for the month. That’s consistent with the prior month and in line with expectations. Let’s go through the details:

All items improving. Core still sticky.

Back at 2%. That’s a normal rate.

Food:

Food inflation came in at 2.8%, slightly down from last month but well above the recent 1% -2% numbers that I thought were understated. Food at home was up 2.0%, a decrease from last month. Food away from home is now up 3.9%, continuing to rise. Restaurant prices and increased tipping demands are pushing more people to eat at home. Even fast-food places known for their low prices, have taken such large price increases that their budget-conscious customers are visiting less often.

We continue to note that both the rate of increase and price levels for food purchases are creating stress in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families.

Energy:

Energy has been an overall tailwind for the CPI following the huge increases in 2022. Energy prices were down -3.7% vs last year, but up 0.7% for the month. Gasoline was down 11.8% y/y, and down 0.1% for the month. Fuel oil was again a big mover declining by 9.6% vs last year and 1.3% vs last month. President Trump is trying to bring down energy prices. That’s happened, but not necessarily in the way he hoped. Concerns about a worldwide recession due to tariff plans have reduced energy prices. Worldwide markets are projecting a decrease in future demand. Energy was again THE reason for this month’s lower-than-expected CPI. We’ll see if future progress in talks with China reverses this trend.

Vehicles:

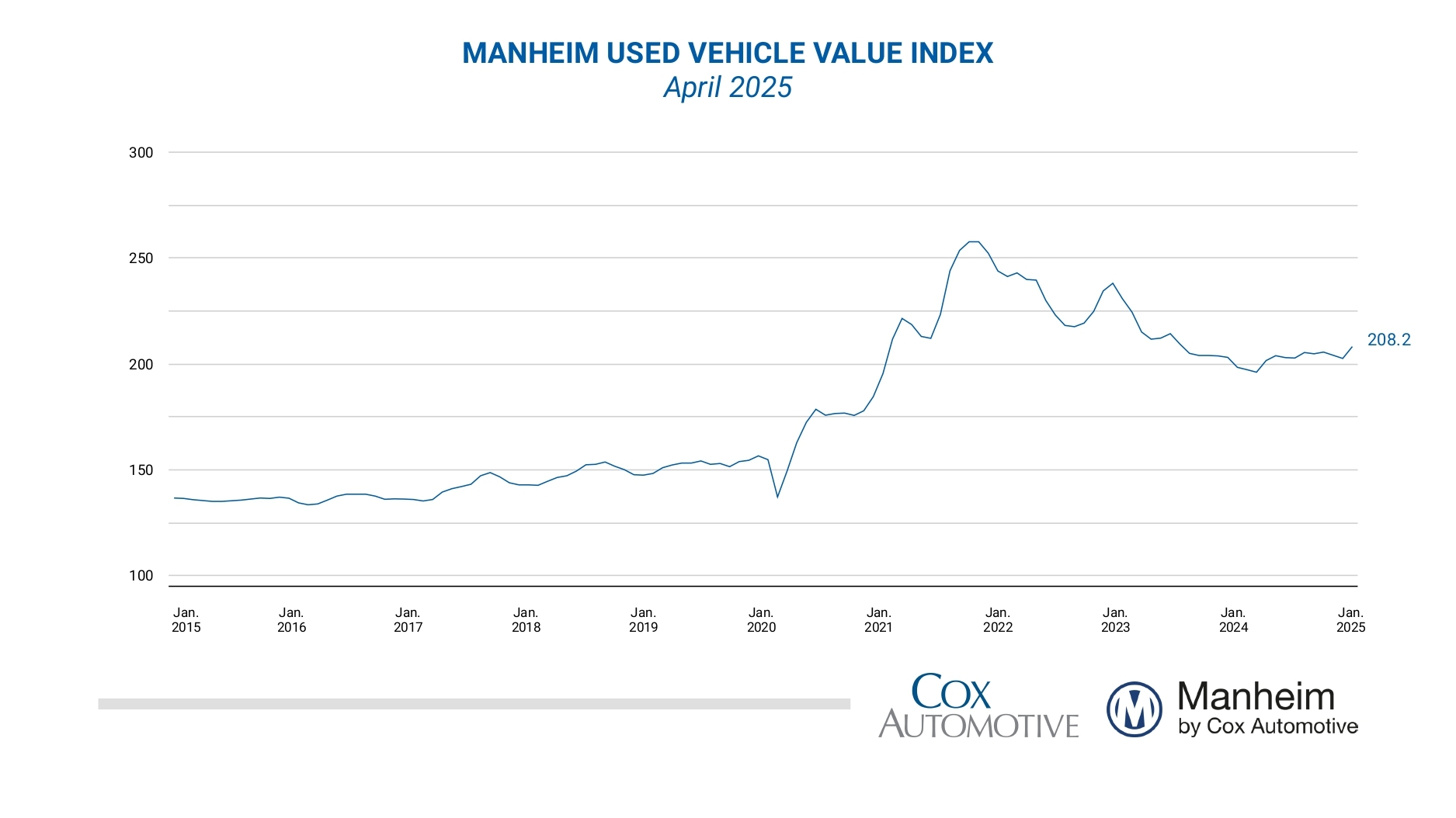

New vehicle pricing was flat for the month and up only 0.3% y/y. The monthly changes there have been very small for months. Used vehicle pricing was up 1.5%, but down 0.5% vs last month. After months of increases, the last two months have shown lower prices. Much of the Covid-related run-up in used car prices has been alleviated, but at this point, further pricing improvements have stalled. There’s also a substitution effect. As new cars become increasingly unaffordable, that increases demand and pricing for used cars.

The CPI has a small decrease and Manheim has a small increase.

Services:

Services prices were up 3.6%, roughly the same as last month. Much of the increase has been caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. In addition, we’re about to start seeing the effect of a reduction in government employment in the next few months. For the last few years, job growth has been in government jobs or jobs heavily funded by the government. DOGE might put this trend in reverse, although without much loss in national production.

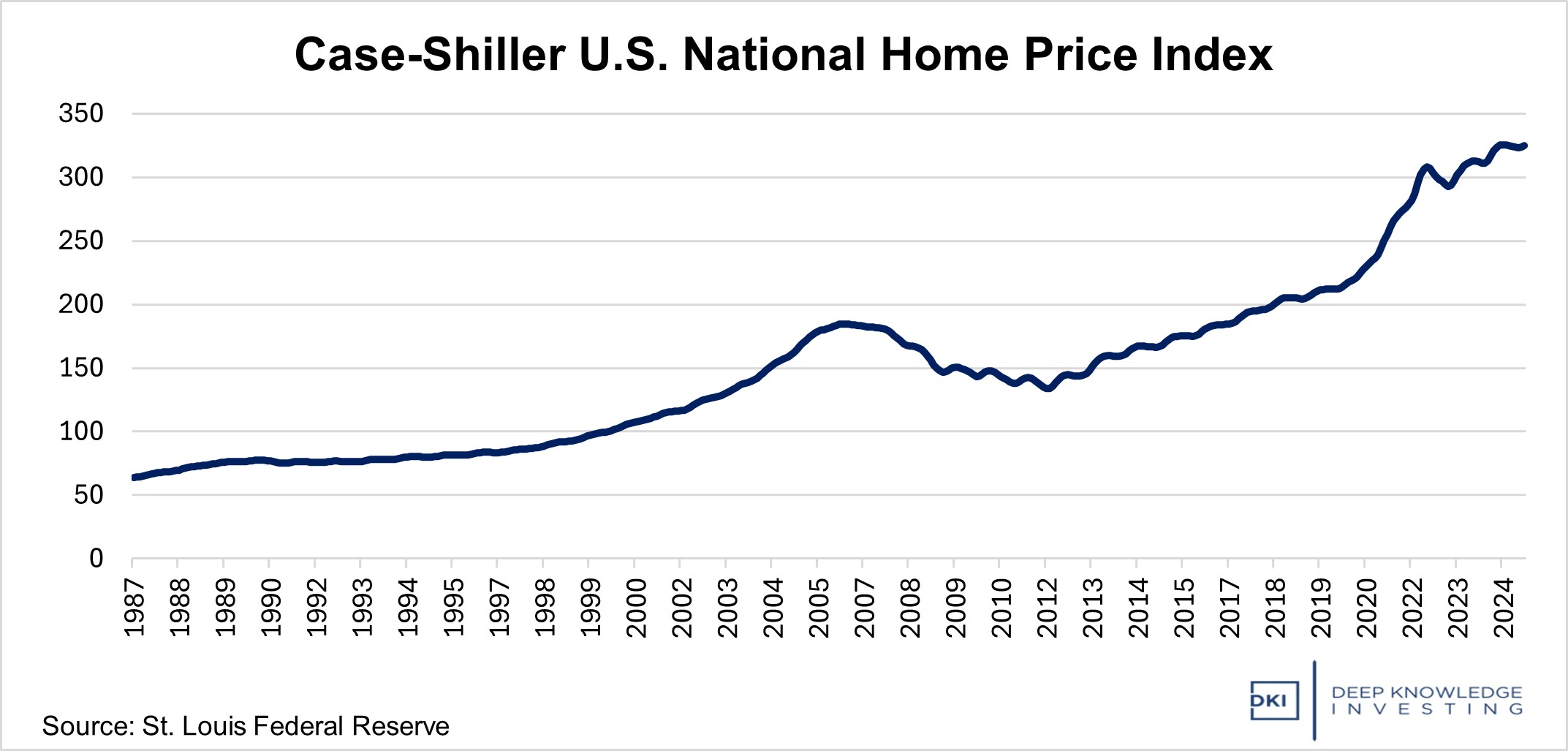

Shelter (a fancy word for housing) costs were up 4.0% which was consistent with last month and accounting for more than half of this month’s CPI increase.

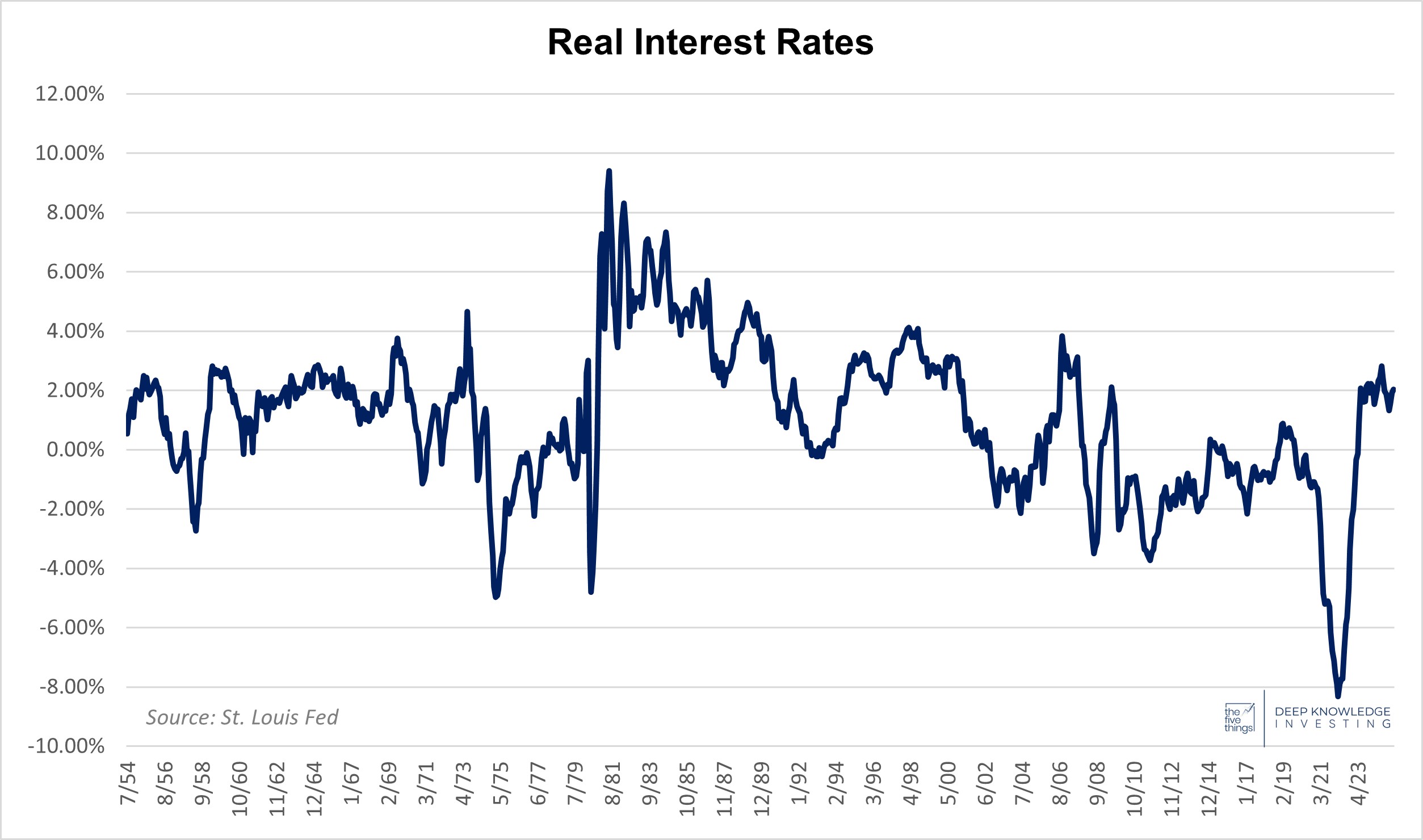

The Trump Administration is trying to reduce the yield on the 10-year Treasury because due to some unwise political gamesmanship by former Secretary Yellen, they have to refinance another $7 trillion in the next 12 months. They were making progress, but concerns about tariffs reduced the perception of the dollar as a safe haven and also caused some foreign countries to talk about reducing their Treasury holdings. The 10 year yield is up just slightly over the past month.

Still getting more expensive – just at a slower rate.

Conclusion:

Tariffs are the big story right now. While the FinX community is screaming about the benefits of free trade, it appears to me that people are underestimating the possibility that President Trump’s threats will land us with LOWER tariffs all-around. It appears the US already has a deal with the UK and recent talks with China have resulted in both sides lowering tariff levels for the next 90 days to continue what appear to be productive discussions. Dozens of other countries are now trying to work out deals with the White House.

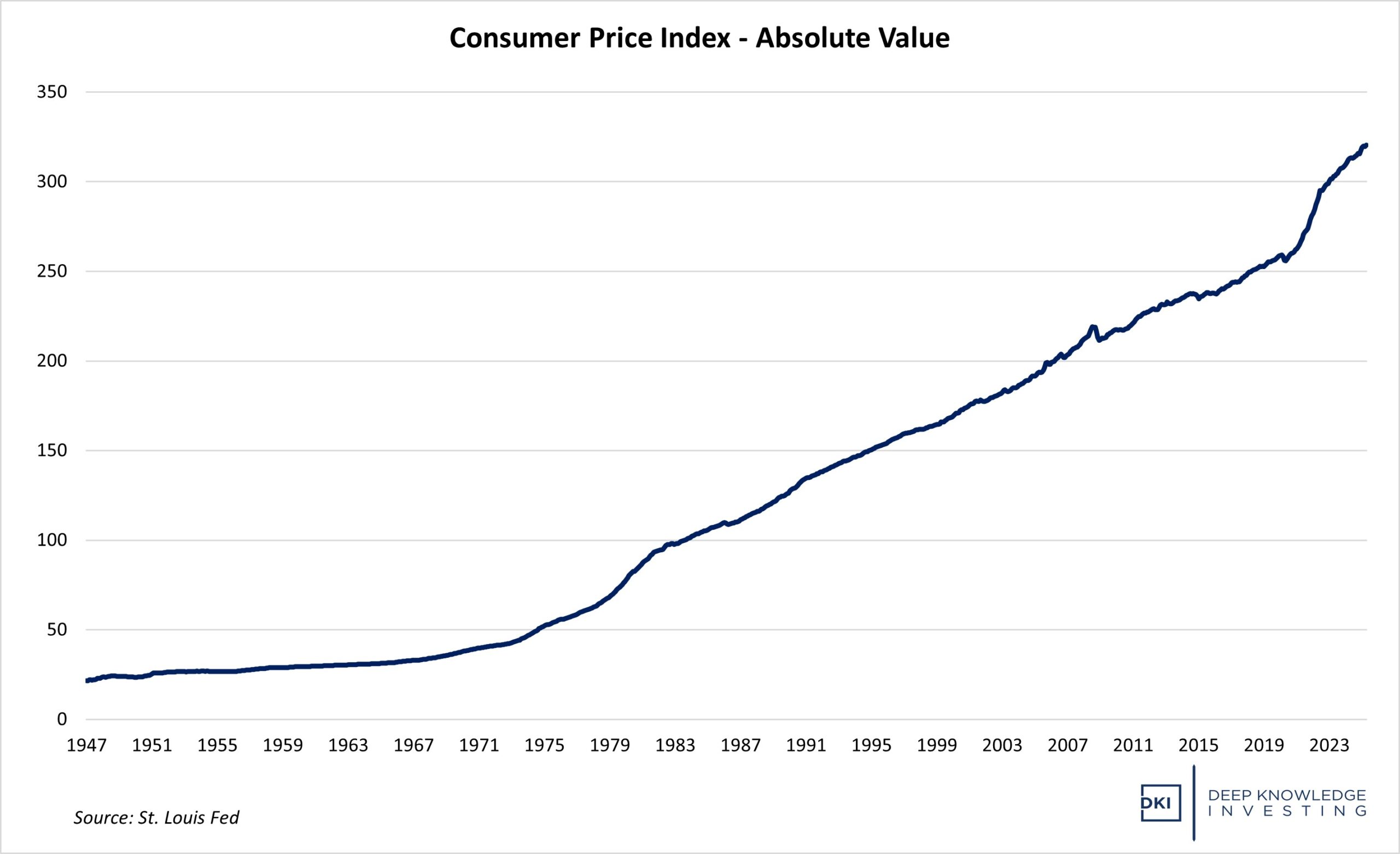

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

One positive trend we’re seeing is a meaningful increase in the savings rate for Americans as well as more investing in the stock market by retail investors. As more people become concerned about the economic future, saving and investing more looks like a smart choice. The other side of that is both use of credit and delinquencies are rising as well. Buy now, pay later is going to be a significant problem for many young people who somehow think that if you don’t pay for something at the point of purchase it’s “free”.

The Fed kept rates flat at last week’s meeting and today’s lower CPI print will increase pressure on them to cut soon. The difficulty they’ll have is a lower overnight rate is likely to lead to higher 10-year rates as the bond market prices in expected higher future inflation. There is little the Fed can do right now without spending cuts from Congress, something I do not expect to see despite a lot of click-bait headlines saying otherwise.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.