Overview:

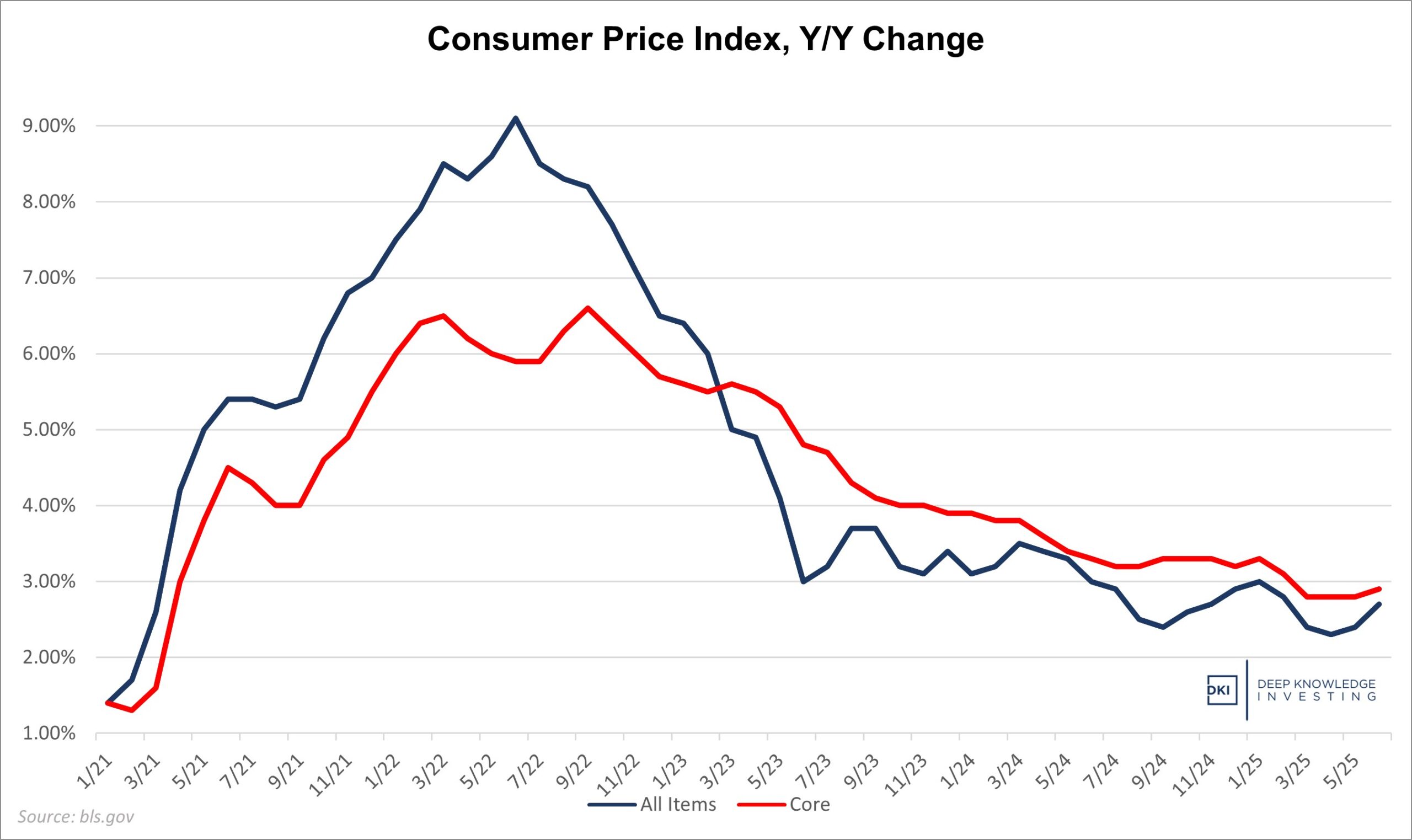

Today, we got the June Consumer Price Index (CPI) report which showed an overall increase of 2.7% for the last year and up 0.3% for the month (annualizes to 3.7%). The annual number is up 0.3% from May and 0.1% above expectations. The monthly is up 0.2% and consistent with expectations. The Core CPI which excludes food and energy was up 2.9% vs last year and up 0.2% for the month. The yearly Core number was above last month’s 2.8% and in line with expectations. The monthly was 0.1% above last month and 0.1% below expectations. Let’s go through the details:

Trending up a couple of months in a row.

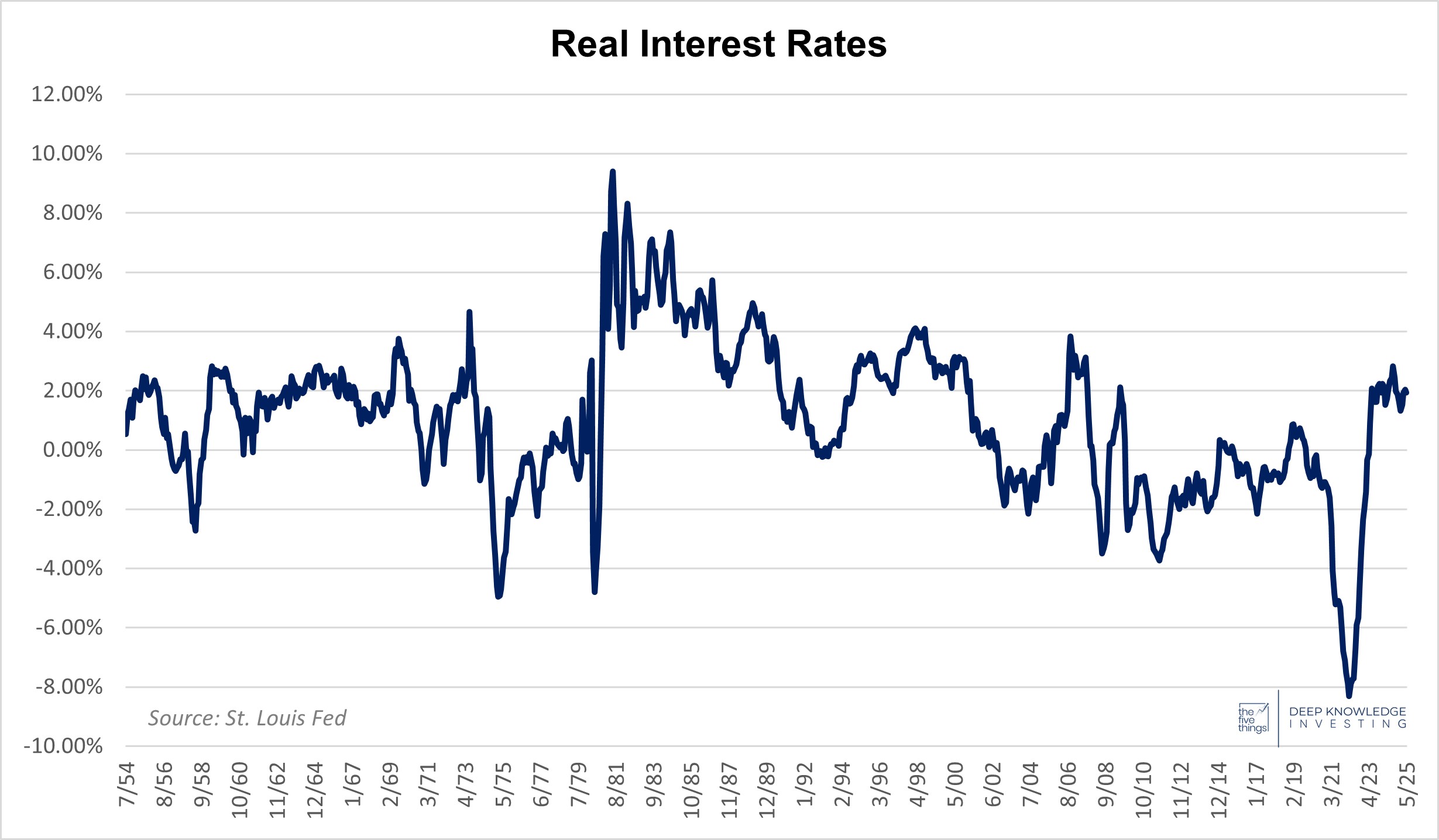

Still below 2%. The Fed is not “restrictive” as many claim.

Food:

Food inflation came in at 3.0%, slightly up from last month and well above the recent 1% -2% numbers that I thought were understated. Food at home was up 2.4%, an increase from last month. Food away from home is now up 3.8%, consistent with last month. The monthly figures have been up 0.4% in four of the past five months. That annualizes to almost 5%. Restaurant prices and increased tipping demands are pushing more people to eat at home. Even fast-food places known for their low prices, have taken such large price increases that their budget-conscious customers are visiting less often.

We continue to note that both the rate of increase and price levels for food purchases are creating stress in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families. Recent trends show an increase in consumers using buy now pay later for groceries. Financing your groceries in this way is not an encouraging sign for the health of the consumer.

Energy:

Energy has been an overall tailwind for the CPI following the huge increases in 2022. Energy prices were down 0.8% vs last year, and up 0.9% for the month. Gasoline was down 8.3% y/y, and up 1.0% for the month. Given the recent hostilities between Iran and Israel, this could have been worse. Fuel oil prices declined by 4.7% vs last year but were up 1.3% vs last month, the second straight month of increases.

The end of active hostilities between Iran and Israel in addition to likely increases in OPEC production could bring oil prices down further. Oil prices will also be dependent on global growth estimates. In turn, those estimates will depend on where tariff levels settle following this round of negotiations.

Vehicles:

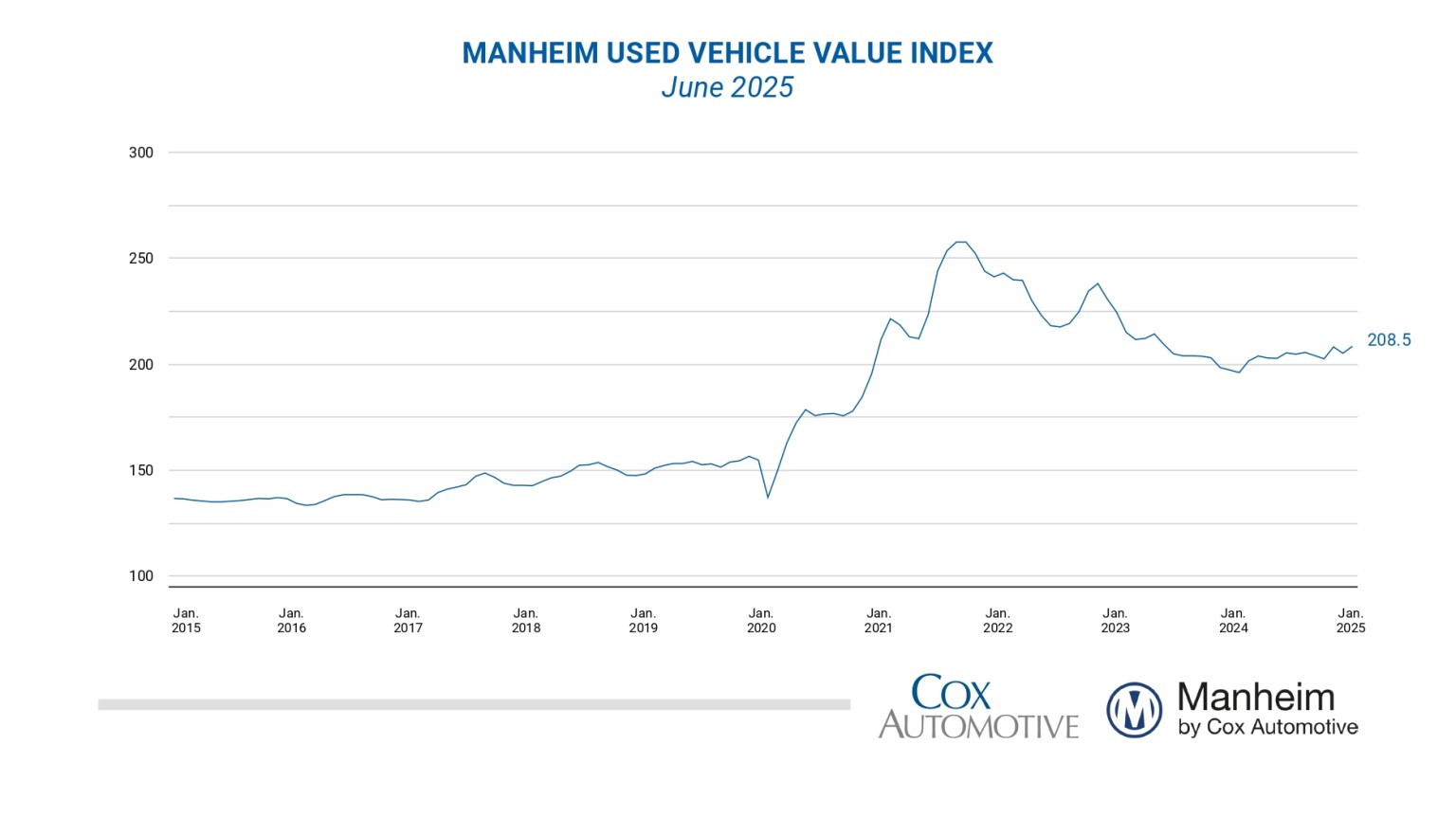

New vehicle pricing was down 0.3% for the month and up only 0.2% y/y. The monthly changes there have been very small for months. Used vehicle pricing was up 2.8%, but down 0.7% vs last month. After months of increases, the last four months have shown lower prices. Much of the Covid-related run-up in used car prices has been alleviated, but at this point, further pricing improvements have stalled. There’s also a substitution effect. As new cars become increasingly unaffordable, that increases demand and pricing for used cars. Overall, it looks like we’ve reached a stable pricing level for auto prices although still meaningfully higher than the pre-covid level.

After a huge increase and some retracing, we’ve reached a more stable plateau.

Services:

Services prices were up 3.6%, the same as last two months. Much of the increase has been caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. In addition, recent employment data has been slightly misleading. They’ve shown an increase in overall jobs. However, a large decrease in government jobs (a reverse of the trend for the past few years), means the productive private economy grew more than the headline numbers suggest.

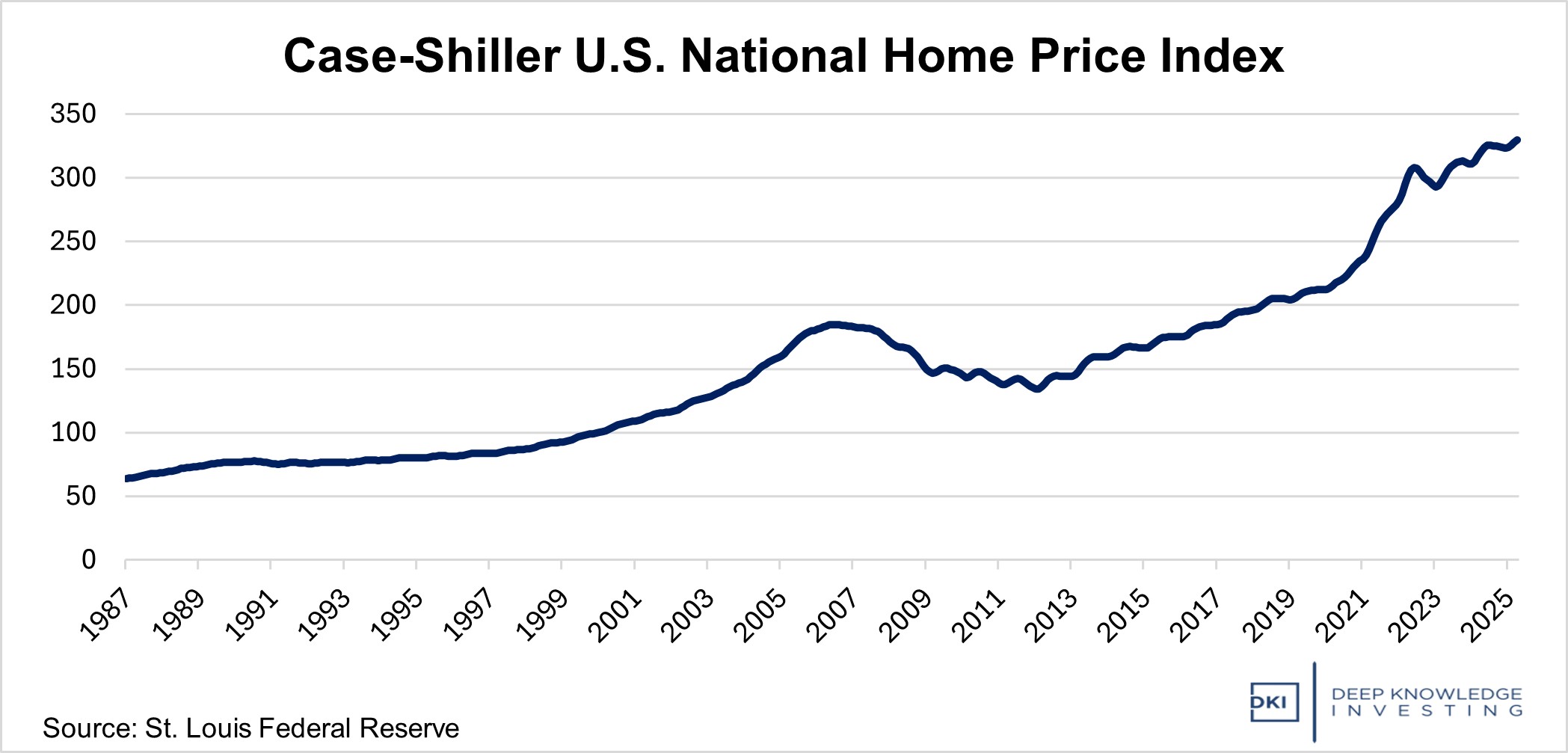

Shelter (a fancy word for housing) costs were up 3.8% which was roughly consistent with last month and “was the primary factor in the all items monthly increase”. I’m seeing reports of weakness in several large local housing markets, but the overall trend has been continued increases in shelter prices. Worth noting: Because it takes a few months for housing sales to move from contract to completion, this data tends to lag by a comparable time period.

Still the primary reason for the increase in the CPI – not tariffs.

Conclusion:

Tariffs are the big story right now. While the FinX community is screaming about the benefits of free trade, it appears to me that people are underestimating the possibility that President Trump’s threats will land us with LOWER tariffs all-around. Talks with other nations aren’t resulting in deals as quickly as many hoped, but recent deals have been struck at levels below where many feared. There have also been trillions of dollars of announcements of new US manufacturing capacity. Increased domestic supply will offset much of the fears of higher tariff-based imports.

The goods sections of the CPI weren’t up very much this month. While these things can take time to move through a complicated supply chain, the tariff-related carnage fiat economists have been carrying on about has not appeared – at least yet. It could happen in the future, but as of now, there is little evidence of the massive price increases that many feared.

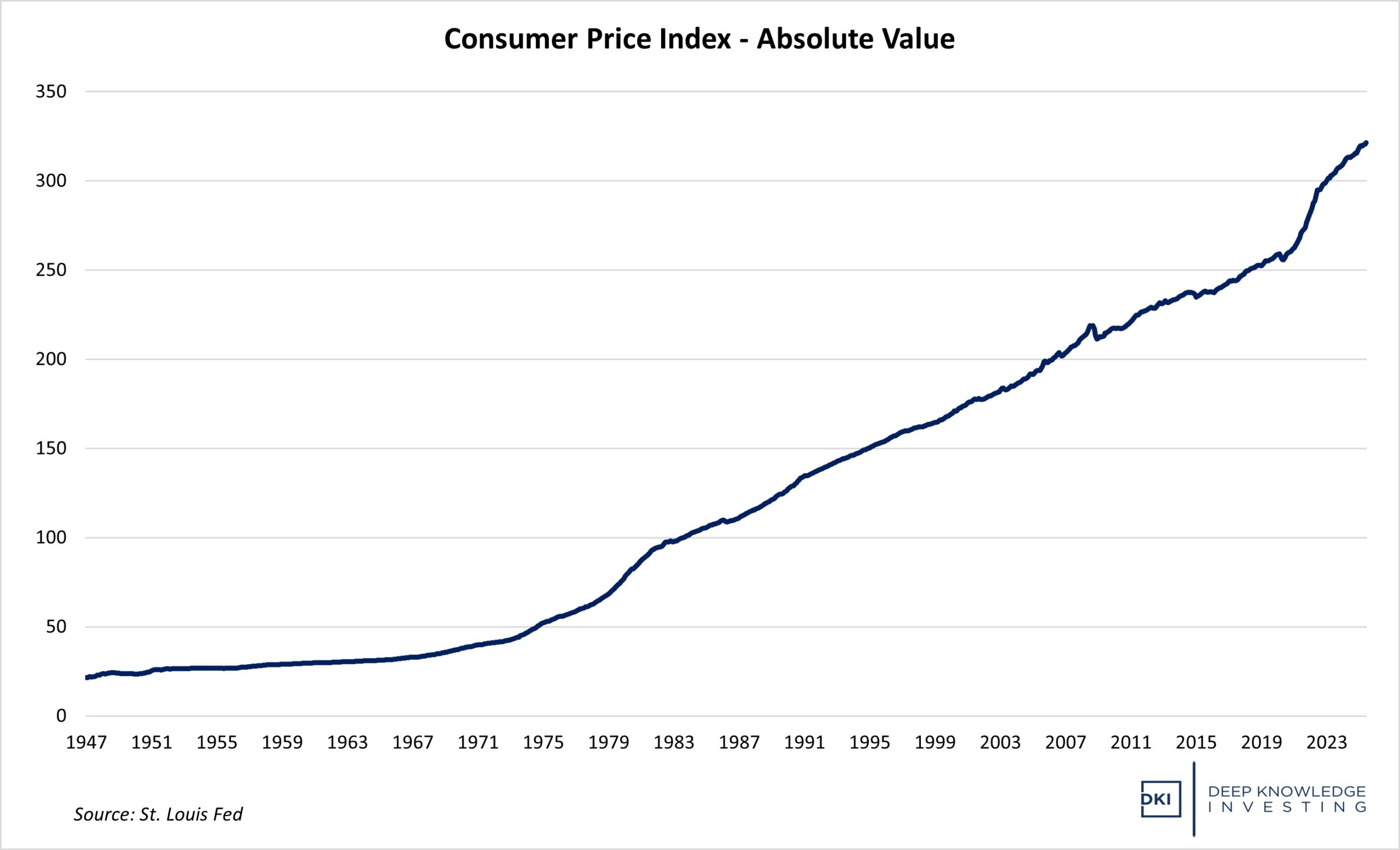

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

We continue to see signs of increasing consumer credit stress. As buy now pay later loans are being reported to credit scoring agencies, many Americans are seeing their FICO scores fall. Credit card and auto loan delinquencies are increasing. Those with student loans are now again responsible for making payments and leading to further decreases in credit quality for millions. We’ve seen reports from those with student loans complaining that they now have to reduce discretionary spending because the multi-year break from payment requirements has expired. It’s interesting that so many chose to spend this temporary break from payment requirements rather than save or invest the money. Our culture needs to have a change in our relationship with spending and debt. That change should start in Congress.

I agree with current consensus that the Fed will keep rates unchanged at the next meeting. The difficulty they’ll have is a lower overnight rate is likely to lead to higher 10-year rates as the bond market prices in expected higher future inflation. There is little the Fed can do right now without spending cuts from Congress, something I do not expect to see despite a lot of click-bait headlines saying otherwise.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.