Quick announcement: I’ll be in Bangkok for the next few weeks. While I’m here, I’m open to a small number of in-person conversations. If you’re based locally, or know someone here you think it would be worthwhile for me to meet, feel free to reach out privately at IR@DeepKnowledgeInvesting.com.

We had most of this issue written by Thursday morning. The ensuing volatility requires some explanation. Word leaked that President Trump had decided that Kevin Warsh would be his nominee to replace Jerome Powell as Chairman of the Federal Reserve. Markets and I had expected the President to appoint a dove (one who favors lower interest rates). Instead, Warsh has a history of making more hawkish (favoring higher interest rates) remarks, especially when it comes to quantitative easing. Gold swung by 10% in a matter of hours on Thursday, then fell more on Friday.. Silver just fell from $120 down to under $100 in less than a day then dropped into the $80s. Bitcoin barely managed to stay above $80k before partially recovering. Let’s explain what’s happening:

Assumed higher interest rates mean a stronger dollar. If you get paid a higher yield, you’ll be more attracted to the asset that pays that yield. Another way of saying the dollar is stronger is to say it has greater purchasing power. A dollar with more purchasing power means fewer of them are required to buy an ounce of gold and silver or a Bitcoin. Another way to look at this is based on yield. The advantage of dollars over no-yield assets like gold, silver, and Bitcoin is you get paid to hold dollars. The advantage gold, silver, and Bitcoin have over dollars is it’s difficult to mine the former while the latter is being debased by the addition of trillions of units of fiat every single year. As the yield on the dollar rises (higher interest rates), the comparison where it has an advantage over its no-yield competitors becomes more favorable to the dollar. Simply stated: Investors determined they would get paid more to hold dollars so they sold commodities and Bitcoin and bought dollars. For more on this topic, check out our blog post: Here’s What Just Happened in Gold, Silver, and Bitcoin.

I’ll ask you what really changed? Warsh has said publicly he’s in favor of a lower fed funds rate and certainly would have relayed that message to President Trump. He might be more hawkish about the next round of quantitative easing, but continued Congressional overspending is a guarantee that the “debasement trade” hasn’t gone away. All we saw was selling related to incremental and surprising news that led to reductions in the price of gold and silver from recent massive gains. This caused margin calls leading to forced sales and deleveraging. The long-term fundamentals haven’t changed; only the short-term forced trading flows.

This week, we’ll address the following topics:

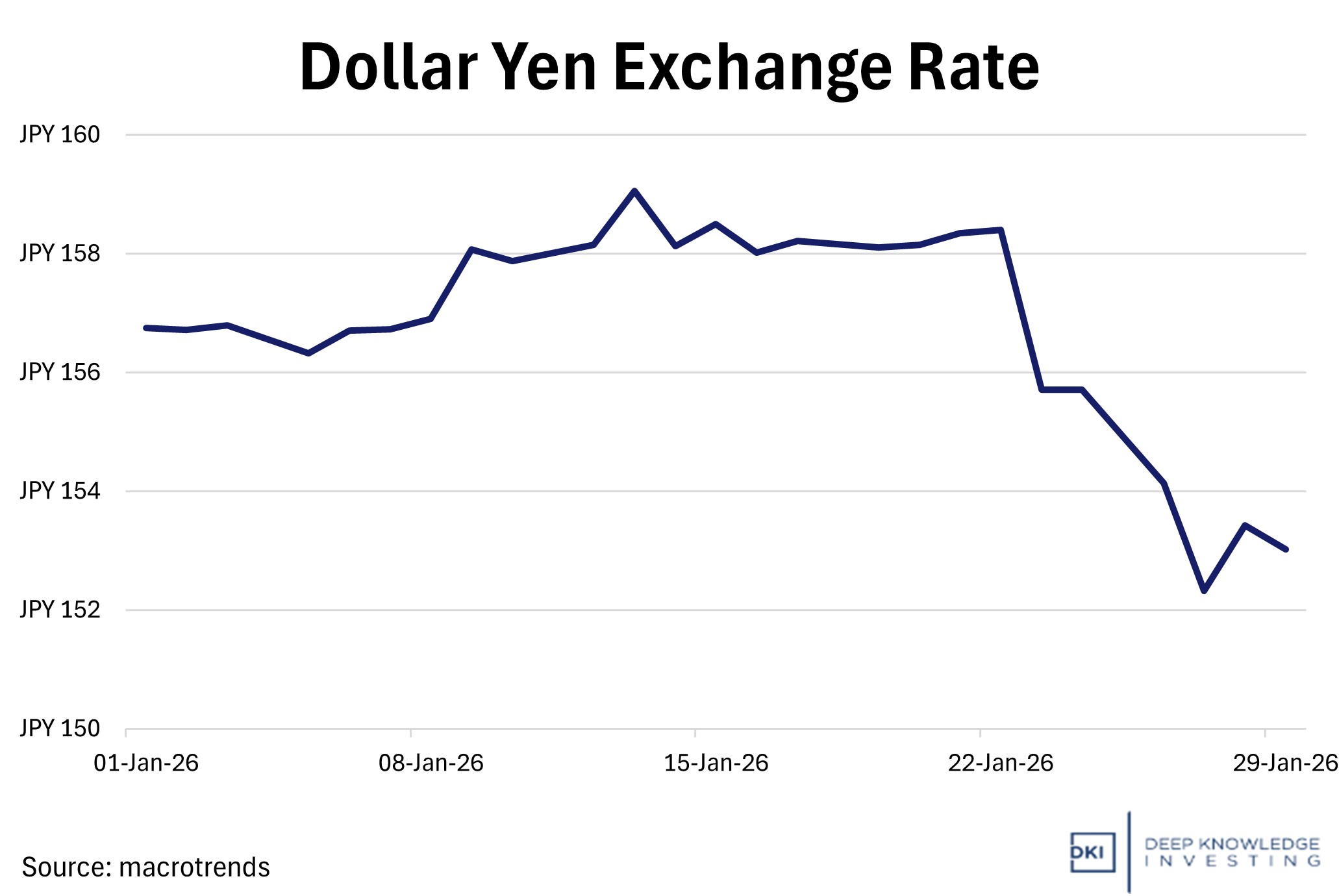

- The yen strengthens against the dollar – from 159 to 155 in hours and to 152 in a couple of days. There were rumors of government action, but what was the incentive?

- The Fed surprises no one by keeping the fed funds rate unchanged. Does this matter? Should you care about Powell’s comments? Read on and we’ll explain.

- Pundits are claiming President Trump caused the “debasement trade”. How can that be true if we were investing based on it in 2021? Someone isn’t being honest about the history of assets that started rising in price years ago.

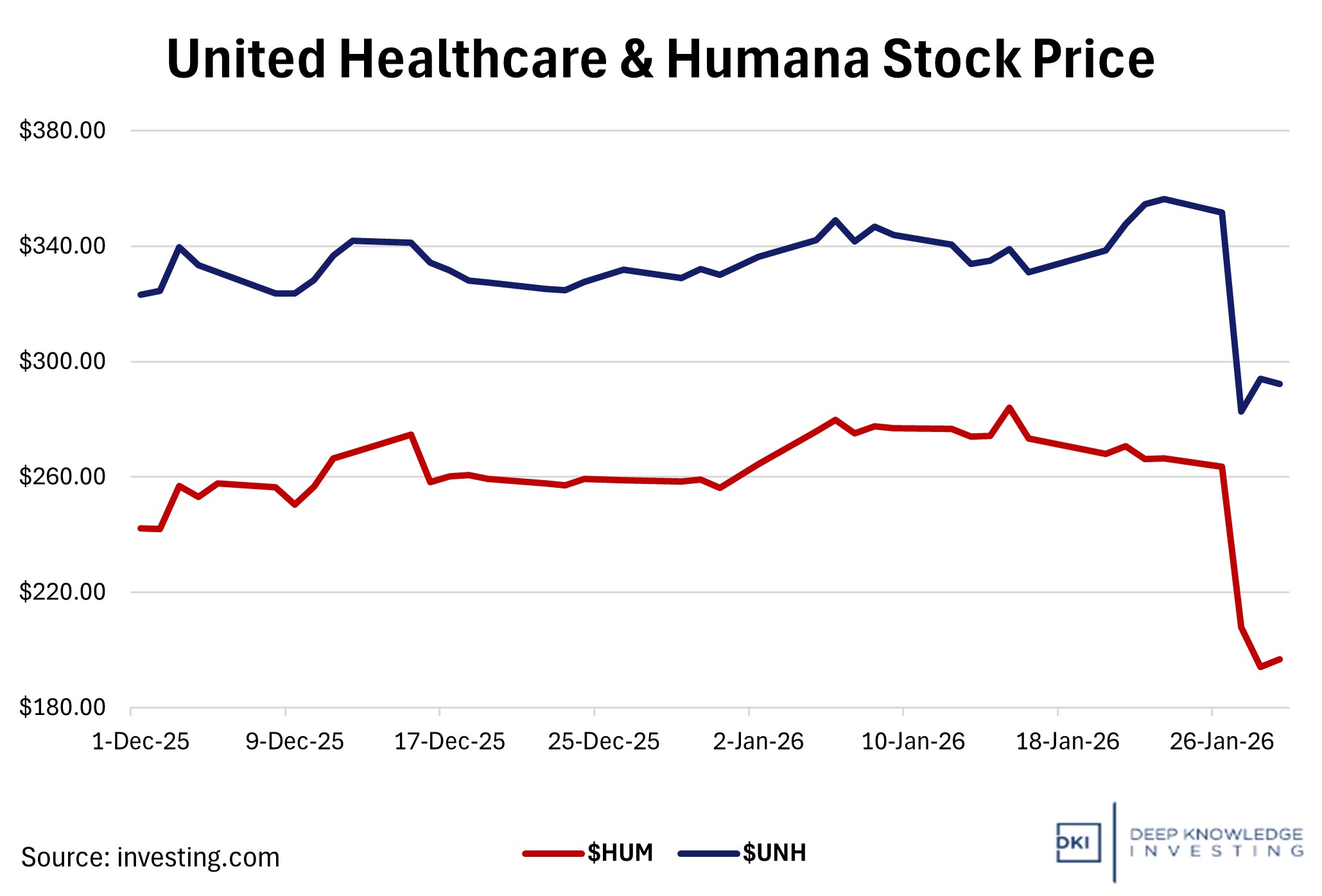

- The CPI says health insurance costs have been flat for the past seven years. But when CMS proposes no change to reimbursement rates, insurers drop $100B in market cap. Someone is wrong. (It’s the BLS – the BLS is wrong.)

- Have you ever wondered what investment managers mean when they discuss terms like Alpha or Beta? In this week’s educational topic, we explain.

DKI Interns, Cashen Crowe and Samaksh Jain, remain more reliable than Federal Reserve Governors and more consistent than the price of gold. (That last one seemed like a bigger compliment when I wrote it a few days ago.) I know it was a volatile week, but let’s take a quick second to appreciate their considerable contributions to the weekly Five Things.

Ready for a week of asset prices with charts that look like a roller-coaster? Let’s dive in:

1) Yentervention:

On Friday, January 23rd, the Japanese yen strengthened against the dollar going from 159 to 155 and change. That’s a huge move in the foreign exchange (Fx) market and most of it took place in just a few hours. Speculation immediately began that the Bank of Japan (BoJ) worked with the US Treasury to engineer the violent correction. By early the following week, experienced Fx traders swore that there was no coordinated government action. Then, a third group came out and said that the BoJ and the US Treasury didn’t do anything, but they quietly indicated a threat of potential action that caused traders to do the heavy lifting for them without requiring Japan to exhaust more of its foreign exchange reserves. I don’t know what either government did in secret. To me, the interesting question is why both sides would have an incentive to weaken the dollar against the yen.

That move from 159 to 155 in hours and to 152 in a couple of days is enormous.

DKI Takeaway: I’ve been writing about Japan’s slow-moving currency disaster since 2022. The country has massive debt (about 250% of GDP) and suppressed interest rates to afford that debt. Near-zero rates led to a multi-trillion dollar “carry trade” where people sold yen and bought US Treasuries using leverage. This caused the yen to fall from just over 100 to the dollar to 160 leading to inflation. The BoJ needed to strengthen the yen and raise rates to head off a societal problem that has already contributed to a change in government.

The better question is why the US might have wanted to get involved. With Japanese government bond (JGB) yields rising, there was an incentive to unwind the carry trade. That involves selling US Treasuries and buying JGBs. Selling that much US debt leads to lower prices and higher yields. The US still has to finance several trillion dollars a year and to re-finance additional trillions due to former Treasury Secretary Yellen’s practice of shortening the duration for US bond sales. The last thing the current White House (or the USA) needs is higher bond yields when it’s trying to refinance trillions of dollars. I can’t tell you whether the Treasury Department acted here, but I can tell you they had an incentive to do so.

2) Fed Meeting:

The Fed concluded its January meeting, and as expected, took no action. Most Fed Governors voted to maintain the current fed funds rate with two dissents favoring a small 25bp (.25%) cut. The market shrugged and finished flat(ish) to up small on Wednesday depending on your favored index. This was a reasonable reaction.

Many are still focused on Fed actions as a lever to blow up an even bigger asset bubble than the one we currently have. US equity indexes are trading at/around all-time highs. Gold and silver are were blowing through record prices every single day. Uranium cracked $100 while oil has rebounded hard from recent weakness. Assets are gaining value over continually-debased fiat which is losing purchasing power by the day. If you think this means the DKI portfolio, which is heavy in commodities and dollar alternatives, is performing well, you’ve guessed correctly. While the precious metals drawdown on Thursday and Friday wasn’t fun, both gold and silver were up in January.

175bp of cuts for this?

DKI Takeaway: It no longer matters what the Fed does, what Chairman Powell says, or what President Trump wants. The Fed has cut by 175bp over the past 16 months while the yield on the 10-year Treasury is higher than where it was before this cutting cycle began. That’s because the Fed only controls the overnight rate and the bond market is correctly pricing in higher long-term inflation. President Trump wants lower borrowing rates. He’s almost certainly going to get a lower fed funds rate when he replaces Powell in a few months, but the bond market is under no obligation to accommodate the President. Pundits were focused on Chairman Powell’s comments about Federal Reserve intentions and independence. Those are also irrelevant. Powell will be replaced in a few months so his views will no longer be represented in a short time. Regarding Fed independence, that was only a polite fiction never reflected in reality. If you want a short list of political pressure applied to the Federal Reserve over the past 100+ years, check out our article, President Trump, The Fed, and What Really Matters. The only way we’ll get lower interest rates is if Congress stops overspending. I don’t think that’s going to happen so invest accordingly or feel free to reach out if you want some help.

Update: The nomination of Kevin Warsh sent short-term asset prices into a temporary deleveraging tailspin and means the Fed will probably be less dovish than we originally expected. I don’t think that changes the long-term investment outlook for gold, silver, and Bitcoin, and don’t think it will make much of a difference for long-term bond yields.

3) The Pundits are Misunderstanding Gold:

I’m using the word “misunderstanding” to be polite. I’ve seen plenty of commentary in recent weeks saying the price of gold is rising because President Trump has “politicized the Federal Reserve” which has led to a loss of confidence in the dollar and the international financial system. These pundits have tried to tie the term “debasement trade” to recent actions the President has taken including criticizing Fed Chairman Powell, using tariffs to address political issues, saying impolite things about allies (who regularly criticize him in loud voices), and using his dinner fork to eat his salad. I’ve said that I disagree with President Trump venting his issues with Powell in public and that I think threatening Greenland was sub-optimal despite the likely positive outcome. However, the analysis being provided in the press is completely inaccurate.

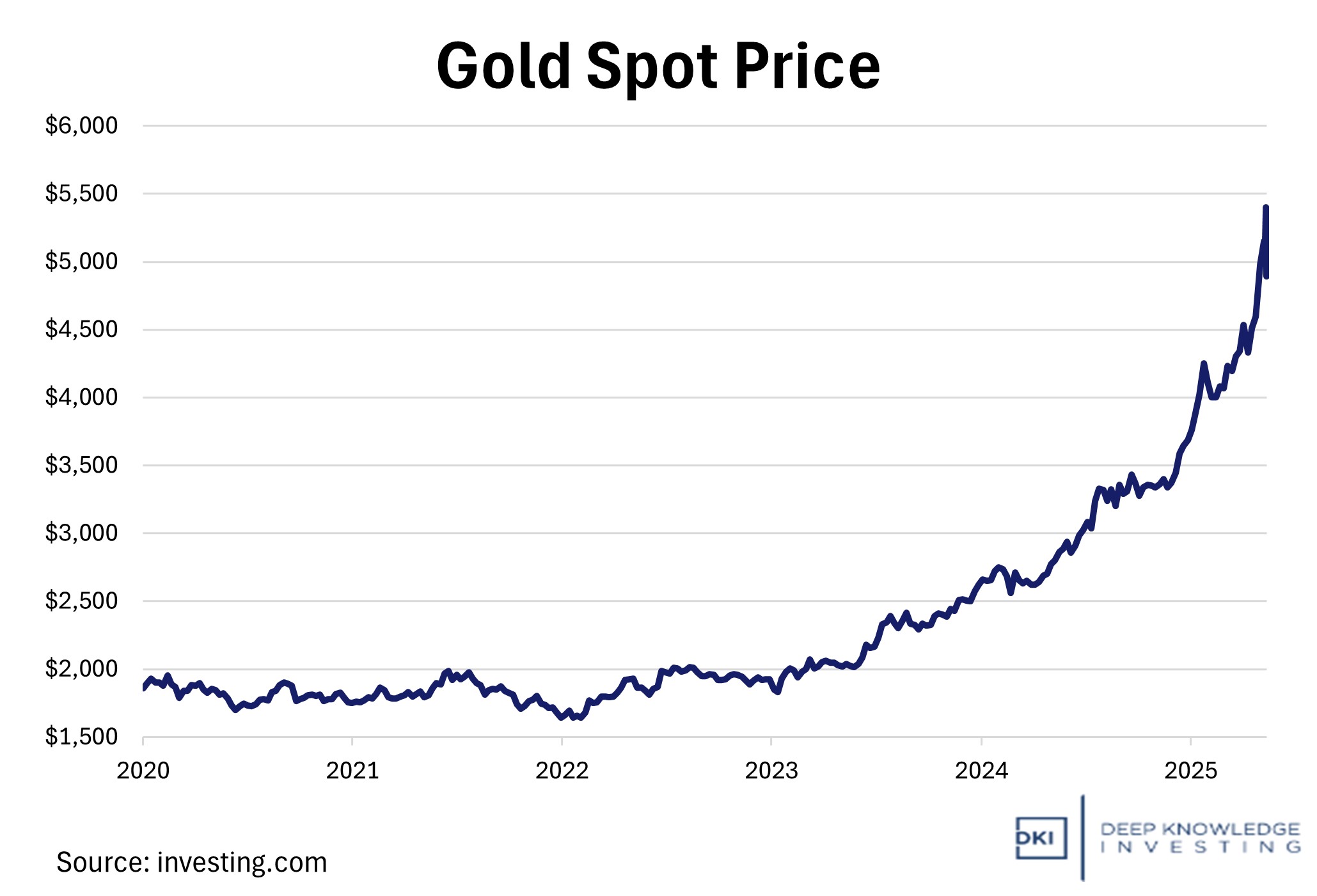

The big increase started in 2023 and continued through 2024.

DKI Takeaway: I started buying Bitcoin, gold, and silver in 2020 due to a massive expansion of the money supply related to Covid “stimmies”. Many of us saw that the huge increase in M2 for short-term spending would lead to a decrease in the purchasing power of the dollar (inflation) and rushed to own “hard” assets that can’t be easily created. I was using the term “debasement trade” long before President Trump won a second term and wasn’t the only one doing so.

Things got worse for the dollar and better for gold when the previous Administration froze/stole Russian dollar assets. At the time, I said that even if we agreed that pressuring Russia was a noble goal, Americans would regret the action. It turned the world’s reserve currency into an asset that only held value as long as other countries remained in the good graces of Washington DC, a place that changes leadership and policies every few years. The BRICS countries led by China and India scrambled to buy physical gold and silver leading to a massive increase in the price of gold starting in late 2023 (again well before Trump, the Sequel).

If DKI bought Bitcoin, gold, and silver in 2020, warned about theft of Russian dollars in 2022, and China and India starting buying huge quantities of physical gold in 2023, it takes some revisionist (or short-sighted) history to tell people that the debasement trade started in January of 2025. If you wish you had bought hard assets a few years ago, please consider subscribing to Deep Knowledge Investing. For many people, personal finances are getting more difficult. We’ve been able to help.

Update: I fielded calls Thursday night/Friday morning from people concerned about the drop in the dollar price of gold. This was related to the change in likely Fed Chair nominees as explained at the beginning of this piece. Also, if you hadn’t been watching the daily charts and simply saw that gold was just below $5k by the end of the week, we’d all be talking about its incredible rise and not the decline to the same level at the end of the week. The long-term view here is the best one.

4) Medicare Advantage Rates Held Flat Despite Historic CPI Anomalies:

The Centers for Medicare & Medicaid Services (CMS) proposed on January 26 that Medicare Advantage (MA) payment rates for 2027 will increase by only about 0.09%, far below the 4% to 6% rise analysts had expected and significantly less than the 5.06% increase implemented for the current year. This flat rate comes with changes to risk-adjustment methodologies including limiting certain chart-review diagnosis payments, that further reduce baseline reimbursements. The market reaction was pronounced: shares of UnitedHealth Group, Humana, CVS Health, Elevance Health, and other insurers plunged sharply, erasing over $100 billion in market cap as investors priced in compressed earnings and slower Medicare-driven growth. The timing of this policy decision highlights a recurring disconnect between headline inflation data and underlying cost pressures. Notably, Wolf Richter’s analysis of the Consumer Price Index shows that the health-insurance component of CPI has not tracked real cost trends, reporting “0% health insurance inflation since February 2019” and a decrease since 2022 even as premiums and provider costs climbed in the real economy.

The stock market did not agree that medical insurance expenses were flat.

DKI Takeaway: A constant subject of DKI commentary has been how inaccurate government statistics are. That’s especially pronounced in CPI (consumer price index) data because it’s the inflation measure that people use when evaluating the economy. When the CPI indicates health insurance premiums are flat since 2019 and down from 2022, but consumers continually pay more for coverage and the government shuts down because politicians are arguing about how much the government should provide in supplements, Americans understand they’re being gaslit. Almost no one believes inflation is currently under 3% and no one should believe that health insurance costs are flat for the past seven years. When the market destroys $100B of equity value because government reimbursement rates track the CPI, that’s the stock market telling the Bureau of Labor Statistics that the CPI is pure weapons-grade bolognium.

5) Educational Topic: Beta vs. Alpha:

Alpha and beta describe the nature of investment returns. Beta measures a portfolio’s sensitivity to the overall market. A beta of 1.0 means an investment moves with the market. A beta above 1.0 implies higher volatility than the market, while a beta lower than 1.0 would imply lower volatility. If your portfolio rises and falls with the market, then you have bought or copied something close to an index fund.

Alpha represents excess return generated beyond what would be expected from just being invested in the broader market. It is the portion of performance attributable to skill or strategy rather than market exposure. A hedged portfolio with zero net market exposure (long exposure minus short exposure) that earns positive returns has done so through skill (alpha generation).

Beta is free. Alpha requires skill.

DKI Takeaway: Broad market exposure can be obtained inexpensively through index funds or ETFs. This is the most effective way to purchase market exposure. Paying high fees for an active manager who simply delivers market-like returns is inefficient. At DKI, our focus is on generating Alpha. We’re looking for stock picks and investment opportunities that will outperform the market over the long-term and frequently hedge out market exposure. That’s why we don’t worry about market draw-downs.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.