$AMD offers stock and chips to OpenAI in an effort to break $NVDA’s near-monopoly status. DKI wonders where we’re going to get the electricity supply to power all those chips. Gold crosses $4k on the way to a new all-time high. Or as we like to put it: Gold is staying stable while the dollar loses purchasing power. $ORCL discloses that it has very low margins on its AI datacenter business. There are real questions about how anyone is earning a return on the massive capital outlays for AI. xAI is doing a $20B funding round where they use $NVDA chips as collateral to keep debt off the balance sheet. When we see the first chip-backed CDO, that’s your sign to head for the exits. The market lurches after President Trump announces that China is again withholding rare earth elements. After the close, he announced 100% tariffs. The US needs to decouple and produce these elements domestically. In our educational topic, we explain index funds and describe an important risk.

This week, we’ll address the following topics:

- $AMD gets a multi-billion-dollar order from OpenAI and offers stock options to get a seat at $NVDA’s table. We need 5 Hoover Dams to power that much compute. DKI’s latest stock pick can provide it.

- Gold hits a new high and crosses the psychologically important $4k mark. DKI subscribers have made 170% in gold, more than 700% in Bitcoin, and almost 100% in silver.

- $ORCL discloses it’s AI datacenter business has 14% gross margins vs 70% for the rest of the business. @hkuppy finds out that no one in the industry has any idea how they’ll make money.

- xAI is doing a $20B funding round where they use $NVDA chips to avoid putting debt on the balance sheet. If you see a GPU-backed CDO, run!

- China withholds rare earth elements (again). President Trump imposes tariffs (again).

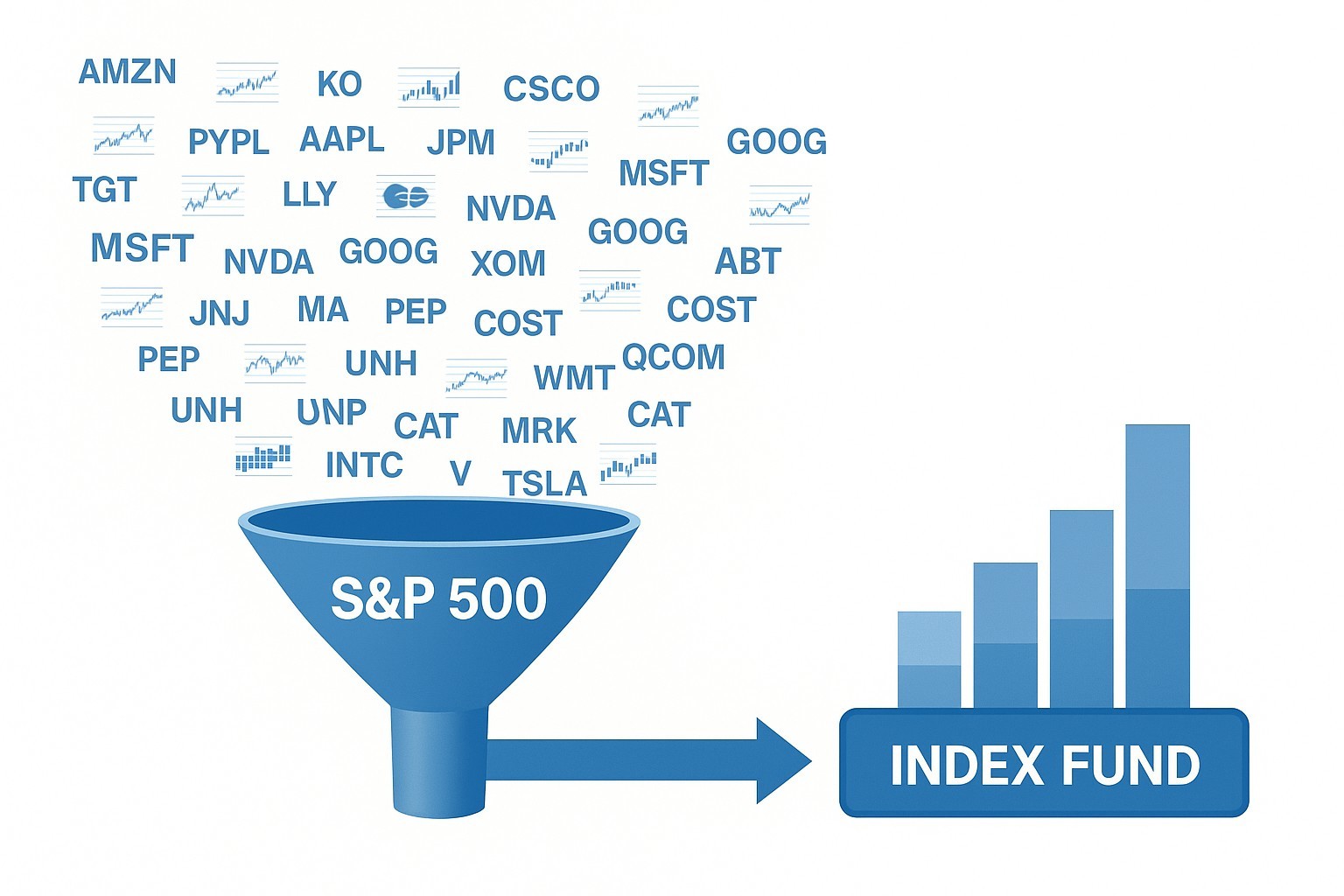

- Ever wonder what an index fund really is and what the risks are? In our educational topic, we explain.

As usual, the DKI interns, Cashen Crowe, Samaksh Jain, and Gideon Rotem come through with excellent analysis and continually improved writing. Well done!

Ready for a golden week of record gold prices? Let’s dive in:

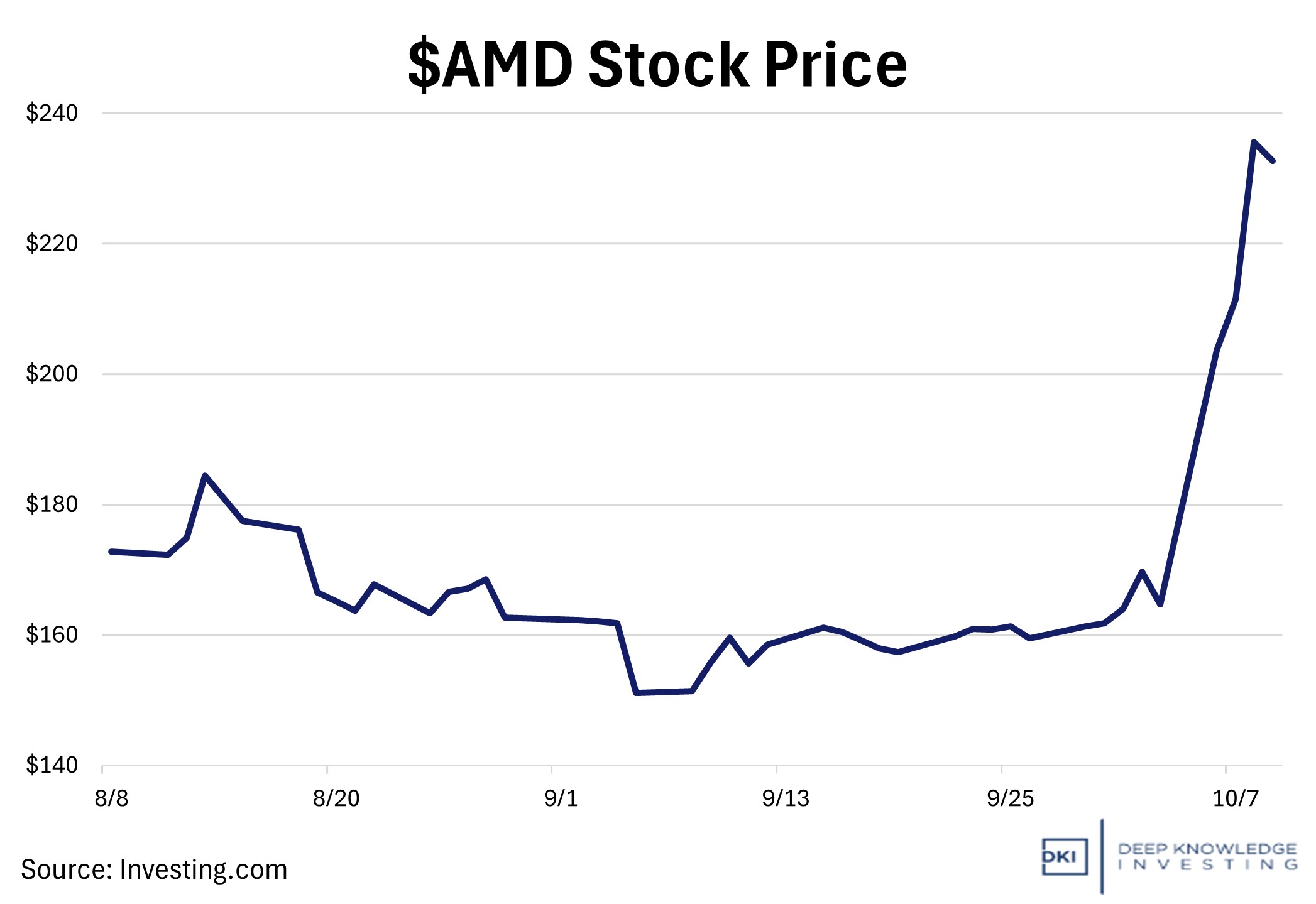

1) AMD Adds to the Heat with OpenAI Partnership:

OpenAI and AMD announced a landmark multi-year agreement on October 6, under which OpenAI will deploy 6 gigawatts of AMD GPUs across multiple chip generations, beginning with a 1 GW rollout of the Instinct MI450 series in the second half of 2026. As part of the deal, AMD issued to OpenAI warrants for up to 160 million shares (roughly a 10% stake), vesting in tranches tied to deployment and share-price milestones. The agreement deepens a long-standing collaboration. OpenAI has previously advised on AMD’s AI roadmap and mentions AMD as a “core strategic compute partner,” rather than merely a backup to Nvidia’s hardware dominance. The scale of the commitment, the equity link, and the timing all reflect OpenAI’s urgent need for diversified compute capacity in the face of global GPU bottlenecks.

The market loved the deal. We think it’s great, but with reservations.

DKI Takeaway: This AMD deal is emblematic of a growing feedback loop in AI finance: companies are investing in their own supply chains, blurring the lines between customer, investor, and vendor. OpenAI doesn’t just buy chips; it may own AMD equity. AMD has become more than a supplier since it’s now aligned with deployment success. That circularity amplifies both the upside and downside of these arrangements. A downturn in computing demand, chip margin pressure, or execution delays will impact the entire sector. For investors, the danger is that financial entanglements start to obscure real demand signals. DKI notes that 6 GW of electrical production is 3x the full capacity and almost 5x the recent operating capacity of the Hoover Dam. Our latest stock pick was delivered to subscribers last week and is designed to take advantage of this supply/demand imbalance. It’s already up 17% and I’ve still been buying it.

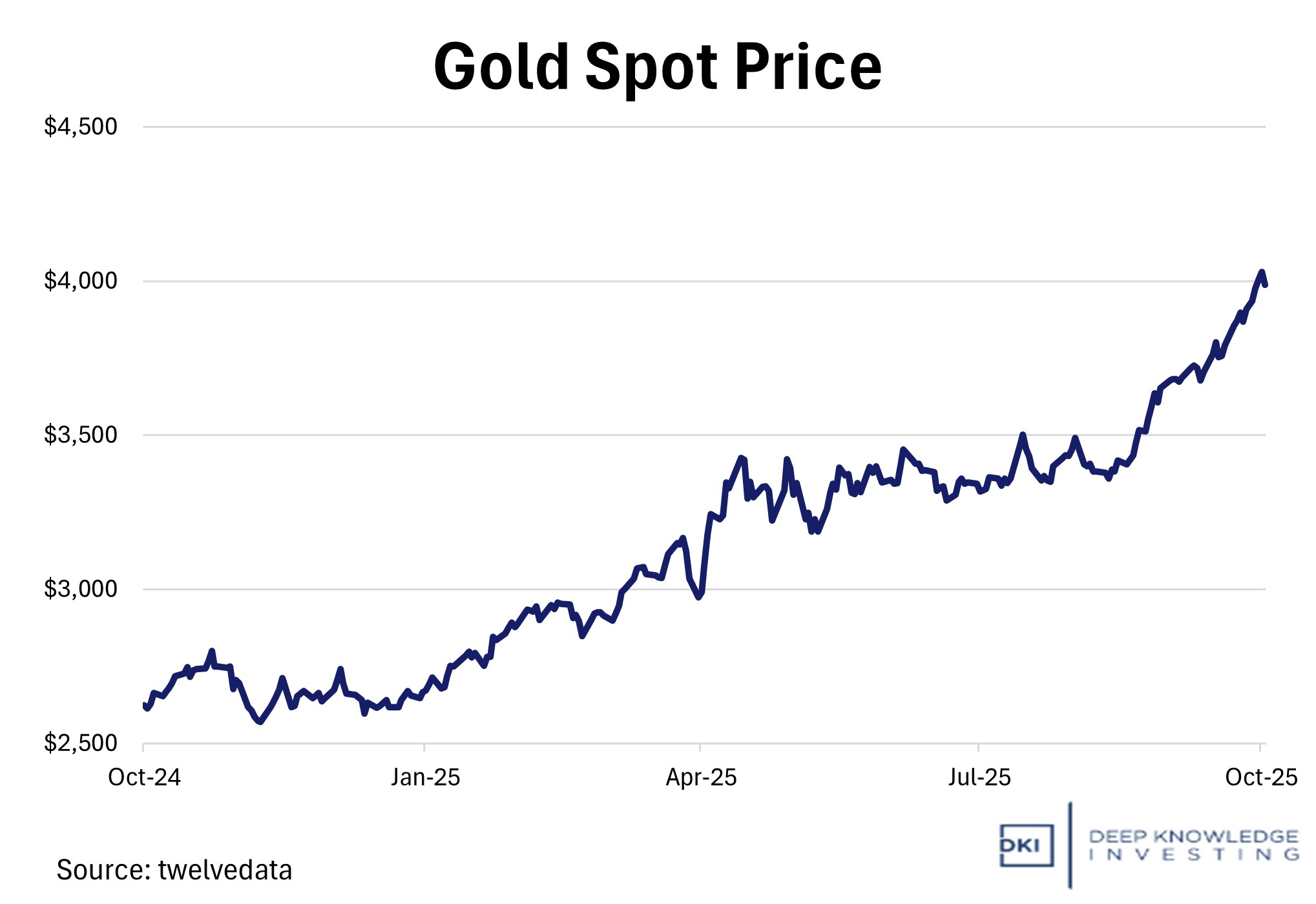

2) Gold Breaks $4,000 as Investors Seek Shelter:

On Tuesday, Gold eclipsed the $4K per ounce mark for the first time. During a time of rising inflation, investors and central banks are pouring fiat into the metal. Gold’s rise makes it one of the year’s best-performing assets, outperforming the stock market and crypto. Banks, retail buyers, and central banks are rushing to protect themselves from currency debasement and international instability. “Gold is a very excellent diversifier in the portfolio,” says Ray Dalio, Founder of Bridgewater Associates.

DKI subscribers started buying at $1,500.

DKI Takeaway: Previously, Goldman Sachs had a $3,000 price target for gold by 2026. After the week’s milestone, Goldman Sachs raised the price forecast for December 2026 to $4,900. As DKI has pointed out many times, the sell-side will raise their targets after asset prices rise and lower their targets after asset prices fall. Every major central bank started this rally in gold by debasing their increasingly worthless fiat currencies with overspending. That trend won’t change. In an effort to rein in Russia, the US froze Russian dollar reserves. As DKI wrote in 2022, that move wouldn’t (and didn’t) restrain Russia, but did signal to the world that their dollar assets, the world’s reserve currency, were only safe as long as countries remained in the good graces of Washington DC, a place where policies change every few years. BRICS countries responded by reducing dollar assets and adding gold. DKI subscribers have owned Bitcoin and gold since 2020 producing profits well-over 100%. We’ve owned silver as well which has nearly doubled.

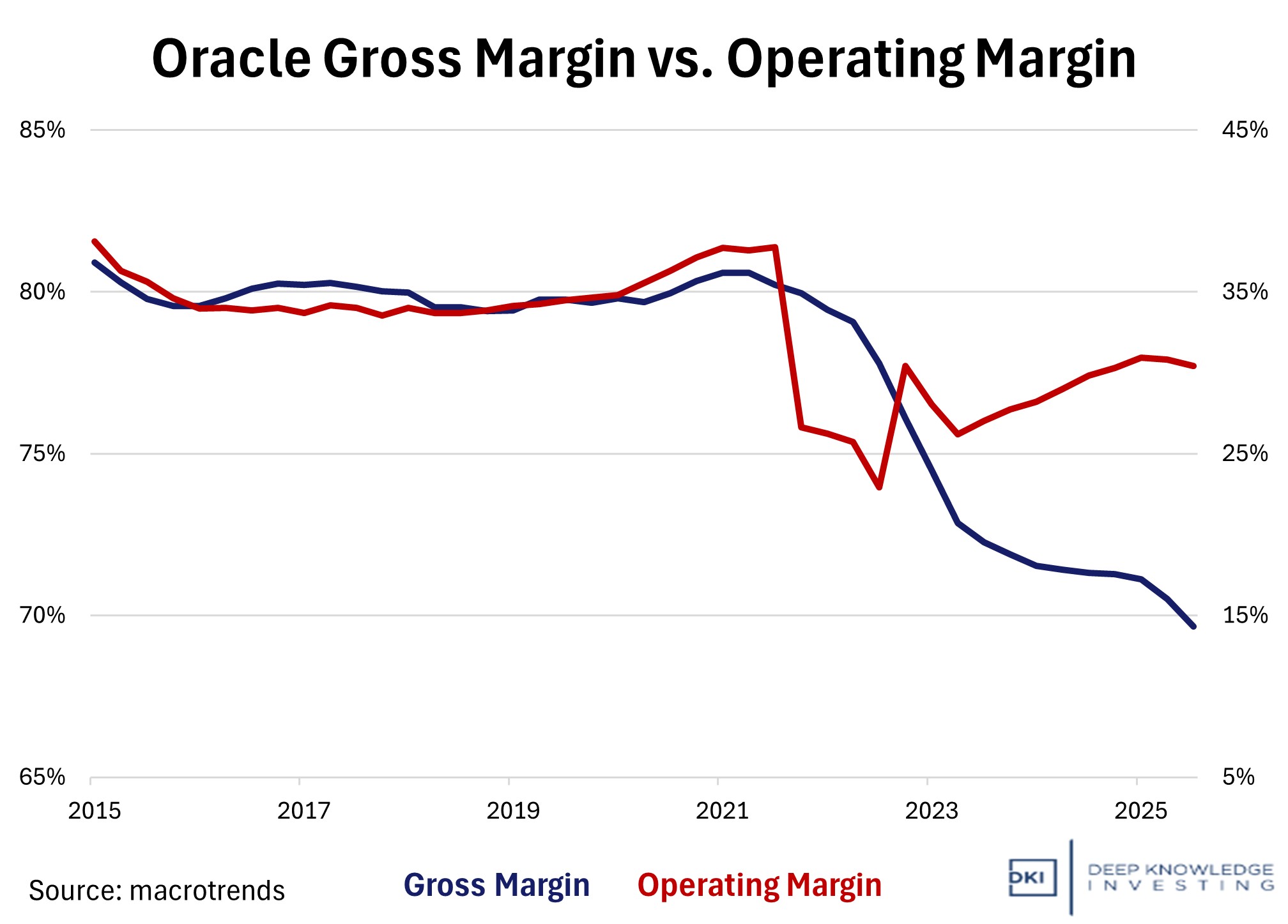

3) Oracle’s AI Cloud Faces Margin Trouble:

Oracle’s stock experienced some volatility this week after the company disclosed weak profitability in the business line focused on renting Nvidia-powered servers to companies for AI purposes. The business did $900MM in revenue for the quarter ended August 31st, but only produced $125MM in gross profit. That’s a gross margin of 14%. Oracle’s main business line is selling database software and services which has gross margins around 70%. The market’s shock was muted by the quirky $AMD/OpenAI deal and Oracle’s stock quickly recovered. This brings up a concern DKI has been expressing about the AI business for more than a year.

The high-profile AI database business has a gross margin of 14% vs 70% for the rest.

DKI Takeaway: Oracle’s cloud division is dishing out loads of money to support AI workloads. This, however, isn’t just a company-specific issue. Companies in this field are all expanding capital expenditures due to the AI race. Data centers are expensive. Oracle’s profits are still staggering. The stock has already surged 60% this year, largely on AI optimism, and cloud revenues are forecasted to grow 700% in the next three years.

The big concern we’ve been discussing in this space for more than a year is that the companies spending hundreds of billions of dollars on AI don’t yet have a business model to recover those costs let alone earn a return on massive capital outlays. This week, Harrison Kupperman disclosed that he had spoken with two-dozen senior people in the AI datacenter business. They all admitted that they had no idea how the site would earn a return on capital, but figured that everyone else knew and they were just the dumb one who didn’t understand. This is the sector that’s been propping up the equity indexes. If you’ve ever wondered what a situation looks like where everyone believes something that isn’t true, this is a perfect example.

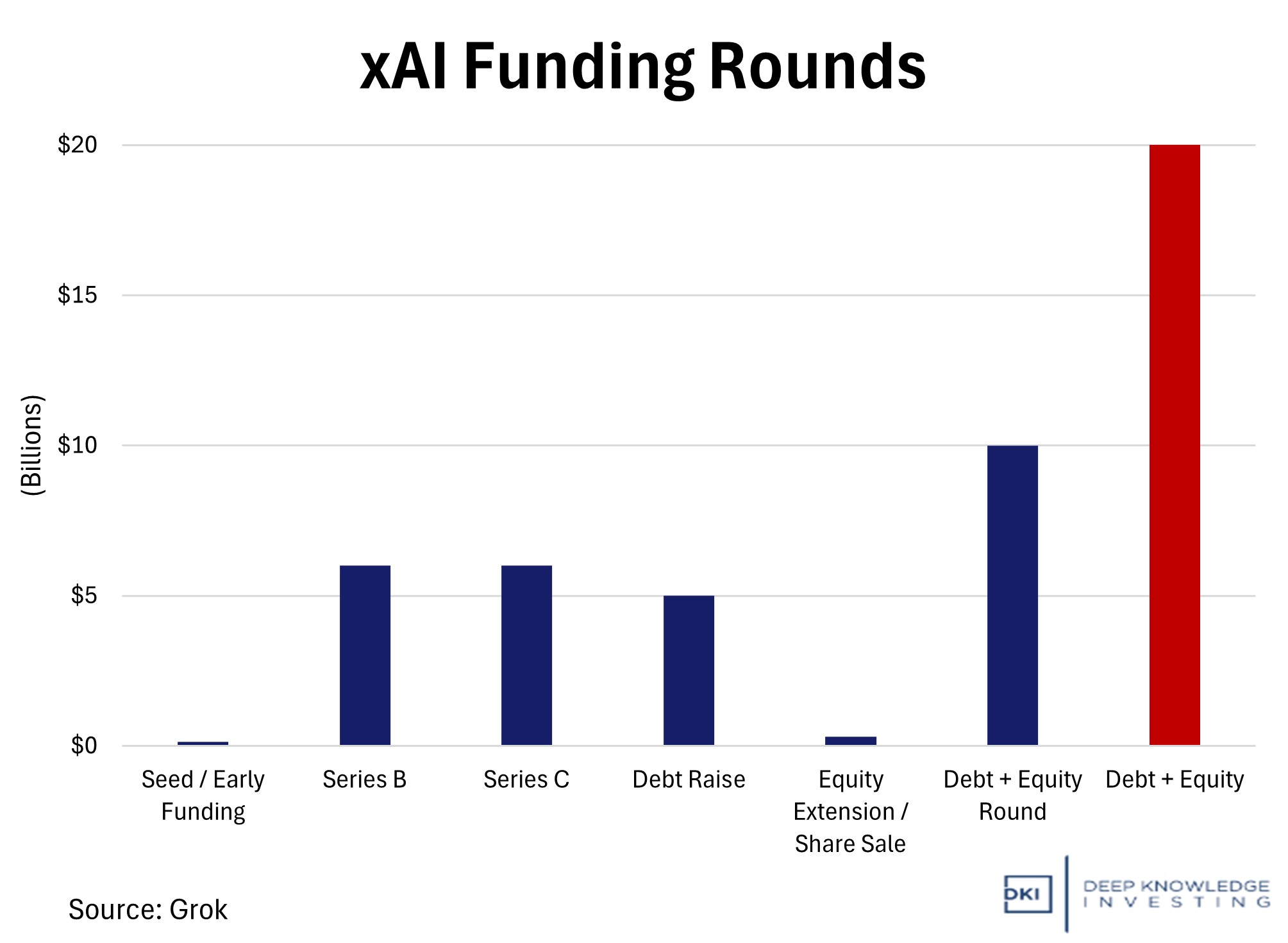

4) xAI Raises $20 Billion to Challenge OpenAI:

Elon Musk’s xAI is reportedly raising $20B in what could be one of the largest private funding rounds in tech history. There are reports that Nvidia is investing $2B of the $7.5B equity round with an additional $12.5B in debt funding targeted. This will include a special-purpose vehicle (SPV) that will purchase Nvidia GPUs and lease them to xAI. This structure will help Musk keep debt off xAI’s balance sheet by using Nvidia’s chips as collateral. Providing lenders tangible assets as security can secure computing capability without balance-sheet leverage. (I can’t be the only one reminded of 2008.)

The funding rivals the largest rounds in tech history and puts xAI in the same realm as OpenAI and Anthropic (valued at ~$500b and ~$183b, respectively). Musk is providing xAI the resources to compete against industry leaders, even with a scarcity of high-quality GPUs.

How will they earn a return on this?

DKI Takeaway: Infrastructure in this industry is starting to become funded more like an energy project with debt than software startups that are traditionally all equity. This lets credit investors participate and continue to raise funds. As AI remains the most capital-hungry sector in modern finance, it is apparent that secure access to quality chips is becoming more of a competitive moat than just data or algorithms. We note (again) that no one has a plan to earn a return on all the spending and every week, the financing plans get more complicated. If you see a GPU-backed CDO, it’s time to sell everything.

5) China Withholds Rare Earths. US Imposes Tariffs:

The market fell on Friday as President Trump announced that China has again placed export restrictions on rare earth elements. China has a near-monopoly on the business of mining and refining these materials which are required for semiconductors, weapons, and automobiles. President Trump responded by saying he wasn’t going to meet with Chinese President, Xi, but later left the matter open. After the market closed, he set a November 1st date for 100% import tariffs against Chinese goods.

If China withholds rare earth elements, it’s going to be harder for them to sell other goods to the US.

DKI Takeaway: Investors are worried this is tariff surprise part 2. Others are aware the entire matter could disappear with a Sunday afternoon social media post by the President saying he has an excellent relationship with Xi. It does appear that there was some sort of miscommunication as the Wall Street Journal is reporting that China was surprised that the US would potentially cancel the planned trade summit over this issue. I’m not sure why the Chinese are surprised this action received a serious reaction so think there may have been some unclear back-channel communication between the parties. With the market uncertain of the outcome, investors went “risk-off”, a trend likely to continue barring pre-opening news on Monday or over the weekend. DKI has pointed out multiple times this year that China has sponsored cyber-attacks against US businesses and the US government. We’ve explained how they’ve used hidden technology in solar panel equipment to potentially damage the US electric grid. As long as they are the sole supplier of materials necessary for US manufacturing and self-defense, the CCP will have undue influence. There will be costs, but the US needs to decouple, reshore manufacturing, and become more self-sufficient.

6) Educational Topic: Breaking Down Index Funds:

Index funds are one of today’s most popular investment instruments. With low fees and low effort required, many go the “set-it-and-forget-it” route. An index fund is a mutual fund or ETF that tries to mirror a market index (like the S&P 500) by holding the assets that constitute the index. You can’t invest directly in a stock index, as it is simply a list of assets, but these funds replicate the index and make it possible to invest directly.

The S&P 500 is regarded as the premier gauge of US large-cap equities. It contains 500 of the largest publicly traded companies in the US. Each company is weighted by its market value. The bigger the company, the bigger its slice of the index. The tech sector has grown to the point where the top 10 companies in the index make up 38% of the total.

You can own 500 companies with one ticker.

DKI Takeaway: Building an index involves setting clear rules about what gets included, and periodic rebalancing helps to keep the index up to date. Many times, critics will point to the S&P’s market cap weighting system as a potential drawback since investors can end up with a lot of exposure to a handful of big names. We also caution that a market-weighted index means that investors end up buying more exposure to more expensive names and have reduced exposure to stocks with lower valuations. Owning an index fund is more similar to a momentum strategy than a value-based one. It’s generally worked out well for investors, but be aware of this risk.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.

Related to the index fund Thing, ETFs like RSP exist which mirror the companies in the S&P 500 *without* the market cap weightings; they just own all the companies equally.

That’s true. By owning (or shorting) these, you have exposure to all 500 companies at a .2% weighting. It eliminates the massive tech concentration.