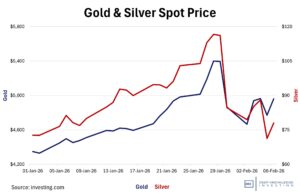

At the end of last week, silver rocketed to an all-time high of almost $84. Yesterday, it traded below $71 before recovering to $74 as I write this. That’s approximately a 15% move in under one trading day which is big for a stock and enormous for a commodity. Let’s go through what’s happening in plain language:

- As discussed in this past weekend’s post, silver has a huge paper market where contracts are typically settled in dollars instead of physical metal. I’ve seen estimates that the size of the paper market is 50x – 300x the size of the physical market. Regardless of which estimate is accurate on a particular day, this creates a situation where there are a lot of people who are short silver who expect to deliver dollars and a lot of people who are long silver who expect to receive metal.

- Silver also has extensive industrial uses particularly in the high-growth areas of solar panels and electronics. That market has been supplied for years from existing silver stockpiles instead of through an increase in mining leading to a larger silver supply. That means demand is greater than supply and no one is slowing production of electronics right now.

- Most silver mining is a by-product of mining for other metals meaning a higher silver price won’t necessarily lead to an increase in production. This is one of those unusual situations where higher prices don’t result in greater supply.

- With industrial demand higher than supply and fear of dwindling stockpiles, more holders of silver contracts decided they wanted delivery in physical metal rather than in fiat dollars. That led to crisis levels of warehoused silver. There was not enough metal to supply people who had claims on physical delivery. Prices skyrocketed as exchanges tried to lock up supply.

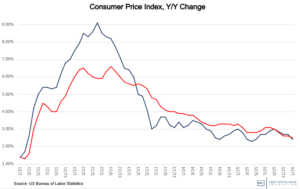

- All of this was exacerbated by the constant abuse of the world’s reserve currency by the US Congress’ massive overspending and expansion of the money supply. This poor financial judgment is being mirrored by legislatures and central banks in other countries as well with reduced purchasing power seen in the British pound, the euro, and the yen. With countries like China wanting an alternative to the continually debased dollar, demand for metal stored in in-country vaults rose. China and India have been accumulating and storing huge amounts of gold for the past few years and are adding silver as well.

- China has just put in place export restrictions on silver which reduces supply at the same time western warehouses need it most. Large US tech companies are looking at buying silver mines to ensure their own supply. Some of the largest countries and companies in the world are trying to lock up physical supply.

- We could see emergency demand from exchanges and warehouses in backwards forward pricing. Typically, buying a contract that gives you the right to take delivery of silver in a year would have a higher price than buying silver in the spot market (right now). The reason for that is there are expenses associated with storing, guarding, and insuring the physical metal for the year. Recently, the cost of future silver was below the current (spot) price because the exchanges needed supply NOW.

- The price in Shanghai is higher than the price in the US primarily because the Shanghai market is one where physical silver has to be delivered while in the US, most of the trading is in paper silver requiring delivery of fiat.

- Yesterday (Monday), the Chicago Mercantile Exchange (CME) raised the margin requirement for March silver delivery from $20k to $25k. This reduced leverage in the system which is a fancy way of saying people who couldn’t meet the higher margin requirement with additional cash were forced to sell immediately. This was non-discretionary price insensitive selling and is the reason for Monday’s big price decrease.

- There have been rumors that a big US bank was short so much silver into the recent parabolic price increase that they might have had to declare bankruptcy. There are further rumors that the Federal Reserve added liquidity to the system to bail out this bank and provide them with current funds to meet liabilities. I have no way to verify whether this rumor is true or not, but the story is being circulated widely meaning lots of people are speculating that it might be true.

All of that explains why the price of silver rose so rapidly and why the price decreased yesterday. The CME can increase margin requirements further causing additional price-insensitive selling and reducing leverage in the system. The Fed can bail out insolvent sellers of silver contracts. This chewing gum and duct tape approach to keeping the system solvent would likely reduce the spot price of silver further – for a while. However, it doesn’t change the long-term issue that current supply is less than current demand. The world will continue to demand solar panels and electronics. China will continue to stockpile supply at any (“reasonable”) price. US tech firms will continue to look for ways to secure supply. And the US Congress, accompanied by governments around the world will continue to abuse their fiat currencies incentivizing more people to flee into hard assets like gold, silver, Bitcoin, and energy.

DKI started buying silver in the mid-$20s in 2020. I haven’t sold any.

Questions? Reach out at IR@DeepKnowledgeInvesting.com.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.

Is DKI continuing to buy more silver?

Hi Robb. My 1% position is now about 3% of capital. Gold has more than doubled to be more than 10%. And Bitcoin is up about 6x from initial purchase price to more than 40% of capital. I’m not buying more right now because the dollar alternatives part of my portfolio has become huge. But I also haven’t sold any. Thanks for the great question.