The AI Issue

This week we have data and analysis of the latest (and possibly last) Fed hike of this cycle, consistently inconsistent economic data (particularly when it comes to the employment picture), and our continuing disagreement with the market regarding whether Jerome Powell is serious when he says “higher for longer”. However, we think the big news of the week was seeing the first business model implosion caused by generative AI. We cover that in more detail below. Also, more bank failures. The system is not “sound and resilient”.

1) The Fed Raises by 25bp and Pauses (Probably):

The Fed increased the fed funds rate to 5.00% – 5.25% and provided softer language regarding the possibility of future increases. The market was disappointed by the fact that the Fed is still considering another rate hike AND that inflation concerns mean they’re not currently considering lowering rates. Chairman Powell noted that reduced bank lending would slow the economy as well. While that means Powell will stop raising rates sooner, it will be with a weaker economy.

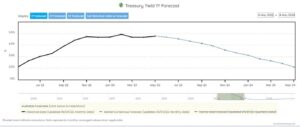

Chart from Econforecasting shows the market expects interest rates to fall this year.

DKI Takeaway: The market still expects rate decreases within the next year (as it has incorrectly done for the past year). The Fed is probably done raising for now, but Powell would rather cause a recession than see persistent inflation. DKI thinks the market is premature in its rate reduction expectations. More details for subscribers here.

2) US Job Openings Fall:

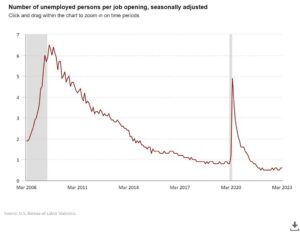

U.S. job openings fell from 10.0MM to 9.6MM in March. This is down from a recent high of around 12MM. DKI has been documenting inconsistent economic data since last November, but it’s starting to appear that Fed rate hikes are just beginning to hit the economy.

While available jobs fell, there are still many more jobs available than interested workers. Chart from U.S. Bureau of Labor Statistics.

DKI Takeaway: The jobs report isn’t bad as the above chart shows. Fed Chairman, Powell, needs to weaken the labor market to try to reduce wage increases that are part of the sticky services inflation we’re seeing. The thing that will make the Fed lower rates is a much weaker economy which isn’t going to be good for stock prices. The DKI portfolio for subscribers is set up to benefit from this.

3) The Bank Failures Aren’t Done:

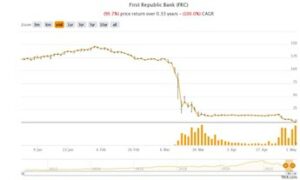

First Republic ($FRC) failed and was taken over by the FDIC last week. By the beginning of the next week, the assets had been sold at a discount to JP Morgan with the government taking responsibility for some future potential losses. We’ve now seen the 2nd and 3rd largest bank failures in US history and total assets at failed banks this year have now exceeded what we saw in 2008.

Graph from TIKR. $FRC went from $150 to $0 in 3 months.

DKI Takeaway: Jerome Powell and Treasury Secretary keep describing the banking system as sound and resilient, and saying problems are transitory. Please remember that when the next bank fails. First Republic won’t be the last. (This was written May 4th and another bank may have failed by the time you read this.)

4) Chegg ($CHGG) Cut in Half Due to Chat GPT:

Last Wednesday, “tutoring site” Chegg was down almost 50% because management acknowledged a slowdown due to students’ use of Chat GPT. Chegg is not an educational company; but rather, is most known for helping students cheat. That business was always going to be ripe for disruption, and the bad business model is the reason DKI avoided the stock.

Graph from TIKR showing Chegg’s terrible day.

DKI Takeaway: This is the first time we’ve seen a business so negatively affected by artificial intelligence technology. There will be others, but Chegg might be the first company wiped out by AI. DKI also points out that Chegg’s business (tutoring/cheating) is not at all the same as Coursera’s ($COUR) which is education and providing branded educational credentials. More details for subscribers here.

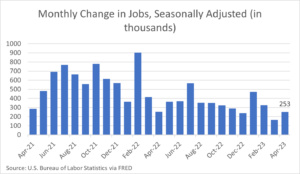

5) April Jobs Report Much Better Than Expected:

As noted above, economic data has been consistently inconsistent. While the jobs report showed a contraction of jobs available, the payroll report showed robust hiring. Nonfarm payrolls were up 253k for April which was far above the 180k expected. The unemployment rate was 3.4% vs expectations for 3.6%.

The employment environment remains strong.

DKI Takeaway: While the number of jobs available has declined, the number of people employed continues to increase. The unemployment rate of 3.4% is indicating the Fed has room to consider an additional rate hike beyond market expectations.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.