The government is about to use its incredible stores of data to feed advanced AI models. It could be effective in staying ahead of China, but there are some un-discussed security issues involved. Bitcoin has gone hyper-volatile again. Why does it keep happening at night on weekends? Does it matter? Multiple States are investigating buy now pay later. I generally prefer light regulation, but we have far too many young people who are somehow surprised when they get bills from BNPL. With or without an investigation, we need to provide financial education for these people and start to ask why the Department of Education hasn’t done so already. The US eliminates tariffs on UK pharma and the UK agrees to pay higher prices for US drugs. This is a win for the Trump Administration. Many who are tired of subsidizing drug discovery for the rest of the world are wondering why this took so long. Finally, in our educational topic, we discuss ADRs. Ever wonder what they are and what the hidden risks of investing in them might be? Read on and we’ll explain.

This week, we’ll address the following topics:

- The US government plans to centralize its databases in an effort to ensure we remain ahead of the Chinese in AI. It’s a great idea – unless you’re a civil libertarian.

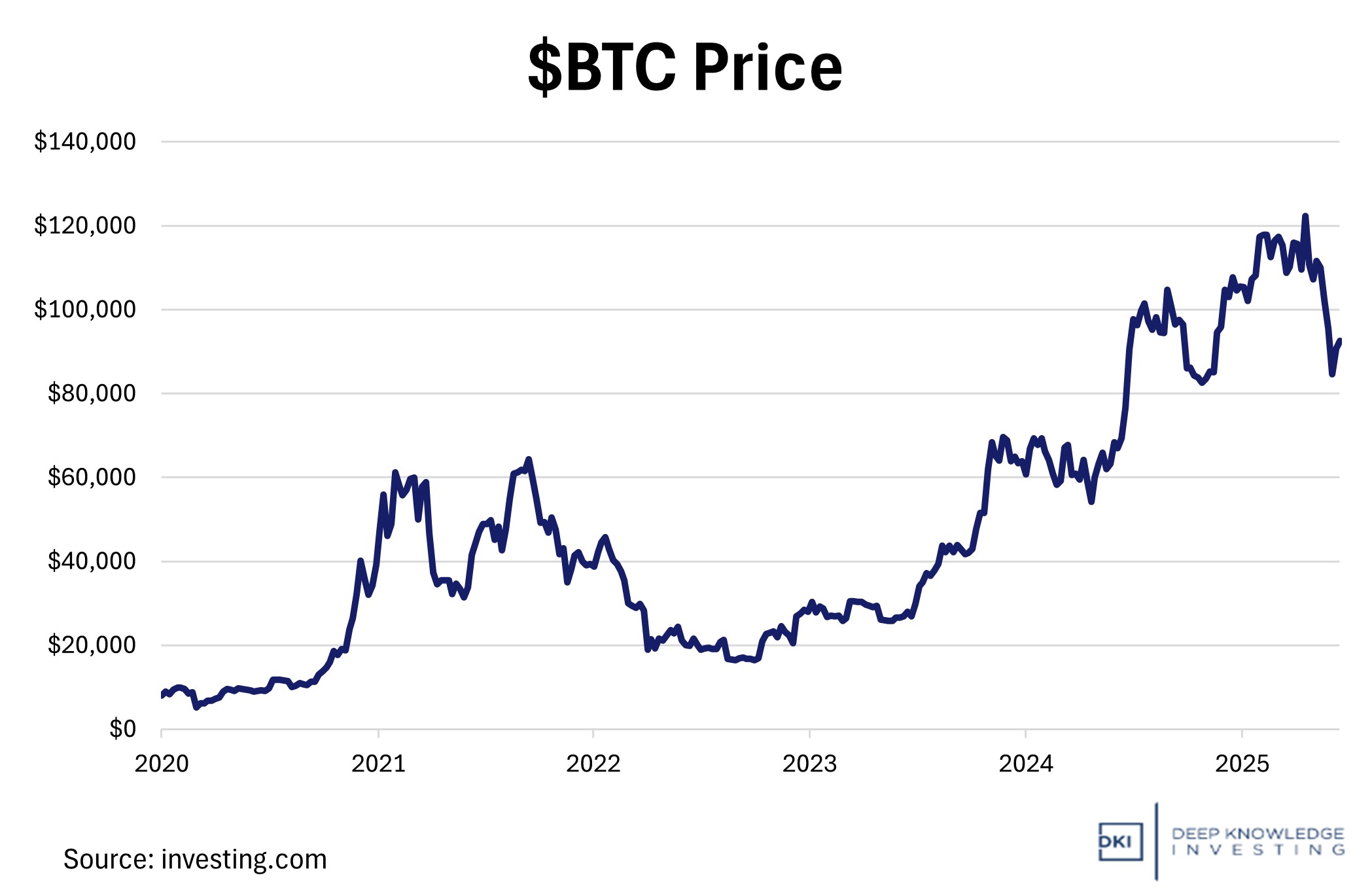

- Bitcoin volatility has reduced the dollar price of my favorite position. Strangely, these big declines tend to happen during the weekend and overnight in NY. Did we panic, or buy more? We didn’t panic.

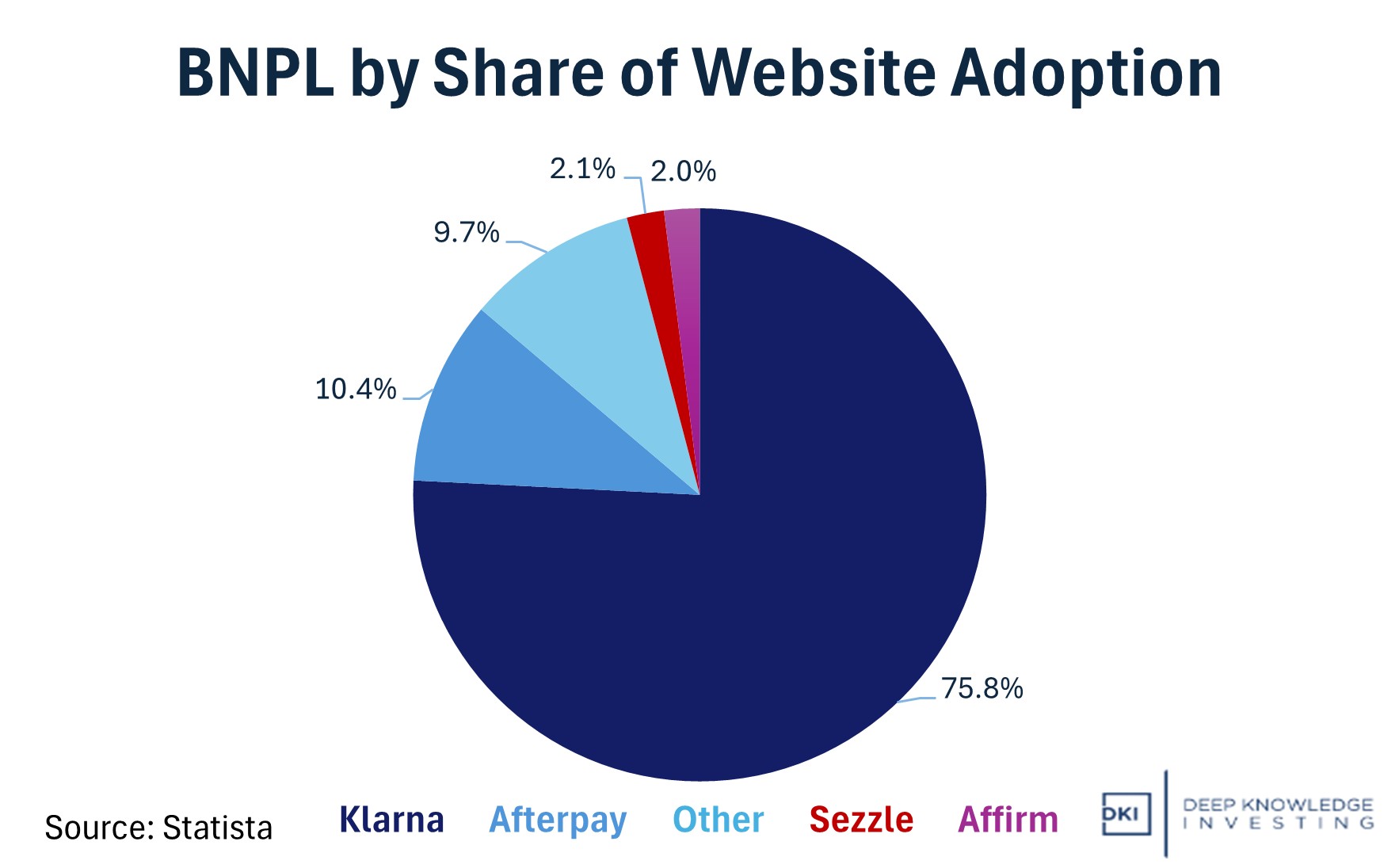

- The Attorneys General of seven States are investigating buy now pay later. DKI generally prefers light regulation, but it’s clear that too many young people don’t understand that BNPL means taking on debt they need to repay.

- The US eliminates tariffs on UK pharma. The UK agrees to pay closer to market price for US pharma. This has been a priority for both parties and looks like a win to us.

- Ever wonder what an ADR is or how you could invest in foreign stocks in your US brokerage account? In this week’s educational topic, we explain.

A round of thanks from all of us for the work that DKI Interns, Cashen Crowe and Samaksh Jain, contribute to each week’s 5 Things. They continue to produce high-quality work regardless of life’s other distractions.

Ready for a week of supercharged government data? Let’s dive in:

1) Genesis Mission: White House Launches a National AI-Driven Research Push:

The White House issued an executive order launching the Genesis Mission, a comprehensive national effort to leverage artificial intelligence, supercomputing, and federal research infrastructure to accelerate scientific discovery across various domains, including energy, biotechnology, semiconductors, quantum science, advanced manufacturing, and national security. The order tasks the Department of Energy (DOE) with building the so-called American Science and Security Platform: integrating national lab supercomputers, large federal datasets, AI modeling tools, and experimentation environments to support “foundation models,” hypothesis-driven research, automated experimentation, and high-impact national-scale challenges.

Implementation deadlines are aggressive: within 90 days, DOE must identify available computing/storage assets; within 120 days, it must outline initial data and model assets; within 240 days, it should assess robotic-laboratory and production capabilities; and within 270 days, it should be ready to demonstrate the platform on at least one major scientific challenge. Early execution signs are visible, for instance, the National Nuclear Security Administration (NNSA) issued an RFI last week seeking “transformational AI capabilities for national security,” indicating the Mission is evolving from concept to procurement.

![]()

In this area of the economy, more demand leads to LOWER prices.

DKI Takeaway: The Genesis Mission represents perhaps the boldest bid yet to institutionalize AI as a backbone of U.S. scientific infrastructure. If successful, it will rewrite not only what the government funds, but how breakthroughs in biotech, energy, security, and materials occur. This amounts to treating AI as strategic infrastructure rather than optional tech. For investors and industry stakeholders, this presents both opportunities and risks. On the upside, firms supplying high-performance chips, data-center capacity, AI stack software, and industrial-scale experimentation platforms stand to gain if the DOE funnels heavy, long-term procurement their way. On the risk side: this level of centralization may crowd out private-sector initiatives or distort research priorities toward government-driven agendas, potentially leading to inefficiencies or politicized tech cycles. This is a direct shot to ensure the US remains ahead of China and the effort will benefit from the additional information the government will provide. On behalf of the civil libertarians in the crowd, we caution that more government data sharing may not work to our ultimate benefit and carries significant privacy risks.

2) Bitcoin Takes a Hit – A Few Quick Thoughts:

Bitcoin had been down about 25% from its all-time highs reached earlier this year before falling another 7% before the market open on Monday. This drop started Sunday (11/30) evening NY time and has been blamed on interest rates in Japan, large and leveraged sellers, and the possibility that the US Federal Reserve won’t cut rates this month. Bitcoin has had multiple 90% drawdowns in its history. Here at DKI, we bought Bitcoin at $15k, enjoyed the run-up to $64k, and stayed calm as it fell more than 75% to end up back at $15k. The DKI response: we bought more in the $15k – $20k range.

My thesis on Bitcoin is simple. First, every major government is going to overspend and continue to destroy the purchasing power of their increasingly worthless fiat currencies. Second, increasing governmental and institutional adoption will create buying pressure. Both of these reasons benefit from the fixed-supply nature of Bitcoin combined with a disinflationary issuance schedule.

If you can stay calm and ignore the volatility, the reasons to own Bitcoin are unchanged. That doesn’t mean the dollar price of Bitcoin can’t go lower; but rather, if you have time and patience, you should do very well long-term.

Volatile but with a clear trend. Do you think Congress is going to stop overspending?

DKI Takeaway: Some of the recent sales were caused by too much leverage in the system. People borrow money to buy Bitcoin. When the price of Bitcoin falls, the collateral of these borrowers declines. When they sell, it causes the price of Bitcoin to fall, creating more forced selling. I’m not against leverage, but it does create additional volatility because selling creates the need for more selling. Fiat debasement is being driven by Congressional overspending. So, while lower rates from the Fed would help our Bitcoin positions today, it doesn’t really matter to the thesis. The dollar will continue to lose purchasing power, and fear of that loss will continue to drive people (including massive pension funds) towards gold and Bitcoin.

3) State Attorneys General Question BNPL Lending Practices:

On December 1, a coalition of seven U.S. state attorneys general led by the offices of California, Connecticut, North Carolina, and others formally requested detailed disclosures from the six largest BNPL providers, including Affirm, Klarna, Afterpay, PayPal, Sezzle, and Zip, asking for their pricing, repayment-assessment, billing, dispute-resolution policies, and credit-reporting practices. The inquiry arrives as federal oversight has receded. Earlier this year, the federal agency that had clarified BNPLs were covered under existing lending laws rescinded that guidance, leaving BNPL in a regulatory gray zone. State regulators say they are increasingly concerned that BNPL may expose young consumers to “debt traps” via fees, insufficient underwriting, and opaque repayment terms, particularly during the heavy-usage holiday season.

While X users joke about securitizing burritos, many young people don’t understand that they’re taking on debt which must be repaid.

DKI Takeaway: The multistate AG investigation could mark a turning point for BNPL, an industry that has thrived on light regulation and aggressive growth. For investors, two outcomes seem likely: increased compliance costs and possible restrictions on business practices. BNPL firms may need to dial back riskier underwriting and improve disclosure, which could suppress margins and growth. Over the longer term, regulators are signaling they view BNPL not as a harmless convenience, but as a lending product needing oversight, meaning investors should treat successful BNPL platforms like traditional lenders rather than retail-payment startups.

4) US-UK Pharmaceutical Trade Deal Win:

The US and UK just reached a landmark pharma trade agreement linking tariff policy with drug pricing reforms. The US will maintain zero tariffs on UK-made pharmaceuticals, drug ingredients, and medical devices for at least the next three years. In exchange, the UK agreed to raise the amount its National Health Service will pay for new patented medicines by 25%. The US is pressuring wealthy countries to pay more for advanced medicines rather than relying on charging US residents high prices in order to subsidize global research and development.

The world likes US pharma. US citizens have wondered why they don’t pay full price.

DKI Takeaway: For the UK, patients may start to gain earlier access to advanced treatments, and the life sciences sector could see stronger investment. However, higher pricing could impact budgets unless offset by other funding. For the US, pharma companies will benefit from improved access to a major market. Progress is also being made in addressing international price disparities. Overall, the White House has been making strides to reduce price disparities and make drugs cheaper for Americans, something both sides of the aisle have talked about for years. Getting foreign countries to fund their share of drug development is a win for the American people and is consistent with the stated priorities of both team red and team blue.

An American Depository Receipt is a security representing shares of a non-US company that can be traded in the US. ADRs were originally created to simplify foreign investing by allowing a US bank to hold the foreign shares and issue the ADR to investors. A depository bank in the US will purchase or hold the company’s shares in the home market and then issue ADRs that mirror those shares. They are typically denominated in US dollars and can be listed on major exchanges like the NYSE or NASDAQ. They are bought and sold with US dollars and even pay dividends in USD, relieving investors of the need to deal with foreign currency issues. ADRs give investors a way to gain exposure to international stocks with fewer complications.

ADRs represent a simplified way for US shareholders to invest in foreign companies.

DKI Takeaway: ADRs aren’t simply for convenience. They are a strategic gateway that allows US investors to profit from global growth while still operating within US market infrastructure. They mix international opportunities with the regular investing practices that investors find familiar. On the other side, this “ease” can hide some risks. ADRs are denominated in dollars, but are not immune from currency swings. Limitations on shareholder rights are sometimes difficult to determine. In the case of many Chinese ADRs, what US investors actually own is often not clear. Understanding the structure is important. Issues like who holds the real shares, what specific rights you have, and how foreign rules affect the investment become crucial in the event of a dispute. Taking all of this into consideration is necessary for making informed global investment decisions.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.