The Federal Reserve concluded its last meeting of 2025 and as expected, lowered the fed funds rate by 25bp (.25%). In an increasingly more common event there was dissent. For years, any Fed Governor dissenting was unusual. Any arguments were held behind closed doors while the committee presented a unified face to the public. Today’s vote had three dissents, something that hasn’t happened since 2019. One Governor (Miran) wanted a 50bp cut while two (Goolsbee and Schmid) wanted no change.

This was one of the four meetings each year where the Fed provides the “dot plot”. That’s the graph where each Fed Governor indicates where they expect the fed funds rate to be for each of the following few years. While there was some movement within the graph, the averages remained unchanged.

The press release indicated the reason for the 25bp cut was the committee thought there was more risk to employment than there was to inflation. Based on the employment numbers that have been announced recently (which tend to be highly-inaccurate), it looks like the employment market is in decent shape. Conditions have declined from the post-Covid period when companies were desperate to hire, but they’re still good unless you’re a recent college graduate. On the other hand, inflation has remained well-above the 2% target for years and based on the CPI, has been increasing in recent readings. As I’ve noted in previous posts, the Fed continues to pay lip-service to the 2% target, but has effectively moved the real target to something in the 3% – 4% range.

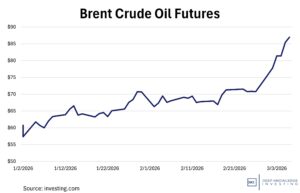

The biggest news was in the implementation note where the Fed indicated they would “Increase the System Open Market Account holdings of securities through purchases of Treasury bills and, if needed, other Treasury securities…”. Quantitative Easing is back and the money-printer is restarting. I think this is all a mistake, but I don’t have a vote. The right move here is to own hard assets that are difficult to duplicate while Congress and the Fed continue to debase the dollar and crush its purchasing power.

While market analysts and economists have been focused on today’s announcement for months, and while the market will trade up and down during Chairman Powell’s press conference as he gives hints about his view of the near-term future, I don’t think any of this matters. Earlier today, the Wall Street Journal wrote that the Fed has cut 1.75% (175bp) since the start of this cycle in September, 2024, and “somehow” the yield on the 10-year Treasury has increased. It’s not “somehow”. The bond market is pricing in higher projected long-term inflation.

The Fed has completely lost control of the situation. In general, corporations borrow based on the 5-year Treasury and mortgages get set based on the yield on the 10-year. The Fed can cut all they want, but the bond market isn’t buying at those prices. In a related move, President Trump is going to appoint a new Fed Chair soon who will be even more dovish than the too-dovish Powell. Rates will continue to fall, but the fed funds rate is the overnight rate. The bond market sets the price on the rest of the yield curve. The President is now traveling around the country to try to convince people that inflation is no longer a problem. President Trump doesn’t have any more control over the situation than Chairman Powell does.

There is only one fix for the situation and that’s a massive cut to Congressional spending (not rate cuts and QE). This is never going to happen. My conclusions:

– Ignore anything Chairman Powell says in today’s press conference.

– Ignore anything President Trump says about inflation.

– Congressional overspending will continue.

– Under the coming guidance of a new Chairman, the Fed will continue to cut the fed funds rate and continue QE.

– Prepare for higher long-term inflation. The DKI portfolio is more optimized for this outcome than anything else right now.

Note: There is currently a debate on Fin-X regarding whether the Fed buying more bonds is technically quantitative easing or not. I agree with Lyn Alden on this one that regardless of the label, it constitutes money-printing. The end result is the same.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.

This is true – “The right move here is to own hard assets that are difficult to duplicate…

Thanks Melinda. Great to hear from you!

What is the DKI position on Gold? What percent should be allocated to that?

What percent should be allocated to crypto or bitcoin? Shouldn’t both these assets increase with a weakening of the dollar and potentially treasuries?

Gold is one of my largest positions and Bitcoin is my largest. Completely agree that both of them should appreciate in dollar terms as the dollar is continually debased.

Position size details here: https://deepknowledgeinvesting.com/current-recommendations/