Overview:

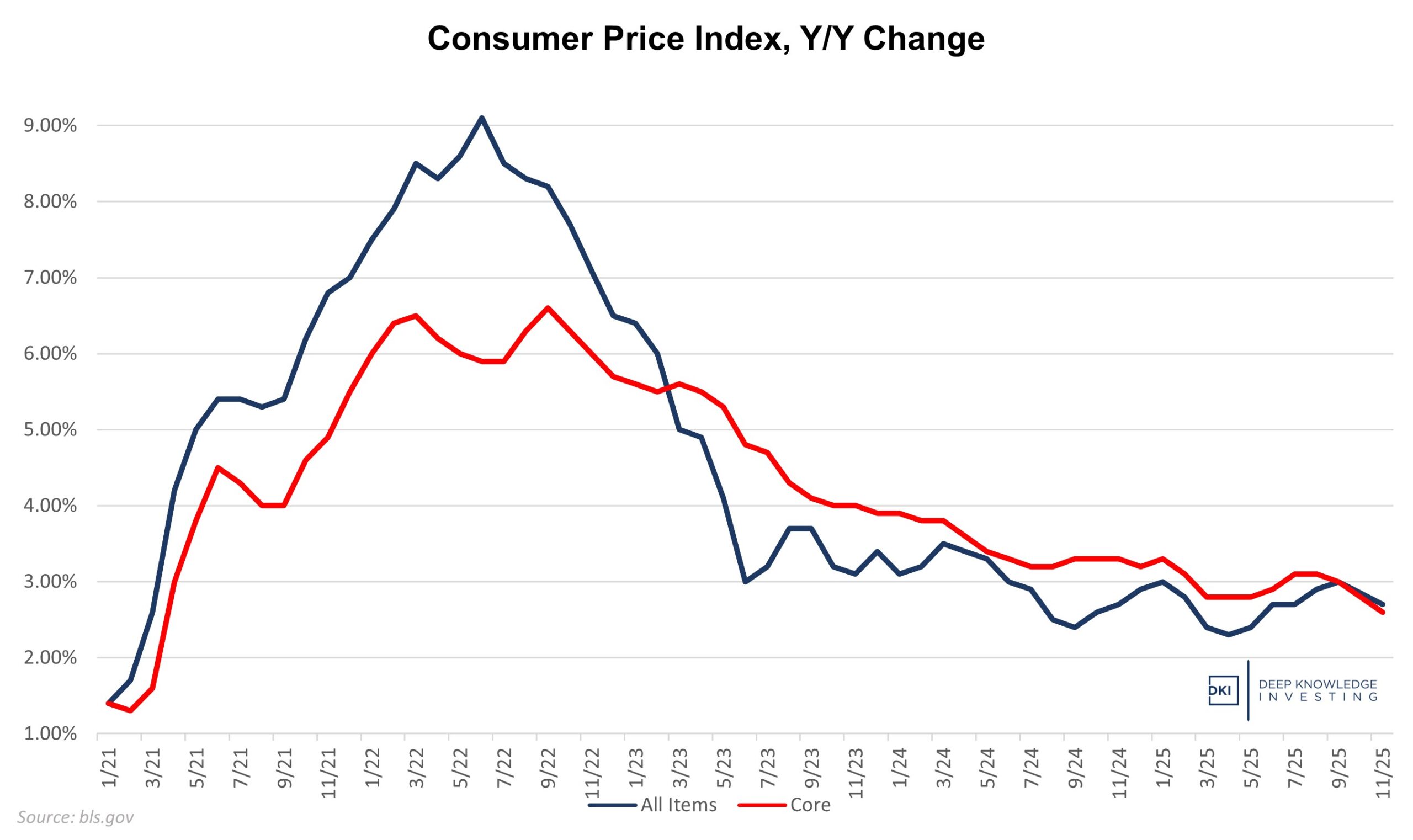

Today, we got the November Consumer Price Index (CPI) report which showed an overall increase of 2.7% for the last year. There was no October report due to the government shutdown so there will be no monthly comparisons in this piece. The annual number is down 0.3% from the September report and 0.4% below the forecast of 3.1%. The Core CPI which excludes food and energy was 2.6%, far below expectations of 3.0%. We still have inflation well above the 2% target (which is 2% too high), but the market will be focused on a monthly print that’s well-below September and expectations. Let’s go through the details:

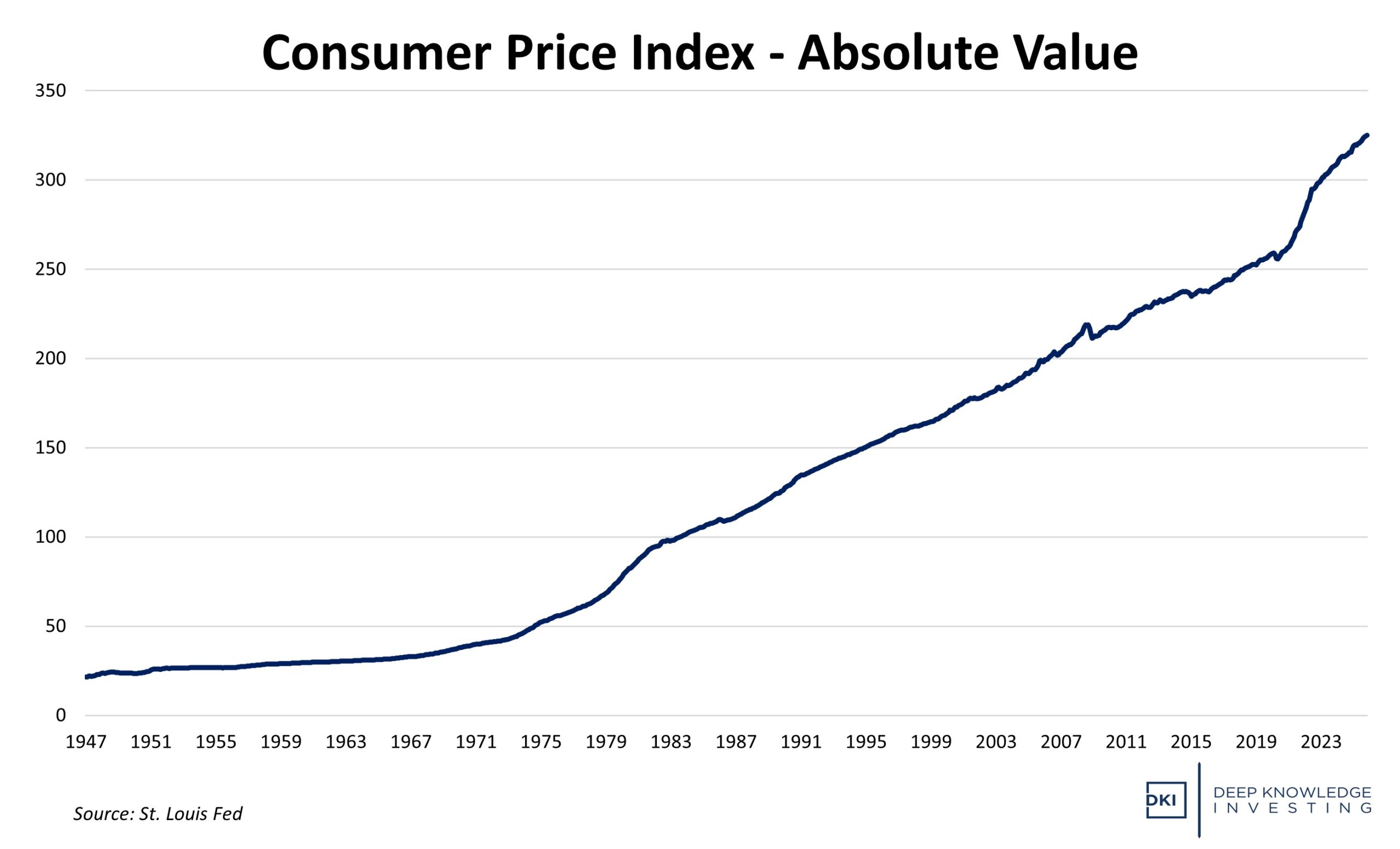

Schrodinger’s inflation. Is the line pointing down, or is it too high?

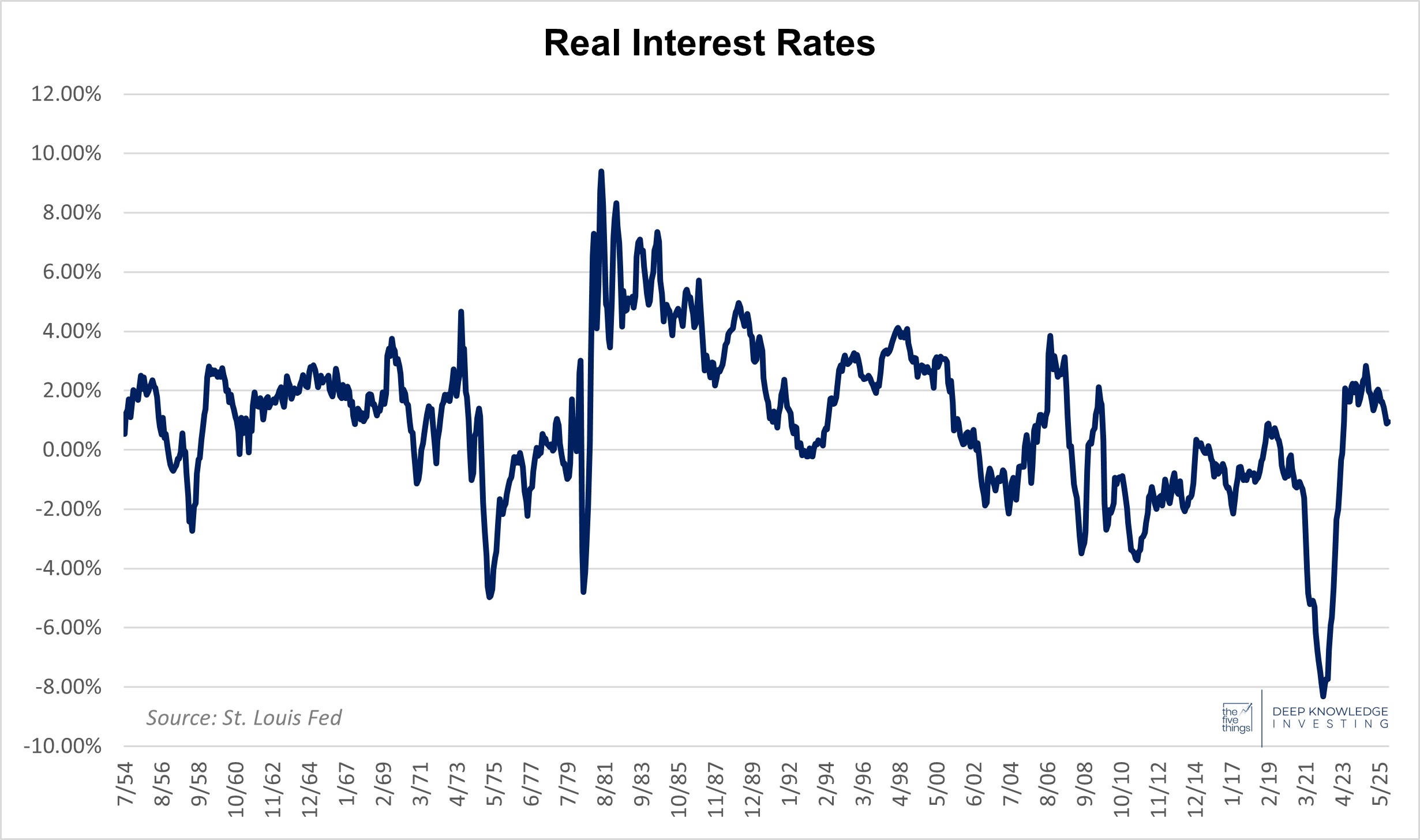

A big decrease in the CPI should have led to lower real rates – but the Fed cut more.

Food:

Food inflation came in at 2.6%. We’re still above 2% here, but this month’s figure is also well below September’s 3.1%. Food at home was up 1.9%, a big decrease from September’s 2.7%. Food away from home was up 3.7%, consistent with September.

We continue to note that both the rate of increase and price levels for food purchases are creating problems in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families. Using buy now pay later for groceries has become common. This category continues to create stress for consumers. (Copied from prior months because household finances don’t change that much from month to month and this is still an issue.)

Energy:

Energy was up 4.2% y/y following a big 1.5% monthly gain in September. Gasoline was up only 0.9% vs last year and prices at the pump are at a multi-year low, fulfilling one of President Trump’s big campaign promises. Fuel oil was up 11.3%. this is largely due to geopolitical concerns and efforts to limit Russia’s ability to sell oil. While those efforts have been unsuccessful, they have made transportation of Russian oil riskier and as a result, more expensive. Active tensions between the US and Venezuela are adding to price increases as well.

Vehicles:

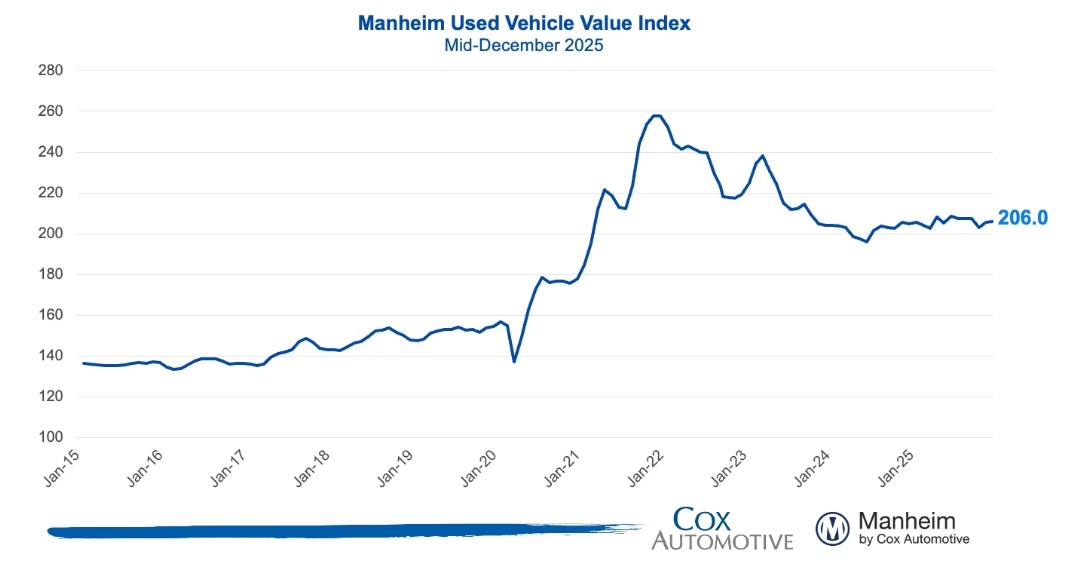

New vehicle pricing was up just 0.6% y/y. Consumers have pushed back on the huge price increases from earlier this decade. Prices are still high, but no longer rising much. As we’ve pointed out in previous CPI analysis, the higher new car prices have pushed more people into the used market where prices were up 3.6% vs last year. Increasing numbers of consumers falling behind on expensive car loans remain a concern.

That plateau is looking permanent.

Services:

Services prices were up 3.0%. Like the all-items CPI, this is both high and a meaningful reduction from September’s 3.5%. Much of the increase has been caused by higher wages. Headlines earlier this week indicated concern about a weak labor market. My view is different. The unemployment rate has risen, but that’s largely an effect of more people coming in off the sidelines to look for work which is a positive for the economy. Job losses were in unproductive government positions while the productive private market economy added jobs. (More on this in this week’s 5 Things to Know in Investing – available to DKI subscribers this weekend.)

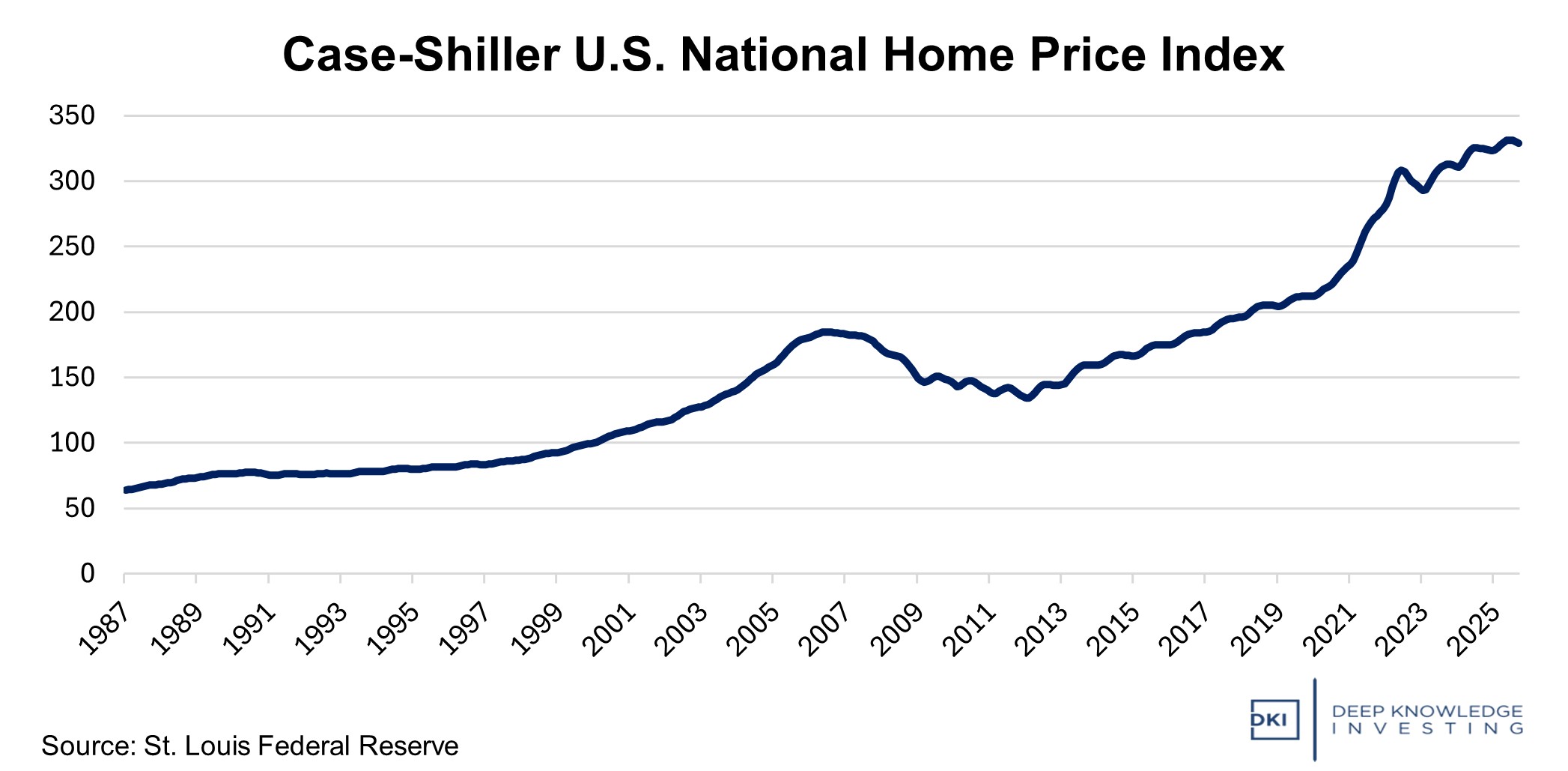

Shelter (a fancy word for housing) costs were up 3.0%. This line item is highly market-specific. While prices for consumer electronics like phones and televisions tend to be the same nationwide, housing price trends depend on location. Some markets have continued to weaken while others remain strong or are even rising. I spoke with a top real estate broker in the SE United States who told me he’s getting deals done at continued high prices. Much of the Northeast remains strong as well.

I’m not sure lower mortgage rates help this.

Conclusion:

Despite all the predictions of catastrophe from fiat economists relating to the Trump tariffs, disaster simply hasn’t happened. We were warned the tariffs would lead to massive inflation. That then got altered to a big one-time increase in the price level which would then be stable. Then, there were threats that tariffs would lead to decreased trade and a worldwide recession. None of that has happened. Some fiat economists have reasonably said that it might take a while for the higher tariff prices to work through complicated supply chains, but we’re past the point when this would have happened. If they were more honest, they’d start issuing public mea-culpas.

This chart shows why most Americans are experiencing more financial distress. Is the CPI really down?

The market is already trading off of this light CPI print and the equity indexes and Bitcoin are going full risk-on at the moment. The thinking is straightforward. People think that lower inflation (not lower prices) mean the Fed will reduce the fed funds rate. In turn, that will lower borrowing costs and encourage people to buy equipment, growth their businesses, hire more people, and help consumers out of expensive mortgages and credit card payments. I disagree.

First, today’s CPI isn’t going to change opinions at the Fed. Fed personnel are changing to match President Trump’s opinions. I think Chairman Powell has done a poor job because he kept rates far too low for far too long and started cutting far too early. We’ve had four straight years of big unpleasant inflation as a result. Powell is months away from being replaced by someone who will be much more dovish and will amplify his errors.

More importantly, I don’t think anything the Fed does now will matter much. They’ve cut 175bp since September of 2024, and the yield on the 10-year has RISEN. The bond market is correctly pricing in higher long-term inflation. The Fed only controls the overnight rate. Corporates tend to price off of the 5-year Treasury yield and mortgages off of the 10-year. The Fed can cut all they want, but the bond market is looking at Congressional overspending and long-term inflation.

As you invest, try thinking about inflation as the loss of purchasing power of your dollar. And if you’re planning for retirement, think about whether your dollars will buy as much as you’re accustomed just a few years in the future. The Fed has quietly changed the 2% inflation target to a 3% – 4% range. Start incorporating a higher inflation rate into your long-term planning. My personal portfolio is highly exposed to this thesis.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.