Andy Wang has been kind enough to have me on his excellent show, Inspired Money, several times including just last week. Here are some details and the link:

When the financial markets feel chaotic, it helps to get insights from experts who thrive in uncertain times. On a recent episode of Inspired Money, host Andy Wang welcomed a panel of seasoned investors and market thinkers, including Gary Brode, Managing Partner at Deep Knowledge Investing. Gary was joined by Katie Stockton (Fairlead Strategies), Mike Taylor (Simplify Asset Management), and Seth Cogswell (Running Oak Capital) for a conversation on how to navigate today’s market turbulence.

Panel Insights: From Volatility Signals to Defensive Strategies

Throughout the episode, the panel explored critical topics ranging from the meaning of volatility indicators like the VIX and put-call ratio, sector rotation strategies, defensive positioning using Treasuries and gold, and the psychology of investing in bear markets.

– Katie Stockton discussed the technical side of managing risk, emphasizing sector rotation and the power of technical indicators to spot regime shifts in volatility.

– Mike Taylor shared his experience running hedge funds, shifting from never owning gold to making it a core holding in the face of long-term fiscal risks, and the importance of portfolio sizing during market swings.

– Seth Cogswell highlighted his disciplined, rules-based approach, focusing on quality, valuation, and protecting clients from major drawdowns.

Spotlight: Gary Brode’s No-Nonsense Approach to Risk Management

Gary brought his trademark candor to the discussion, questioning conventional wisdom around volatility: “The VIX is really more than anything a measure of feelings… real risk is permanent loss of capital.” Rather than obsessing over daily market movements, Gary prefers to focus on his investment thesis, company fundamentals, and long-term strategies.

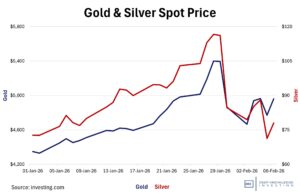

Amid the current climate of government overspending and ballooning debt, Gary advised viewers to avoid bonds and fiat currency, instead turning to hard assets like Bitcoin, gold, and silver as reliable anchors. As Gary put it, “They are going to debase the dollar into oblivion… I want to own things that can’t be easily replicated.”

Gary also emphasized the value of holding high-quality companies with durable free cash flow, especially those investing in genuine growth, not just maintaining operations. “If I stick to my investment thesis, I’m going to do well,” he explained, underscoring the importance of discipline and preparation during periods of extreme volatility.

Why You Should Watch (or Listen) to the Full Episode

This Inspired Money episode is rich with actionable ideas whether you’re a seasoned investor or just trying to find calm amidst the noise. You’ll get perspectives from technical, fundamental, and multi-strategy investors, along with practical tips for writing your own “panic-proof playbook.”

Ready for more? Catch the full panel discussion here: https://www.youtube.com/live/jsBayDIoTnI

Or listen to Inspired Money wherever you get your podcasts!

Final Thoughts

Gary’s appearance, alongside Katie Stockton, Mike Taylor, and Seth Cogswell, offers an opportunity to hear how top investors are preparing for both storms and recoveries. Whether you’re hedging risk, seeking opportunities in hard-to-replicate assets, or building your own rules-based portfolio, this episode has takeaways for every investor.

Don’t miss it—watch or listen, and start turning volatility from a threat into an informed investing advantage.