Quick announcement: I’ll be in Bangkok for the next few weeks. While I’m here, I’m open to a small number of in-person conversations. If you’re based locally, or know someone here you think it would be worthwhile for me to meet, feel free to reach out privately at IR@DeepKnowledgeInvesting.com.

The big news of the week was Intel announcing their 3rd generation of the Core Ultra line of processors. These mobile-optimized chips combine a CPU, a GPU, and an NPU which can handle a variety of AI and video needs with reduced power draw. Production is moving back to the US from Taiwan. The nuclear regulatory commission has stalled and prevented new nuclear construction for half a century. The DOE now has expedited approval authority for ten companies and just approved Terrestrial Energy for a new Gen IV nuclear plant. President Trump wants to prevent big finance and PE firms from buying residential housing. My concern is that either way, the government will have more influence over the housing market. Goldman Sachs is selling the Apple credit card portfolio to JP Morgan at a big discount. JP Morgan is looking at cross selling financial products to millions of Apple fans. In this week’s educational topic, we explain what working capital is and why investors care about it.

This week, we’ll address the following topics:

- Intel launches the 3rd generation of their Core Ultra line of chips with a CPU, GPU, and NPU. Production is moving from Taiwan Semiconductor to Intel’s US-based 18A plant.

- Terrestrial Energy ($IMSR) receives expedited DOE approval for an integral molten salt reactor. Want the AI future we were promised? Gen IV nuclear is how we power it.

- President Trump talks about banning big investment firms from buying homes. DKI has mixed feelings because either way, it means more government interference.

- JP Morgan Chase is buying the Apple credit card portfolio from Goldman Sachs at a big discount.

- Ever wonder what working capital is and why investors care about it? Check out this week’s educational topic where we explain in clear language.

As usual, DKI’s star interns, Cashen Crowe and Samaksh Jain, deliver week in and week out. They’re more reliable than your local mail carrier. Much of what you’re about to read reflects their research and writing.

Ready for a week of making difficult things locally? Let’s dive in:

1) Intel Core Ultra Series 3:

This week, Intel ($INTC) publicly announced its new Core Ultra Series 3 line of processors. The Core Ultra product has a CPU, a GPU, and an NPU (neural processing unit) on one chip. These chips are mobile optimized with multiple cores including low-power-draw efficiency cores which extends the battery life of laptops making them more competitive with Qualcom-powered mobile devices and Apple devices.

This generation of Core Ultra processors will be produced in the new US-based Intel 18A fab plant. The chips are already available for pre-order and will start to be rolled out in new OEM computer designs later this month. Intel outsourced production of last year’s Core Ultra Series 2 line to Taiwan Semiconductor ($TSM). By moving production of this crucial chip back in house, Intel is signaling confidence in its ability to produce high yields at volume in the new plant, something that was part of DKI’s positive thesis on the stock when we bought it 34% below where it is at the time of this writing.

That chart reflects a de-risking of the business plus better fundamental execution.

DKI Takeaway: There’s talk that Nvidia ($NVDA), Apple ($AAPL), and AMD ($AMD) are all watching how Intel’s 18A production process handles the rollout of a high-volume chip. If it goes well, they should all be interested in manufacturing in a proposed 14A plant in a couple of years. While Taiwan Semiconductor ($TSM) has the best fab plants in the world, no one wants to have a single sourced supplier; especially one that will be facing a Chinese invasion at some point and may eventually belong to the CCP. There have also been recent concerns about DRAM prices. While I see the same big pricing increases for standalone DRAM everyone else is seeing, as of now, laptops with good memory specs have consistent and value-based pricing. I’m not seeing big finished product price increases as long as you’re not trying to build your own computer.

2) Terrestrial Energy’s Accelerated DOE Approval:

There are multiple Gen IV SMR (small modular reactor) companies. They all have welcome plans to provide safe small(er) footprint clean energy in any location. They also have one big thing in common: None of the US-based companies has a full-scale working model operating yet. Frustrated with a nuclear regulatory agency that through excessive and endless regulatory reviews has effectively shut down new plant construction, the Trump Administration has enabled the Department of Energy to work with ten companies to accelerate regulatory approval for new nuclear plants. This week, the DOJ announced it has an agreement with Terrestrial Energy ($IMSR) to construct and operate an integral molten salt reactor.

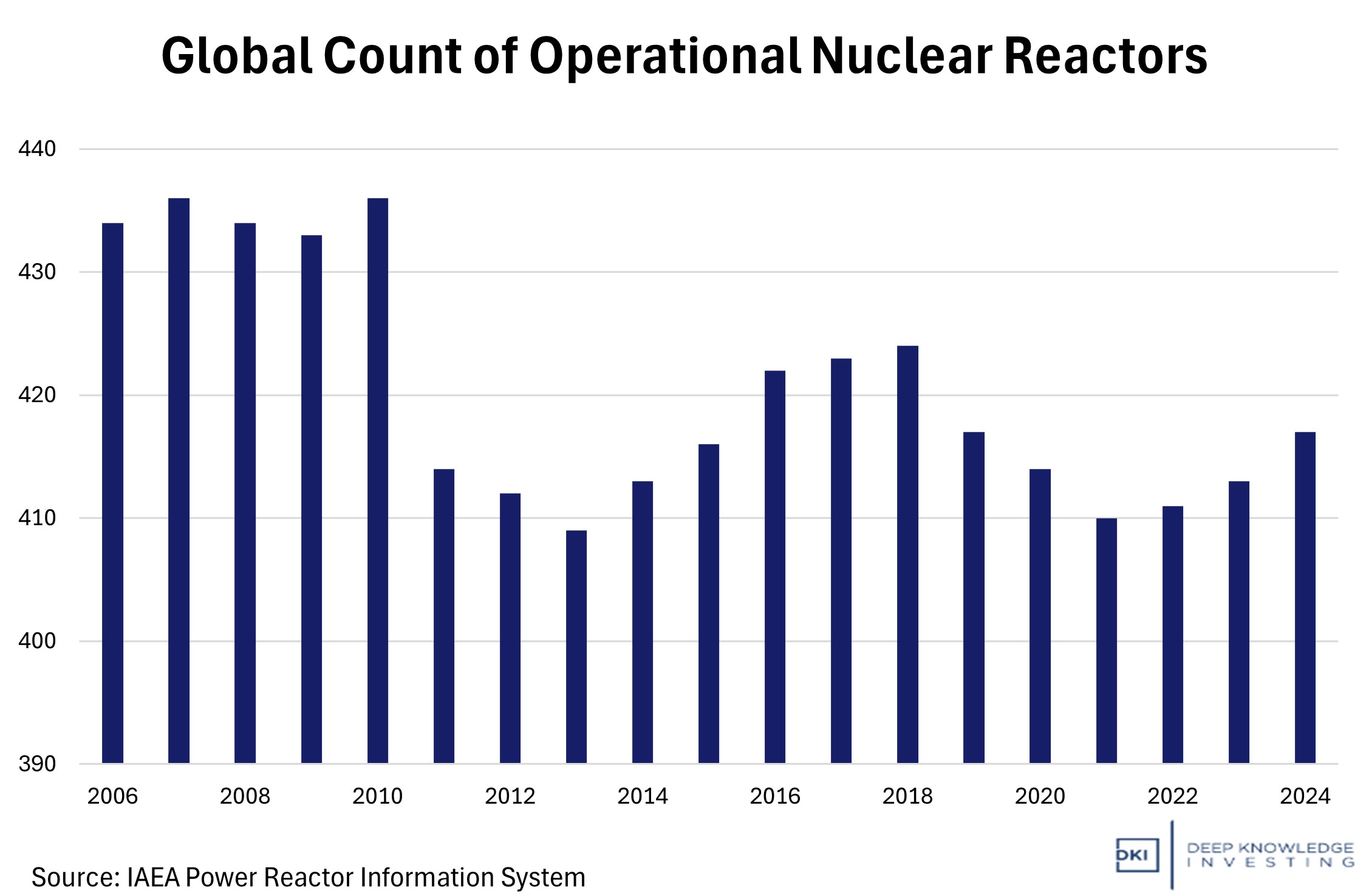

This is going to increase by a lot over the next couple of decades.

DKI Takeaway: New Gen IV nuclear is safe and can’t have Chernobyl-like meltdowns. Right now, the US is trying to maintain a lead in AI and that requires massive amounts of power. Under our current system, companies like Google and Amazon are bidding against homeowners for electricity. People are seeing huge increases in their monthly bills as a result. New nuclear is the fastest safest cleanest answer to this problem and waiting decades to get approval is a sure path to a creaky unreliable grid, higher prices, and losing technological leadership. The Terrestrial Energy plant uses widely-available SALEU. Some competitors need HALEU which is currently difficult to source. We’re hoping the plant gets built quickly and demonstrates the expected power production.

3) President Trump’s Plan to Ban Institutional Investors Buying Single-Family Homes:

President Trump announced that his administration will potentially pursue a policy to ban large institutional investors from purchasing single-family homes, framing it as a way to make homeownership more accessible for Americans struggling with affordability. In a Truth Social post, he wrote that “people live in homes, not corporations” and said he will urge Congress to codify the ban, arguing that corporate buying has “priced out” first-time and middle-class buyers. Stocks in single-family rental companies and institutional landlords reacted sharply. The shares of Invitation Homes, American Homes 4 Rent, Blackstone, and others sold off after the announcement.

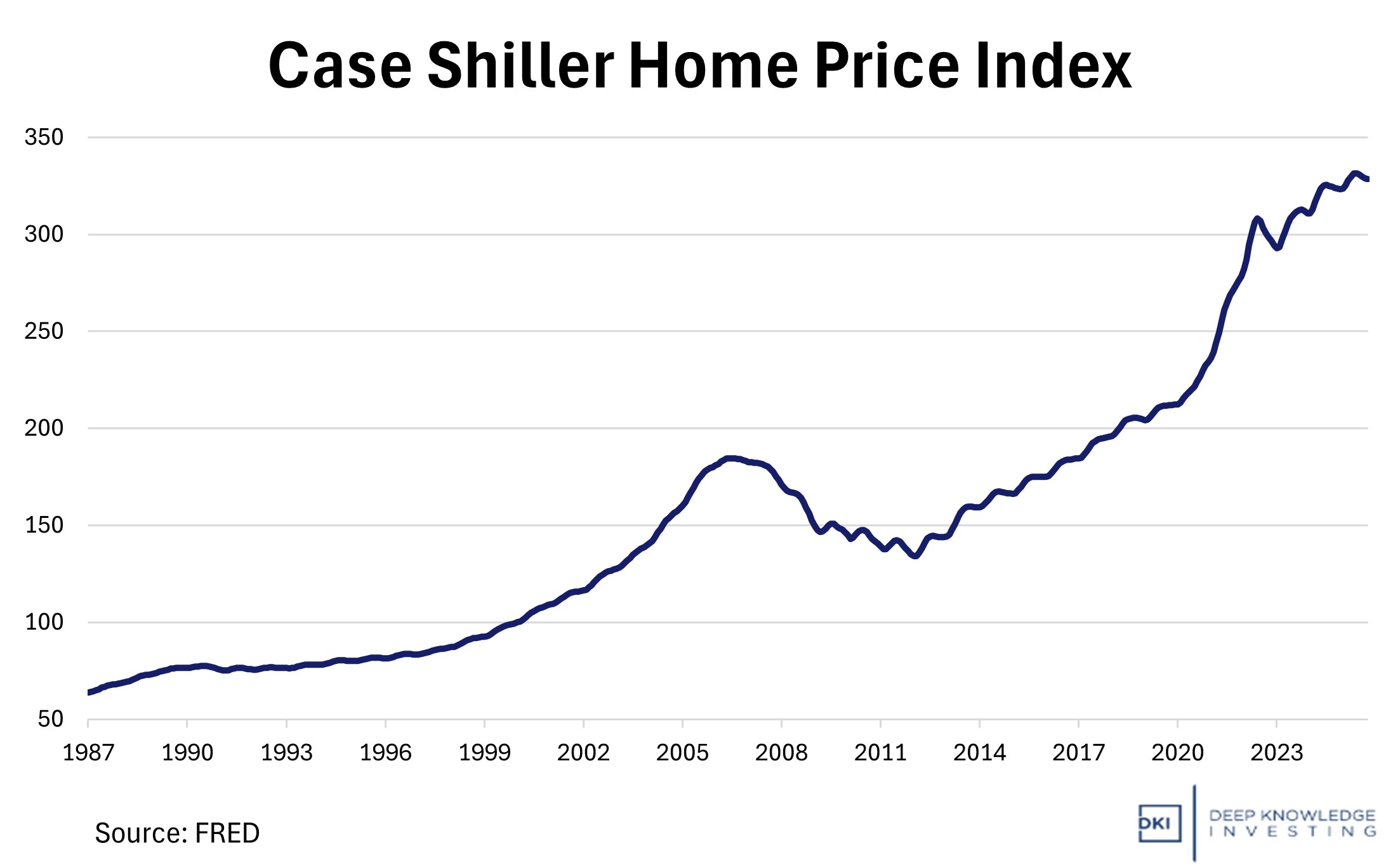

Large institutional investors currently own a relatively small share of the total single-family housing stock estimated at 1% nationally. However, it is significantly higher in specific markets in the Sun Belt like Atlanta and Charlotte. This impact on local competition has drawn bipartisan attention from housing advocates and some lawmakers. President Trump’s proposal comes amid broader concerns about housing supply constraints, soaring mortgage rates, and record median prices near $425,000, pressures that cannot be solved by demand-side restraints alone.

You can understand the frustration and concern of people in their 20s.

DKI Takeaway: President Trump’s investor ban is a politically potent idea, but its economic impact is likely to be modest. Although limiting large institutional purchases may ease competitive pressures in specific markets, it won’t address the fundamental shortage of housing supply that drives prices nationwide. The real solution lies in expanding housing starts, easing zoning restrictions, and improving affordability through supply-side reforms.

I have mixed feelings about this topic. On one hand, property rights are important. Should a homeowner be told they can’t sell to the highest bidder, or to one that has less risky conditions to closing? On the other, do we really want to doom younger generations to perpetually renting from Blackstone? Big asset management companies have a symbiotic relationship with Washington DC and it’s easy to imagine a situation where people get locked out of the housing market because a corporation doesn’t like a social media post with unapproved positions. Remember, if you like this kind of government influence, at some point, it will be run by people you don’t like. I’m left with the unpleasant conclusion that either way, we run the risk of heavy-handed government influence in the housing market. Your view may depend on whether you’re more likely to buy, sell, or rent as your next transaction.

4) JPMorgan Chase Takes Over Goldman Sachs’ Apple Card:

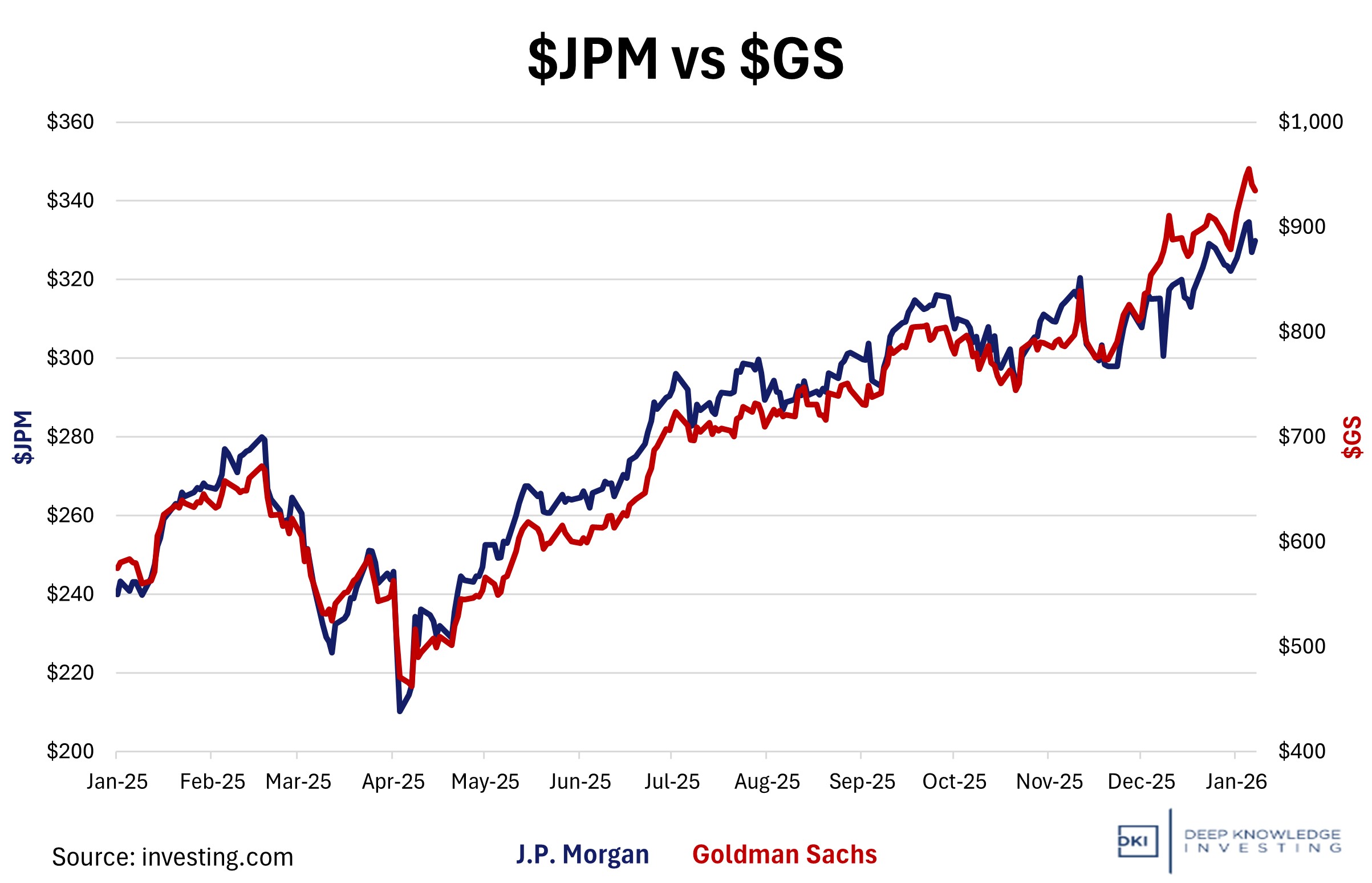

JPMorgan Chase is set to replace Goldman Sachs as the issuer of Apple’s credit card, ending Goldman’s role in the 6-year partnership. Chase will assume roughly $20 billion in outstanding card balances at a $1B discount reflecting asset quality concerns. The transition will take about two years to complete, pending regulatory approvals. Apple emphasized that there will be no immediate changes for cardholders in terms of features and rewards, and Mastercard will continue as the payment network.

Goldman Sachs decided to exit the consumer credit business after significant losses and challenges. Since its launch in 2019, GS suffered higher-than-average delinquency rates and a sizable subprime borrower segment. For JMPC, taking over the card aligns with its strategy to expand in consumer finance, especially with Chase’s excess capital and an opportunity to cross-sell to millions of tech-savvy customers in the Apple ecosystem.

It’s been a good environment for big banks.

DKI Takeaway: As this transition takes place, more power is consolidating in the hands of the largest issuer. JPM was already the top US credit card issuer in 2024, and absorbing the Apple Card portfolio will add even more purchase volume. Apple is continuing its commitment to grow its fintech and services ecosystem without becoming a bank itself (yet). Apple Card has always been positioned as an extension of Apple’s digital wallet, and a way to keep customers engaged in the iPhone-centered ecosystem for daily transactions.

5) Educational Topic: Explaining Working Capital Management:

Working capital is the money that a company can use for its day-to-day operations after covering short-term liabilities and debts. To calculate it, subtract a company’s current liabilities from its current assets. If this calculation yields a positive number, the company has enough resources to cover its short-term obligations. In contrast, negative working capital means current liabilities exceed current assets, which can signal potential liquidity problems. (There are some rare industry-specific exceptions to this.)

Working capital management is the process of overseeing and optimizing a company’s short-term assets and liabilities so the business runs efficiently and pays obligations on time. Common activities include ensuring the company has enough cash available to meet everyday expenses, regulating inventory levels to avoid tying up too much cash in inventory, making weekly payroll, and speeding up collections from customers while managing payments to suppliers wisely.

An imbalance is a sign of a potential problem and worth investigating.

DKI Takeaway: While there isn’t a “right” or “wrong” way to go about managing working capital we do want to look at is as part of evaluating a business. A company that requires less cash to manage daily operations is different from a business with large operational requirements. Some companies need to add a lot of working capital in order to grow. Others, like insurance companies, generate additional working capital when adding new business. Either can be a good investment, but it’s important to know how these dynamics work when evaluating a company.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.