The CPI stays locked in a tight range thanks to the BLS presenting a constantly-understated version. High inflation continues regardless of the official statistics or the actions of the Fed. Chairman Powell announced that he’s being investigated causing political actors to bemoan the politization of the Fed. The Fed has always been a political institution with previous interventions taking place behind closed doors. If you trusted the system a week ago, I’d like to know why because nothing is different today. President Trump wants to cap interest rates on credit cards. That’s fine for the 800-credit score crowd that rarely carries a balance. For the subprime group, this doesn’t lead to lower monthly bills; but rather, a shuttering of credit lines and a forced move to more expensive options. Talen Energy ($TLN) is buying billions of dollars of generation assets in the constrained PJM market. DKI subscribers have made almost 300% in the name in less than two years. (HT to Enrique Abeyta for the original idea.) In our educational topic, we discuss what an inverted yield curve is and why it matters. If you’ve found that terminology confusion, read on and we’ll explain.

This week, we’ll address the following topics:

- The CPI remains locked in a tight range, but only because multiple big line items are lies. Is your health insurance the same price it was in 2019? Mine isn’t.

- The DOJ is investigating Chairman Powell while central bankers circle the wagons. DKI asserts that the Fed has ALWAYS been politicized and that the only thing that’s different now is we see the fight happening in public.

- President Trump suggests cutting credit card interest rates. Consumers with low FICO scores will love that – until their credit lines get pulled sending them to even more expensive payday lenders.

- Talen Energy ($TLN) is buying more generation capacity in the constrained PJM market and says the deal will be cash flow positive. DKI has made almost 300% in the stock in under two years. HT to Enrique Abeyta who presented the original idea.

- Ever wonder what the yield curve is and why people care when its “inverted”? Check out this week’s educational topic where we explain.

Credit to DKI Interns, Cashen Crowe and Samaksh Jain, who consistently do so much of the heavy lifting for The Five Things. Well done!

Ready for another week discussing why we should #EndTheFed? Let’s dive in:

1) CPI:

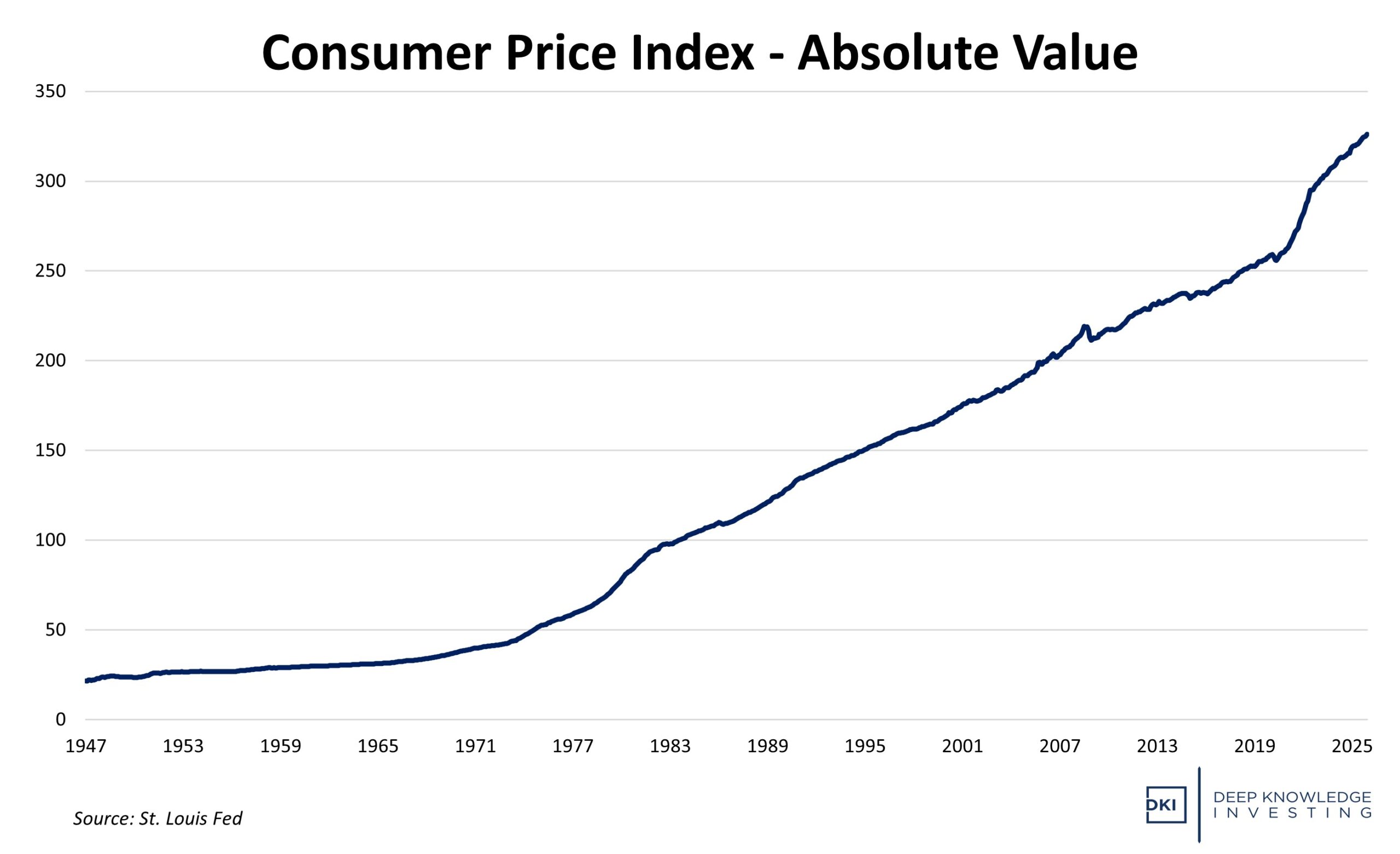

The December CPI (consumer price index) was 2.7% with the Core CPI at 2.6%. These were roughly in line with expectations and have meant the CPI has been locked in the mid/high 2% range for months (mostly). Despite this continued elevated level of official inflation, the Fed has cut 175bp. Despite the cuts to the fed funds rate, the yield on the 10-year Treasury has risen, something DKI warned about before the Fed started its cutting cycle in September of 2024. A few notes on the report:

Food inflation has risen to 3.1% with the monthly change a huge 0.7%. DKI has been warning about unrealistically-low food inflation for years.

Despite higher electric prices partly driven by data center demand, the energy portion of the CPI was up only 2.3%. That’s due to lower gasoline prices.

Vehicle prices were barely above flat. In general, goods prices have not risen, and I have not seen the mea culpas from the fiat economists who predicted tariff Armageddon nine months ago.

To his credit, Wolf Richter pointed out some egregious anomalies in the shelter and health insurance data. Shelter prices were officially up 3.2%, but he notes a huge unexplained dip a few months ago that got carried forward a month due to the government shutdown. OER (owners’ equivalent rent) means that the shelter portion of the CPI is always understated, and I agree with Wolf that the current version is likely understating housing costs by even more than usual.

A few years ago, I wrote about the massive downward revision in the health insurance index. Wolf illustrates the insane level of the current adjustment. According to the Bureau of Labor Statistics, health insurance is now more than 30% LESS expensive than it was in September of 2022 and at the same level it was at in February of 2019. Do any of you believe that insurance costs haven’t risen in the past seven years?! I don’t either.

The market moves depending on whether the CPI is 2.7% or 2.8%. The above is evidence of long-term systematic theft.

DKI Takeaway: The CPI remains elevated over the 2% target (which is 2% too high). The Fed doesn’t care and neither the White House nor Congress understands. In addition, the CPI “data” seems more skewed than usual and the prices actually being paid by American consumers probably reflect a much higher inflation rate.

One final note: During the previous White House Administration, I frequently wrote that employment and CPI reports seemed designed to help the Democrats in power at the time. Over the past year, we have seen similar patterns of bad employment data and an understated CPI continuing during the Trump Administration. I retract my previous claim that the bureaucracy was favoring team blue over team red. I now think they’re just bad at their jobs and have neither the inclination nor the capacity to produce accurate data.

2) Fed Investigation:

The big headlines last week were related to Fed Chairman Powell’s video announcing he’s being investigated by the DOJ related to the cost of renovations at the Fed’s, headquarters and Powell’s testimony about those costs.

I have no idea if the investigation of Powell is warranted or not. I have no idea if Powell actually committed a crime. For the purposes of running DKI, I don’t need an opinion and it doesn’t change the portfolio. Feel free to let me know if you think Powell committed a crime. My “solution” to the whole situation would be to close the Federal Reserve and sell the building, but I’ve been on team #EndTheFed for years so this is nothing new.

The crux of the issue is the (reasonable) claim that President Trump is using the DOJ to push around the Federal Reserve and in doing so has politicized a grand institution that has operated above politics for more than a century. Let’s be clear on two points here. First, that is absolutely what the President is doing. He’s been hectoring Powell in public all year and despite continued rate cuts, he’ll use all avenues within his power to embarrass the Fed Chairman.

My second point is more subtle. The Fed has NEVER been an independent institution. It’s been a political influence machine since its founding. For a short list of some of the more obvious historical examples, please see my earlier blog post President Trump, the Fed, and What Really Matters. I’m not going to rehash it all here again as the linked article has enough detail to make my point.

I frequently wrote in 2024 that Powell cutting rates just before the November elections looked a lot like he was trying to help the Democrats retain power. To me, it looked like he chose a political side at the expense of Americans suffering from inflation. The people in the press braying that the White House has just now politicized the Fed look a lot like Captain Renault insisting “I’m shocked, shocked to find that gambling is going on in here!”

The only difference between this political intervention and previous ones is President Trump (and his DOJ) are acting in the full light of day while previous situations were handled behind closed doors.

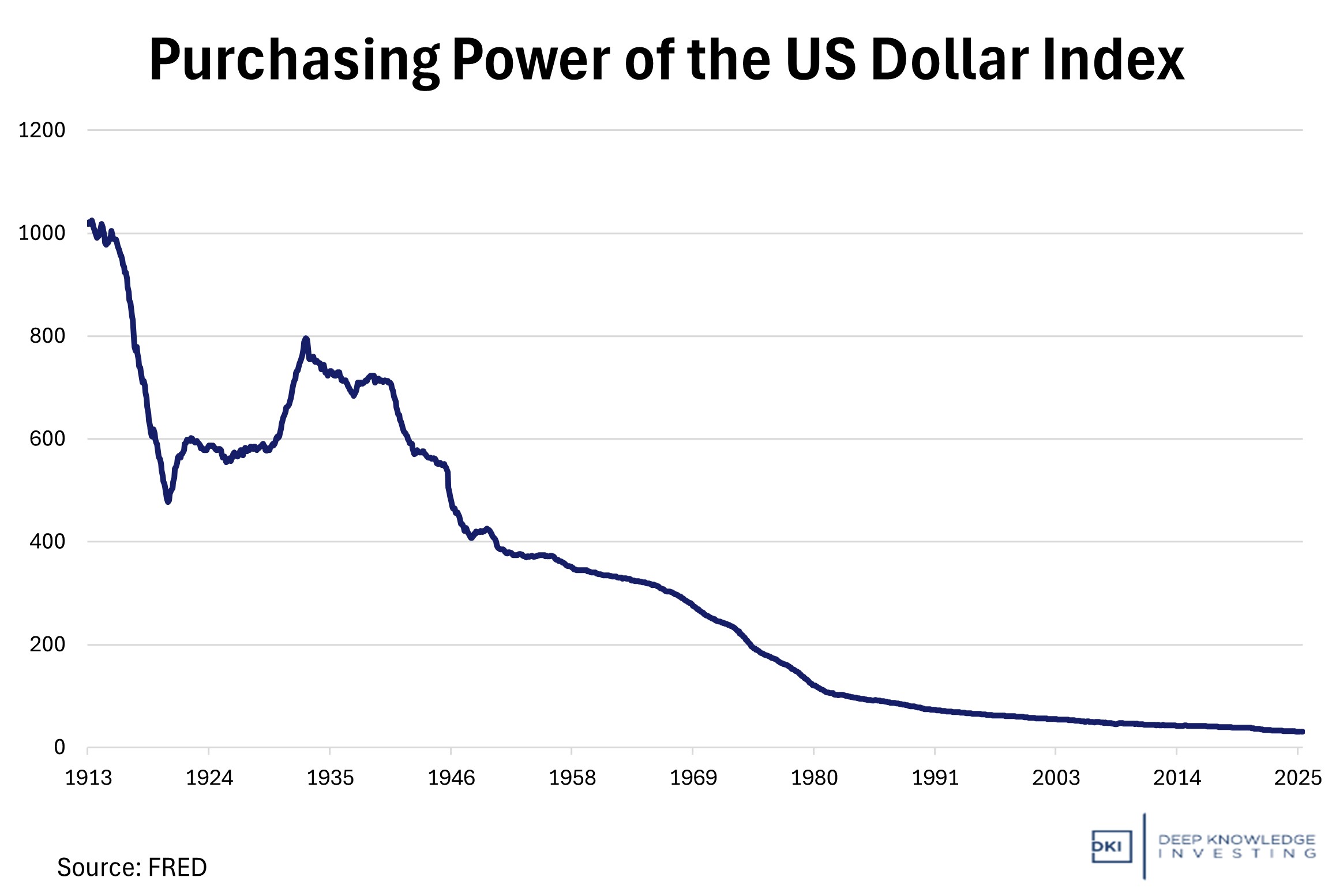

This is what the Fed has done to our currency. This is why you can’t save in dollars. The rest is just a sideshow. #EndTheFed.

DKI Takeaway: Moving past the “everybody does it” part, the real question for our purposes is whether any of this will affect Fed policy and whether a change in Fed action leads to a need to adjust the DKI portfolio. The answer to both is a hard no.

Powell has only a few months remaining in his tenure at which point, he’ll be replaced by an ultra-dove. President Trump will put in place a new Fed Chair who will get the job by promising lower rates. I disagree with this policy, but it’s what’s going to happen. The potential charges against Powell are an unpleasant side show, but don’t change likely Fed policy once we get out another few months. I think the market recognized this following Powell’s video when pre-market equity indexes were indicated down followed by a quick turn into positive territory.

Second, I’ve made the case plenty of times that with Congress running multi-trillion-dollar consumption-focused annual deficits, there’s nothing the Fed can do that will matter. Powell and the current Fed have cut 175bp over the past 16 months and the yield on the 10-year Treasury has risen. The Fed controls the overnight rate. The bond market controls the rest of the yield curve and it is correctly seeing higher long-term inflation on the way. More rate cuts haven’t changed that and are unlikely to do so in the next year.

DKI’s response: Ignore the sideshow of fighting in DC and own Bitcoin, gold, and silver.

3) President Trump’s Proposed Cap on Credit Card Rates:

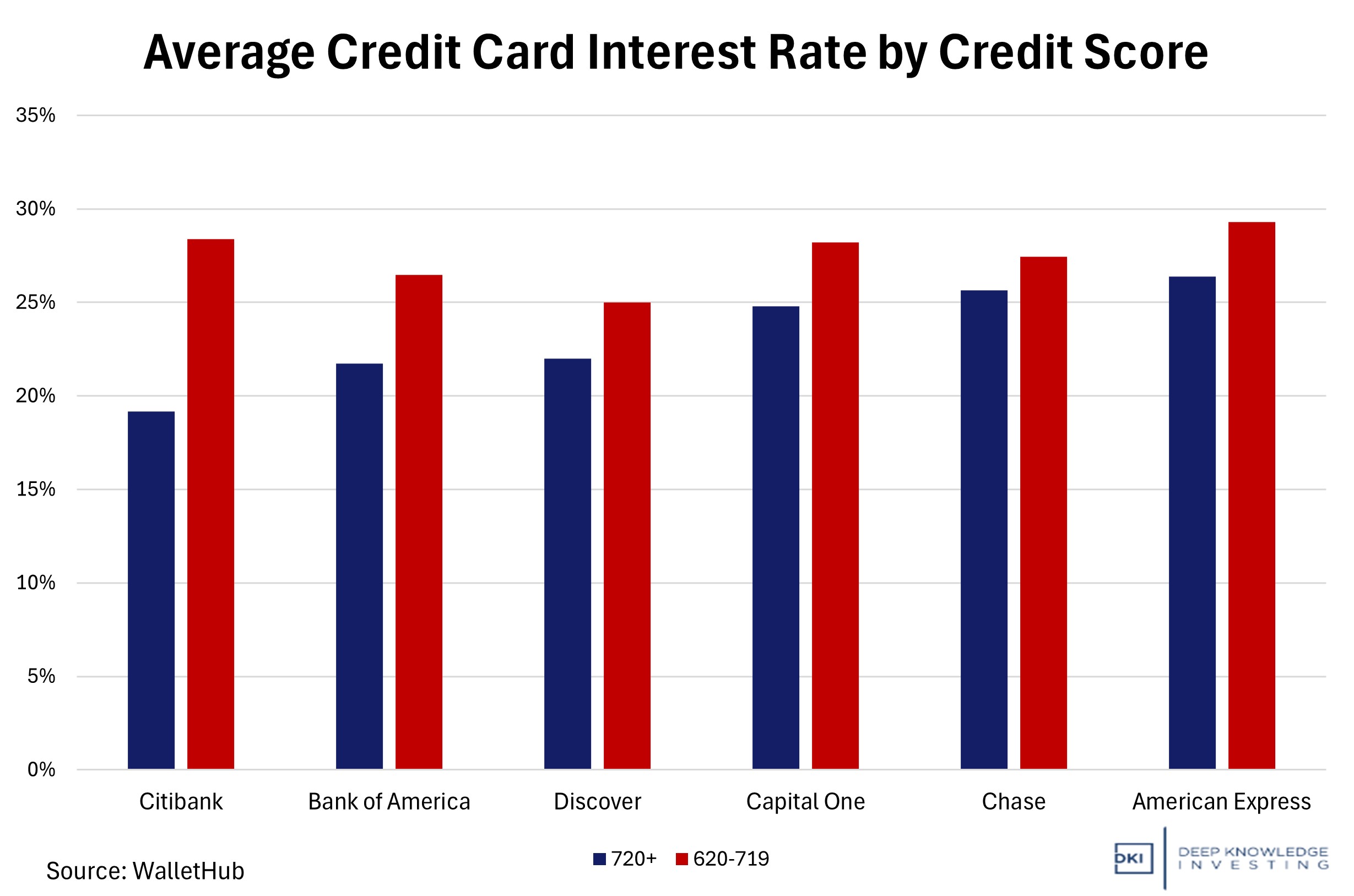

President Trump has called for a one-year cap on credit card interest rates at 10% APR, set to take effect January 20, 2026, aiming to curb what he describes as “rip-off” rates that commonly exceed 20% to 30% on U.S. consumer cards. The proposal was announced via social media and during press interactions but lacks an existing legal or regulatory mechanism. Credit card rate caps would require congressional legislation or new regulatory authority to be enforceable.

The market reaction was swift: shares of major card issuers, such as Capital One and Synchrony Financial, fell by roughly 6% to 9%, while large banks, including JPMorgan Chase and Bank of America, also faced concerns over prospective earnings headwinds. Industry groups, including the American Bankers Association and the Bank Policy Institute, jointly warned that such a cap would reduce credit availability for many consumers and small businesses, potentially pushing borrowers toward higher-cost, less-regulated alternatives.

You can understand the anger even if you don’t agree.

DKI Takeaway: While the headline appeal of lower rates is strong, a cap risks choking credit flow, especially to borrowers with weaker credit, and would force them toward payday or BNPL solutions that have higher consumer costs. The proposal highlights a broader tension in American finance: the push for consumer affordability versus the structural economics of unsecured lending. It might feel kind to insist low credit score consumers get lower interest rates than high credit score people have now. But with charge offs in those parts of the portfolio much higher than the average, the banks will cut credit lines. An interest rate cap just removes an option for these people. The best choice is to let them choose what financing solution (if any) is right for them instead of limiting the banks.

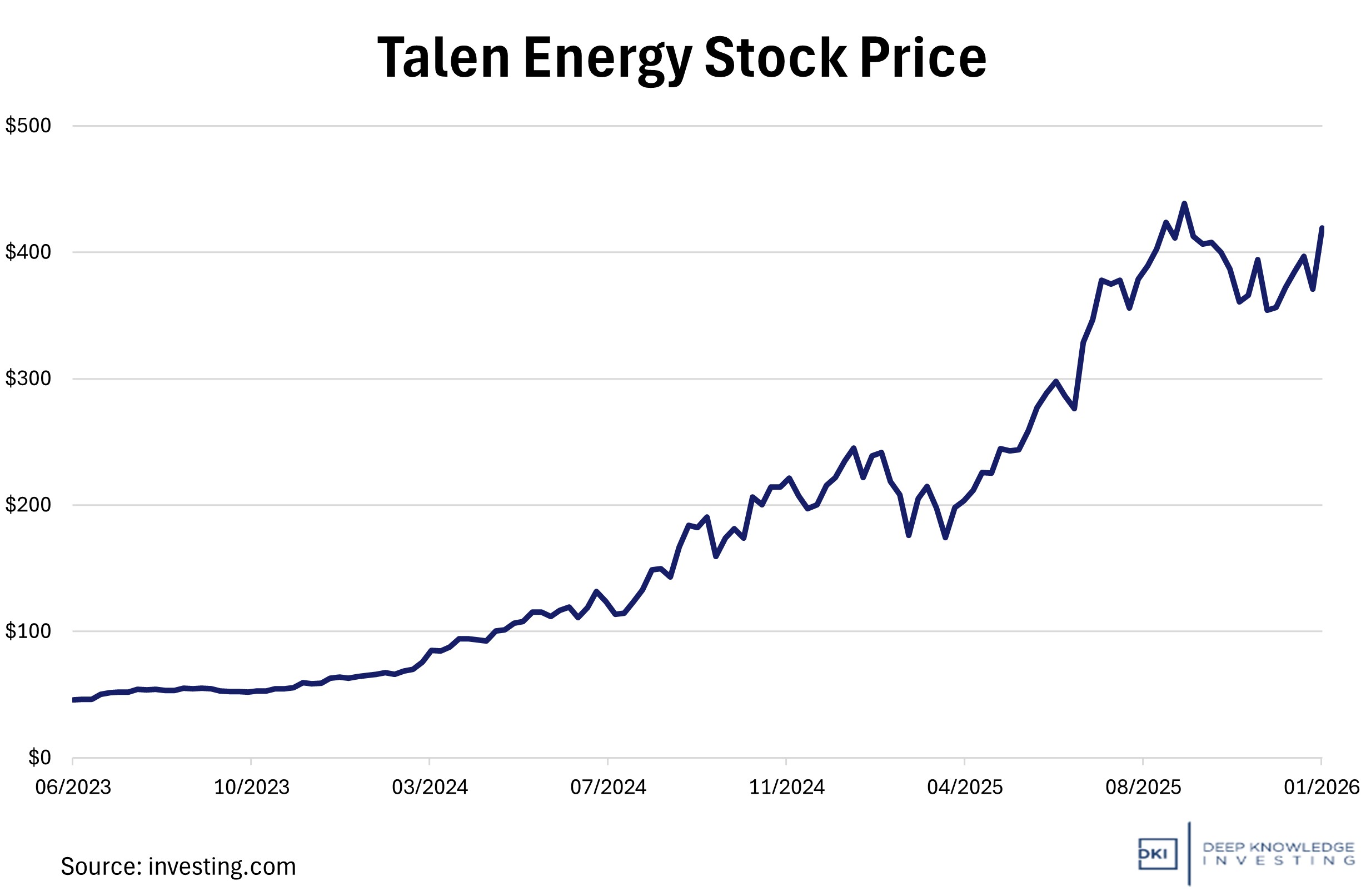

4) Talen Energy’s $3.5B Expansion Bet:

Talen Energy, a DKI portfolio company, recently announced an agreement to purchase Cornerstone Generation from Energy Capital Partners for $3.5B. The deal brings several large-scale, modern gas plants under Talen’s ownership which will sell power directly into competitive wholesale markets rather than operating under long-term regulated utility frameworks. This expands both scale and geographic concentration in the large PJM power market. This region is facing a growing power supply imbalance driven by rising electricity demand and tightening capacity. Data centers and AI infrastructure demand more power while older coal plants are retiring. By leaning into natural gas generation, Talen will be able to more quickly ramp output and operate during peak demand periods to provide reliability when renewables can’t.

DKI first bought at $107. Stock is up 292% in under two years.

DKI Takeaway: With consumer demand rising and datacenter demand skyrocketing, electric rates in the PJM market have risen to record levels. Reliable power provider, Talen Energy, has nuclear and natural gas plants and is selling directly to both the big AI hyperscalers and to individual homes. Talen says this acquisition will be immediately cash flow positive. DKI has made almost 300% in this position in under two years. As always, we credit Enrique Abeyta of HX Research for the original idea. Sound interesting? You’re welcome to check us out here.

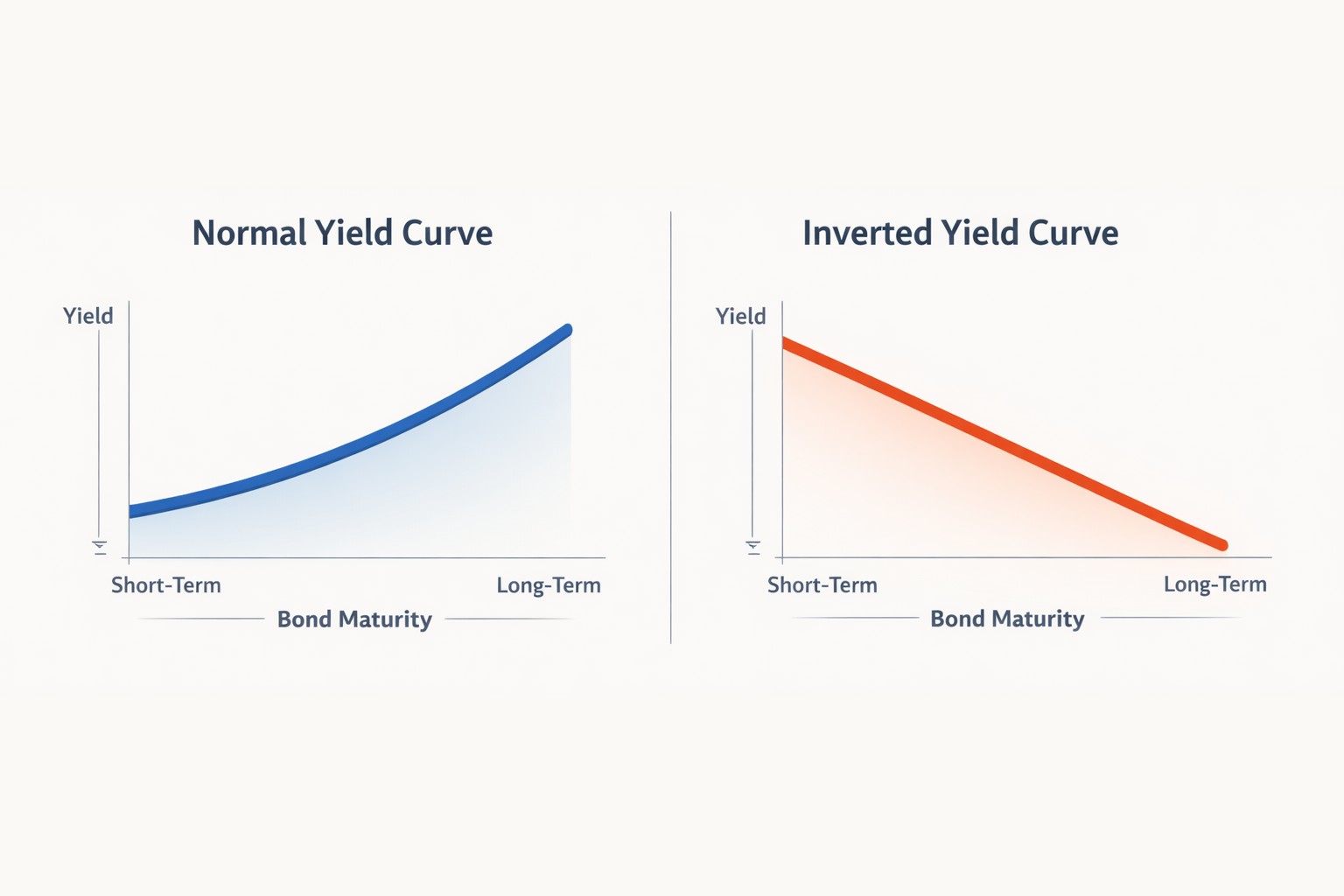

5) Educational Topic: Explaining Yield Curve Inversion:

The yield curve can be pictured with a graph that shows the interest rates (yields) of bonds of the same credit quality across different maturities. It is most commonly represented by US treasuries ranging from 3-month to 30-year maturities. Under normal circumstances, this curve slopes upwards, meaning short-term bonds carry lower yields than long-term bonds. Investors usually demand a higher return when tying up capital for a longer period of time. In contrast, an inverted yield curve is downward sloping, meaning short-term rates are higher than long-term ones. This reflects unusual conditions where investors are willing to accept lower yields on long-term bonds due to things like slowing economic growth or concerns about future inflation.

Yield curves can invert for a few reasons, but mostly due to investor expectations and central bank policies. If investors anticipate a weakening economy, they expect the central bank to cut short-term rates. This outlook leads investors to buy long-term bonds, which drives yields down. Yield curve inversions also occur after periods when the Fed is aggressively raising short-term rates to combat inflation. The short-term rates can occasionally end up above the level of long-term rates.

The whole curve rarely inverts. Investors often look at the 2-year / 10-year spread.

DKI Takeaway: Historically, when an inverted yield curve corrects has been a reliable recession indicator. When short-term rates rise above long-term rates, it reflects a broad expectation that economic conditions will deteriorate. Every U.S. recession in the past 50 years was preceded by an inverted yield curve. I think the reason we didn’t get a recession following the recent inversion was massive government stimulus spending kept nominal GDP positive. It’s rare for the whole curve to invert so investors often look at the 2-year / 10-year spread. You can calculate it by subtracting the 2-year

Treasury yield from the 10-year Treasury yield. If it’s positive, we have a normal curve. If it’s negative, the curve is inverted.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages