We got an estimated CPI that shows inflation has slowed. The market loved seeing that, but I still think inflation is too high. Plus, do any of you think the Bureau of Labor Statistics estimated a low CPI? Me either. Oil prices continue to fall. Efforts to embargo Russian oil have failed. DKI predicted this almost four years ago. We got an employment report that shows job losses and a higher unemployment rate. That seems bad, but I disagree. Read on to find out why. DKI has been saying that banks will lose share to stablecoins. The banks agree and got the FDIC to issue rules which will help the banks create their own stablecoins. This is a smart move. The US and China seemed to come to an agreement regarding the sale of the Panama Canal ports. Now, the Chinese want to alter the deal. There are going to be continuing fights over regional dominance and influence. In our educational topic, we discuss competitive moats, what they are, and why they matter in investing.

This week, we’ll address the following topics:

- An estimated CPI shows disinflation, but is still too high. 2.7% was well-below expectations so the market went risk-on.

- Oil prices continue to fall due to increased supply. Efforts to embargo Russian oil failed as we predicted.

- The unemployment rate is up and there were job losses. Read on to see why we think going beyond the headlines provides a different perspective.

- The FDIC issues rules which will help banks issue their own stablecoins. I like the idea of being your own bank and the banks are smart to try to hold onto that market share.

- The US and China are back to fighting about the Panama Canal ports as both countries try to defend areas of strategic influence.

- In this week’s educational topic, we discuss competitive moats.

As we roll into the end of the year, I want to recognize DKI’s interns, Cashen Crowe and Samaksh Jain, for their exceptional work on The Five Things. They handle much of the topic selection and writing, and produce the images. Their work is impressive and thoughtful, especially for undergraduate students. Let’s also take a moment to applaud their incredible work ethic. Knowing they both have holiday travel planned, I offered them two weeks off. They both responded that one week would be plenty. I’m proud of both of them for the work they do and the drive they exhibit.

There will be no issue of The Five Things next week. We’ll be back the first week of 2026. Thanks to all of you for reading this and for being part of DKI. Please feel free to forward this to a friend. Merry Christmas, Happy Hanukkah, Happy Holidays, and a prosperous and safe New Year to all.

1) The CPI is Lower – Or So They Tell Us:

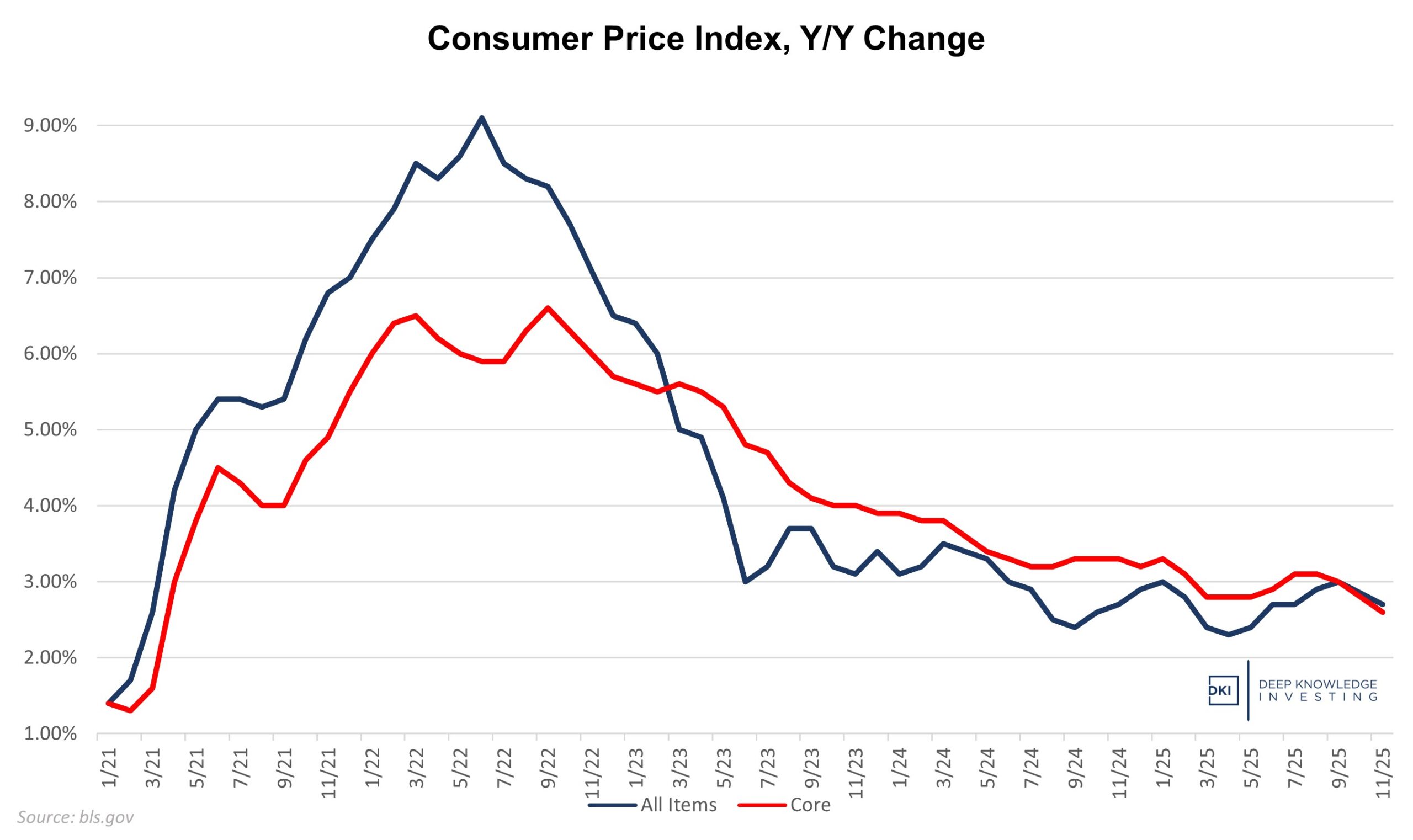

This week, we got the November Consumer Price Index (CPI) report which showed an overall increase of 2.7% for the last year. There was no October report due to the government shutdown so there will be no monthly comparisons in this piece. Important to note: As a result of limited data, many of the numbers in this month’s CPI release was estimated. Estimated is a polite word for “we made it up”. The annual number is down 0.3% from the September report and 0.4% below the forecast of 3.1%. The Core CPI which excludes food and energy was up 2.6%, far below expectations of 3.0%. We still have inflation well above the 2% target (which is 2% too high), but the market was unsurprisingly focused on a monthly print that’s well-below September and below expectations.

Lower, but not low.

DKI Takeaway: The November CPI isn’t going to change opinions at the Fed. Fed personnel are changing to match President Trump’s opinions. I think Chairman Powell has done a poor job because he kept rates far too low for far too long and started cutting far too early. We’ve had four straight years of big unpleasant inflation as a result. Powell is months away from being replaced by someone who will be much more dovish and will amplify his errors.

More importantly, I don’t think anything the Fed does now will matter much. They’ve cut 175bp since September of 2024, and the yield on the 10-year has RISEN. The bond market is correctly pricing in higher long-term inflation. The Fed only controls the overnight rate. Corporates tend to price off of the 5-year Treasury yield and mortgages off of the 10-year. The Fed can cut all they want, but the bond market is looking at Congressional overspending and long-term inflation.

As you invest, try thinking about inflation as the loss of purchasing power of your dollar. And if you’re planning for retirement, think about whether your dollars will buy as much as you’re accustomed just a few years in the future. The Fed has quietly changed the 2% inflation target to a 3% – 4% range. Start incorporating a higher inflation rate into your long-term planning. My personal portfolio is highly exposed to this thesis.

2) Oil Hits Lows Among Oversupply:

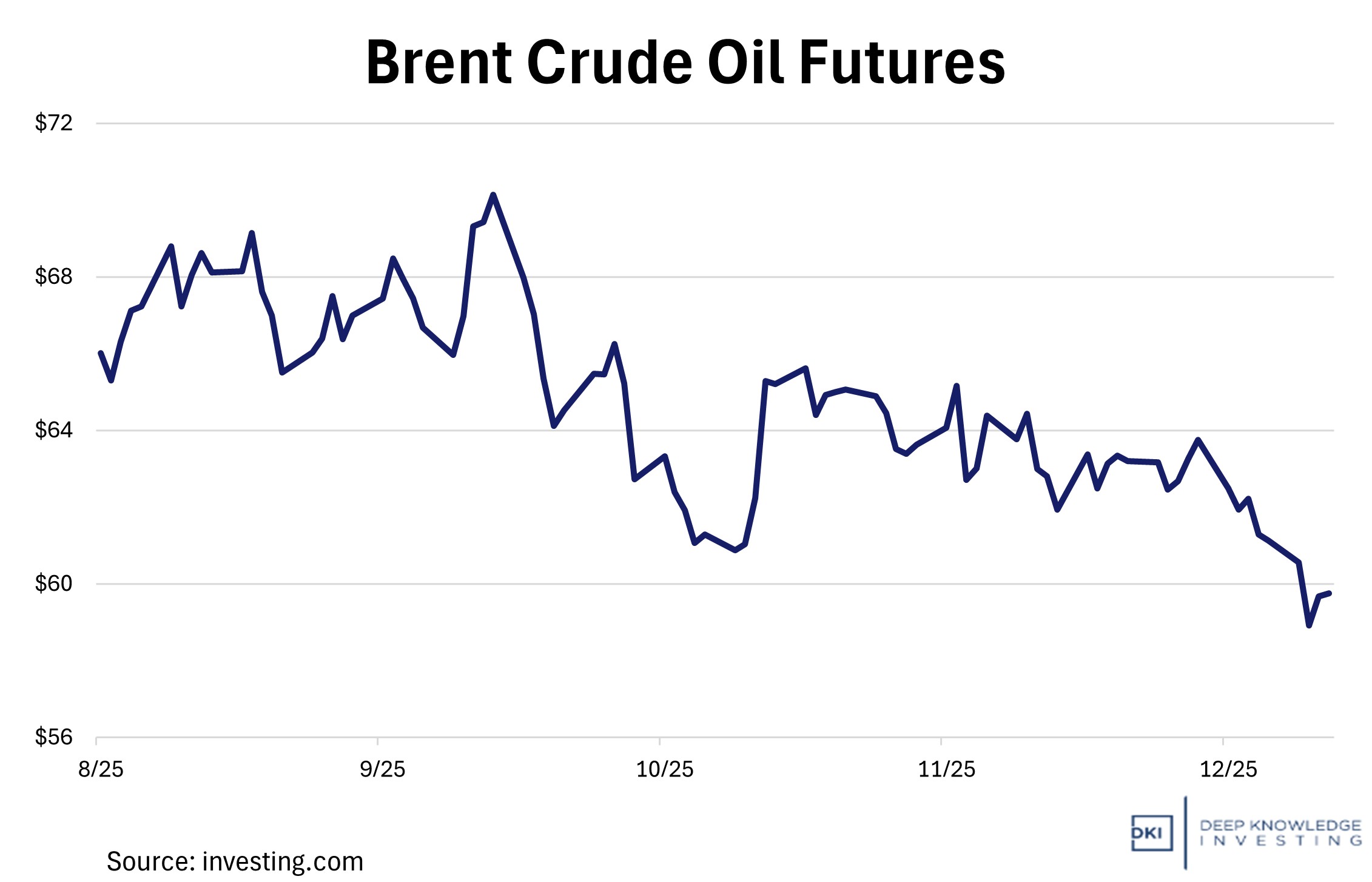

Global crude oil prices slid sharply in early December, with Brent crude futures dipping below $60 a barrel, a level not seen since early 2021, as persistent oversupply overwhelmed demand. Analysts describe the market as “cartoonishly oversupplied,” with oil on pace for more than a 20% annual decline amid record inventories and broad production growth. The supply surge reflects several converging factors: OPEC+ and allied producers have unwound many voluntary cuts, bringing incremental barrels to market; non-OPEC output from the U.S., Brazil, Canada, and other regions remains robust; and demand, particularly in China and Europe, has softened due to slower economic activity and structural shifts such as rising EV adoption. Price dynamics are further pressured by reduced geopolitical risk premiums, growing hopes for a Russia-Ukraine peace process, and easing global tensions, reducing the traditional “risk buffer” in crude pricing.

We can’t block “Russian” oil.

DKI Takeaway: The collapse in Brent below $60 highlights a fundamental shift in the energy landscape: supply growth is currently outstripping demand, not just temporarily but structurally. This poses risks to energy earnings, national budgets (especially for producers like Nigeria or Venezuela), and investment in future capacity, particularly in higher-cost shale and frontier plays. At the same time, cheap oil could act as an economic stimulant by reducing input costs for transport and manufacturing. DKI said back in 2022 that it’s not possible to stop sales of “Russian” oil. Many nations haven’t agreed with the NATO-led embargo and have continued to buy from Russia despite higher insurance premiums and transport costs. China is also working on increasing production.

3) The Issue with Supposed Poor Employment Numbers:

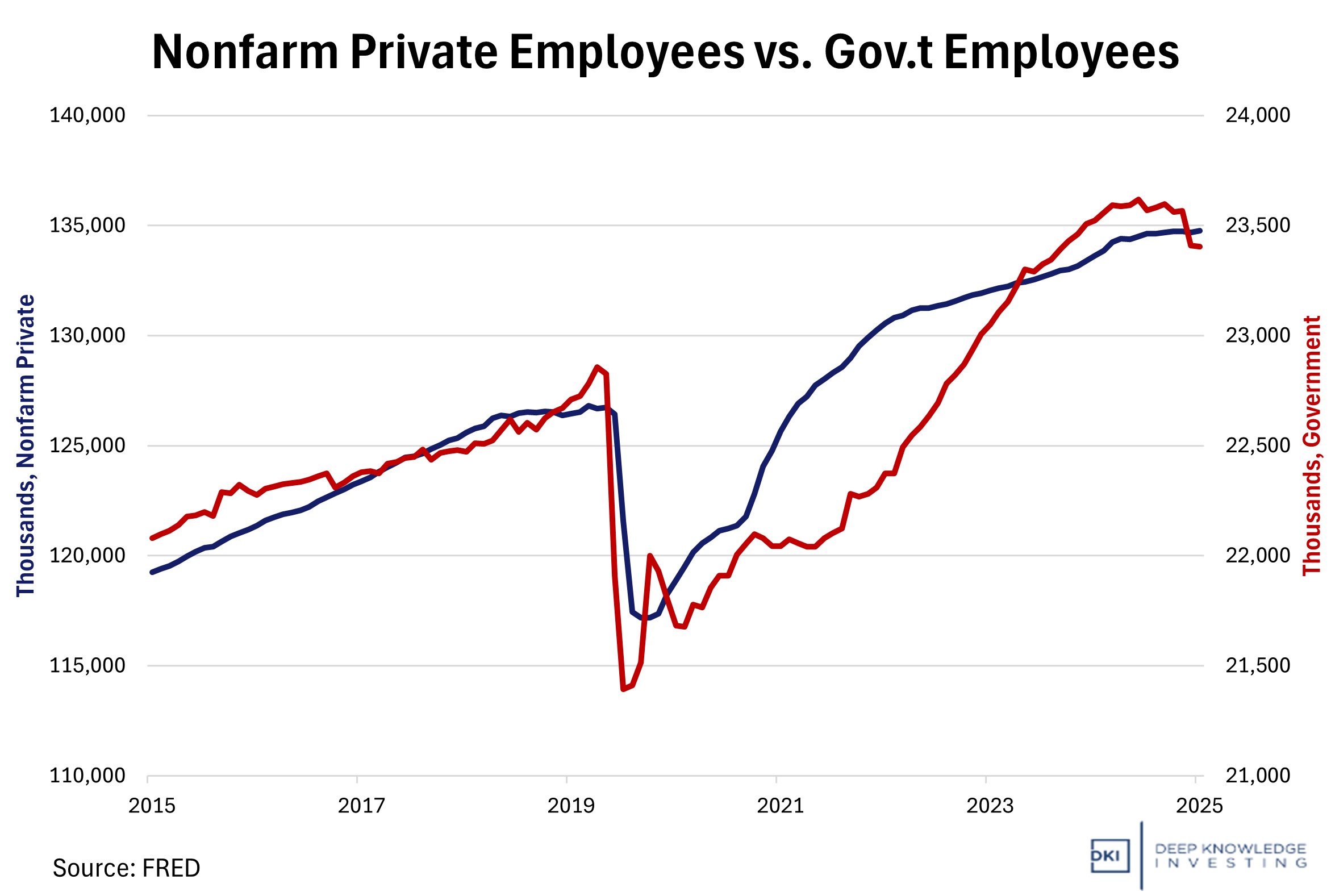

From September to November of this year, federal government employment fell by about 172,000 jobs while the private sector added roughly 225,000 jobs. In October alone, 162,000 federal jobs were cut, turning headline nonfarm payrolls negative even though private hiring was positive. Federal layoffs reflect policy choices, not the actual health of the economy.

They told you it was a bad employment market…but private employment increased.

DKI Takeaway: Most of the employment headlines were negative and focused on job losses and higher unemployment. We see it differently. Job losses were in unproductive government jobs while the productive private sector continued to add positions. A key reason for the increase in the unemployment rate was more people coming off the sidelines to rejoin the labor market. I think more people wanting to work is a positive sign, not a reason to worry. The unemployment percentage is misleading because the denominator is the number of people in the labor force plus those looking for work. Any government can kill production and reduce the unemployment rate by increasing welfare payments and competing with the private sector for labor, a policy choice that would lead to better optics and worse outcomes.

4) FDIC Proposes Formal Approval Path for Bank-Issued Stablecoins:

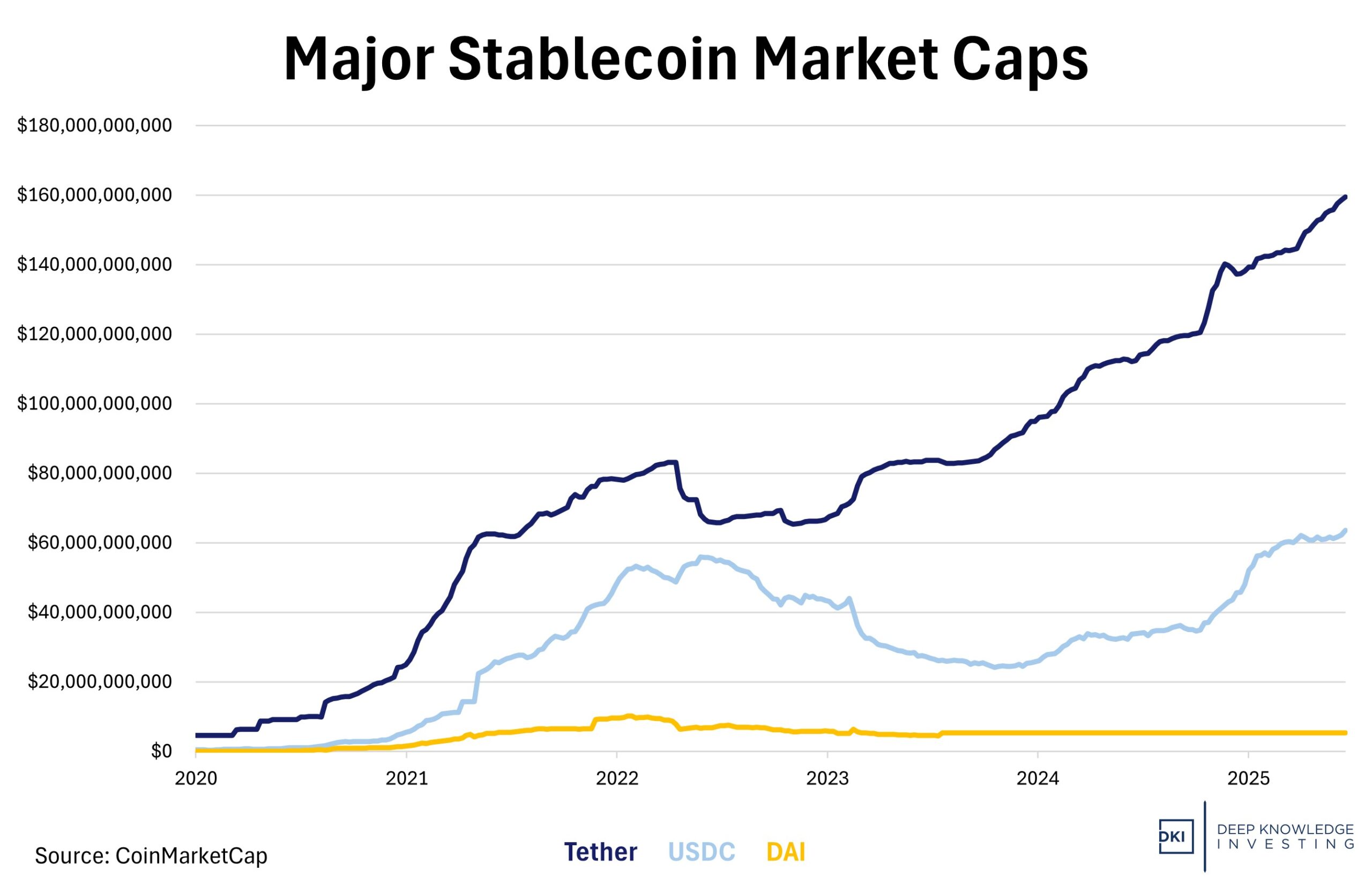

The FDIC Board just approved a notice of proposed rulemaking to establish how insured banks can apply to issue stablecoins as a form of payment. This relates to the GENIUS Act that we have covered in previous issues; a law enacted this past July to create a framework for dollar-pegged stablecoins. The proposed rule establishes a “tailored application process” for bank subsidiaries to legally issue payment stablecoins.

Because the GENIUS Act expressly defines a payment stablecoin as a redeemable digital asset at a fixed dollar value that isn’t a deposit or security, Congress has given stablecoins a clear legal language and issuer class. With stablecoins going “mainstream,” they are moving further from the gray area to a regulated product with explicit oversight. In practice, any bank-backed stablecoin would have FDIC or OCC supervision and insured reserves, which were some of the main regulatory concerns about redeemability and trust.

Rather than lose share, the banks want to participate in the system.

DKI Takeaway: This action signals that banks can now enter the stablecoin business on a level playing field with crypto firms, which encourages banks to launch dollar tokens for payments and lending platforms. However, even though stablecoins are coming closer to becoming a reliable form of payment, the act’s framework defines stablecoins as non-currency, non-security instruments. This essentially means that stablecoins aren’t cash, but they also aren’t unregulated crypto. This has been a regular Five Things topic and we see stablecoins as a financial instrument that can allow many to exit the fee-seeking banking system and simplify payments. The banks are smart to participate instead of ceding future market share.

5) Panama Canal Ports Deal Under Threat by Beijing:

In March of 2025, a consortium led by BlackRock agreed to buy an 80% stake in a Hong Kong tycoon’s ports business (valued at ~$22.8B). As we relayed in March, a completed deal would give BlackRock and Mediterranean Shipping Company (MSC) a 90% share of the Panama Ports Company. China’s government immediately expressed strong objections. Beijing stated that the state-owned Chinese shipping and terminal operator COSCO would need to be included in the deal or the sale would be blocked. Originally, they demanded an equal share but have recently demanded a majority stake in the transaction. BlackRock and MSC have indicated that they could include COSCO, but negotiations have stalled.

This is a strategic asset built by the US.

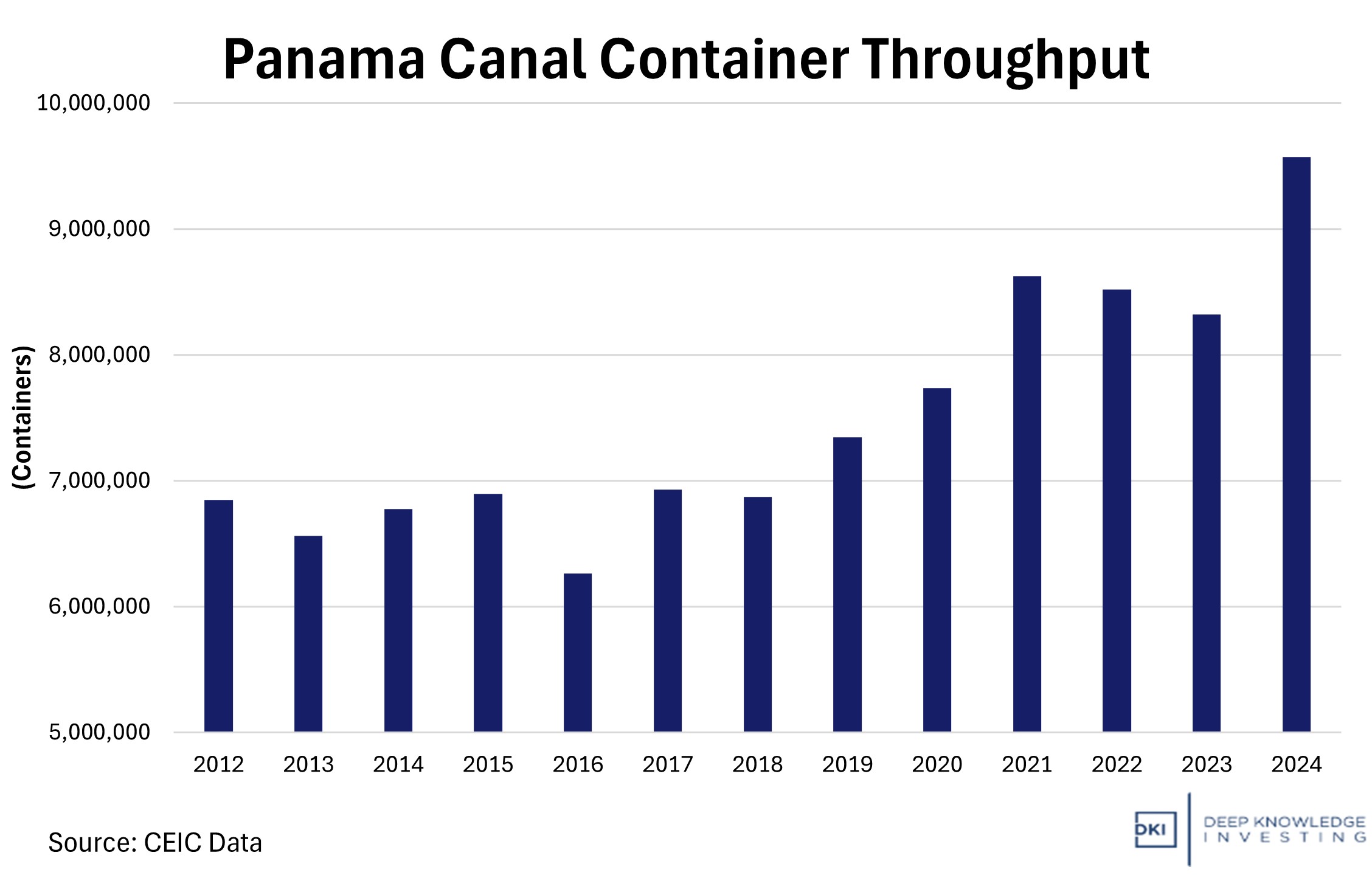

DKI Takeaway: The standoff is significant considering how vital the Panama Canal is to global trade. Linking the Atlantic and Pacific oceans, roughly 12,000 ships passed through the canal last year. Even when the numbers make sense, political risk can quickly upend deals in strategic industries. BlackRock’s acquisition was to be the firm’s largest infrastructure investment, but analysts note that the very complex deal could take years to finalize. A Chinese foothold would shift the competitive dynamics of the deal entirely, but a failed deal could leave US control off of the table. The Trump Administration has been trying to ensure strategic influence in North and South America, the backyard of the US. China has been seeking to increase its influence while fending off US relationships in its own backyard. The result here will be driven more by geopolitical influence than by financial returns.

6) Educational Topic: Understanding Competitive Moats:

Some companies are remarkably good at keeping competitors at bay. It’s called a competitive moat meaning an enduring competitive advantage that protects a company from rivals and protects its long-term profits.

A competitive moat is any structural strength or unique advantage that helps a company sustain market dominance over time. Think of Apple’s “ecosystem” or the size-related cost advantage of Walmart and Costco. A company that can produce goods and services at a lower cost or make it difficult for customers to switch away from its product will be able to discourage rivals. Whether through cost advantage, intangible assets, network effect, or regulatory advantage, competitive moats directly contribute to maintaining high performance.

Just one of those factors is enough to ensure high returns.

DKI Takeaway: A company’s moat is about assessing the durability of its competitive advantage. Companies with wide, defendable moats are often able to compound earnings over a longer period of time, which can help identify promising long-term investment ideas. These companies are usually industry leaders that can fend off competitive threats and make future profits more predictable and secure.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.