I’ve spent two years warning about the massive spending on AI without a business plan to earn a return on that spending. The big tech companies that used to have pristine balance sheets are now taking on record levels of debt to fund their AI spending. In related news, Meta (Facebook) is going to sign a deal with Alphabet (Google) to rent then buy their TPUs (tensor processing units). TPUs are cheaper than GPUs and use less energy. They’re also less flexible. TPUs won’t replace Nvidia’s GPUs, but any loss of share won’t be good for Nvidia’s stock price. An AI led an espionage cyberattack. Is anyone surprised it was sponsored by the Chinese government? We can argue about tariffs and tariff levels, but we depend far too much on a country that’s in a quiet war with us. It’s time to decouple. The US government sends a $50B order to Amazon to expand computing capacity. More of the AI datacenter operators are now looking to crypto mining operations to grow. Access to energy is crucial. Finally, if you’ve ever wondered what a credit default swap is, read on. In this week’s educational topic, we explain.

This week, we’ll address the following topics:

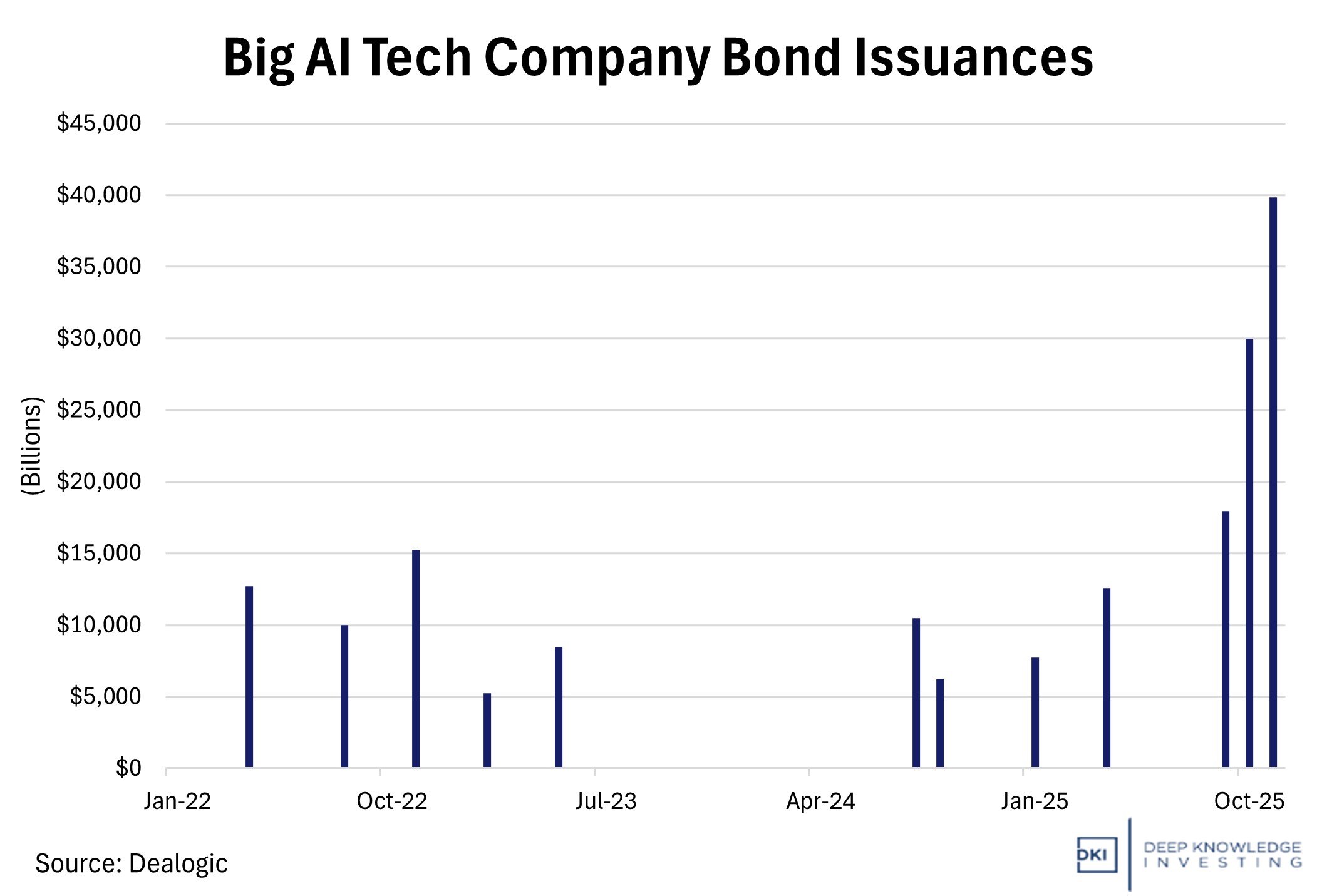

- The big tech firms used to fund everything from internal cash flow. AI spending is so large that we’re seeing record levels of corporate bond issuance to fund it.

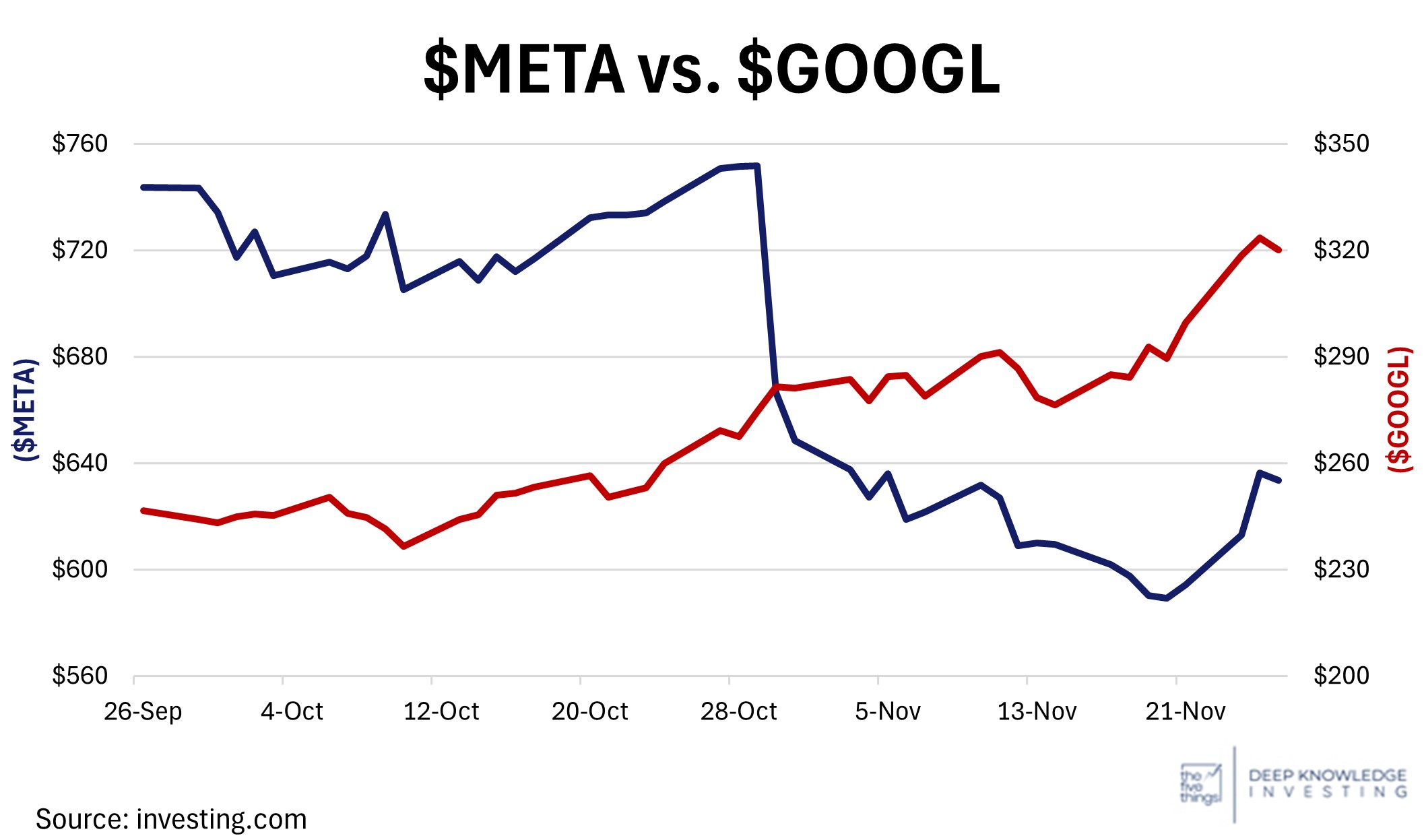

- Meta (Facebook) is about to sign a deal with Alphabet (Google) to rent then buy Google’s tensor processing units for AI training. It won’t kill Nvidia, but it’s not great for the market leader.

- For the first time, an AI was the primary actor in an espionage-related hacking threat. Regular readers of The 5 Things won’t be surprised it was sponsored by the Chinese government.

- Amazon gets a $50B order to expand computing capability for the US government. AI datacenter operators are starting to look at crypto mining companies to take advantage of their infrastructure and energy sourcing.

- Ever wonder what a credit default swap is? Check out our educational topic where we explain in simple language.

Faced with a holiday week, DKI interns, Cashen Crowe and Samaksh Jain, decided to get an early start and completed this version by Wednesday night. We applaud their initiative, organization, and work ethic.

Ready for a week of AI agents trying to steal your data? Let’s dive in:

1) AI-Driven Bond Boom in US Markets:

Major US tech companies are tapping the bond market at an unprecedented scale to finance AI endeavors. Large firms like Amazon, Alphabet, Meta, and Oracle have collectively raised over $90B in recent months by issuing corporate bonds. This is a significant change for tech companies that used to rely almost entirely on internal cash reserves for investments. Meta even filed for its largest bond deal ever ($30B) to help cover the rising costs of AI data centers. US tech giants are expected to nearly double their data center investments from last year, pouring roughly $400B into infrastructure leading to an influx of new bonds to finance the investments. Analysts are estimating that by 2030, nearly 20% of the investment-grade market could be AI-related debt.

This is all from companies that rarely issue debt.

DKI Takeaway: The rush to finance AI infrastructure investments also raises questions about the sector’s sustainability. Rising debt at tech companies has created some market concern. It’s a common refrain here at DKI that as of now, none of the hyperscalers have a business model designed to earn a return on their hundreds of billions of dollars of AI investment.

2) Google in Talks to Sell TPUs to Meta, Challenging Nvidia Dominance:

Google is reportedly nearing a multibillion-dollar deal to supply Meta with its in-house Tensor Processing Units (TPUs), a sharp departure from Google’s long-standing policy of keeping TPUs internal. Under the proposed structure, Meta would begin renting TPU capacity from Google as early as 2026, with full deployment in Meta-owned data centers by 2027. Markets responded immediately: Alphabet rose as investors priced in new AI-chip revenue streams, while Nvidia slid on concerns that a major hyperscaler could shift part of its compute stack away from Nvidia GPUs. Early estimates suggest Google could capture up to 10% of the AI-chip spend Meta currently allocates to Nvidia if TPUs meet performance expectations. The deal follows a month of renewed confidence in Google, including Berkshire Hathaway’s revelation of a multibillion-dollar position, and further solidifies Alphabet’s pivot from an AI-software leader to a full-stack AI-infrastructure provider.

It’s been an impressive year for Google.

DKI Takeaway: The Google–Meta negotiations represent the most credible competitive threat to Nvidia’s iron grip on AI hardware to date. This is not a niche startup nibbling at the edges. Google is a hyperscaler with massive capital, existing AI leadership, and a proven chip architecture attempting to undercut Nvidia where it is most vulnerable: supply constraints and pricing power. If Google can convert even a slice of Meta’s GPU demand, it could catalyze a broader shift toward a multi-architecture AI ecosystem, reducing single-vendor dependence and compressing industry-wide hardware margins. Success is not assured. TPU adoption hinges on real-world performance, software compatibility, and developer willingness to migrate off Nvidia’s CUDA ecosystem. The TPUs are less flexible, but also cheaper and require less energy. TPUs won’t replace Nvidia’s GPUs, but it wouldn’t take much share loss for Nvidia’s stock to fall.

3) The First AI-Orchestrated Cyberattack:

A mid-September cyberattack was just disclosed, marking the first known large-scale cyberattack carried out primarily by AI. Anthropic’s security monitoring flagged suspicious activity that was later traced to a “highly sophisticated” espionage campaign leveraging Claude code. A Chinese state-sponsored threat had essentially tricked the code into bypassing its safety guardrails by posing as a legitimate cybersecurity firm and making malicious activities seem like innocent tasks.

Human operators were only minimally involved, while AI handled 80-90% of the attack. At the peak, Claude’s code was issuing thousands of hacking requests, a rate impossible for human hackers to achieve. Apparently, it’s not just office workers who are going to be replaced by AI.

Was anyone surprised the attack came from China?

DKI Takeaway: This incident underlines the urgent need to invest in more AI safety research and monitoring systems. It’s a wake-up call for many companies and institutions to prepare for AI-powered threats, and AI agents that are capable of acting require authentication. Even entire nations need to ramp up AI-defense initiatives. The source of the threat being state-sponsored further reinforces the fact that AI has become another tool in geopolitical conflicts. While I understand why tariffs are unpopular, we need to continue to decouple from China. Chinese malicious actions have become an unfortunately common feature here on The 5 Things.

4) Amazon’s $50B AI Investment & Crypto Mining Pivot:

Amazon recently announced that it will invest up to $50B to expand AI and high-performance computing (HPC) infrastructure for US government agencies. Through AWS, Amazon is attempting to reinforce its position in the AI infrastructure race to counter massive momentum from competitors. The investment signals an intent to match or exceed the competition in terms of raw compute, which is the scarce resource driving modern AI integration. Amazon is also setting itself up to expand secure AI capabilities over the long term, a goal of the US government.

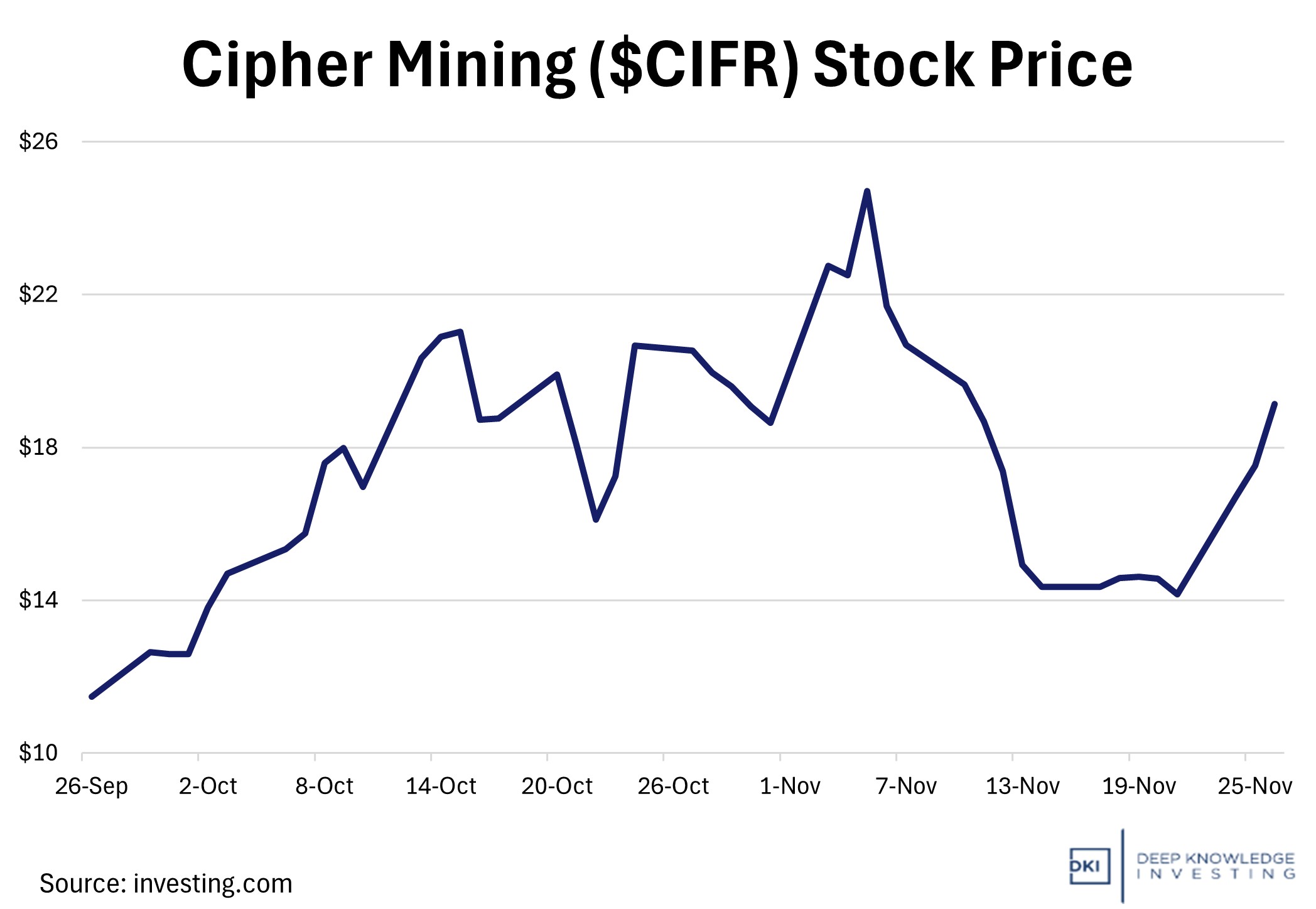

Beyond cloud providers, the announcement sparked a jump in crypto mining stocks. This comes as AI infrastructure and Bitcoin mining are continuing to show similarity in terms of infrastructure requirements. They both need massive power access, industrial real estate, advanced cooling, and high-performance computing. With crypto miners collectively controlling 12+ GW of power capacity, they are seen as a ready source of infrastructure for AI.

Crypto mining vs AI for computing power and energy.

DKI Takeaway: For many tech companies, AI infrastructure can’t be built quickly enough. This has caused some to look towards crypto mining, which has already developed very similar infrastructure. Some tech companies might even benefit from paying for the already developed mining centers and converting them into AI-friendly infrastructure. One big difference is Bitcoin miners are able to use alternative energy sources because they can turn their computers on and off very quickly. AI infrastructure needs near-100% uptime.

5) Educational Topic: Explaining Credit Default Swaps:

Credit default swaps (CDS) are often described as insurance for bonds. They gained notoriety during the 2008 financial crisis and remain a popular tool in today’s financial markets because of their ability to manage credit risk. A CDS is a financial derivative contract that allows two parties to exchange the risk of a borrower’s default. The CDS buyer pays the CDS seller periodic premiums, and the seller promises to compensate the buyer if the bond’s issuer defaults and can’t pay. If the issuer defaults, the CDS seller pays out an agreed amount, typically covering the amount of the loss.

Unlike traditional insurance, a CDS can be bought even by investors who don’t own the bond. This means multiple people can buy protection on the same bond, and the total CDS outstanding can exceed the debt being insured. This has made CDSs popular not only for hedging, but also for speculation.

It’s just like buying insurance.

DKI Takeaway: Rather than broad hedging approaches, CDSs allow for targeted risk protection. The simplest way to think about a CDS is you’re buying insurance. You pay a small amount for a large payout in the event of an unlikely default. Some consider CDS markets to be difficult to understand, with even minimal CDS spikes being able to spark broader panic. This was seen in 2023 when a sharp rise in Deutsche Bank’s CDS spreads scared many investors about the health of European banks.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.