Overview:

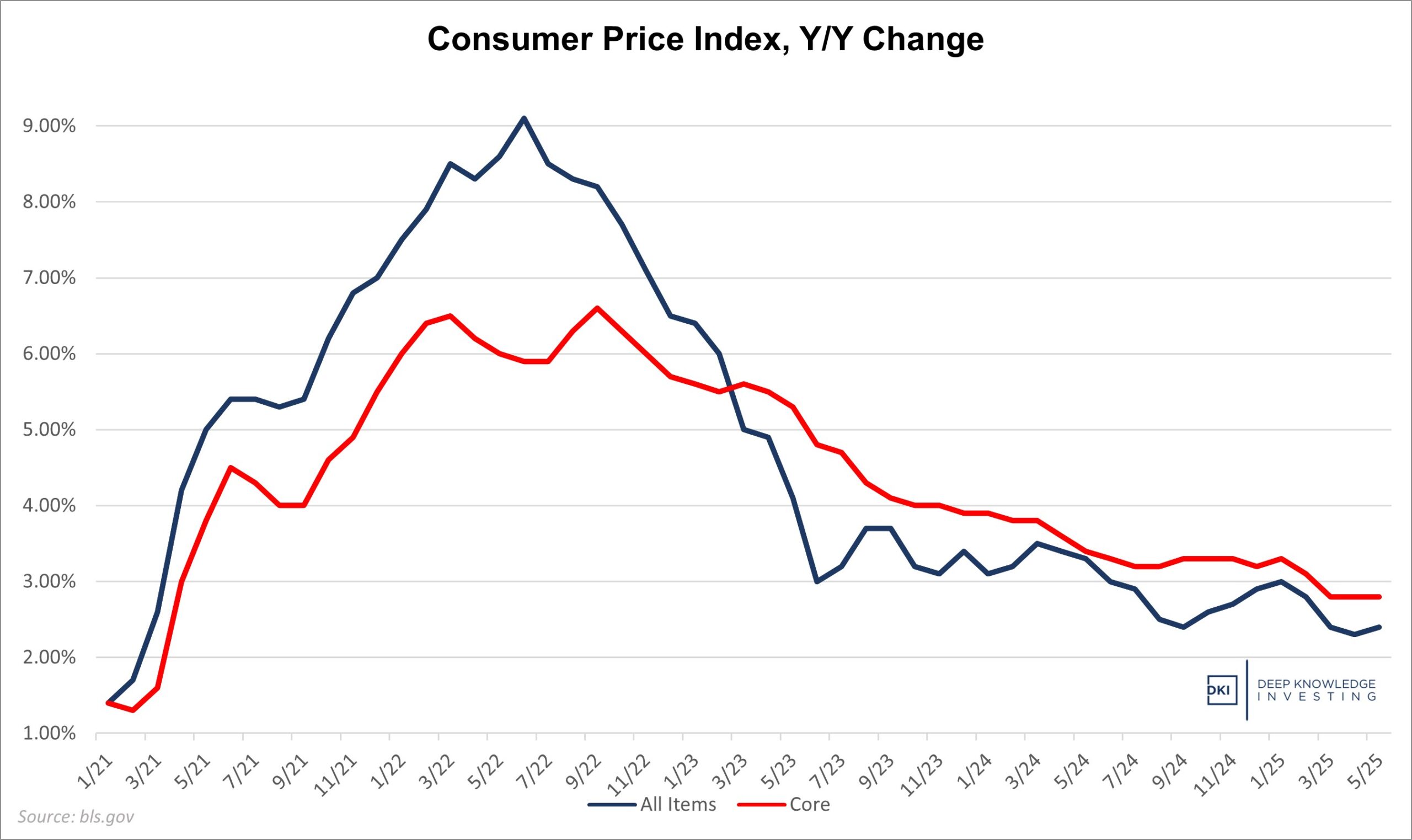

Today, we got the May Consumer Price Index (CPI) report which showed an overall increase of 2.4% for the last year and up 0.1% for the month. The annual number is up 0.1% from April and in line with expectations. The monthly is down 0.1% and below expectations. The Core CPI which excludes food and energy was up 2.8% vs last year and up 0.1% for the month. That’s consistent with the prior month and 0.1% below expectations. Let’s go through the details:

Small increase in the all items. Core still sticky.

Back below 2%. The Fed is not “restrictive” as many claim.

Food:

Food inflation came in at 2.9%, slightly up from last month but well above the recent 1% -2% numbers that I thought were understated. Food at home was up 2.2%, an increase from last month. Food away from home is now up 3.8%, roughly consistent with last month. Restaurant prices and increased tipping demands are pushing more people to eat at home. Even fast-food places known for their low prices, have taken such large price increases that their budget-conscious customers are visiting less often.

We continue to note that both the rate of increase and price levels for food purchases are creating stress in many homes. Simply stated, even if food prices stop rising, the current level remains too high for many families. Recent trends show an increase in consumers using buy now pay later for groceries. Financing your groceries in this way is not an encouraging sign for the health of the consumer.

Energy:

Energy has been an overall tailwind for the CPI following the huge increases in 2022. Energy prices were down -3.5% vs last year, and down 1.0% for the month. Gasoline was down 12.0% y/y, and down 2.6% for the month. Fuel oil was again a big mover declining by 8.6% vs last year but up 0.9% vs last month. President Trump is trying to bring down energy prices. That’s happened, but not necessarily in the way he hoped. Concerns about a worldwide recession due to tariff plans have reduced energy prices. Worldwide markets are projecting a decrease in future demand. If tariff negotiations with China reach a positive conclusion and/or negotiations with other trade partners results in lower overall tariffs (an outcome I believe the market is under-valuing), we would expect to see global growth estimates increase and energy prices rise. Additional tensions with Iran also have the potential to lead to higher energy prices.

Vehicles:

New vehicle pricing was flat for the month and up only 0.4% y/y. The monthly changes there have been very small for months. Used vehicle pricing was up 1.8%, but down 0.5% vs last month. After months of increases, the last three months have shown lower prices. Much of the Covid-related run-up in used car prices has been alleviated, but at this point, further pricing improvements have stalled. There’s also a substitution effect. As new cars become increasingly unaffordable, that increases demand and pricing for used cars. Overall, it looks like we’ve reached a stable pricing level for auto prices although still meaningfully higher than the pre-covid level.

After a huge increase and some retracing, we’ve reached a more stable plateau.

Services:

Services prices were up 3.6%, the same as last month. Much of the increase has been caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. In addition, last week’s employment data was slightly misleading. It showed an increase in overall jobs. However, a large decrease in government jobs (a reverse of the trend for the past few years), means the productive private economy grew more than the headline numbers suggest.

Shelter (a fancy word for housing) costs were up 3.9% which was roughly consistent with last month and “was the primary factor in the all items monthly increase”. I’m seeing reports of weakness in several large local housing markets, but the overall trend has been continued increases in shelter prices. Worth noting: Because it takes a few months for housing sales to move from contract to completion, this data tends to lag by a comparable time period.

Still getting more expensive – just at a slower rate.

Conclusion:

Tariffs are the big story right now. While the FinX community is screaming about the benefits of free trade, it appears to me that people are underestimating the possibility that President Trump’s threats will land us with LOWER tariffs all-around. Talks with other nations aren’t resulting in deals as quickly as many hoped, but recent discussions with China appear to be heading in the right direction (at least for now).

This month, we had a 0.1% increase in the all items CPI and no change in the Core CPI. While these things can take time to move through a complicated supply chain, the tariff-related carnage fiat economists have been carrying on about has not appeared – at least yet. It could happen in the future, but as of now, there is little evidence of the massive price increases that many feared.

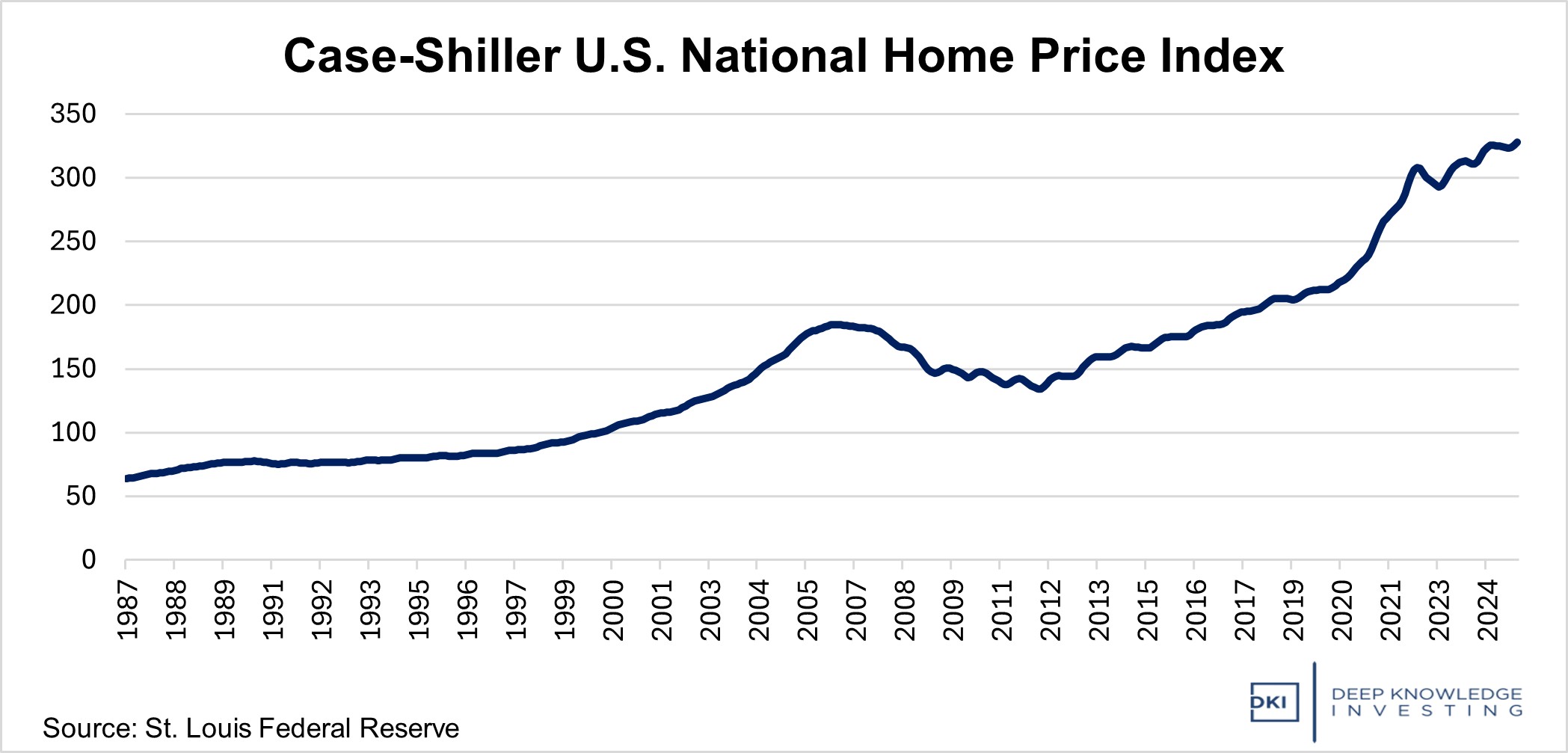

Washington DC has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart shows why most Americans are experiencing more financial distress.

Last month, we wrote about increases in the savings rate for Americans as well as more investing in the stock market by retail investors. Those were positive signs of Americans taking responsibility for their financial outcomes. This month, we’re seeing increases in credit usage and a more concerning increase in delinquencies. Fortunately, the banks have been increasing their loan loss reserves in response. In addition, buy now, pay later is going to be a significant problem for many young people who somehow think that if you don’t pay for something at the point of purchase it’s “free”. That credit usage has already started to hit credit reports.

I agree with current consensus that the Fed will keep rates unchanged at the next meeting. The difficulty they’ll have is a lower overnight rate is likely to lead to higher 10-year rates as the bond market prices in expected higher future inflation. There is little the Fed can do right now without spending cuts from Congress, something I do not expect to see despite a lot of click-bait headlines saying otherwise.

IR@DeepKnowledgeInvesting.com if you have any questions.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.