Silver pricing rockets as warehouses can’t supply everyone with obligations to deliver rare metal rather than unlimited fiat. The CME tries to help, but can’t change the long-term supply/demand equation here. China limits exports of silver as they continue to build stockpiles. US tech firms respond by publicly saying they’re looking at buying silver mines. Imagine the improbable chain of events that cause the world’s best makers of bits to start digging in the ground. Treasury spreads widen. Market commentators start talking about recession indicators. I think it’s more a marker that the Fed is impotent right now. Congress is going to keep overspending and debasing the currency. Prepare your portfolio for continued inflation. In related news, as the Fed cut rates, the dollar fell against other fiat currencies. If you’re an Fx trader, that matters. Most Americans just want to be able to afford housing, the electric bill, food, and gas for the car at the same time. Want to know why it’s potentially dangerous to place market orders? In this week’s educational topic, we tell you the story of how Bitcoin traded below $25k – last week!

This week, we’ll address the following topics:

- Silver goes parabolic. The CME and Fed can try to interfere, but long-term demand is greater than supply. DKI has owned silver since the mid $20s.

- China limits exports of silver. US tech firms are looking at buying mines to secure supply.

- The spread between the 2-year and 10-year Treasuries widens. Some are saying it’s a recession indicator. I’m saying it’s an indication that the Fed has lost control.

- The dollar declined in 2025 as the Fed cut. With the price of oil down, it’s not a huge sign that prices for Americans will rise. That’s due to actions by Congress.

- Bitcoin briefly traded below $25k. This is why you should use limit orders instead of market orders. We explain.

After a short week off, DKI interns, Cashen Crowe and Samaksh Jain, put together an outstanding version of The Five Things. They deserve much of the credit for the analysis, images, and writing that follows. A special round of applause for Cashen who scored a big internship opportunity for next summer. After more than a year with DKI, it’s in his best interests to learn from someone else for a while. He will depart this upcoming summer with our appreciation. Congratulations, Cashen!

Ready for a week of extra silver news? Let’s dive in:

1) Silver Goes Parabolic:

The dollar price of silver has gone parabolic, up more than 173% year-to-date. The silver market is strange with meaningful industrial use, jewelry, and store-of-value bars in vaults. Silver is primarily mined as a by-product of other metals mining so a higher silver price doesn’t necessarily result in increased mining activity as it would with gold. In addition, the silver market is highly-manipulated with the amount of paper silver far exceeding the supply of actual metal.

Paper silver is a derivative or other promise. Imagine I want to own exposure to silver, but don’t want to pay for insurance, guards, and a vault. I might go to a bank or institution and do a swap trade where if the price goes up, they give me dollars to reflect the change in value, and if the price falls, I would give them dollars. That alone doesn’t create a problem.

Right now, there are a lot of contracts maturing where people have the right to receive actual physical silver instead of settling in fiat. As you can imagine, most of those contracts are now deeply profitable and the holders are asking for delivery of physical silver which has to be delivered. (With paper silver, you might just receive fiat.) The problem for the sellers of that paper silver, is the physical supply in many markets is gone. You can’t buy what isn’t available and you can’t deliver what you can’t buy.

With the vaults empty, the silver markets have turned upside down. Normally, you’d pay something for storage, security, and insurance to take delivery in the future. Now, it’s cheaper to buy future silver than spot silver. (“Spot silver” is silver today). The reason is it’s hard to find the actual metal right now. What we have is the exact result the Hunt brothers tried to achieve in their attempt to corner the silver market decades ago.

DKI started buying silver in 2020 with the price in the mid-$20s.

DKI Takeaway: A day after silver hit an intra-day record price of almost $84, it traded below $71, a 15% (temporary) drop. The Chicago Mercantile Exchange (CME) raised the margin requirement for March silver delivery from $20k to $25k. This reduced leverage in the system which is a fancy way of saying people who couldn’t meet the higher margin requirement with additional cash were forced to sell immediately. This was non-discretionary price insensitive selling and was the reason for Monday’s big price decrease.

The CME can increase margin requirements further causing additional price-insensitive selling and reducing leverage in the system. The Fed can bail out insolvent sellers of silver contracts. This chewing gum and duct tape approach to keeping the system solvent would likely reduce the spot price of silver further – for a while. However, it doesn’t change the long-term issue that current supply is less than current demand. The world will continue to demand solar panels and electronics. China will continue to stockpile supply at any (“reasonable”) price. US tech firms will continue to look for ways to secure supply. And the US Congress, accompanied by governments around the world will continue to abuse their fiat currencies incentivizing more people to flee into hard assets like gold, silver, Bitcoin, and energy.

For more on this timely topic, check out DKI’s non-paywalled posts: Japan, Failing Fiat, and Precious Metals, and Here’s What’s Happening with Silver.

2) China to Enforce Strict Silver Export Controls as Prices Surge:

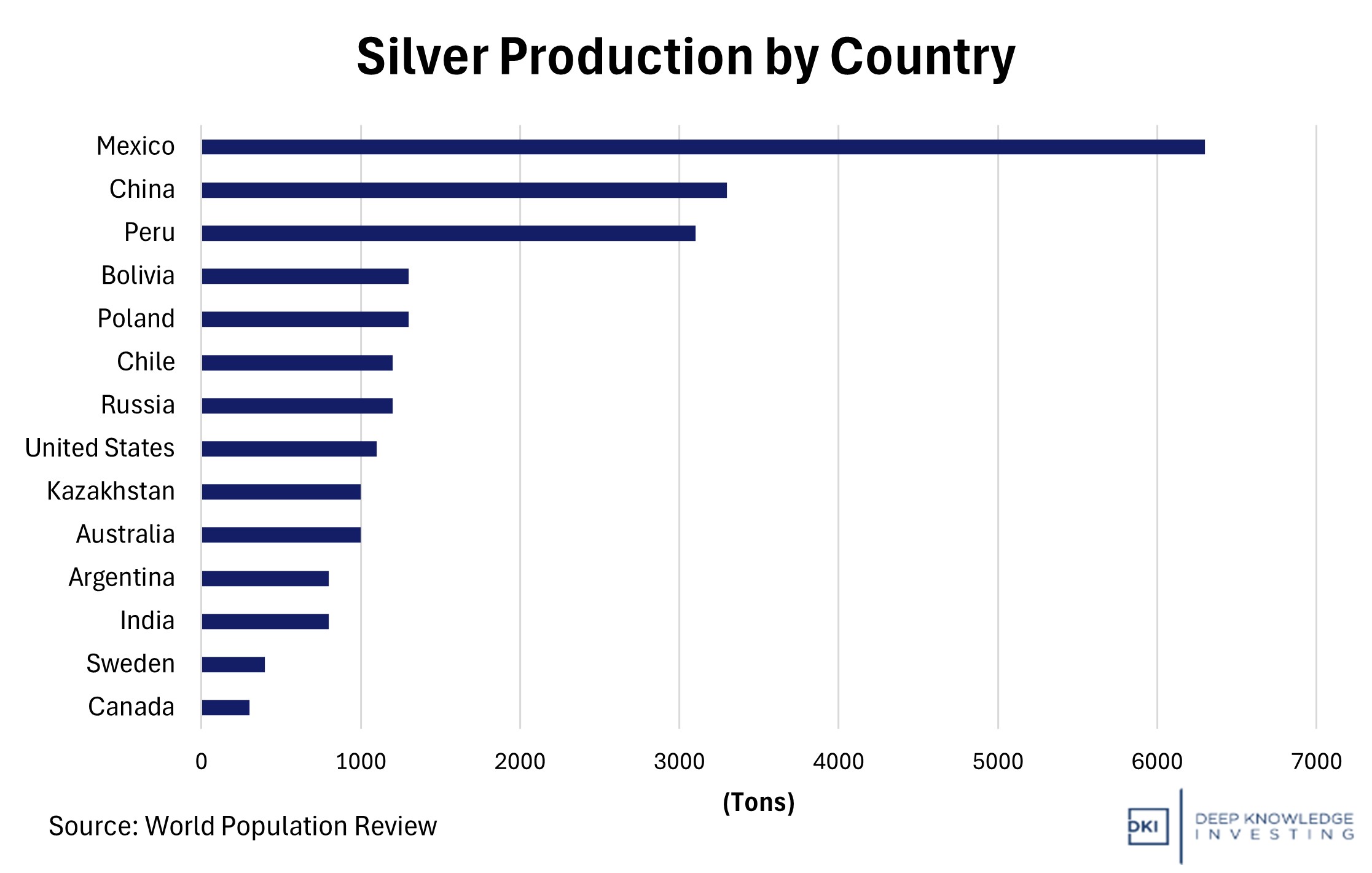

China’s Ministry of Commerce is implementing a new export-licensing regime for refined silver that took effect on January 1, 2026, requiring government approval for all overseas shipments. This limits supply to a small group of state-approved firms. Under the rules, exporters must meet multiple criteria, including over 80 tons of annual silver production as well as financial requirements, to qualify for licenses. China dominates roughly 60% –70% of global refined silver capacity, meaning that these controls could substantially reduce the metal’s tradable supply and ripple through industries dependent on steady flows of refined silver. Global silver prices have already surged to multi-decade highs, briefly topping $80 per ounce, amid tightening fundamentals and speculative interest. Tesla CEO Elon Musk publicly flagged the development, writing on social media that “This is not good. Silver is needed in many industrial processes,” highlighting silver’s critical role in technologies such as solar photovoltaics, electric vehicles, electronics, and data-center power infrastructure.

This is silver production. China has a near-monopoly in refining.

DKI Takeaway Silver’s combination of superior electrical and thermal conductivity makes it indispensable in solar panels, EV power electronics, medical equipment, and AI hardware sectors, where substitution is costly or infeasible. The restriction complicates global supply chains at a time when industrial demand is rising, and mining output is structurally constrained. The practical consequence is higher input costs for tech and alternative-energy producers, potential inflationary pressure in industrial metals, and renewed focus on supply-chain diversification. Securing supply is so crucial that some big US tech firms are now openly looking at acquiring silver mines. Imagine going from producing high-margin technology products and services and then getting into the ancient business of mining.

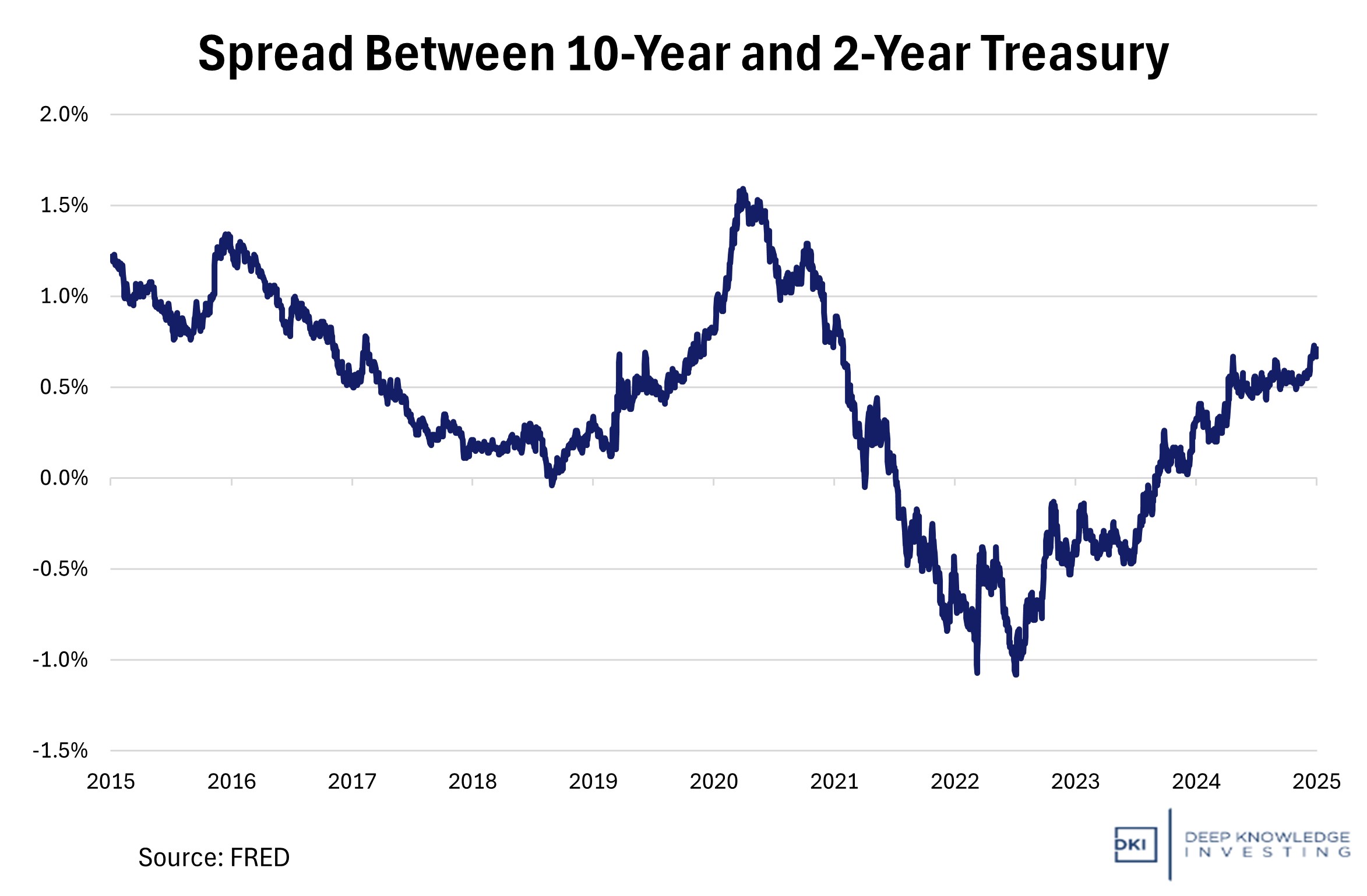

3) The Spread Between 2-Year and 10-Year Treasuries Widens:

From roughly +0.3% a year ago, the 10-year treasury yield spread over the 2-year yield has increased to about +0.7%. This is up from around -1.1% at its most inverted point in mid-2023, the deepest 2s/10s inversion in over 40 years. The Fed has continued to cut the fed funds rate causing short-term yields to fall. However, long-term rates have risen, raising concerns about large government deficits and the Fed’s limited control. Historically, this spread served as a way to gauge market sentiment, with a steep curve often reflecting expectations of stronger growth or inflation, whereas an inverted curve can signal recession fears. A steeper curve also typically boosts bank lending profits by widening the gap between banks’ funding costs and loan rates. This encourages banks to lend more than when the yield curve is inverted.

Chairman Powell has been saying policy is restrictive. The bond market disagrees.

DKI Takeaway: An inverted yield curve returning to an upward slope preceded each of the last 8 US recessions. Given the more pro-growth policies of the Trump administration combined with continued increases in government spending, a near-term recession isn’t a guarantee. I do think this movement in rates illustrates a point DKI has been making for a few years. Many investors have been screaming for rate cuts; however, the Federal Reserve only controls the overnight rate. DKI has said that the Fed is painted into a corner by Congressional overspending. We’re seeing that now as a lower fed funds rate has led to higher long-term rates because the bond market is pricing in higher long-term inflation. This trend will continue as long as Congress continues its multi-trillion-dollar annual deficits.

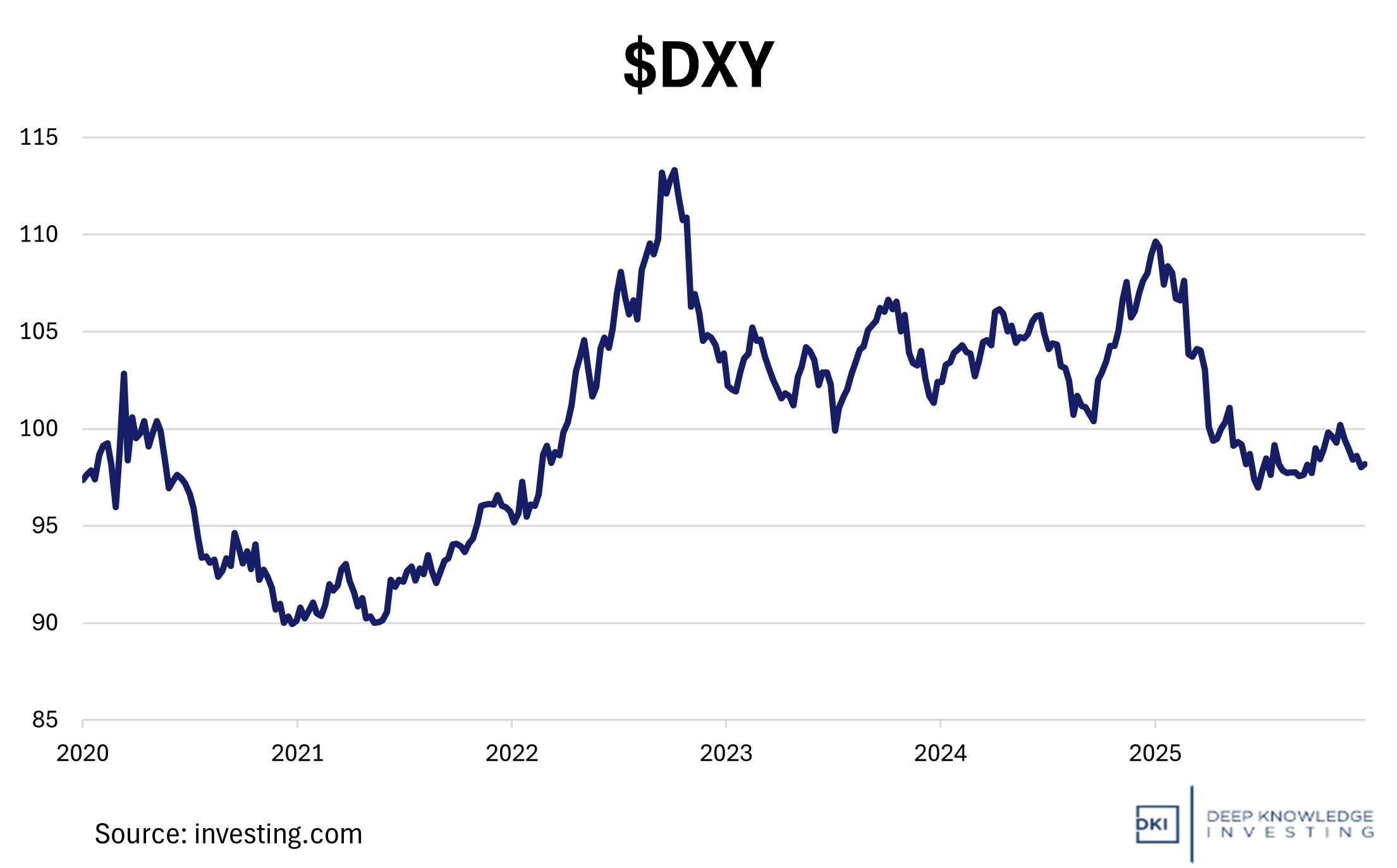

4) A Year of Dollar Decline:

The US Dollar suffered a decline in 2025, marking the steepest drop in nearly a decade. The $DXY fell roughly 9.5% for the year with other major currencies rising against it. After aggressive rate hikes in 2022-2024, the Fed hit pause and then began an easing cycle. With markets betting on rate cuts, dollar support began eroding. By mid-2025, the dollar’s drop was its worst in decades, reflecting anticipation of looser monetary policy despite other central banks also cutting rates.

Global factors also played a large role. Economic momentum overseas, particularly in Europe, improved significantly. With the US historically outperforming other nations, 2025 became a year of portfolio rebalancing and reallocation towards more international equities. A softer dollar also eased pressure on countries with dollar debts, who were able to get some more breathing room as a result.

These are big moves for major currencies.

DKI Takeaway: There is often confusion surrounding this issue. $DXY is an index of how the dollar is performing against other big fiat currencies. This is important if you want to buy euros or yen. Most Americans aren’t foreign exchange traders, and just care about buying housing, food, paying the electrical bill, and putting gas in the car. The dollar has been losing purchasing power and we experience that as higher prices or inflation. While people clamor for lower rates from the Fed, only lower spending from Congress will have an impact. Since that isn’t going to happen, I’ve kept my large profitable positions in dollar alternatives like gold, Bitcoin, and silver. It’s in the massive dollar price increases for these harder assets that we see the real carnage of constant fiat debasement.

5) Educational Topic: Why Limit Orders are the Safer Route:

While trading, when you enter a market order, your broker’s order system will execute the order immediately regardless of price. When trading something highly liquid, that’s often fine. For example, if you’re trying to buy $10,000 of $AAPL, you’ll almost certainly get decent execution with a market order. If there’s news on the tape and you want to execute the trade immediately, this is the fastest way.

My advice: Don’t do it!

The reason is because on very rare occasions, the market will glitch. Last week, on Binance, Bitcoin fell from $87k to below $25k for a few seconds. If you had entered a market order to sell during those few seconds, you would have sold at a massive discount. There is no remedy for such issues. That’s where the market was during those few irrational seconds.

It doesn’t happen a lot, but do you want to be the one with the rare story?

DKI Takeaway: I almost always use a limit order. That’s where you specify the lowest price at which you’d sell and the highest price at which you’d buy. If I had been trying to sell Bitcoin on Binance during the mini crash, and had entered a limit order, my order wouldn’t have been executed until a few seconds later when the market recovered.

Now, let’s say you need a combination of the above; immediate news-driven execution combined with limit order security. In those circumstances, I typically enter a limit order with bounds outside the current bid/ask spread. For example, let’s say I want to sell $AAPL immediately and the current bid price is $273. I might enter a limit order with a limit of $272. That would almost certainly ensure my order would get executed immediately but without the risk of selling during a flash crash.

These situations don’t happen often, but given that one happened recently, I thought it was a good time to remind everyone.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.